Step-by-step guide to your unapproved annual return

The guide contains the following…

-

What is an annual return and do I need to do it for my Unapproved scheme?

-

Do I need to report any other events when doing my annual return?

-

What do I need to do if there is no reportable activity but I have a registered scheme?

What is an annual return and do I need to do it for my Unapproved scheme?

An annual return is a notification to be made to HMRC, where you inform them of certain events regarding your options. As this is a HMRC reporting requirement we advise you speak to an accountant for more certainty, but we have also compiled general information from HMRC's guidance notes here below.

You need to do an annual return for your Unapproved Option scheme if either of the below apply:

-

you have registered your scheme with HMRC

-

you have granted options to an employee or director within the last tax year or previously

Please note that there are a few steps to complete the annual return for unapproved options - scheme registration (for which you need to have your PAYE online module set up), and the submission of the annual return. The PAYE module must be activated by a code delivered by post, so please kick off the process a month or so before the deadline to allow plenty of time!

Do I need to notify HMRC of an Unapproved Option grant?

Unlike the EMI Option Scheme, you don’t necessarily have to notify HMRC of the grant of unapproved options. However, you do need to notify HMRC of Unapproved Option grants if the option holder is an employee or director, which is done via the annual return. This applies to all employees and directors who are caught by the so-called “employment securities regime” or “ERS” (your accountant should know who they are). Those tax-resident in the UK will be caught automatically, but so will, for example, non-residents who are likely to relocate to the UK during their vesting period.

As mentioned you don’t notify HMRC of an Unapproved Option grant via a standalone process like you do for EMI. But if an option is granted to an employee or director within a tax year, in that year’s annual return you will notify HMRC of the option grants as well as any other reportable activity. So for example, if options were granted on the 12th December 2024, you will notify HMRC of them, as well as any other reportable events in the 2024/2025 annual return, by 6th July 2025.

How do I register my Unapproved option Scheme with HMRC?

If you have granted Unapproved Options to an employee or director, you will need to register your scheme with HMRC first. We don't recommend registering your unapproved schemes until you have granted the options.

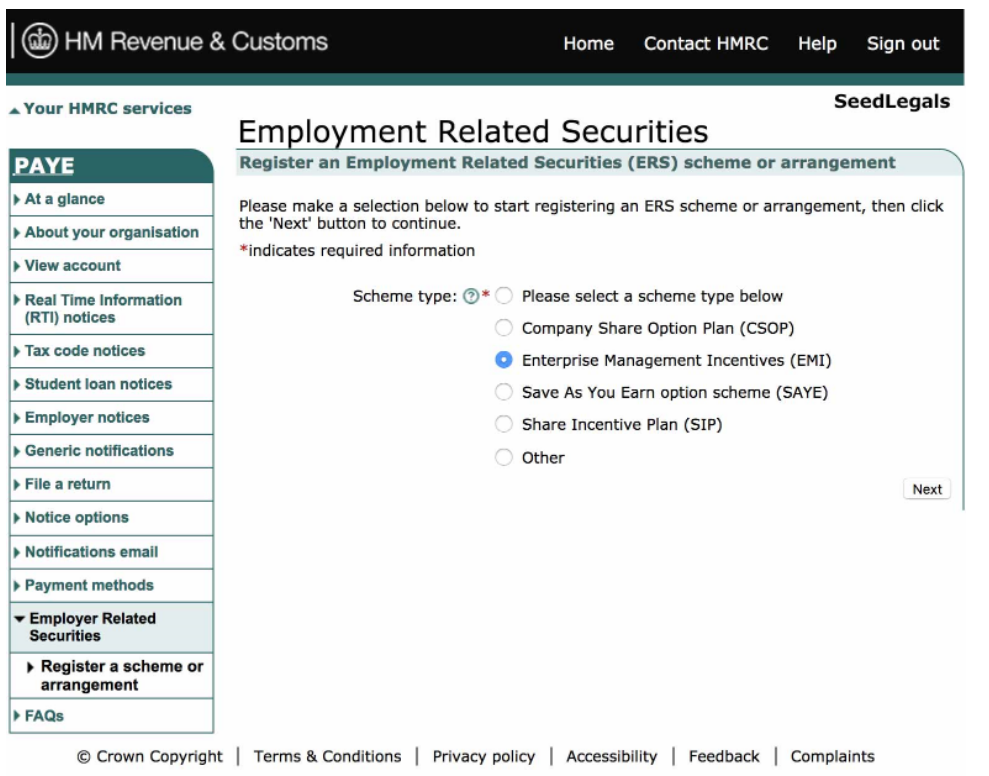

The process to register your scheme is very similar to the EMI scheme registration so you can follow our guide (linked above), except where it asks you the type of scheme you are registering (Step 4 in our guide). For an Unapproved scheme, you need to specify that the scheme type is ‘Other’ not EMI.

General Guidance on Formatting

-

Please note that, when entering the information, monetary values should be in British pounds sterling and entered to 4 decimal places.

-

Where necessary, round up figures ending in 5 or more and round down figures ending in 4 or less. Use any reputable currency convertor to convert to pounds sterling if the value is quoted in another currency.

-

The values for the shares or securities should be to 2 decimal places.

-

Where AMV is mentioned, this is the value of the share after taking into account any restrictions

-

Where UMV is mentioned, this is the value of a share ignoring any restrictions

-

Where a question or column does not apply, leave the entry blank

-

The exercise price per share is the price at which the employee was granted the option

-

Only complete the worksheets that are relevant but upload the whole workbook, including any blank sheets. Please ensure you do not change the structure or formatting of your attachment as the file will be rejected when you submit it.

-

If your scheme has ceased and you have entered a final event date, you must submit any outstanding returns up until the date of cessation.

How do I notify HMRC of grants made last tax year?

You will submit your unapproved annual return by logging into your Government Gateway account and filling in and uploading the template available at the following: ‘Other employment related securities schemes and arrangements: end of year return template’.

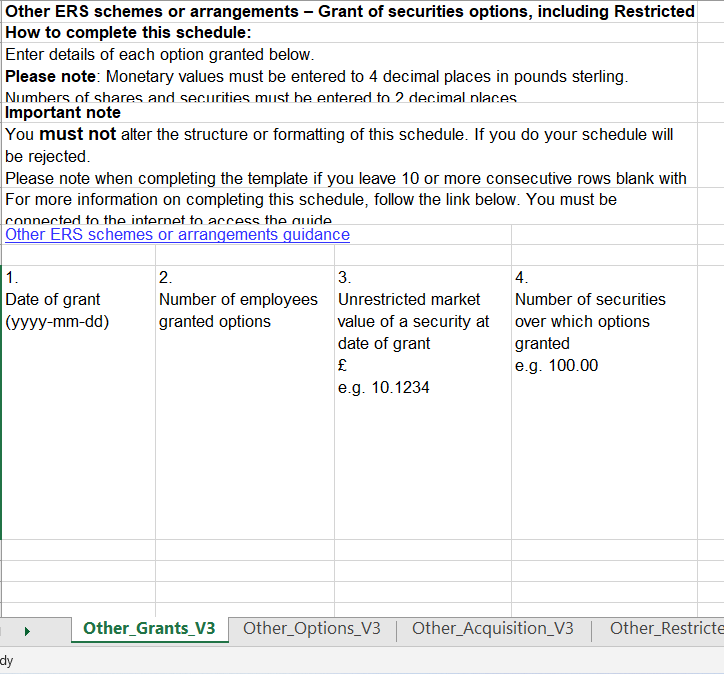

In order to notify HMRC of the grants, please fill in the first sheet of the template, Other_Grants_V4 - please see HMRC’s guidance here:

The date of grant will be the date the option agreement was fully executed by your company. All options granted on the same date can be reported in one row as long as the Unrestricted Market Value of the security is the same for all options granted on that date.

The Unrestricted Market Value (UMV) is the market value of the securities at the date of grant, ignoring any restrictions or the risk of forfeiture. This is not the same as the exercise price or the strike price, but rather reflects the value of the shares at the date of grant. On this matter HMRC states “It is not necessary to have formally agreed the valuation of shares and securities with HMRC. However, where shares are not listed on a recognised stock exchange, you may have asked for a valuation from HMRC. If you agreed a valuation with HMRC then provide the reference number on the attachment. If the number is prefixed with ‘Company Reference Number (CRN)’ do not enter those letters. If you didn’t get a valuation you should continue to retain records of how you reasonably established the valuation.”

Therefore, if you had a valid EMI Valuation for the same class of shares at the time the options were granted, you may want to use this, or another reasonable estimate (like the price per share from your last funding round or an independent valuation). It is important to provide an accurate valuation, as HMRC will use this information to calculate any tax charged on the options.

For more information on the market value to be used, please read HMRC’s guidelines here.

All granted options must be recorded in the return. For example, if on the 8th December 2024, I made two unapproved option grants to an employee, each for 100 options and a UMV of £2.80, I would put these into one entry:

Tables can't be imported directly. Please insert an image of your table which can be found here.

2024-12-08

2

2.8000

200.00

Please check to see whether you need to fill out any of the other worksheets on the template, before submitting the annual return.

Do I need to report any other events when doing my annual return?

Beyond the initial notification, you need to report whether there has been any activity on the option grants. Please see HMRC’s guidance for full details, and below for a summary:

The activities which require notification include:

-

Other_Options_V4 worksheet - If any of the options you have notified HMRC of previously (or in this annual return) have been exercised, released, assigned, cancelled or lapsed in the tax year.

-

Other_Acquisition_V4 worksheet - employment related securities are acquired by an employee not through securities options in the tax year.

-

Other_RestrictedSecurities_V4 worksheet - if there are chargeable events after acquisition of restricted securities.

-

Other_OtherBenefits_V4 worksheet - if an employee, or a person connected with an employee, has received a benefit, not otherwise chargeable to Income Tax, in connection with employment-related securities.

-

Other_Convertible_V4 worksheet - if there is any benefit or chargeable amount received from convertible securities in the tax year., where an employee has acquired employment-related securities that carry an immediate or potential entitlement to be converted into securities of a different description i.e. convertible securities.

-

Other_Notional_V4 worksheet - Use this worksheet to tell HMRC about the amount of notional loan outstanding immediately before discharge for each relevant person in the tax year.

-

Other_Enhancement_V4 worksheet - if there are any securities that are artificially enhanced i.e. the market value of an employee’s employment related securities is increased by more than 10% by non-commercial actions in a relevant period e.g. through a buy-back and cancellation of shares.

-

Other_Sold_V4 worksheet - if securities sold for more than their market value for each relevant person in the tax year.

The most relevant worksheet for the Unapproved scheme will be the Other_Options_V4 worksheet.

In future, for example when these securities are sold, the Other_Sold_V4 worksheet may be relevant, as well as any of the others.

If you have questions regarding your company needing to report any of the above, please do seek advice from your accountant.

How do I fill in the‘ Other_Options_V4 worksheet?

The following is from HMRC’s Guidance:

Question 1: date of event (yyyy-mm-dd)

-

Date of event is the date the ERS options were exercised, released, assigned, cancelled or lapsed.

Questions 2 to 7: see common fields guidance above

Question 8: PAYE reference of employing company

-

Only make an entry in this column if the company that employs the employee has its own PAYE reference.

Question 9: date of grant of option subject to the reportable event (yyyy-mm-dd)

-

Enter the date ERS options were granted to the employees. The date would be on the option certificate or agreement.

Question 10 to 19: grantor or Employing Company, CRN, CT Ref, PAYE Ref

-

Grantor Company is the company that decides which employees will be awarded options. If options weren’t granted by a company but by a partnership, a sole trader or an individual, include their details here. You don’t need to provide a CRN, CT ref or PAYE ref if they don’t have them.

Question 20 to 29: company whose securities under option

-

Provide details of the company whose securities are under option. Scheme rules and other documents relating to the award of the option will have the details of this company.

Question 30: were the options exercised?

-

Enter ‘yes’ if the employee exercised his options.Enter ‘no’ if the option was not exercised but there is another event to be reported in relation to that option.

Question 31: total number of securities employee entitled to on exercise before any cashless exercise or other adjustment

-

Enter the number of securities employee is entitled to acquire from this exercise, vesting or event. This is the gross number of securities and ignoring securities withheld to pay for tax and NIC.

-

Example - an employee has options over 200 shares. He chooses to exercise his option to acquire 100 shares. 40 of those shares are withheld to pay for the employee’s income tax and NIC liability. You enter 100 in this field.

Question 32: if consideration was given for the securities, the amount given per security

-

Only enter any consideration paid by the employee per security and NOT the total to acquire the security. This will most commonly be the exercise price. Exercise price is also often referred to as grant or strike price.

Question 33: If securities were acquired, Market Value of a security on the date of acquisition

-

If securities are restricted and no election is made to disregard all restrictions, enter AMV of a security on the date of acquisition. If securities are unrestricted or an election was made to disregard all restrictions, enter UMV of a security on the date of acquisition.

Question 34: if shares were acquired, are the shares listed on a recognised stock exchange? (yes/no)

-

AIM is not a recognised stock exchange. For more information, go to Recognised stock exchanges.If yes, go to question 37. If no, go to question 35.

Question 35: if shares were not listed on a recognised stock exchange, was valuation agreed with HMRC? (yes/no)

-

If yes, go to question 36.If no, go to question 37.

Question 36: if yes, enter the HMRC reference given

-

The HMRC reference will be on the valuation letter sent to you from the Shares and Assets Valuation office. The reference given will normally be your CRN. Enter the numbers only from this reference, ignoring any letters.

Question 37: if the shares were acquired, total deductible amount excluding any consideration given for the securities

This is the total amount of:

-

any amount paid for the grant of the option

-

any expenses incurred for the acquisition of the securities

Don’t include:

-

exercise price also often referred to as grant or strike price

-

any expenses in connection with the sale or disposal of the securities

-

any Employers NIC the employee may have agreed to pay under a joint NIC Agreement or Election

-

income tax

Question 38: if securities were not acquired, was money or value received on the release, assignment, cancellation or lapse of the option? (yes/no)

-

If yes, go to question 39. If no, no further information for this event is required.

Question 39: if yes, amount of money or value received

-

Enter the amount of money or money’s worth received by the individual employee or anyone else for the ERS options released (including exchanges), cancelled or lapsed.

Question 40 to 42: see common fields guidance above

What do I do if there is no reportable activity but I have a registered scheme?

If there hasn’t been any activity in the tax year, you must still submit a ‘nil’ return. To do so, log into your online ERS service. Log in with your Government Gateway ID and password. When you’ve logged into the online ERS service, select ‘Services you can use’ in the left-hand menu. Click ‘PAYE for Employers’. Then click ‘View schemes and arrangements’ under ‘Employment Related Securities’ towards the bottom right-hand side of the page. Then select the registered scheme you are submitting an annual return for. This will give you the question, 'Have options been adjusted, replaced, released, lapsed, cancelled or exercised during the tax year?'. Select, 'No (nil return)' and click continue. Fill in the relevant information about the company.

How do I submit the Annual Return template to HMRC?

When you’re done filling in the relevant details, please log into your online ERS service to file the return. Log in with your government gateway ID and password. To ensure you haven’t made any formatting errors in your return, you should check your spreadsheet through HMRC’s service. When you’ve logged into the online ERS service, select ‘Services you can use’ in the left-hand menu. Click ‘PAYE for Employers’. Then click ‘View schemes and arrangements’ under ‘Employment Related Securities’ towards the bottom right-hand side of the page. Scroll to the bottom and click ‘Check your ERS files’ and follow the instructions provided. The service will allow you to check as many times as you would like. When there are no errors showing, go back to ‘View schemes and arrangements’ and select the registered scheme you are submitting an annual return for. Then you can submit your finished spreadsheet online.

Do remember to take a screenshot of your submitted registration for your records!