A step by step guide to creating an Option Grant on SeedLegals

So you've set up either an EMI or an unapproved scheme and now you're ready to get that grant paperwork out of the door - nice!

You'll now need to create the grants for each individual. An Option Grant is the actual paperwork that the employee signs to finalise the granting of a share option (i.e. it is a different document from the Option Scheme). Normally this would be a whole lot of copying and pasting - but now it's super easy on SeedLegals!

Below are are the steps and you can also find a short loom video here (for time based grants) and here (for milestone based grants):

- Work out exactly how many share options you're going to give to each team member. It's likely in an employment or advisor contract you've promised a %, but now you'll need to work out a fixed number of shares for the grant.

Because the grant size is diluted by a funding round, if you've accepted investment since the promise, you'll need to work out how many shares would have been granted before you accept new investment. And remember to always use the fully diluted (aka including the options pool) total when working out grant percentages on your cap table - otherwise your maths will be off!

If any of that doesn't make sense - hit the chat button and we can advise. - Once that's done, you can input the details into the options grant:

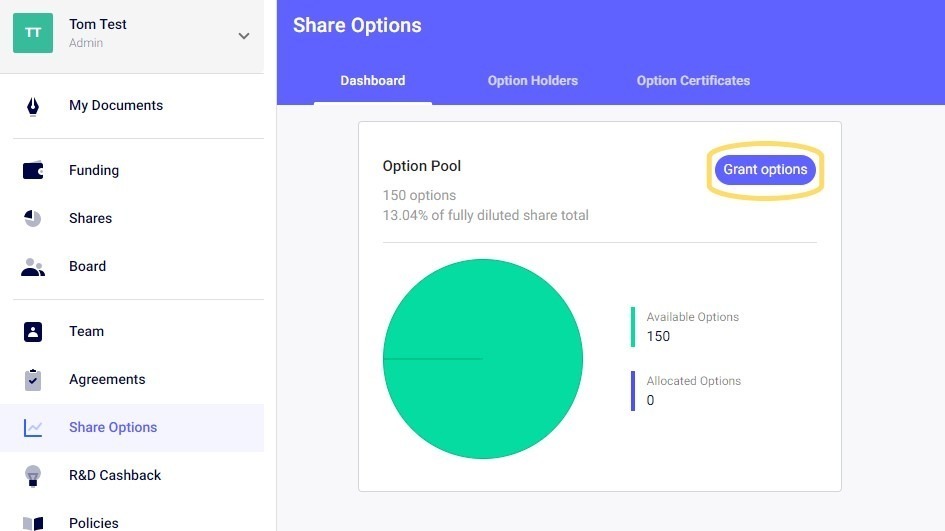

Select Share Options on the left menu and select Grant Options.

