EMI Annual Return: A step-by-step guide

The following guidance on the Annual Return is based on the guidance notes provided by HMRC here.

This guide covers...

What is an Annual Return and do I need to do it?

If you have registered an option scheme with HMRC, you must complete an online end-of-year return for the previous tax year.

Upcoming Annual Return timelines: For activity between April 6 2024 - April 5 2025, you must file the Annual Return by 6 July 2025.

You must submit a return (or nil return) for every scheme that you’ve registered on the ERS online service by midnight 6 July. You may have to pay a penalty if you do not file the annual return or file an inaccurate return. You or your employees may also lose any tax advantages from the scheme.

Notifying HMRC of the EMI grant

- You will not report an EMI grant within the Annual Return, the notification of grant is a separate process (see here).

- The notification period for EMI grants used to be 92 days from the date of grant. This has been updated since 6 April 2024. If you made any EMI grants on or after 6 April 2024, you have until 6 July following the end of that tax year to make the notification.

When you granted options, you had to notify HMRC to confirm the grant was made. HMRC wants to know if there has been any changes to those grants since then, so they ask companies to fill out the Annual Return to provide this information. The annual return reports whether granted options were exercised, cancelled/lapsed or replaced during the tax year - we call these reportable activities. As such, the annual return must be done in addition to any notification of a grant of EMI options.

You must submit a return every year even if there’s no reportable activity. For example:

- You have a registered EMI Scheme but have not granted any EMI options under the scheme

- You have a registered EMI Scheme and have granted EMI options but there has been no activity in the tax year.

Do I need to submit an Annual Return for my Unapproved Scheme?

Usually no, but there is a key exception. You need to submit an annual return for an unapproved scheme when you’ve granted options to UK tax resident employees or directors. In this case you should have registered the scheme as well. As you don't need to register your unapproved scheme unless you have granted options to a UK tax resident employee or director, we don't recommend registering your unapproved schemes until you are preparing to submit an annual return for that scheme, otherwise you will need to submit a nil return, even if there are no reportable events.

As EMI offers superior tax relief, typically employees and directors are granted EMI options. But if an employee or director has received unapproved options, that is a reportable event and you should register the scheme with HMRC and then you’ll do an annual return via a similar process as you would for your EMI scheme. Please see our guide for the Unapproved ERS Return for detail here.

Whilst there is no requirement to make notifications of unapproved option grants, when you submit an Unapproved Annual Return you will tell HMRC about unapproved grants. There may be other reportable events events for unapproved ERS schemes so please see our guide for detail.

What is an activity? What is the cut off for an activity?

There are four kinds of activity:

(i) adjustments - if, during the year, the option price or description of the shares under option was adjusted following a variation in the share capital

(ii) replacements - if, during the year, a company reorganisation i.e. following a merger or acquisition and the options were replaced with new options as a result

(iii) lapses - if, during the year, options were released (i.e. releasing old options in consideration of the grant of new options), lapsed or cancelled

(iv) exercises - if, during the year, options (or replacement options) have been exercised, this includes taxable or non-taxable.

You’ll find guidance on Lapses and Exercises below - if there was an Adjustment or Replacement please see our separate guide here.

Option grants are not a reportable activity in the Annual Return.

If you made any option grants between 6th April 2024 - 5th April 2025, you should have notified HMRC of the option grant within 92 days of the grant being made.

If you only made grants in the 2023/2024 tax year and none of the above activities took place, then you will need to file a nil return (see below).

For the purposes of the annual return, you are reporting activity that happened in the last tax year e.g. as of 2025, during the 2024/25 tax year, or from 6th April 2024 - 5th April 2025. So if it happened in the 2025/26 tax year, you will wait until the next annual return due in July 2026 to report it.

What do I need to do if there was no activity?

If there hasn’t been any activity in the tax year, you must still submit a ‘nil’ return. To do so, log into your online ERS service. Log in with your Government Gateway ID and password.

You must submit a return every year even if there’s no reportable activity. For example:

- You have a registered EMI Scheme but have not granted any EMI options under the scheme

- You have a registered EMI Scheme and have granted EMI options but there has been no activity in the tax year.

When you’ve logged into the online ERS service, select ‘Services you can use’ in the left-hand menu. Click ‘PAYE for Employers’. Then click ‘View schemes and arrangements’ under ‘Employment Related Securities’ towards the bottom right-hand side of the page. Then select the registered scheme you are submitting an annual return for. This will give you the question, 'Have options been adjusted, replaced, released, lapsed, cancelled or exercised during the tax year?'. Select, 'No (nil return)' and click continue. Fill in the relevant information about the company.

