What to do after HMRC approves your valuation: a step by step guide

A complete step by step guide to help you with all the steps needed to grant EMI options to your employees

Great! You have received a response from HMRC approving your valuation.

The valuation approval is subject to the proviso that there are no changes prior to the granting of the options that could affect the accepted value. Such changes may include:

- any change (completed or actively contemplated) in the share or loan capital of the Company;

- any arm’s length transactions (completed or actively contemplated) involving shares of the Company;

- negotiations or preparations for a flotation or take-over;

- any declaration of a dividend on any class of shares in the Company;

- the publication by the Company of any new financial information, for example, the annual accounts or interim results or announcement.

Here are your next steps:

1. Adopt your Option Scheme and register it with HMRC!

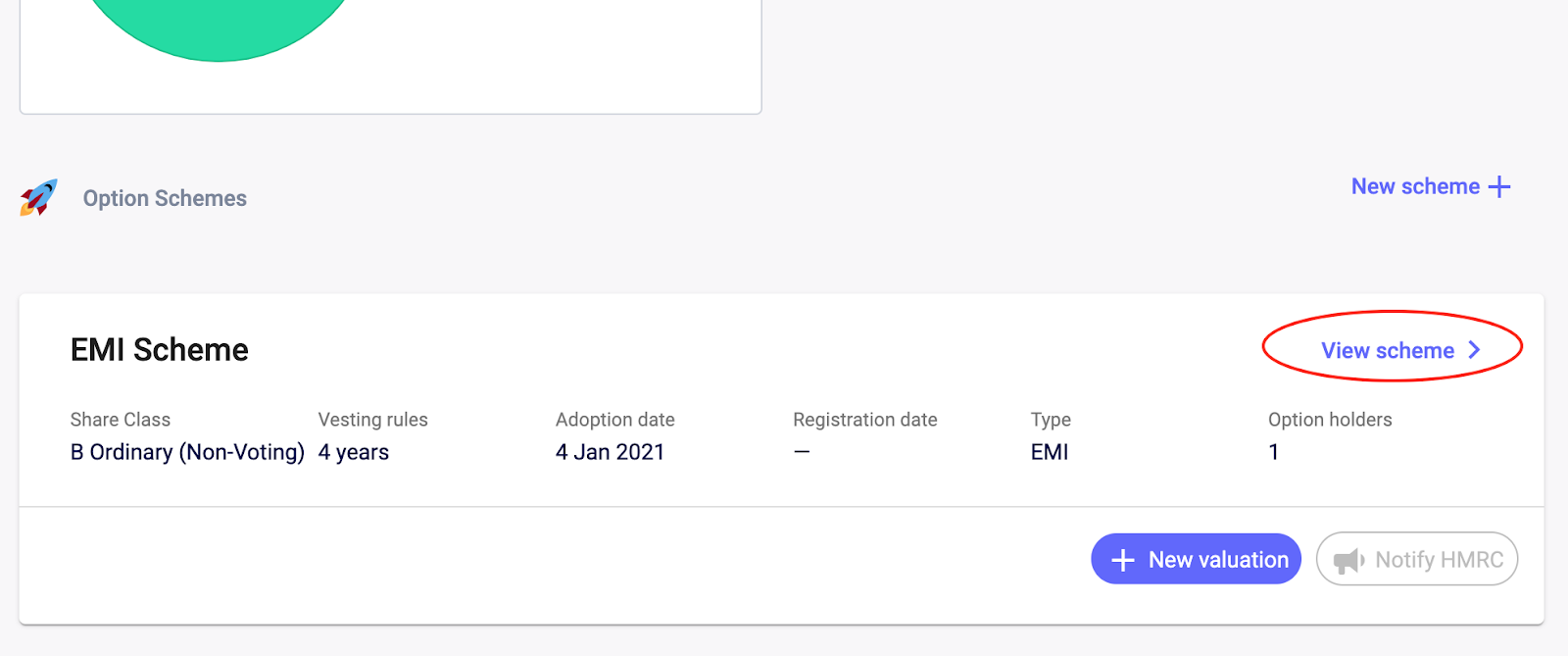

a) Finalise your Option Scheme Rules. To access the Option Scheme Rules and Board Resolution please click ‘View scheme’ under the relevant scheme from your homepage.

