How to convert your SeedFASTs using an Instant Conversion: a step-by-step guide

Using an Instant Conversion to convert your SeedFAST / Convertible Loan Notes? Here's everything you need to know!

If you're looking to convert your SeedFAST or your SeedNOTE into equity for your investor, we'll take you through this step-by-step on the platform. This guide will help you convert your SeedFAST/SeedNOTE using Instant Conversion.

Any previously created SeedFASTs / SeedNOTEs will already appear in your Convertible table, which is found in the Shares tab:

If you have convertibles outside of SeedLegals that you wish to convert with us - you can! Follow the steps in this article to add your off-platform convertibles to the Convertibles table.

What is Instant Conversion?

The default position of a SeedFAST is for it to convert within the company’s next qualifying funding round. But in a scenario where that funding round takes longer to launch than anticipated, Instant Conversion allows for the investor’s SeedFAST to convert by the longstop date and outside of a funding round.

All of our SeedFASTs have a longstop date, and in setting one up, a fixed pre-money valuation (the longstop valuation) is provided so that both the company and the investor know what valuation the SeedFAST will convert at if conversion ends up happening outside of a funding round.

Step 1: Ensure there is an appropriate number of shares existing in the company

We always recommend having at least 1,000,000 shares before taking on investment to keep the investor percentages and price per share manageable. It’s not a problem if you’ve not managed to do this before executing the SeedFAST, but it’s really important that this is done before getting started with the Instant Conversion.

We have a guide on how to do this for free on SeedLegals. Our Share Split product will automatically generate the required documentation you need to file with Companies House, making the process quick and easy for you. Here is also a helpful 5-minute video that walks you through how to do this on the platform. This will need to be completed before the conversion can be started, and the SH02 form actioning the share split will need to be filed with Companies House

Step 2: Review the SeedFASTs you want to convert

The first step to kicking off an Instant Conversion is to select the relevant SeedFASTs you want to convert, which are selected from the Convertibles Table. If you don’t see the relevant SeedFASTs appearing in the Convertibles Table, need some guidance on how to add them to the Convertibles Table or would like to know how to use our Instant Conversion product to convert off-platform ASAs, please check out this article.

Step 1: Head to Shares > Convertibles table to see a list of all the SeedFASTs and SeedNOTEs that have been completed and added to the Convertibles Table.

Consider the longstop valuations of the SeedFASTs you wish to convert. You’ll want to ensure you’re converting SeedFASTs at the same longstop valuation. This is because you want to ensure that you’re not converting any SeedFASTs in a subsequent conversion that has a lower valuation than the post-money valuation of the current conversion you’re doing (you can calculate what the post-money of this current conversion will be by adding up all the longstop valuations of the SeedFASTs you intend to convert).

In practice, this means you’ll want to convert SeedFASTs of the same or similar longstop valuations together. The purpose of this is to always ensure you’re raising at the same, or higher, price per share with each subsequent allotment of shares.

You can see a list of all SeedFASTs that have been created, along with their longstop valuations, by selecting View by Event:

Step 3: Set up the Instant Conversion

Once you’re happy with the SeedFASTs that you’ll be converting in this conversion event, select to View by investment…

…and tick the relevant SeedFASTs you wish to convert. You’ll notice the Convert button will light up and allow you to select it.

A sidebar will appear and ask whether you want to convert via a Funding Round or Instant Conversion. For the purposes of this guide, you’ll want to select Instant Conversion.

Set the date for the conversion - in almost all cases, this will be the day you’re setting it up - and continue onto the Instant Conversion workflow.

Step 4: Set up your Instant Conversion Terms

In the Instant Conversion workflow, click the pencil button to set the Key Conversion Terms:

This is the first part of the workflow. Select if the company has an existing Shareholders Agreement. If you select “Yes,” you’ll be asked to enter the date of that Shareholders Agreement. If you did your funding round with SeedLegals, you’ll find the date at the bottom of the document just above the signature blocks.

