Step-by-step guide to your EMI Valuation

Should I speak to anyone to get started?

No need! Simply fill in the valuation questions, upload your supporting documents and request a review of your application by one of our amazing SeedLegals Options associates. Once we complete the review, we will get in touch with you with our detailed feedback. When everything is finalised, we will provide you with details on how to submit the EMI Valuation application to HMRC. This is usually done via email to savexternal.mailbox@hmrc.gov.uk.

Getting Started

Before we get started, here are the things you need to complete the valuation:

- Your cap table on SeedLegals MUST be up-to-date with all of your funding rounds. Please have a look at our article here if you need help with this: How to set up and edit your Cap Table

- If you have never issued any shares to investors and you are trading, you will go through our Financial Results Methodology valuation,. For this you will need a P&L summary for the last three years of your filed accounts (if your last filed accounts are older than 9 months, you will need recent management accounts) showing your Turnover, Gross Profit and EBITDA figures. You would also need a balance sheet from the last month or so.

Step 1: Add an option pool

Skip this step if you already have an option pool.

From the Cap Table dashboard on the left hand side, you can go to the Options tab where you will be able to either create a new pool or update an existing pool:

Your dashboard will look like the below.

Choose 'Create option pool, create approval documents' if you need to get approvals from shareholders/investors/board to create an option pool, this is the authority to allot. We will provide you with these documents. Please see our detailed article on how to create a new option pool here: How to create an Option Pool

Choose 'Just create an option pool' if you have already obtained the necessary shareholder and investor consents for the pool and you simply need to reflect the number of options. You can then add the number of options the company is authorised to grant and the date that the authority was obtained.

Step 2: Add an EMI scheme

If you haven't already, then please create a new EMI scheme, this can be done under the Share Options category. You may want to select B Ordinary (Non-Voting) as the share class, unless otherwise decided. To do so click Add new share class under the drop down menu and select the Employee share class. If you do not have the share class set up in your Articles of Association already and you need to create a new share class you can follow our instructions here: Step-by-step guide on how to create a new share class.

Next, set the details of the scheme on this page where it says Set Rules. You can set these details now or after the valuation is approved. You can always come back and change the details anytime before the final step of adopting the scheme rules and you can also reach out to your scheme owner with any questions.

Please see this article to help you set up the scheme rules: Which option scheme is right for you?

Click Create after you set the rules.

Step 3: Set details of the valuation

Firstly please ensure you select the correct share class that you need a valuation for.

The date of the application can be updated at any time, so this is not the final date yet. This should be updated just before the application is sent to HMRC to be as accurate as possible.

Company and contact details

- Describe the company, mission, its founders, the challenges it is facing today, as well as how did Covid affect your business. HMRC will want to know about you and your company so take this opportunity to give them additional context that can be taken into account in the valuation. If any of the sections do not apply, please leave blank. We recommend at least 5-10 sentences.

- Leave the SCEC reference number blank if you do not know this or do not have one. The SCEC reference number can be found in your Advance Assurance or Compliance letters from HMRC and it looks like this WMBC/IUR/S0970/12345 67890/SCEC. You will only need the 10 digits.

- Enter the email address and phone number of a director.

Share transactions

- Enter the number of EMI options you plan to grant with this valuation. Please be as accurate as possible for this. If you are unsure, please overestimate.

- For the question Have any shares been allotted since the date of the last company accounts? please look at the date of your last accounts on Companies House and enter the details of any shares allotted via an SH01 since then. If you have never filed accounts on Companies House you should enter all the shares you have issued since Incorporation. You should enter this in the following format: “X Ordinary shares were allotted on 1st January 2020 at £7.45 per share”

- For the question Have any shares in the company been bought or sold within the last year? this refers ONLY to share transfers or share buybacks, not funding rounds or share allotments. Again you should enter this information in the following forma: “X Ordinary shares were transferred on 1st January 2020 at £7.45 per share”

- For the question Have any dividends been paid or declared after the date of the last accounts? select the appropriate response and add a sentence with the amount and date paid and the recipient’s full name.

- For the question Is there a prospect that there will be an opportunity for shares to be sold or exchanged? Or is there a prospect of a flotation or other marketing event? this is asking whether there is an upcoming company exit, here add the appropriate response.

- For the question Any other information that you consider relevant to your valuation? you can leave this blank, unless there is anything else you would like HMRC to take into consideration when valuing the shares. For example if the company is due to receive cash or issue shares.

Click Done!

Step 4. Build your Valuation

The next step is to ‘Build your valuation’ by clicking on ‘Set details’.

-

Most recent balance sheet (from within the last month or two)

-

Profit & loss summary for the last three years (if your last accounts are greater than 9 months, then please use your management accounts).

*An arm’s length transaction is one between two unaffiliated parties who act independently and in their own self-interest. Transactions with family are usually not at arm’s length, but some transactions between friends may not be either.

If you have issued shares at arm's length, select the most relevant transaction for valuing the option shares - this will be the starting point for HMRC in valuing your EMI options.

- Based on the transaction you have selected, select the relevant discounts that apply to this transaction. You should add as much supporting detail or evidence for each discount.

What if there are no transactions to value my option shares or my transactions were not done at arm’s length ?

- If you can justify that the transactions within your company were not done at arm’s length, or if there have never been any share transactions in the company apart from incorporation, please select ‘None of these transactions are relevant’ as shown below, please then provide the reason why the transaction is not relevant, as well as why the transaction was not done at arm’s length.

- In the question 'Are you pre-revenue', if the answer is yes, the next step is to enter your Total Net Assets from your latest Balance Sheet.

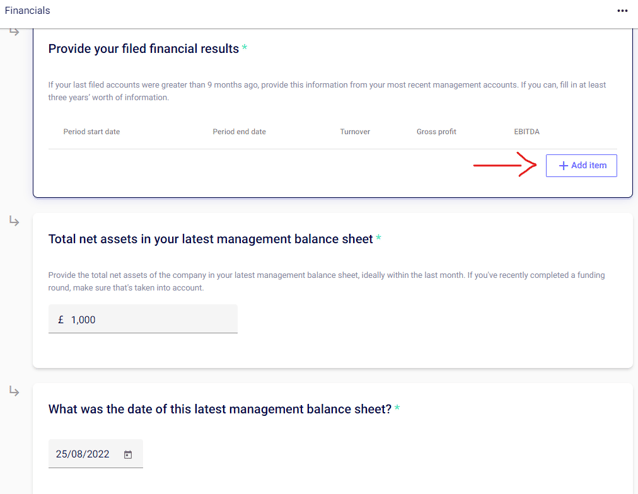

- If the answer is no, please enter the date you started trading and click on 'Add Item' where you can provide the Turnover, Gross Profit and EBITDA figures covering the last 3 years of accounts. If your last filed accounts are older than 9 months ago, please provide figures from your most recent management accounts. EBITDA is typically calculated as Net Profit/(Loss) + Interest + Taxation + Depreciation + Amortisation (or Operating Profit + Depreciation + Amortisation).

- You will also need to enter your Total Net Assets from your latest Balance Sheet, ideally within the last month or so.

The Gross Profit and EBITDA multiples are predetermined and the hint text explains how the report arrives to these, however if you have any questions on these or wish to amend them please speak to your scheme owner.

Click Done!

Step 5: Enter your exercise price

This is the price that your Option holders will have to pay for the exercise of their options. Click Enter price to set your exercise price for the EMI options.

We recommend setting your exercise price to your AMV so that a taxable exercise does not occur. You are welcome to set it to nominal value, as long as you understand that this may trigger a taxable exercise event for the employee and the company.

When you click Enter price, it will autofill with the AMV, if you are happy with that, click the check mark.

Step 6: Upload supporting documents and sign the application

Please upload your supporting documents. The platform will provide multiple portals if you enter multiple Year Ends.

Please click the Sign button as shown in the screenshot below, this will automatically sign the VAL 231 form and Cover Letter (which you can view on the next page along with the valuation report).

The documents must be signed by a director of the company to confirm the accuracy of the details entered in the application so far.

Then click Next.

Step 8: Valuation reviewed by the Options team

Click Review my application. You can also email your assigned options associate (if you know who that is) so that we can get back to you with a thorough review!

Step 9: Sending your valuation to HMRC

Once you get the go ahead from the team it’s time to email your application to HMRC. You can download your application bundle from this page:

Once downloaded send your:

- EMI valuation report

- VAL 231 form

- cover letter

- supporting documents (accounts and Balance Sheet)

- share class shareholders resolution (if applicable)

to HMRC at savexternal.mailbox@hmrc.gov.uk.

Please also cc emi-options@seedlegals.com to ensure the team is copied in all communication with HMRC. HMRC will reply by email upwards of 4-6 weeks, so keep an eye out for it.

Here's what to do once your valuation is approved.

If you need anything else please reach out to our team via the chat bubble.