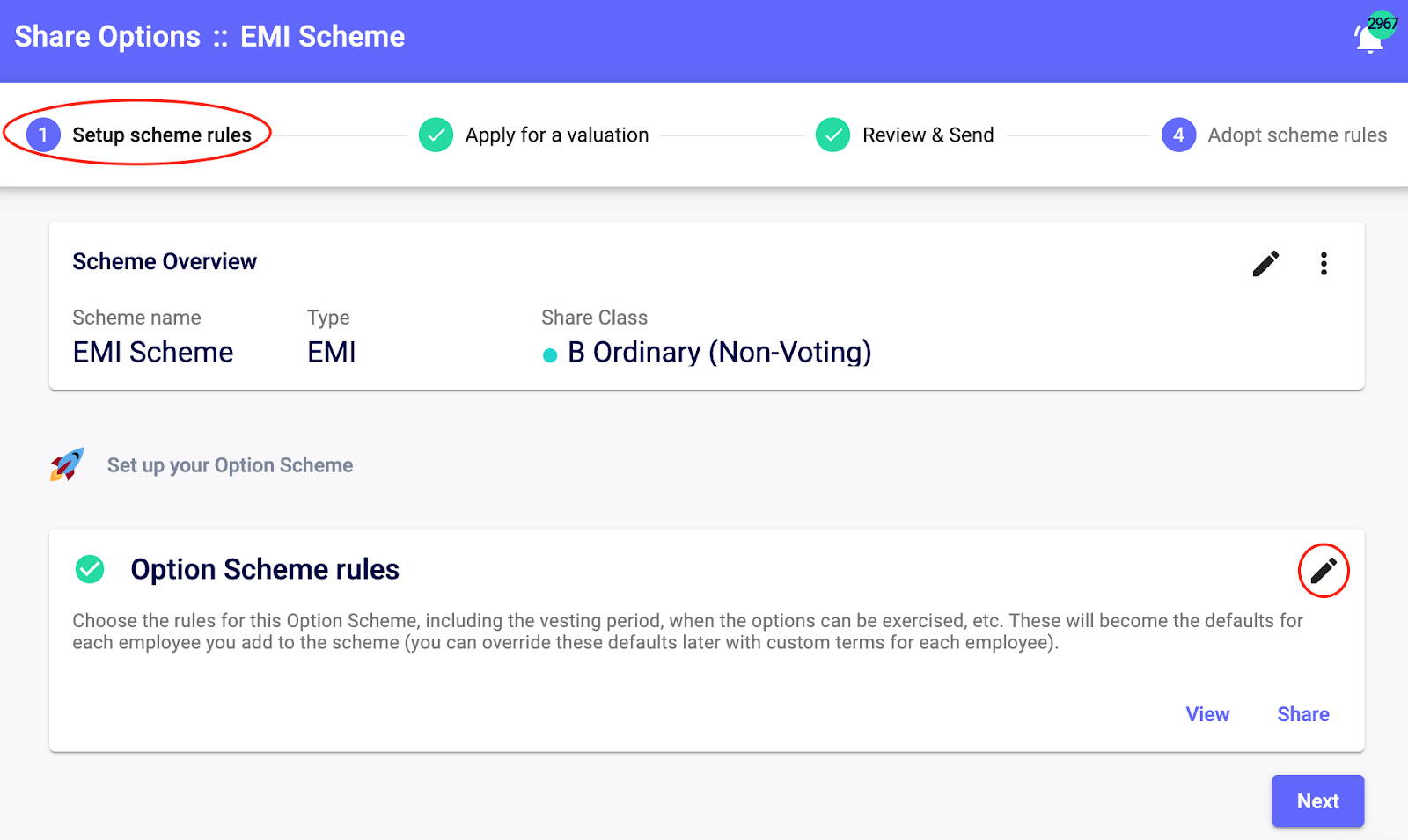

Then click 'Setup scheme rules' and the pencil icon under 'Option scheme rules'. Go through all the terms in your scheme to check you are happy with them.

b) Hold a Board meeting to approve the scheme and HMRC's valuation.