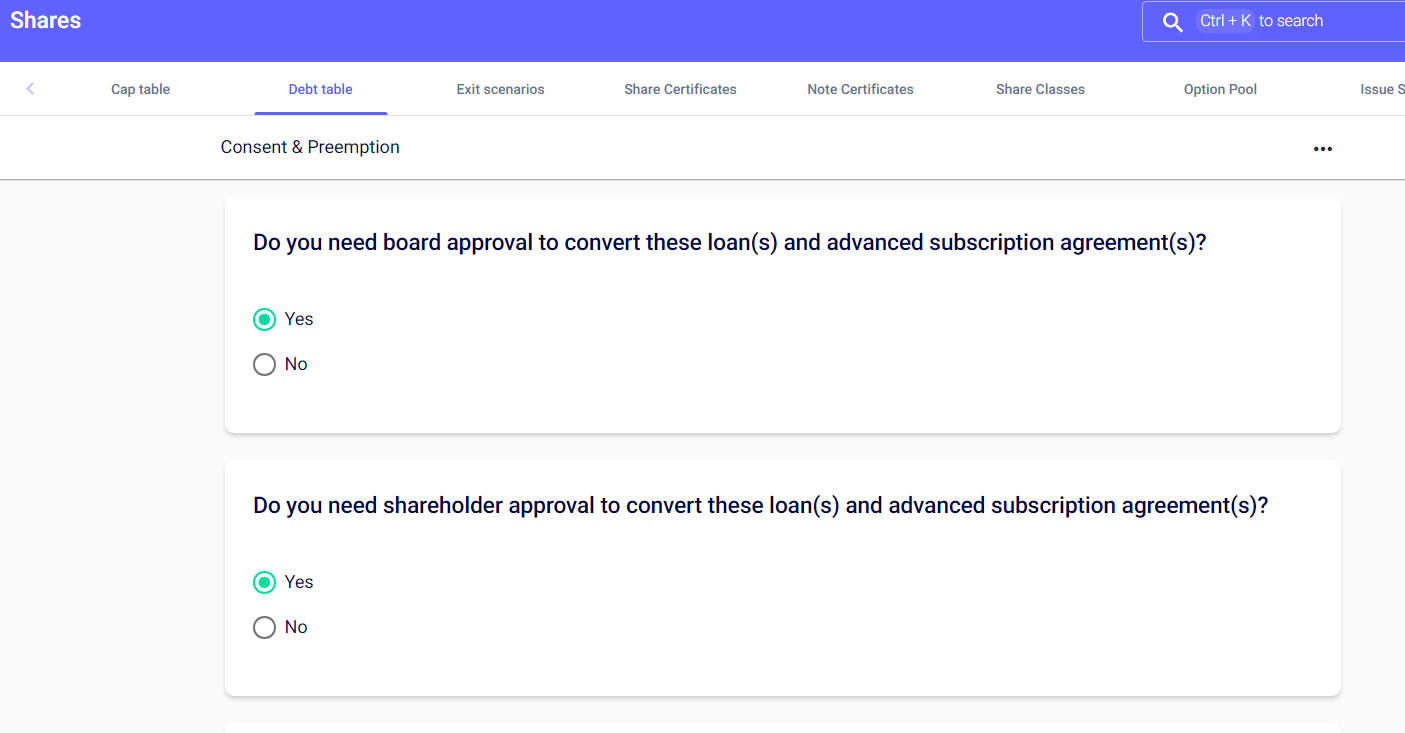

You’ll then be asked whether the board and shareholders' approval is required to execute the conversion (see below). If you select Yes to both options here, then a Board Resolution and a Shareholders Resolution will be created for you to complete.

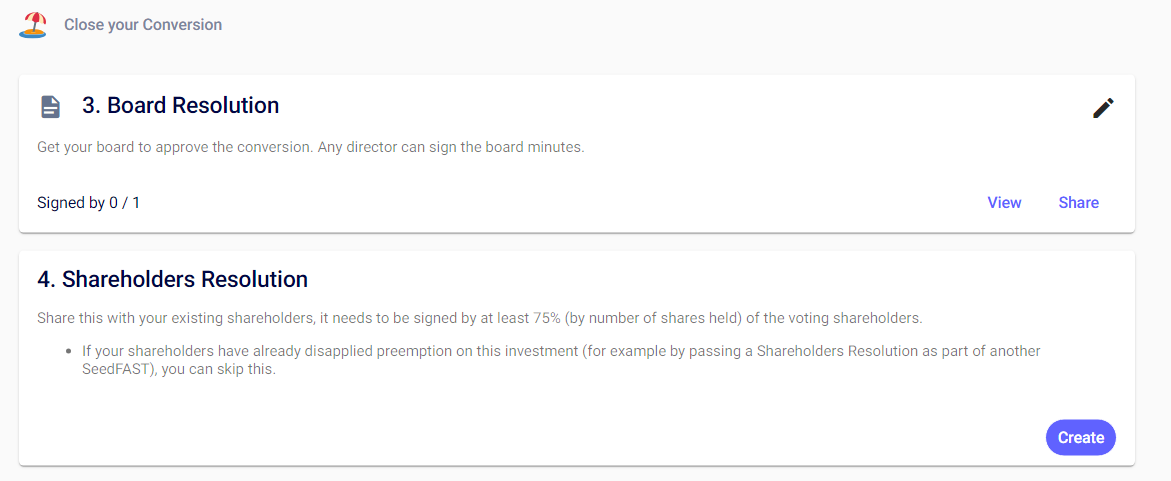

The Board Resolution and Shareholders Resolution are necessary to ensure you have the correct authority to convert the SeedFASTs and issue the shares. Unless you have a board resolution elsewhere (off-platform, maybe), then you will need to tick yes to the Board Resolution here, and the same applies to the Shareholders Resolution. If you're unsure, tick Yes to both to be safe, and feel free to reach out to the team on the chat as well to check!

