Dans quels scénarios un BSA Air peut être exercé et converti en actions ?

Le BSA Air est un contrat sous seing privé permettant de souscrire à des bons donnant droit à de futures actions. Quels sont les scénarios permettant d'exercer les bons et les convertir en actions ?

😌Not to worry, find the English translation of this article below! 👇

🖊️ Tout d'abord qu'est-t-il prévu dans votre contrat ?

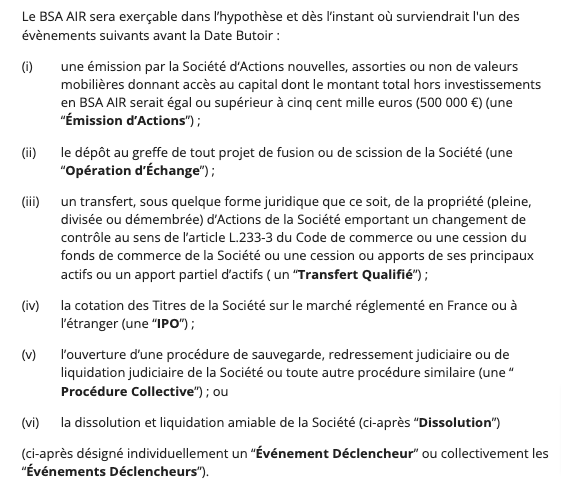

Pour rappel, vous pouvez retrouver à la clause 5 de votre BSA Air SeedLegals les conditions d'exercice du BSA Air en actions :

En cas d'absence d'un événement déclencheur c'est alors la date butoir qui viendra convertir le BSA Air.

Chaque événement ou absence d'événement est expliqué ci-après 👇

📝 Votre contrat a été fait en dehors de la plateforme ?

Vous retrouverez une clause similaire de notre clause "conditions d'exercice du BSA Air" dans votre documentation. En cas de doute n'hésitez pas à nous contacter sur le chat en bas à droite de votre écran !

1. Une levée de fonds qualifiante

Lors de la création du BSA Air, la société spécifie le montant de la prochaine levée de fonds qui viendra convertir le BSA Air en action. Afin de bien identifier cette levée, le montant minimum de la levée est spécifié dans le contrat pour qu'il s'agisse d'une levée de fonds qualifiante.

Quand la société lève ce montant (ou plus), le BSA Air doit être converti.

2. La date butoir ou en cas d'absence d'événement déclencheur

À défaut d'une levée de fonds qualifiante (ou de tout autre événement déclencheurs), le BSA air devra être converti dans un délai de x mois à compter de la date de signature où à une date spécifiée dans le contrat.

Il est courant de prévoir une date entre 18 et 36 mois après signature du contrat. En grande majorité la date butoir est aux alentours de 24 mois après signature.

3. Autres événements déclencheurs

Les autres événements déclencheurs - plus rares - sont les suivants :

(ii) une fusion avec une autre société ou une scission de la société ;

(iii) un transfert d'actions qui entraîne un changement de contrôle dans la société ;

(iv) une introduction en bourse de la société ;

(v) l’ouverture d’une procédure de sauvegarde, redressement ou de liquidation judiciaire de la société par le tribunal de commerce ;

(vi) la dissolution ou liquidation amiable de la société.

Vous souhaitez convertir votre BSA Air ? Alors contactez-nous sur le chat en bas à droite de votre écran !

Toute l'opération de conversion est également expliquée dans ce guide 😄

Enfin, n'hésitez pas à nous solliciter si vous avez des questions sur les cas de conversions de votre BSA Air nous serons ravis de vous aider ! 😺💬

In which scenarios will a BSA Air convert into equity?

A BSA Air (Bons de Souscription d’Actions) is a private contract that grants the holder rights to subscribe to future shares. Here are the scenarios in which a BSA Air can be exercised and converted into shares:

🖊️ What Does Your Contract Specify?

Clause 5 of your SeedLegals BSA Air outlines the conditions for exercising and converting the BSA Air into shares.

If no trigger event occurs, the BSA Air will be converted on the longstop date.

Below, we detail each event or situation that can lead to the exercise and conversion of a BSA Air 👇

📝 Off-Platform Contracts

If your BSA Air wasn’t created on SeedLegals, you should find a similar clause in your documentation under "conditions for exercising the BSA Air". If in doubt, contact us via the chat at the bottom-right corner of your screen!

1. A Qualifying Fundraising Round

When creating a BSA Air, the company specifies the minimum amount of the next fundraising round that will qualify as a trigger event for conversion.

When the company raises this amount (or more), the BSA Air must be converted into shares.

2. The Deadline Date (in Absence of a Trigger Event)

If no qualifying fundraising round or other trigger event occurs, the BSA Air will convert on a specified longstop date.

- This date is usually set between 18 and 36 months from the contract’s signing date, with 24 months being the most common timeframe.

- The specific timeline is outlined in your contract.

3. Other Trigger Events

Some less common trigger events include:

- (ii) A merger with another company or a demerger.

- (iii) A transfer of shares leading to a change of control in the company.

- (iv) An IPO (Initial Public Offering) of the company.

- (v) The initiation of safeguard, reorganisation, or liquidation proceedings.

- (vi) The dissolution or amicable liquidation of the company.

💡 Ready to Convert Your BSA Air?

If you’d like to proceed with the conversion of your BSA Air, contact us via the chat in the bottom-right corner of your screen! You can also follow the complete process step-by-step in this article.

We’re here to assist you with any questions about your BSA Air conversions. Don’t hesitate to reach out! 😺💬