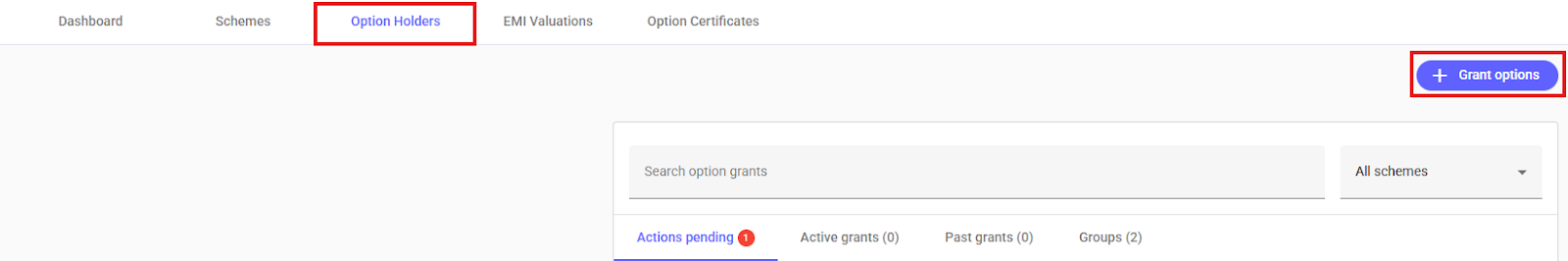

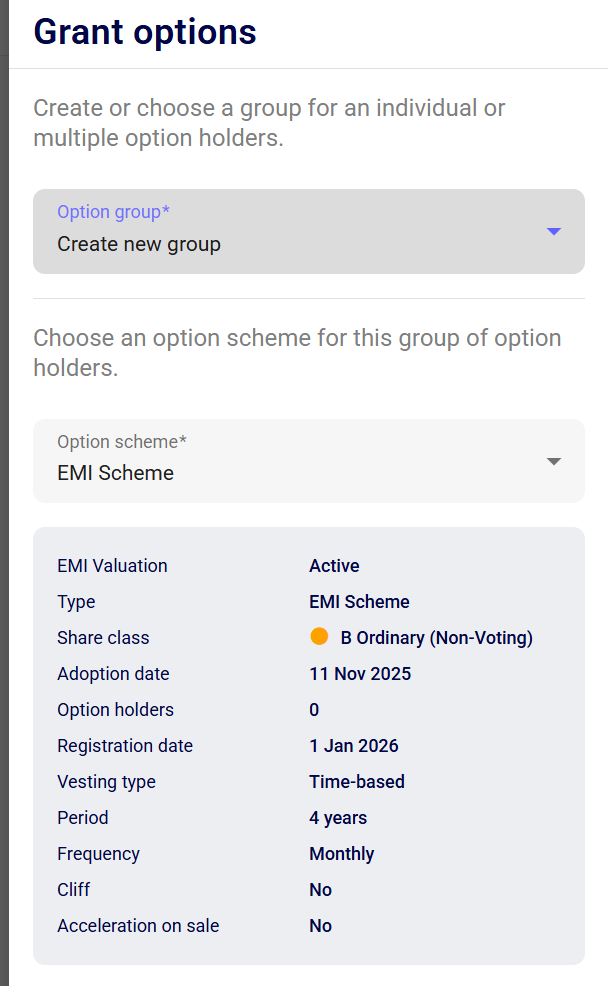

First you’ll create the option grant group, which will allow you to more efficiently deal with similar option grants. You’d be required to set up a group even if you’re setting up a grant for a single option holder. When you create the option group, you’ll need to select the relevant scheme. You can either click “grant options” on the dashboard, or click “create grant” on the option holders tab below:

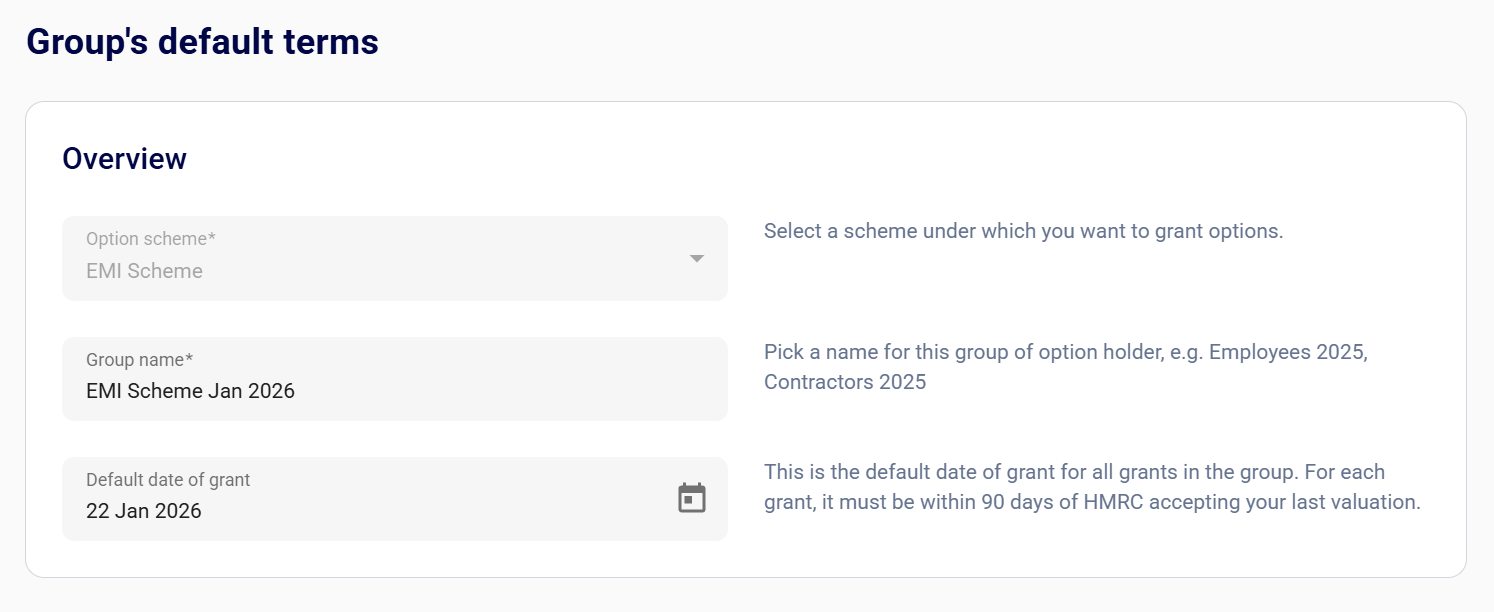

You’ll then select those you want to grant options to and be brought to the group’s default term page. Please add the details of the option holders if this is not already on the system.

You’ll then select the group’s name and default terms. Please note that any of these options can be amended in the individual grants.

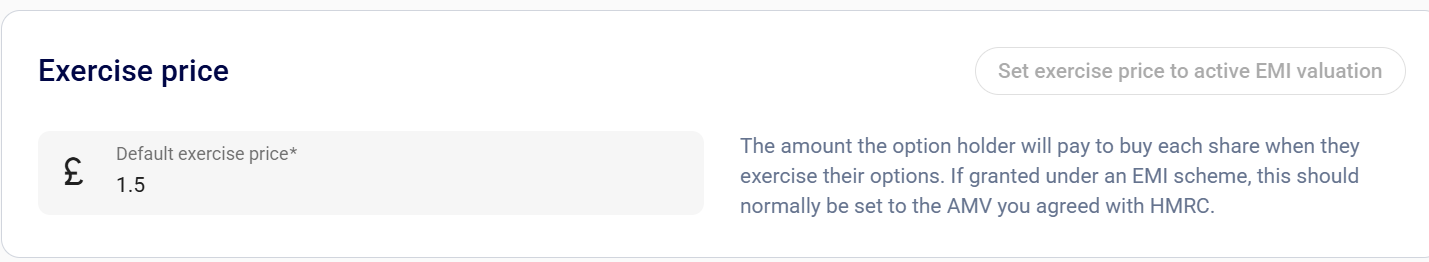

With respect to the exercise price, the platform will automatically pull through the exercise price agreed with HMRC if you’re setting up an EMI grant. If you are setting up an EMI option grant, to ensure there is no income tax upon exercise of the option, it's important to set the exercise price to the market value (AMV) agreed with HMRC.