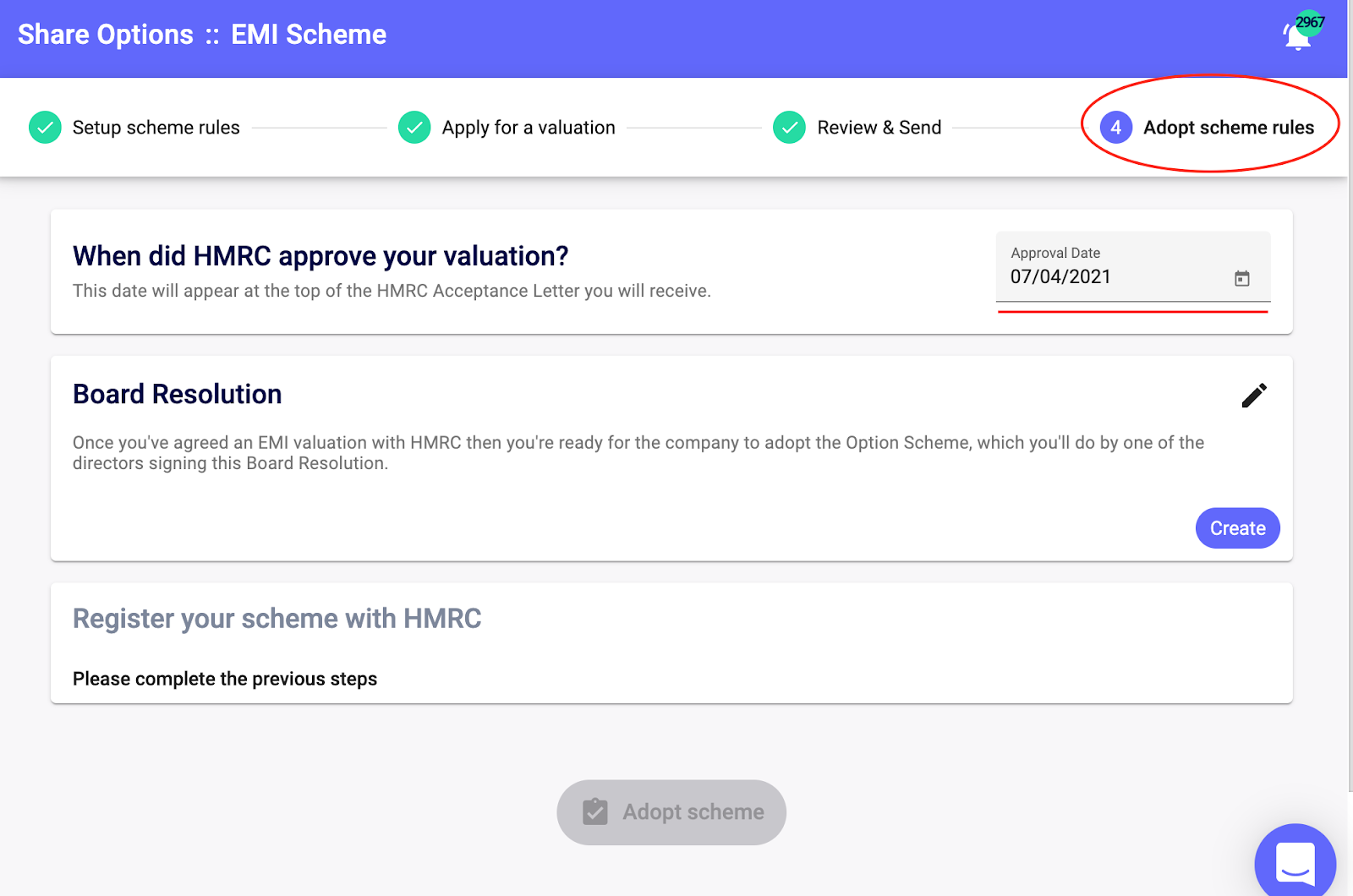

After the meeting, record it with the Board Resolution which you'll find under 'Adopt scheme rules'. Add in the date your valuation was approved, then record the meeting by creating the Board Resolution. The chairman should sign it.