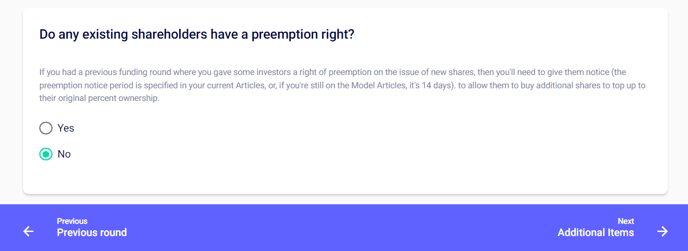

The last question here will be whether existing shareholders have a preemption right:

This should have been covered at the SeedFAST stage. When the SeedFAST is set up, we include a Preemption Notice to be sent to offer whether existing shareholders would like to take up their right of preemption. If this was done at the SeedFAST stage or preemption was disapplied via the shareholders resolution, then “No” can be selected here.

Lastly, you’ll be asked whether you want to enter any Additional Items. This should ideally be left blank, as adding additional clauses to the conversion document isn’t entirely appropriate. However, if this is required, please reach out to the team so we can help you with this.

Step 5: Create, share and get the Instant Conversion Agreement fully signed

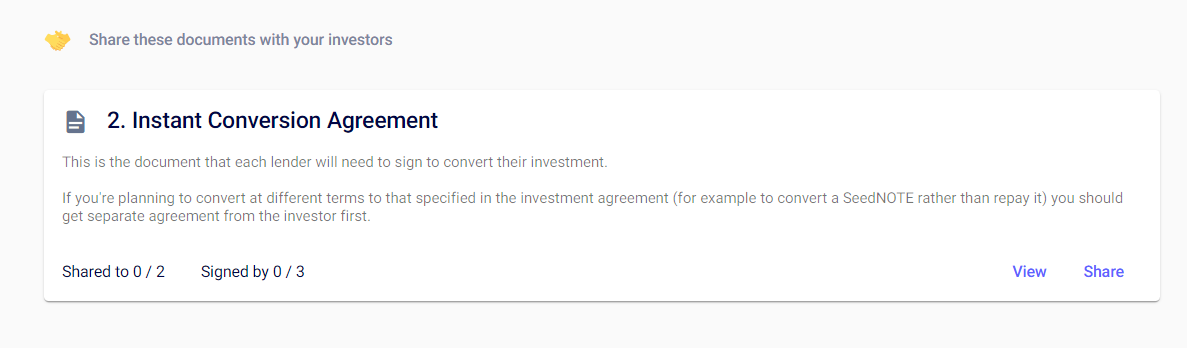

Once you’ve completed the Key Conversion Terms, you’ll be asked to create, and then View/Share the Instant Investment Agreement.

If you’re converting SeedFASTs executed on-platform, you can click to Unlock the agreement for free - but please note if there are any off-platform ASAs being converted, this is where you’ll be charged in order to proceed.

A director of the company can sign this by clicking View and signing the document via the blue Sign button at the top. Your investors will have the same option when the document is shared with them!

Please note that if the company does have an existing Shareholders Agreement and that is selected in the Key Conversion Terms, the Instant Conversion Agreement will become a Deed of Release and Adherence instead of a Subscription Letter. This is because the converting investors will need to adhere to the terms of the existing Shareholders Agreement.

In the case the Instant Conversion Agreement is a deed, both the converting investors and the director who signs on behalf of the company must get the Instant Conversion Agreement witnessed. We have a guide on how to do that here.

Step 6: Create and sign the Board and Shareholders Resolutions

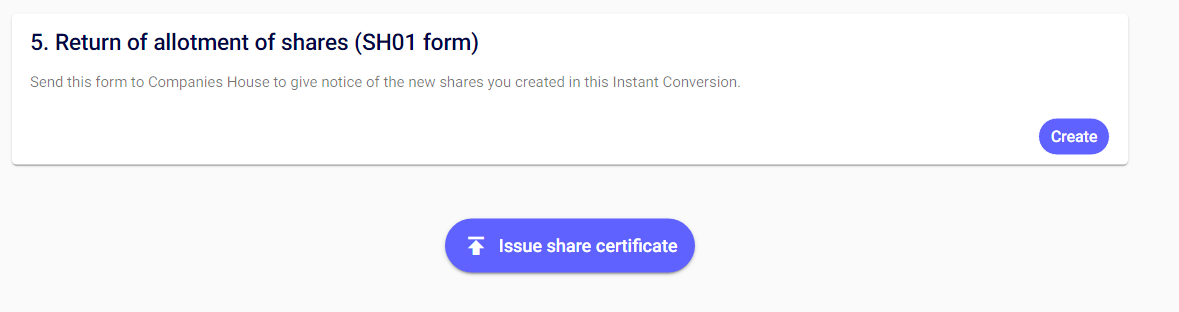

Step 7: Create and sign the SH01 form

Have a director sign the SH01 form at the end of the workflow.

Remember to file the SH01 and Shareholder Resolution with Companies House. Our platform takes care of the creation - you just need to send it! Here is a guide on how to file your SH01 form with Companies House.

Then when the above is completed hit: ‘issue share certificates’. You can see our guide on how to Issue your Investors with their share certificate here. Now, you've converted the SeedFAST / SeedNOTE into equity through the instant conversion - easy. If you want the team to review everything before you issue the share certificates, just reach out to the team!