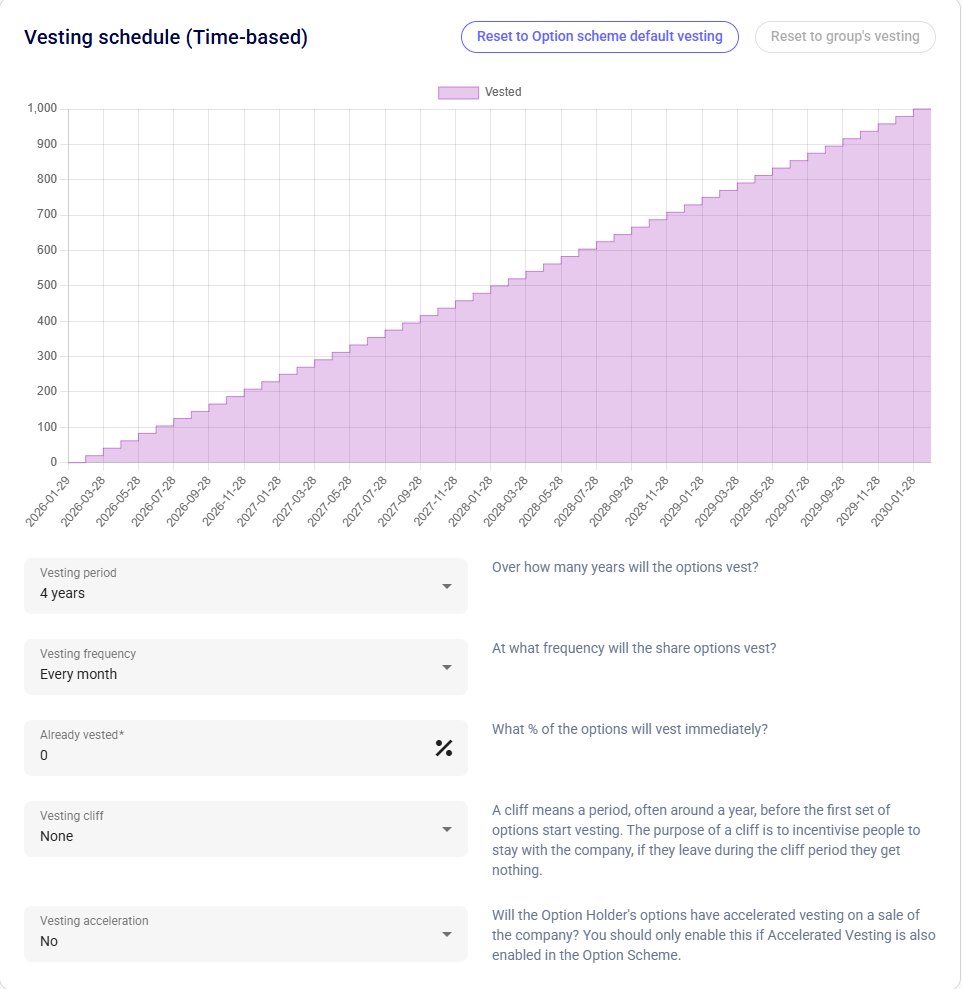

You will then set the following terms:

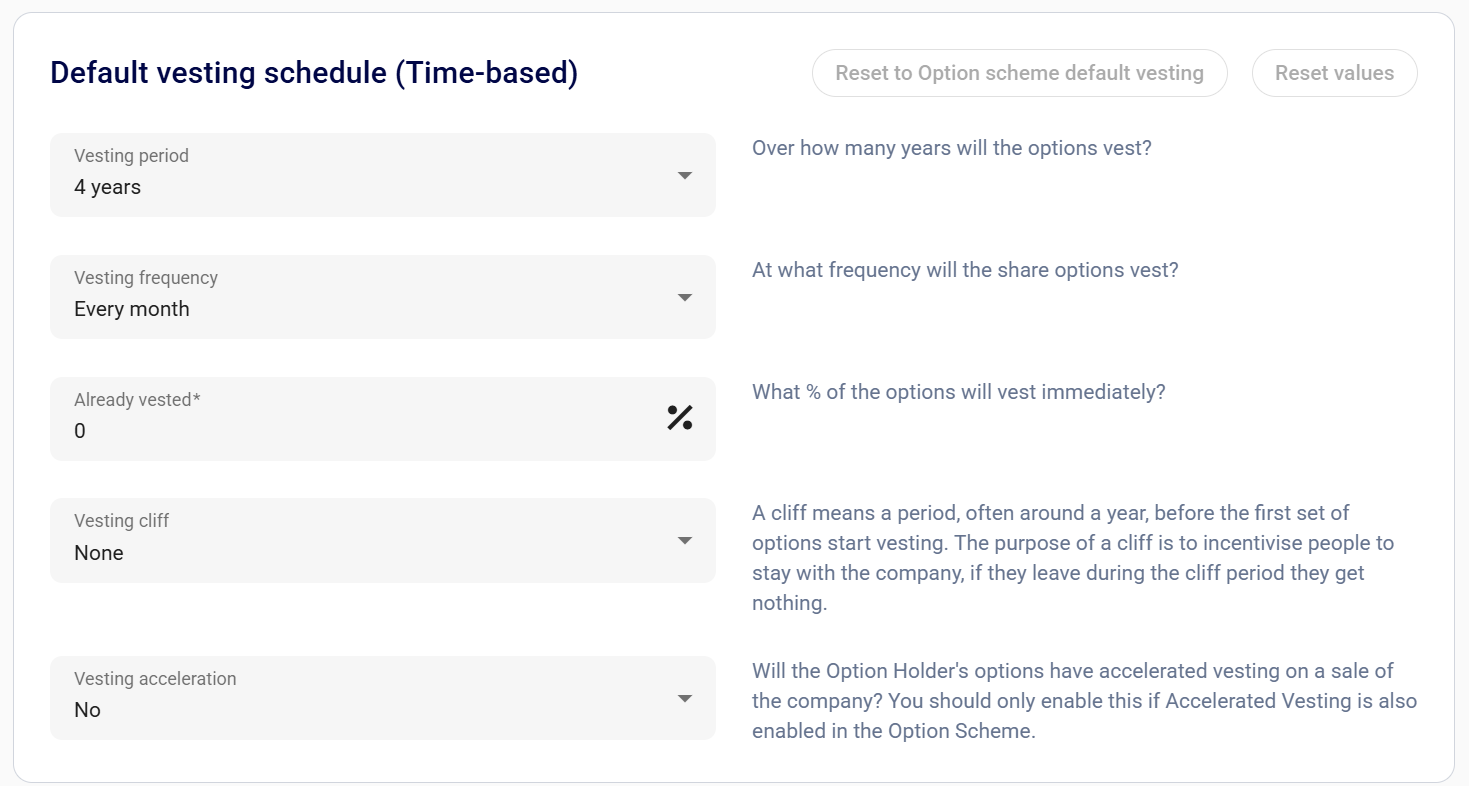

- The vesting period - the period of time over which the options will be earned (ie. vest)

- The vesting frequency - the frequency at which the options vest

- The percentage of option vesting immediately

- The vesting cliff - the period before the first set of options start vesting. If the option holder leaves before the end of the cliff period, they get nothing. Once they finish their cliff period, the amount of options that would’ve vested during the cliff will vest all at once.

- Vesting acceleration deals with whether options will all vest at once at the point of a sale. For example, if you initially had a vesting period of 5 years, but your company was acquired in year 3, with accelerated vesting all of the persons options would vest immediately at the point of that sale instead of 2 years later.

- The percentage of the option holder’s unvested options which will vest immediately on the sale of the company (if applicable)

- The acceleration period (if applicable), ie. the minimum number of months the option holder needs to work for the company following a sale in order to benefit from accelerated vesting

- Accelerated vesting on an IPO (if applicable)

N.B.: If you’re setting up milestone-based options, you’d only need to set vesting acceleration as a default term. You’d set the milestones for your option holders in the individual grant terms.

Once you’ve set the group’s default terms, you can select “Save group” at the bottom of the page, then proceed to amend the individual option grants if needed.