What do I need to do if there was activity?

If there has been activity, you must report this to HMRC by completing the designated excel spreadsheet. Please download and fill in the spreadsheet only if there has been activity in the tax year. You must not alter the structure of formatting of the spreadsheet.

The spreadsheet contains 5 tabs, these are:

- EMI40_Adjustments_V4

- EMI40_Replaced_V4

- EMI40_RLC_V4

- EMI_NonTaxable_V4

- EMI40_Taxable_V4

If you have replacement options or adjustments, then you have to complete all of the tabs. We have advice on how to report those here.

For most companies, the relevant activities are lapses and exercises, which we cover below, so you will only need to complete the last 3 tabs mentioned above.

Only complete the worksheets that are relevant but upload the whole workbook, including any blank sheets. Please ensure you do not change the structure or formatting of your attachment as the file will be rejected when you submit it.

General Guidance for Annual Return Spreadsheet Formatting

-

All values in the sheet should be entered in pounds and pence and entered to four decimal places, round up or down where necessary

-

If the value is quoted in another currency, then convert to pounds using HMRC’s own monthly conversion documents found here.

-

Where AMV is mentioned, this is the value of the share after taking into account any restrictions

-

Where UMV is mentioned, this is the value of a share ignoring any restrictions

- You can find your approved AMV and UMV in EMI Valuation approval letters from HMRC.

-

Where a question or column does not apply, leave the entry blank

-

The exercise price per share is the price at which the employee was granted the option

-

Only complete the worksheets that are relevant but upload the whole workbook, including any blank sheets. Please ensure you do not change the structure or formatting of your attachment as the file will be rejected when you submit it.

-

If your EMI scheme has ceased and you have entered a final event date, you must submit any outstanding returns up until the date of cessation.

Option Lapses

Usually, lapses occur when someone leaves the company and does not exercise their option within 90 days of them leaving. The option will no longer qualify as an EMI option 90 days after the person has left, so from HMRC’s point of view, this will count as being lapsed and still needs to be reported.

Onto the spreadsheet:

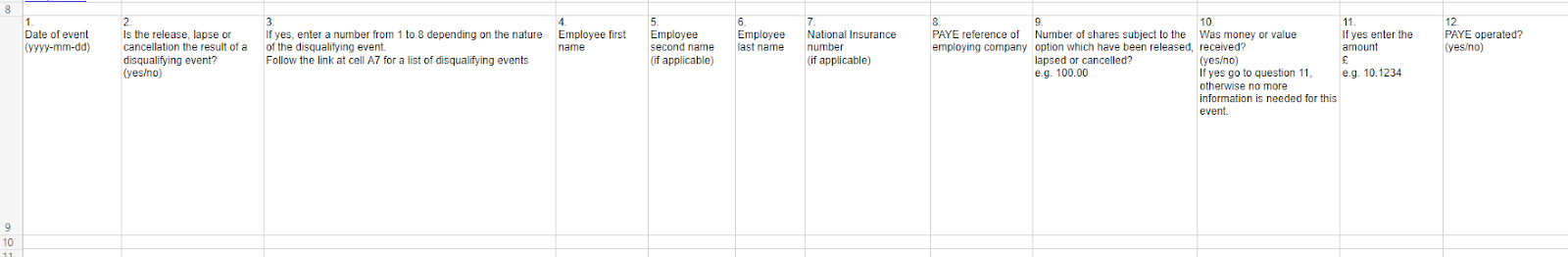

Click on the EMI40_RLC_V4 worksheet (3rd tab from the left) and only fill in information about this tax year’s activity. That means activity before 6th April 2025, since the tax year is 6 April 2024 to 5 April 2025. If someone’s option lapses after 5 April, you should not report it and wait until the next annual return.

Each employee with a lapsing option should have its own allocated row, starting with row 10. Fill in the answers to the questions on the excel sheet.

If you get stuck, please have a look at our guidance below:

1. Date of event

-

This is the date that the original EMI option was released, lapsed or cancelled.

2. Is the release, lapse or cancellation the result of a disqualifying event?

-

Answer yes or no. See disqualifying events here (ETASSUM57080-ETASSUM57130).

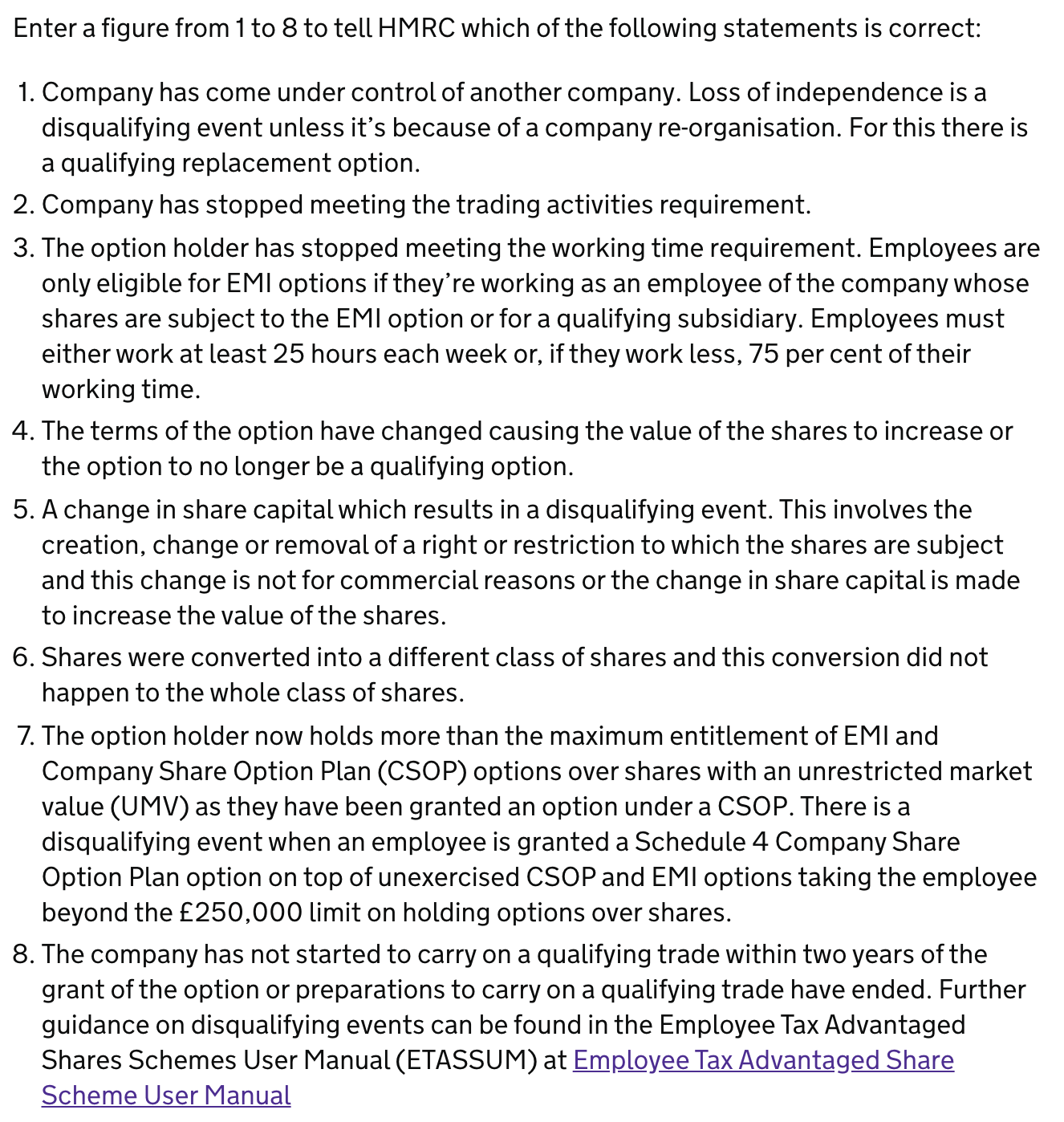

3. If yes, enter a number from 1 to 8 depending on the nature of the disqualifying event.

-

Please see below list of disqualifying events and enter the number next to the relevant disqualifying event:

-

Questions 4-8 are self explanatory. Please see the excel spreadsheet.

9. Number of shares subject to the option which have been released, lapsed or cancelled.

-

Enter the number of options released, lapsed or cancelled. Enter the figure to 2 decimal places, rounding where necessary. If less than 2 decimal places, enter 0 to fill remaining decimal places.

10. Was money or value received?

-

This means any direct monetary value or anything that could be converted into direct monetary value received by the employee for the release, lapse or cancellation of their options.

-

If no, no additional information is needed.

11. If yes, enter the amount.

-

Enter the figure to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

12. PAYE operated?

-

PAYE should have been operated if the shares are readily convertible into cash. The term ‘readily convertible’ means it is easy for the option holder to turn the shares into cash. Enter yes if the shares are readily convertible into cash.

Option Exercises - Non-Taxable

Exercises will be ‘Non-Taxable’ exercises, if you agreed a valuation with HMRC, and the exercise price of the option is the same as that valuation agreed. An option can be exercised by an employee while they are with the company, or within 90 days of leaving the company. If an exercise has taken place under these circumstances, you’ll need to provide exercise details in this section of the spreadsheet.

Onto the spreadsheet:

Click on the EMI40_NonTaxable_V4 worksheet (4th tab from the left) and only fill in information about this tax year’s activity. That means activity before 6th April 2025. If someone’s option are exercised after that, you should not report it - and wait until the next annual return.

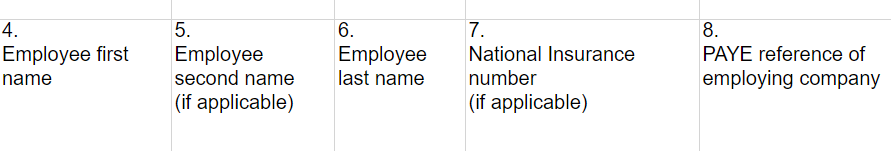

Each employee should have its own allocated row, starting with row 10. Fill in the answers to the questions on the excel sheet.

If you get stuck, please have a look at our guidance below:

Questions 1-6 are self explanatory. Please see the excel spreadsheet.

7. Total number of shares employee entitled to on exercise of the option before any cashless exercise or other adjustment.

-

This is just a fancy way of asking the total amount of options that were exercised by the employee. Enter the figure to 2 decimal places, rounding where necessary. If less than 2 decimal places, enter 0 to fill remaining decimal places.

8. AMV of a share on the date of the grant

-

Enter the AMV that HMRC accepted for these options when you agreed the valuation. Enter the figure to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

9. Exercise price per share

-

Enter the price at which the employee was granted the option. Enter the figure to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

10. AMV of a share at date of exercise

-

This will be the same AMV as agreed with HMRC when you agreed the valuation. Enter the figure to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

11. Are the shares subject to the option exercised listed on a recognised stock exchange?

-

If no, enter no and go to question 12.

-

If yes, enter yes and go to question 14.

12. If no, was the market value agreed with HMRC?

-

If your valuation was approved by HMRC for the option grant, the answer here is yes.

13. If yes, enter the HMRC reference given.

-

The HMRC reference will be on the valuation letter sent to you from the Shares and Assets Valuation office. The reference will normally be your CRN. Enter only numbers, do not enter any letters.

14. Total amount paid for shares

-

Enter the amount the employee paid for the shares. Enter the figure to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

15. Were all shares resulting from the exercise sold?

-

Enter yes if the shares were immediately sold upon exercise.

Option Exercises - Taxable

If you granted Options to an employee at below the market rate agreed with HMRC, or after 90 days of a disqualifying event (which includes if an employee chooses to exercise after the 90 day window), you’ll need to report it in this section instead of the ‘non-taxable’ section.

Onto the spreadsheet:

Click on the EMI40_Taxable_V4 worksheet (5th tab from the left) and only fill in information about this tax year’s activity. That means activity before 6th April 2025. If someone’s option lapses after that, you should not report it - and wait until the next annual return.

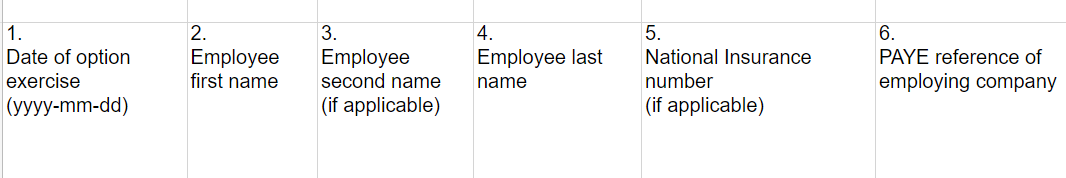

Each employee should have its own allocated row, starting with row 10. Fill in the answers to the questions on the excel sheet.