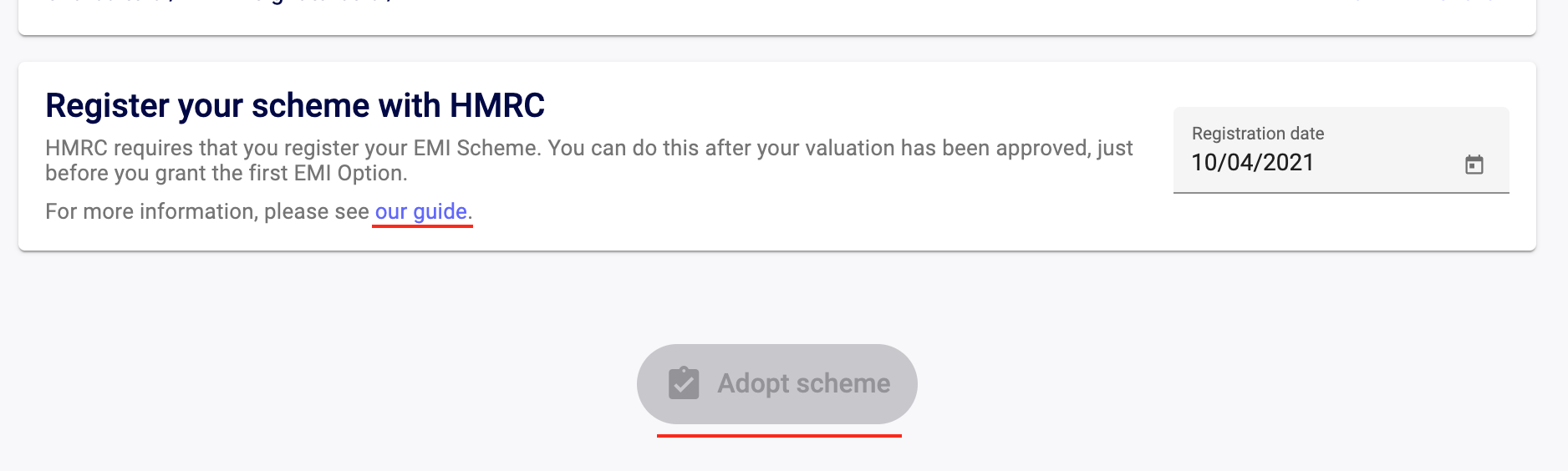

c) Register your EMI Scheme with HMRC via its online service. Please follow these steps to do so. You must register your scheme with HMRC before you notify HMRC of any options granted to employees, so it's good to get it done as soon as possible.

d) Mark the valuation as approved on the platform, with the date it was approved. This can be done if you scroll right to the bottom of your valuation on the SeedLegals platform.

2. Grant options to your employees

You must grant EMI options within 90 days of the valuation being approved.

Please see this guide on creating an options grant on SeedLegals or watch this video.

