Step-by-step guide to applying for an EMI Valuation using the price per share of your last round

We at SeedLegals wouldn’t be doing our jobs if we didn’t warn you of the major drawbacks of using the price per share (PPS) of your last round as an exercise price for your EMI Valuation:

First off, it contradicts the definition of “sweat equity”, as your employees will be paying the same price to exercise their options as your investors have paid for their shares. As employees are getting their options as part of their incentivisation with a vesting period attached to them, they would typically pay as little as possible for their shares at the exercise point and not the same premium that investors pay to get their return without contributing any labour. For this reason, it’s not the best way to incentivise your employees.

Secondly, it might end up being prohibitively expensive. If you use the PPS of your last round as an exercise price this may result in a hefty expense for the employee at the exercise point, for example if your last PPS was £5 per share and you’re awarding 2,000 options that’s £10,000 the employee needs to find to buy their shares. Hopefully, when the company is acquired they’ll get a great return, but it’s still a considerable sum for your employees to pay if they exercise ahead of an exit. The purpose of the EMI Valuation is to agree as low a strike price with HMRC as possible so that as long as your employees pay it, they won’t owe any income tax on exercise and only 10% CGT will be due on disposal - subject to other conditions being satisfied as per HMRC's guidelines here.

If your company has just incorporated, has no revenue and no assets, you’ll be doing a nominal value valuation and the total amount due will be very low. However, in any other case, it’s worth doing a quick calculation to work out what you’re actually asking your employees to pay upon exercise.

If now you’re looking to give proper sweat equity and save your employees and your company a lot of money, you can purchase the SeedLegals Valuation and you’ll find our step-by-step guide to complete it here.

That being said, if you feel compelled to go with the price per share of the last round, here are the next steps:

Getting Started

Before we get started, your cap table on SeedLegals MUST be updated with all of your funding rounds to accurately reflect your total shareholding. Please have a look at our article if you need help with this: How to set up and edit your Cap Table.

Step 1: Add an option pool

Your dashboard will look like the below.

Choose 'Create option pool, create approval documents' if you need to get approvals from shareholders/investors/board to create an option pool, this is the authority to allot. We will provide you with these documents. Please see our article on how to create a new option pool here: How to create an Option Pool.

Choose 'Just create an option pool' if you have already obtained the necessary shareholder and investor consents for the pool and you simply need to reflect the number of options. You can then add the number of options the company is authorised to grant and the date that the authority was obtained.

Step 2: Add an EMI scheme

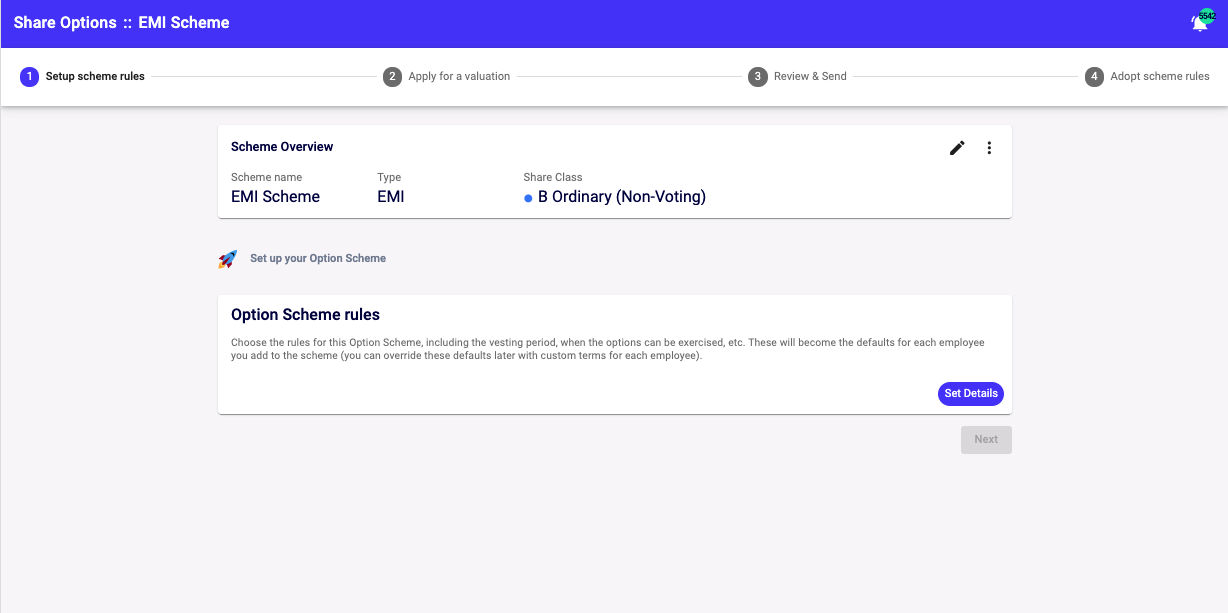

If you haven't already, then please create a new EMI scheme. You may want to select B Ordinary (Non-Voting) as the share class unless otherwise decided. To do so click Add new share class under the drop down menu and select the Employee share class. If you do not have the share class set up in your articles already, we can help you with all the relevant documents as per our guide here.

Next, set the details of the scheme on this page where it says Set Details. You should set these details first before proceeding. You can always come back and change the details anytime before the final step of adopting the scheme rules and you can also reach out to your scheme owner with any questions.

Please see this article to help you set up the scheme rules: Which option scheme is right for you?

Click Create after you set the rules.

Step 3: Submit the EMI Valuation to us for review

You can open up a new application by clicking 'New valuation'. If you already have an application open, click 'continue' instead.

Then start the application by selecting 'Set details' under 'Company details and share transactions'

Company and contact details

-

Leave the SCEC reference number blank if you do not know this or do not have one. The SCEC reference number can typically be found in HMRC letters if you have done an Advance Assurance or Compliance application.

-

Please fill in the questions with background on your company. HMRC would like to have a holistic understanding about what your company does, the challenges it faces and who the founders are.

-

Enter the email address and phone number of a director.

- Make sure to click 'next' at the bottom of the page to save your answers!

Share transactions

-

Enter the number of EMI options you are planning on granting under this valuation.

-

For the question, Have any shares been allotted since the date of the last company accounts?, please look at the date of your last accounts on Companies House and enter the details of any shares allotted since then. If you have never filed accounts on Companies House you should enter all the shares you have issued from Incorporation. You should enter this in the format, “X Ordinary shares were issued on 1st January 2021 at a price per share of £7.45”

-

For the question, Have any shares in the company been bought or sold within the last year? this refers ONLY to share transfers - not funding rounds or share allotments. Again you should enter in the format, “X Ordinary shares were transferred on 1st January 2020 for a price per share of £7.45”

-

For the question, Have any dividends been paid or declared after the date of the last accounts? Select the appropriate response and add a sentence with the amount paid and the recipient.

-

For the question, Is there a prospect that there will be an opportunity for shares to be sold or exchanged? Or is there a prospect of a flotation or other marketing event? Add the appropriate response.

-

For the question, Any other information that you consider relevant to your valuation? - Unless there are special circumstances you need to disclose to HMRC which would impact your valuation, you don't need to add anything here so you can leave this box blank.

Click Done!

Building your valuation

The next step is to ‘Build your valuation’ by clicking on ‘Set details’.

Under this section, you will have to fill in one of two possible valuation methodology details.

1. If there are any transactions on your cap table above nominal value, you will see a list of transactions to pick as your comparable transaction for valuing the EMI options. If there are any relevant transactions, you will be completing a discount based methodology.

- Usually this will be your most recent transaction. If you have multiple transactions on the same date with different share classes, you should be the share class that is most similar to the EMI option share class . If you pick an older transaction, you will need to indicate why you are choosing an older transaction.

2. If you have no comparable transactions on your cap table, or no transaction on your cap table are relevant or recent for valuing the EMI options, you will be be completing a financials based methodology.

- For this methodology you will need to 3 years of full financial accounts, and they must be no older than 9 months from the date of application. You will also need your most recent balance sheet, ideally from the previous month.

Discount based methodology

- Tick all the discounts that apply, and provide details where possible to give us full context. Take advantage of our hint text by hovering over the 'i' next to each discount.

- For some discounts we will indicate an appropriate discount. For others, you will need to give an indication of a discount that you think is proportional to the circumstances. Don't worry, our team will review your response so if we have any comments to adjust, we will let you know!

Financials based methodology

- You will see a page with a series of questions, which ask about your financials. These should be quite straightforward.

- You should add 3 years of full accounts year by year (namely, turnover, gross profit and EBITDA) by clicking 'add item'. Your latest accounts should not be older than 9 months. So for example, in October 2024, your accounts should be made up to year end in at least January 2024.

Once you've input all the answers, click Done!

Step 4: Enter your exercise price and final details

You will be directed to the overview page again once you build the valuation.

You will then need to enter the exercise price in the box below. We recommend setting your exercise price to your AMV so that a taxable exercise does not occur. You are welcome to set it to nominal value or another value, but just know that a lower exercise price than the AMV will trigger a taxable exercise event.

When you click Enter price, it will autofill with the AMV. If you are happy with that, click the check mark.

Step 5: Sign all documents

- Please click the Sign button, this will automatically sign the VAL 231 form and Cover Letter.

- Please note the documents must be signed by a director of the company.

Once signed, you will need to upload the financial accounts if you have completed the financials based methodology.

Otherwise, click Next.

Step 6: Sending your valuation to HMRC

- Time to submit your application to us for review! Click 'review my application' and it will come through to us.

- Otherwise, if the application is ready and you don't need a review, you can email your application to HMRC by downloading your application bundle by clicking 'download files':

Once downloaded, check over your documents and make sure you are happy with them. The pack should contain:

- Application for EMI Valuation (Val231)

- EMI Valuation Cover Letter

- EMI Report

- If applicable, your financial accounts that you uploaded and/or

your shareholder resolution for share class creation.

Send your documents HMRC at savexternal.mailbox@hmrc.gov.uk. Please also cc emi-options@seedlegals.com to ensure the team is copied in all communication with HMRC. HMRC is likely to reply by email in about 4-6 weeks, so keep an eye out for their reply.

If you have any questions, please reach out to our team via the chat bubble.