How to do your SEIS/EIS Compliance on SeedLegals

After your round, here's the fast and easy way to give your investors their SEIS/EIS certificates for their tax returns

Before your funding round it’s likely you have applied for and obtained Advance Assurance (if not, there’s nothing to worry about). This provides investors with an assurance from HMRC that they will get their SEIS or EIS tax deductions later.

For your investors to actually claim SEIS or EIS you’ll need to issue them with an SEIS3 or EIS3 certificate. Here’s how it works:

-

Complete your funding round, take in SEIS and EIS investments.

-

As soon as the round closes, issue your investors their share certificates.

-

Then start your SEIS/EIS Compliance. For SEIS you can do this if you’ve either been trading for 4 months OR spent 70% of the SEIS investment. For EIS you must have been trading or doing R&D intended to lead to the trade for a minimum of 4 months. Here is an explanation of what ‘Trading’ means for S-EIS purposes.

-

Applying for SEIS/EIS certificates is a 3 step process.

-

Once the certificates have been generated and sent to the Investors they will be able to file tax returns claiming their SEIS and EIS relief.

Should I speak to anyone to get started?

No need! Simply fill in some questions, upload your supporting documents and request a review of your application by one of our amazing SeedLegals S-EIS associates. Once we complete the review, we will get in touch with you with our detailed feedback. When everything is finalised, we will also submit the Compliance application to HMRC on your behalf, and keep you posted with any progress.

Applying for SEIS/EIS Compliance step by step

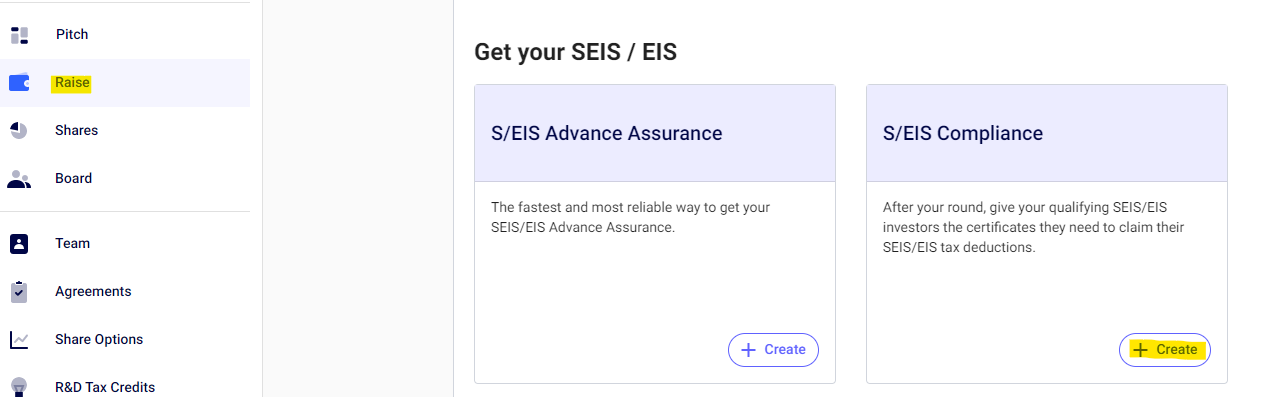

Start off by heading to Raise > S/EIS Compliance > Create

Now it’s time to fill in the details needed for the online submission to HMRC, this should only take a few minutes.

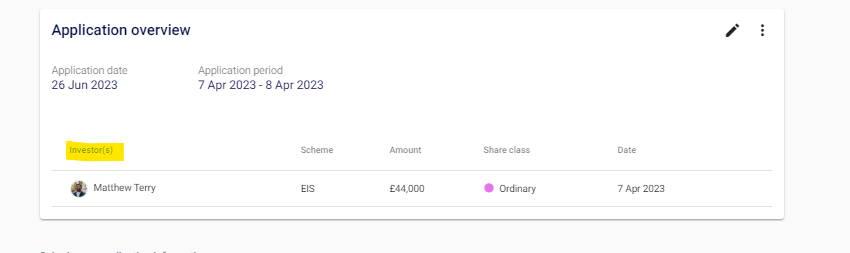

Ensure the application period covers the date range where all the relevant S/EIS shares were issued. For your ease, all investors in the range you selected will be displayed right under it:

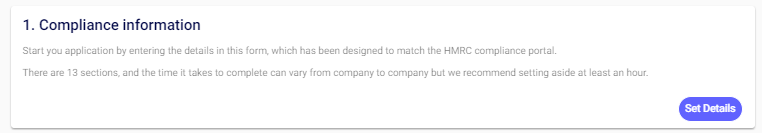

Next, begin answering the questions under "Set Details".

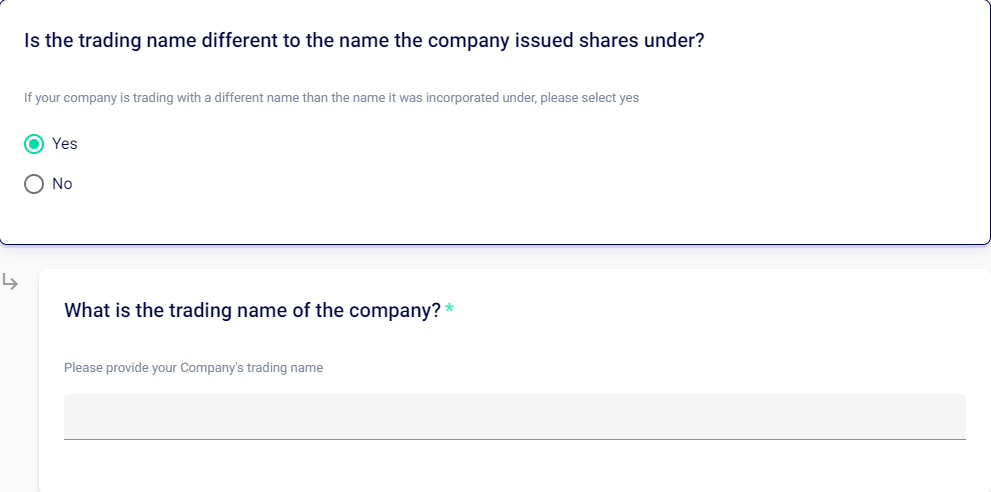

First, if your company is trading with a different name from the incorporation name on Companies House, please disclose it here.

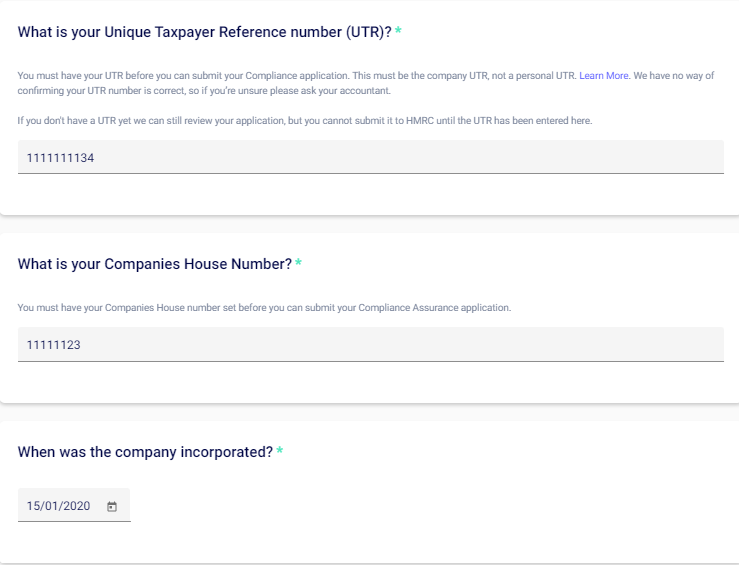

Your UTR, Companies House number and Incorporation date will be auto-populated from your saved Company Details, so just double-check that they are still correct.

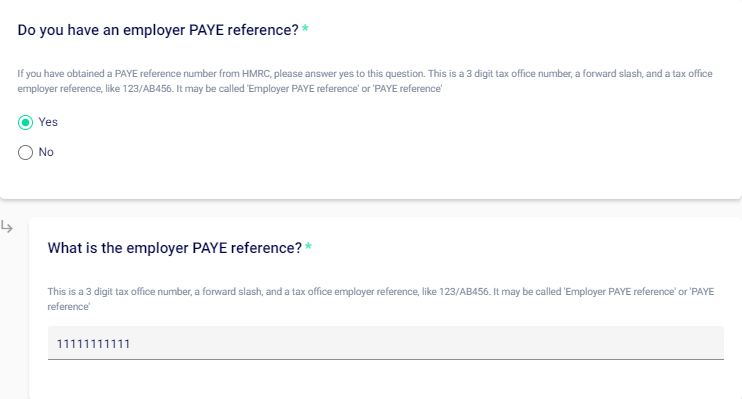

If you have obtained a PAYE reference number from HMRC, please answer "Yes" to this question and provide the number. This is a 3 digit tax office number, a forward slash, and a tax office employer reference, like 123/AB456. It may be called 'Employer PAYE reference' or 'PAYE reference'

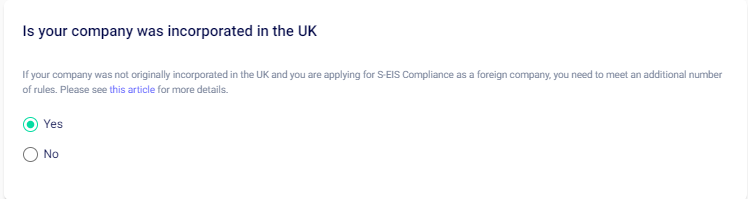

Next, if your Company was incorporated in the UK, please indicate so and your address will be directly pulled through from the Company Details page. If you are a Foreign company seeking Compliance, you will need to provide some additional details, such as the address of the original company, the evidence of permanent establishment, etc.

Next, select what type of Articles of Association you were on when the shares were issued. If you did your Fundraise (Funding round) on SeedLegals, just select option one. If you did not change your articles since incorporation (for example by doing only SeedFASTs and converting them), select the second option. Finally, if you completed your raise outside of the platform, please select the third option.

If you did your Fundraise and updated your Articles outside of SeedLegals, you will also be asked to provide the specific rights attached to the SEIS and EIS shares (i.e. are they Ordinary and what that means).

Then, please answer "Yes" if you have repaid, redeemed or repurchased any shares (completed a share buyback).

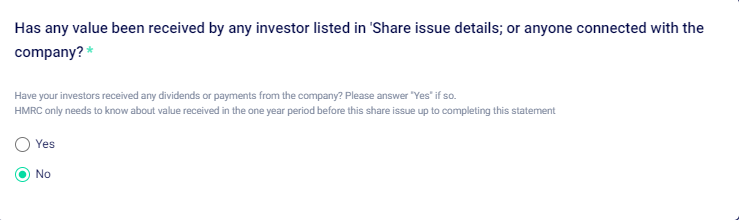

If your investors have received any dividends or payments from the company (direct or indirect, such as free assets), declare it here. HMRC only needs to know about value received in the one year period before this share issue up to completing this statement

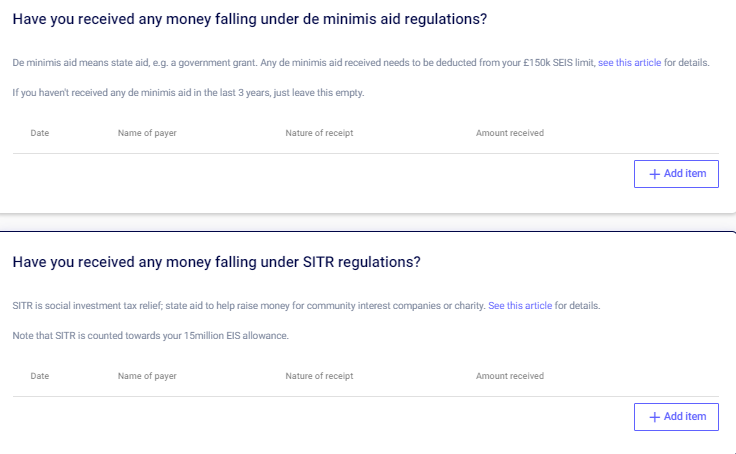

The next section is on previous funding, specifically De minimis aid and social investment tax relief (SITR).

De minimis aid lowers the total amount of SEIS you’re able to claim for. You’ll need to give HMRC details of who the aid came from, what was received, and when it was received.

SITR has the same effect on EIS.

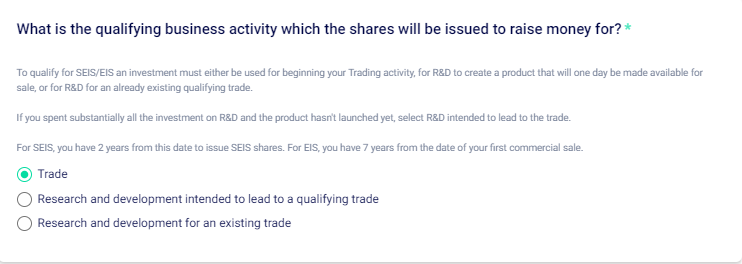

Next, you need to indicate what the S-EIS investment was raised towards. If your company has began trading, please select either option 1 or 3, depending on whether the funds will be spent on the trading activities (marketing, sales, etc.) or R&D for that existing trade.

Next, you need to indicate what the S-EIS investment was raised towards. If your company has began trading, please select either option 1 or 3, depending on whether the funds will be spent on the trading activities (marketing, sales, etc.) or R&D for that existing trade.

If you have not began trading yet, please select the second option. See this article for what counts as trading for SEIS and EIS.

NOTES:

- You can issue SEIS shares for 2 years from your first trading date (this is extending to 3 years with the new SEIS rules - but they are not in place yet!)

- You can only apply for SEIS Compliance if you have been trading for 4 months (R&D is excluded - so you need to have started trading) OR spent 70% of the SEIS funds you are applying for Compliance for

- You can apply for EIS Compliance if you have either been trading OR doing R&D intended to lead to the trade for more than 4 months.

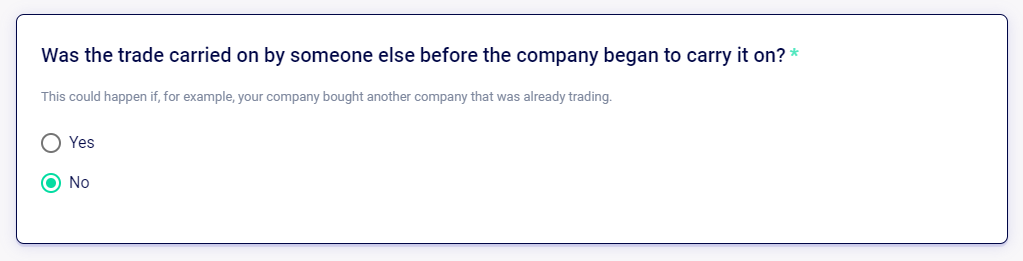

If a related (or acquired) company was carrying out this activity before, or you began the trading activity as a sole trader pre-incorporation, then enter the details here.

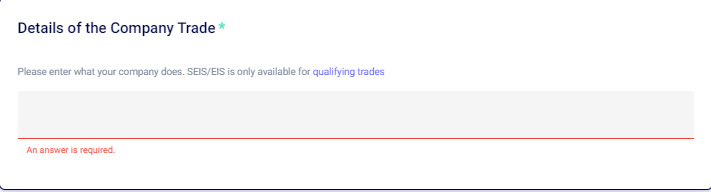

Please describe your trading activities. This should be brief summary of your ‘qualifying trade’ for SEIS/EIS. This is, or will be, the main income generating activity undertaken by the company.

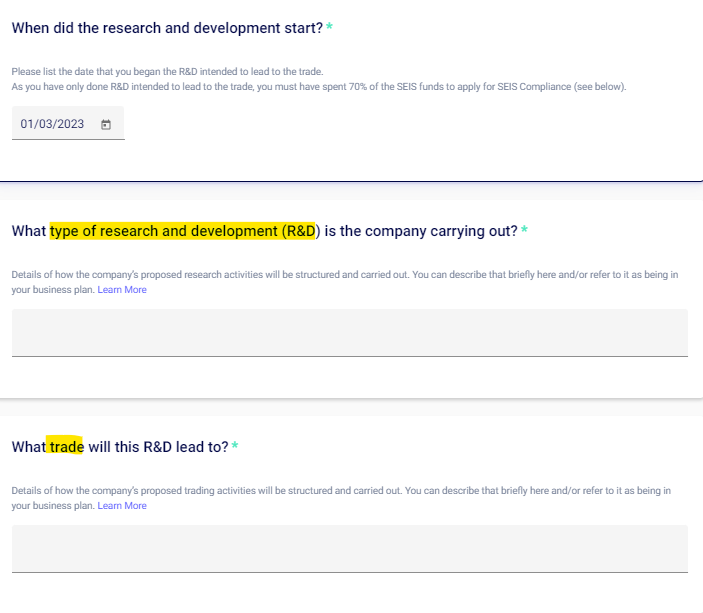

If you selected R&D that would lead to the trade, describe both in the indicated boxes

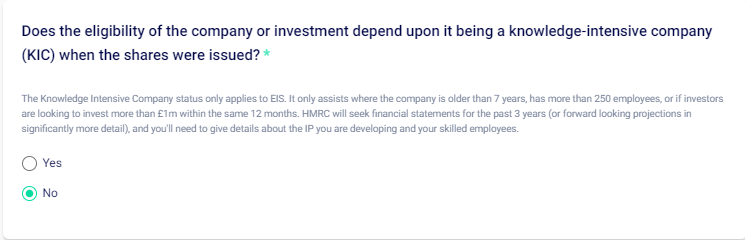

If you are applying for EIS Compliance, you can also apply with KIC status. The Knowledge Intensive Company status only applies to EIS. It is only relevant if the company is older than 7 years, has more than 250 employees, or if investors are looking to invest more than £1m within the same 12 months. So, only select this if you intend to rely on the extra benefits. If you select "Yes", you will be prompted to indicate the exact benefits you need the status for. (Learn More)

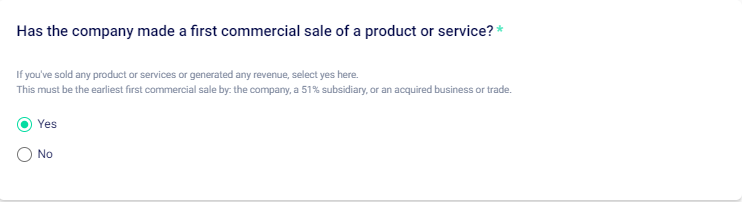

If you have made a Commercial sale (sold any product or services or generated any revenue), select "Yes" and indicate the date you did so. You have 7 years from this date to issue EIS shares.

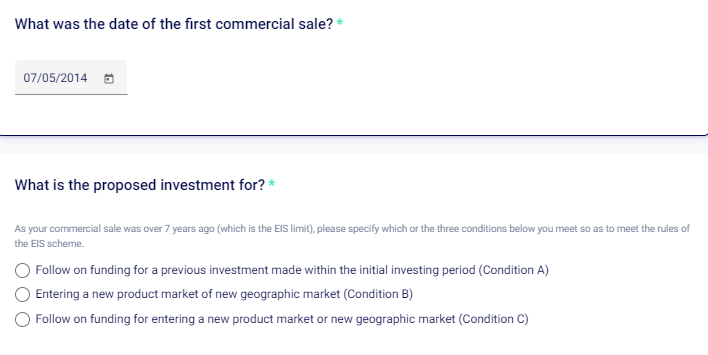

If your commercial sale was more than 7 years ago, you will be invited to indicate which special condition your company meets to be able to issue EIS shares. Find out more about Conditions A, B and C here.

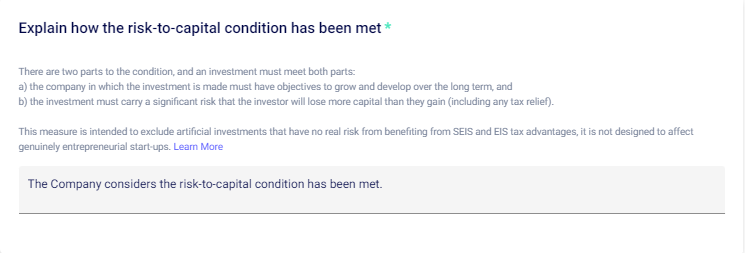

In terms of the risk to capital, please leave the pre-populated text here

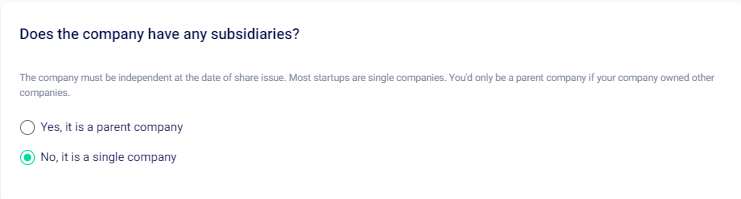

Please indicate if you are a single company or have any subsidiaries below

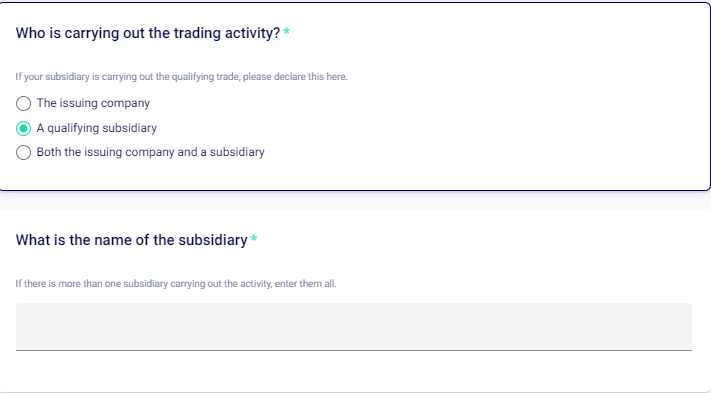

If your subsidiary is carrying out the trade, please put in the subsidiary name. Please also note that for a subsidiary to carry out the trade it needs to be 91% owned by the TopCo.

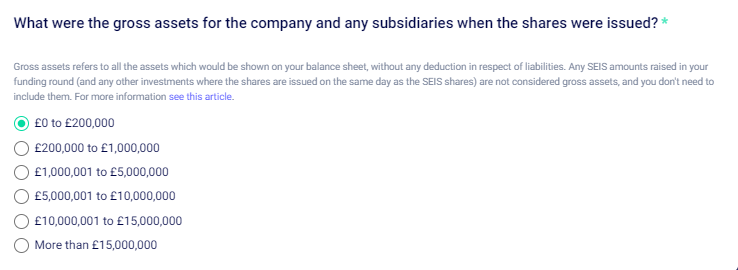

Next, enter in the value of the company’s gross assets immediately before the share issue (excluding the investment). This must be less than £200K for SEIS and less than £15million for EIS.

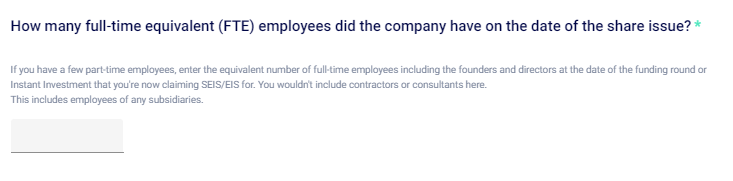

You’ll also need to state the number of full-time employees at the date you issued the shares. Note that this numbers includes founders and directors.

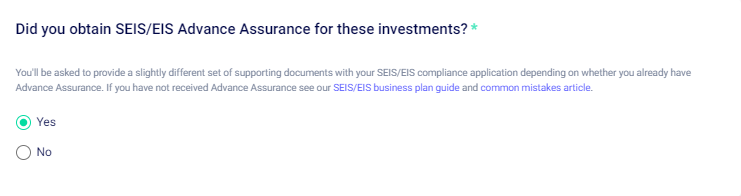

If you have Advance Assurance, great, select it below and add the date you received this from HMRC. If not, don’t worry - just be sure to attach a pitch deck and 3 years projected financials.

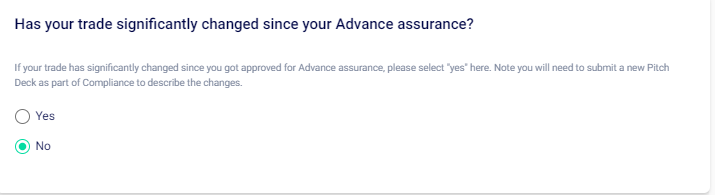

If your trade has significantly changed since you received Advance assurance, please indicate this here (and also upload a Pitch deck of the new and changed trade). A significant change would involve a change of how you generate revenue, or a change of how you conduct your trade as a whole (i.e. a pivot).

If you have filed Company accounts with Companies House, please indicate that.

You can add any additional details of your application here:

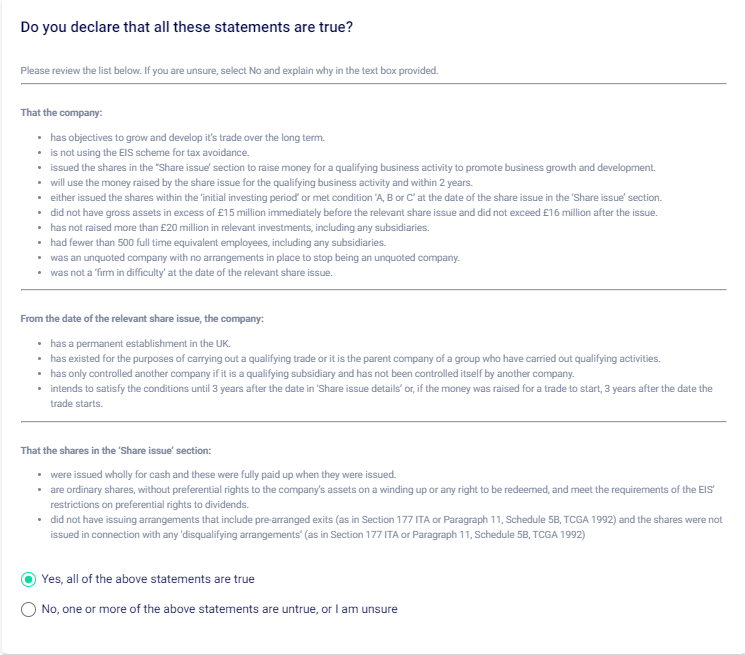

Make sure to carefully read these statements and indicate if they are true about the company. If not, let us know why not / or why you are unsure.

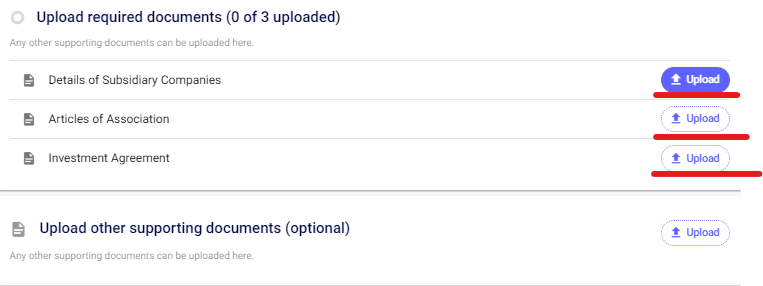

Then, you will be required to upload your supporting documents (based on your answers to the questions). If you have completed your raise on SeedLegals, the majority of these documents will be automatically included in the application for you.

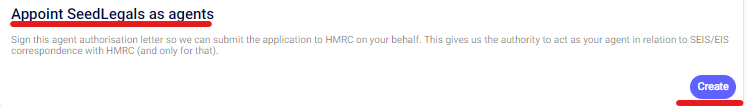

Next, make sure you appoint SeedLegals as your agents on the next step below by generating and signing the Agent Authorization Form.

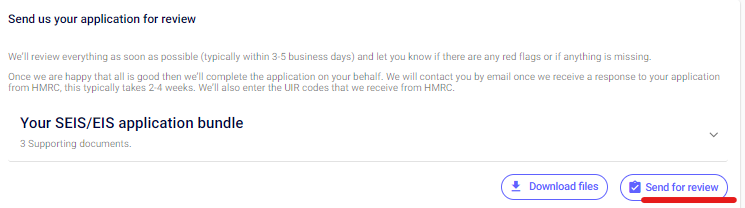

Finally, once you have completed all the steps above, make sure to send us your application for review by clicking this button.

Once we review your application, we will finalise all the answers and supporting documents with you. Your dedicated S-EIS associate will be in touch with you with their comments in 3-5 working days.

Then, once everything is finalised, we will submit the Compliance application to HMRC on your behalf!

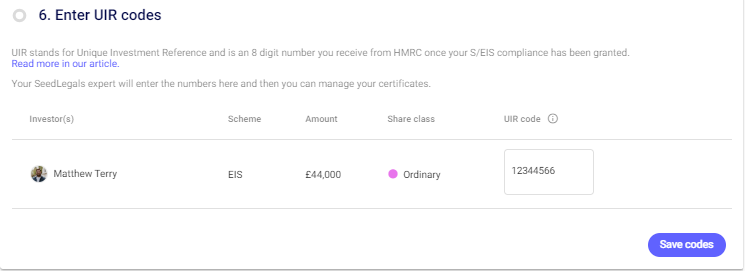

Once HMRC have approve the application, they will send us a Unique Investment Reference Number (UIR number). We will the input it on the next step on the platform for you.

Then, we will send you an email to let you know of the approval.

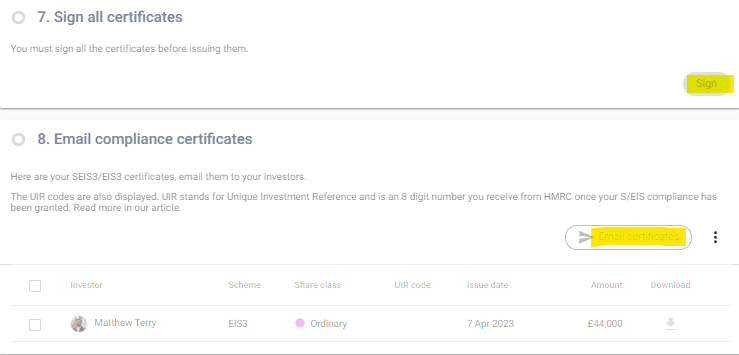

You will need to come back to the Compliance Process (Raise > SEIS/EIS Compliance) and make sure that a director signs the SEIS3 and EIS3 certificates for your investors.

Once you have done that, you can email the SEIS3 / EIS3 certificates directly to your investors through the platform. This is the document that investors will need to claim back their tax relief.

It is the investor's responsibility to claim back their tax relief once they do their tax returns - here's an article with their next steps.