If you get stuck, please have a look at our guidance below:

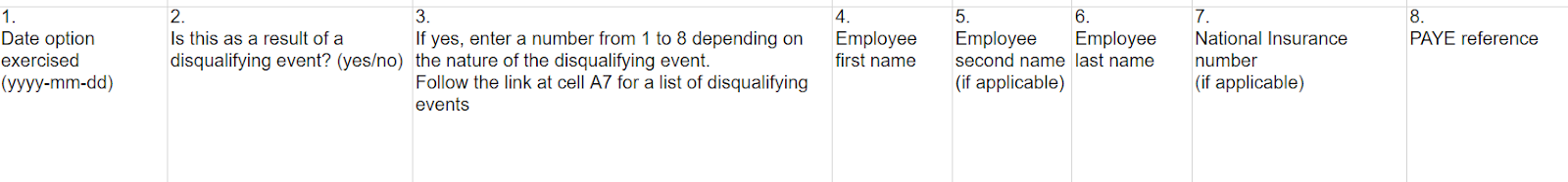

Questions 1-8 are self explanatory. Please see the excel spreadsheet.

9. Total number of shares employee entitled to on exercise of the option before any cashless exercise or other adjustment.

-

This is just a fancy way of asking how many options were exercised. Enter the figure to 2 decimal places, rounding where necessary. If less than 2 decimal places, enter 0 to fill remaining decimal places.

10. AMV of a share on the date of the grant

-

Enter the AMV that HMRC accepted for these options. Enter the figure to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

11. Exercise price per share

-

Enter the price at which the employee was granted the option. Enter the figure to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

12. AMV of a share at date of exercise

-

This will be the same AMV as agreed with HMRC. Enter the figure to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

13. UMV of a share at date of exercise

-

This will be the same UMV as agreed with HMRC in your valuation report/VAL 231 Form. Enter the figure to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

14. Total amount paid for the shares

-

Enter the total amount the employee paid for the shares to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

15. Is the company listed on a recognised stock exchange?

-

If no, enter no and go to question 16. If yes, enter yes and go to question 18.

16. Has the market value been agreed with HMRC?

-

If your valuation was approved by HMRC for this option grant, the answer here is yes.

17. If yes, enter the HMRC reference given.

-

The HMRC reference will be on the valuation letter sent to you from the Shares and Assets Valuation office. The reference will normally be your CRN. Enter only numbers, do not enter any letters.

18. Has an election under Section 431(1) been made to disregard restrictions?

-

This is referring to a Section 431(1) Election to disregard all or some restrictions.

19. Has a National Insurance Contribution election or agreement been operated?

-

Answer yes or no.

-

As an employer, you can legally agree with employees to transfer your National Insurance contributions liability to them on certain shares and share options. This is known as a joint National Insurance contributions (NICs) election.

20. Amount subjected to PAYE

-

Enter the amount put through the payroll for PAYE. Enter the figure to 4 decimal places, rounding where necessary. If less than 4 decimal places, enter 0 to fill remaining decimal places.

- Provided you run the payroll for PAYE, the amount should be calculated as: Number of shares multiplied by the difference between exercise price and Actual Market Value.

Submitting Your Return

When you’re done filling in the relevant details, please log into your online ERS service to file the return. Log in with your government gateway ID and password.

To ensure you haven’t made any formatting errors in your return, you should check your spreadsheet through HMRC’s service. When you’ve logged into the online ERS service, select ‘Services you can use’ in the left-hand menu. Click ‘PAYE for Employers’. Then click ‘View schemes and arrangements’ under ‘Employment Related Securities’ towards the bottom right-hand side of the page. Scroll to the bottom and click ‘Check your ERS files’ and follow the instructions provided.

The service will allow you to check as many times as you would like. When there are no errors showing, go back to ‘View schemes and arrangements’ and select the registered scheme you are submitting an annual return for. Then you can submit your finished spreadsheet online. Ensure you select 'ods' rather than 'csv' when you upload the document.

Please remember to screenshot your submission confirmation for your own record and safekeeping!

Option Adjustment and Replacements

As previously mentioned, if you're looking for a guide with detail on how to record an adjustment or replacement - you can find that in our guide here.

The Annual Return is a HMRC reporting requirement. If you need the Annual Return drafted or reviewed, please speak to your accountant as they will be best placed to help you with the technical components of this filing.