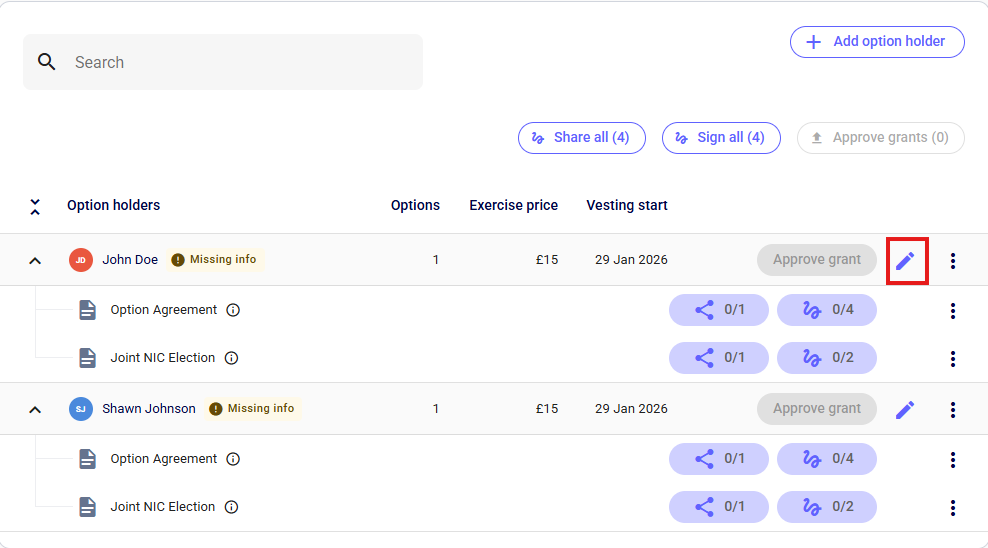

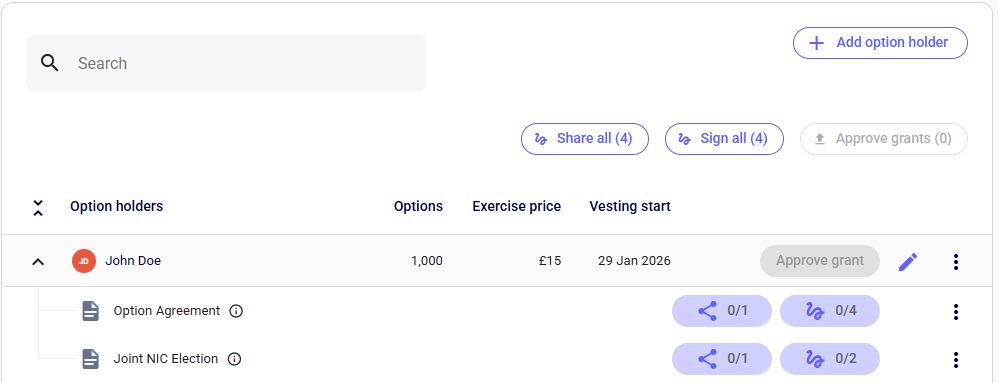

Once you’ve finalised the default terms, you should then see a list of your individual option holders as seen below. You’d be able to click the pencil icon to go in and adjust individual terms for your option holders:

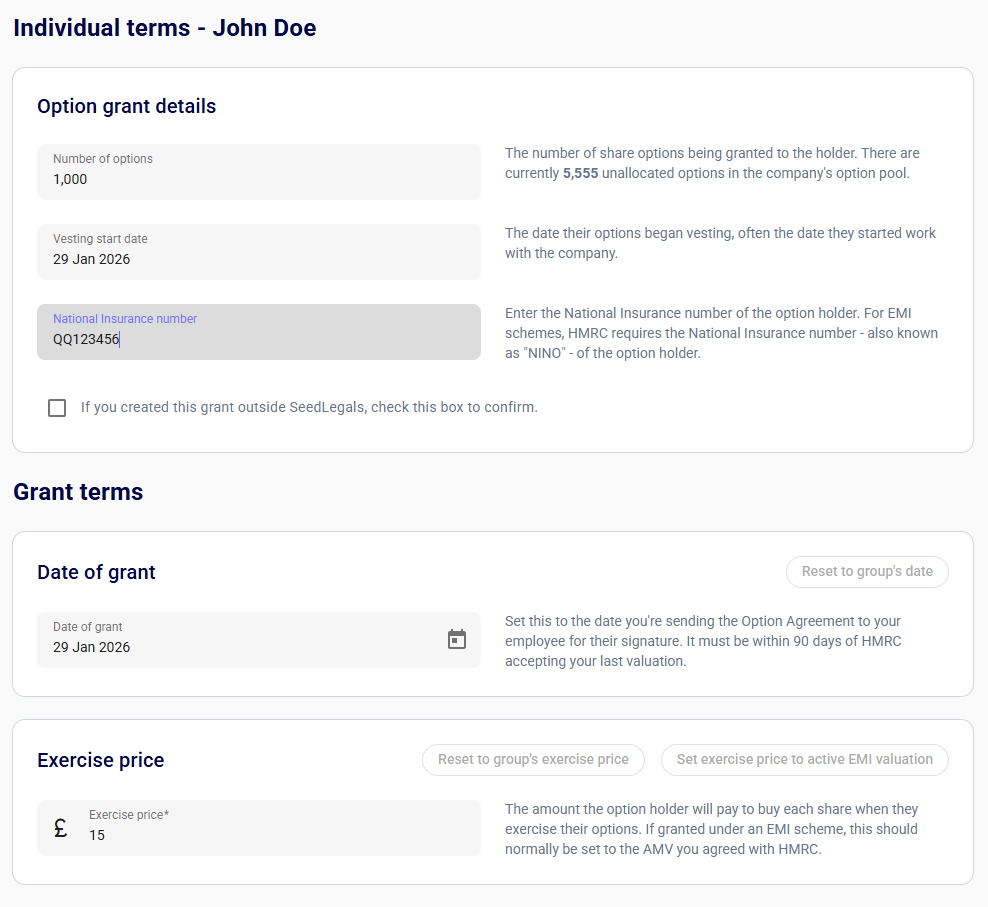

Here you can fill in:

- the number of options to give the individual,

- the exercise price (the amount that the holder will pay for their options) and,

- the date of the grant (this should always be the date that the company signed the Option Agreement. Note - this is not necessarily the same as the vesting start date - that'll come later!)

For EMI schemes - the exercise price will normally be the same as the Actual Market Value (AMV) agreed with HMRC which will mean that employees won't need to pay income or national insurance tax upon exercise. If the exercise price is below the agreed AMV, then they would be taxed on the difference between that price and the AMV.

For unapproved schemes - it's up to you to decide what they'll pay for their shares on exercise; we generally recommend setting this to fair market value to best optimise for tax (a price per share from a recent round can be used as an indicator of fair market value)

Remember, for EMI schemes, to input the holders National Insurance number; this is important for notifying HMRC about the scheme.

- Scroll down and then you'll see the second part of the option grant - the conditions:

Here you'll fill in the vesting start date (this is the date the vesting terms will start from). You can then amend the vesting conditions from the default terms if needed.

N.B.: If you’re doing milestone based grants, you’d be able to add your milestones for each individual on this page.

The platform will then generate the option grant.

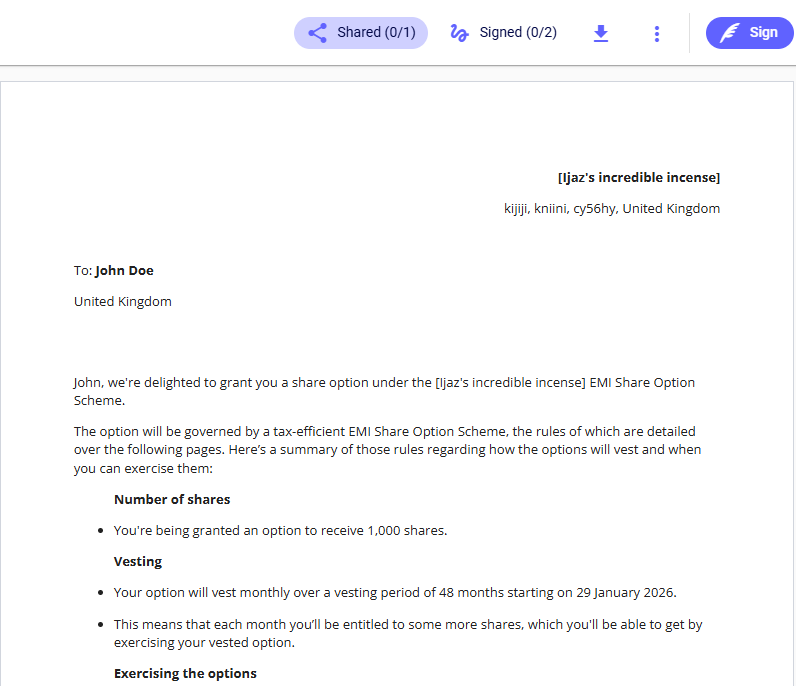

You can click on the Option Agreement, and you'll be able to go through to the document:

And then click on the blue sign button to complete the agreement and send it out to your Option Holder's email.

If your company signs the Option agreement first, the Option holder will need to countersign within 7 or 14 days, depending on your scheme rules.

As this document is a Deed - it'll need to also be witnessed. The platform will generate you a link to send out to to your witness. For the company, 2 directors can witness the agreement or 1 director and 1 person who is not party to the agreement. For the option holders the witness must be someone who is over the age of 18 and not related to the option holder or the agreement and who should physically witness the option holder signing and then they should sign immediately after by stating their full name and address. We have a short video here that breaks down the process.

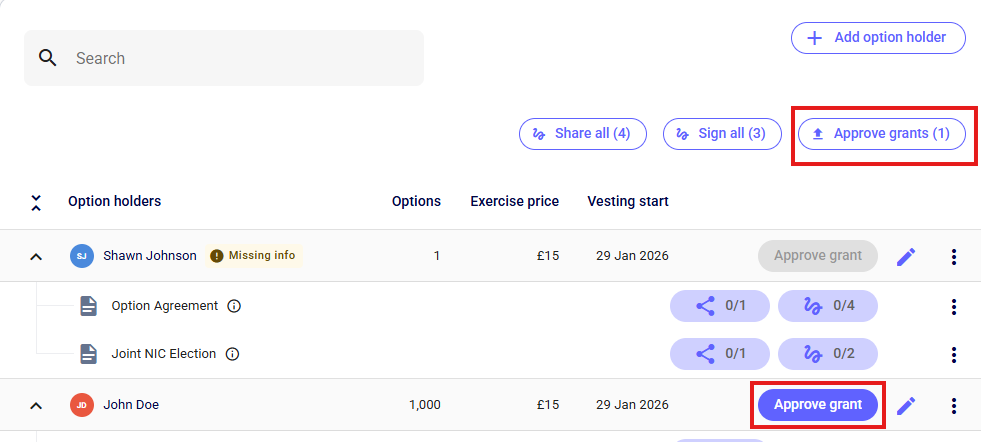

5. Once all 4 signatures have been obtained, you can click the 'approve option grant' button. This will indicate to the platform that the agreement has been fully signed and you are ready to generate an options certificate. It will also move the options granted from 'available' to 'allocated' in the Option Pool.

You can then proceed with the NIC Election as well if you need to - you can see our guide on this here.

6. Repeat this process for all of your option holders, and wait for them to all be signed and witnessed.

Once these Option Agreements are completed - don't forget about letting HMRC know about the EMI grants. You have until 6 July following the end of tax year or previously (if the EMI grants were executed before the 6th April 2024), 92 days from the date of the grant) - and there can be big problems if that's not done.

If you have granted options under the Unapproved Option Scheme to UK employees or directors, you do not need to notify HMRC like you do with EMI options, but you do need to do an annual notification (guide here) by July 6th each year for the previous financial year's activity.

As always with SeedLegals, we're here to support you every step of the way. So, if you get stuck or need a bit of help, hit the chat on the bottom right.