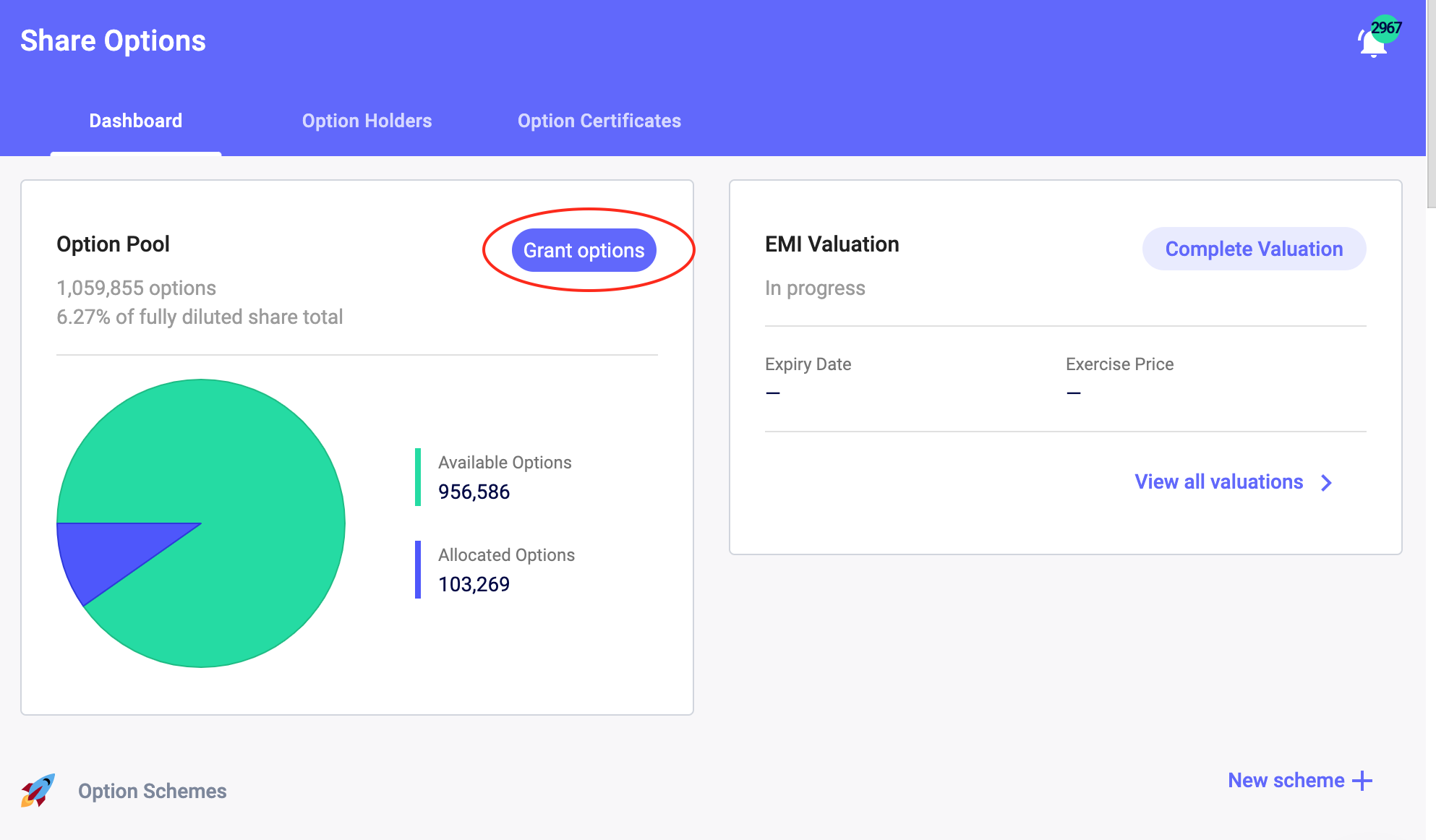

You can grant options right from the Option Scheme homepage.

3. Notify HMRC of these option grants

By 6 July following the end of the tax year the grant was made in, you must notify HMRC of these option grants. See our guide How to notify HMRC about the granting of an EMI Option.

4. If you are signing the Joint NIC Election, we recommend getting approval from HMRC at this point too.

As you are submitting paperwork to HMRC already, it's a great time to also submit the Joint NIC Election to HMRC for approval. The Joint NIC Election is something which employers can use to manage their National Insurance Contributions effectively and reduce the risk of unexpected payments when there is a chargeable event. However, you do not have to sign the NIC Election if you do not want to transfer the NIC liability to your employee.

We recommend sending it to HMRC at this stage as the NIC Election must be approved by HMRC before it can be fully signed and completed. The NIC Election must be signed before an exercise of options, so getting it signed in advance (before you might forget in future) is always our suggestion!

5. Ask us for a Final Review of your scheme and grants!

Once you've completed all these steps, reach out to us through the chat feature for a Final Review of your scheme and grants. You can access the chat by clicking the icon in the bottom right corner on the platform and our website.

If you have any urgent queries, the chat is also the best place to get hold of us!

For more articles please view our help centre page EMI Option Scheme - step by step guides on how to complete a valuation and grant options!

Other articles you might be interested in include: