My co-founder is leaving, what do I do with their shares?

Whilst the breakdown of a founder relationship may come with heightened anxiety, often the first steps will be no different from the end of any other employment relationship. You can separate the process by firstly understanding their stake in the company and then deciding the best method to give them what they are owed.

This article will cover:

-

Has their employment been terminated?

-

What if the Founder is a Director?

-

Is there a vesting schedule?

-

Have you done a funding round?

-

What is the share transfer procedure?

1. Has their employment been terminated?

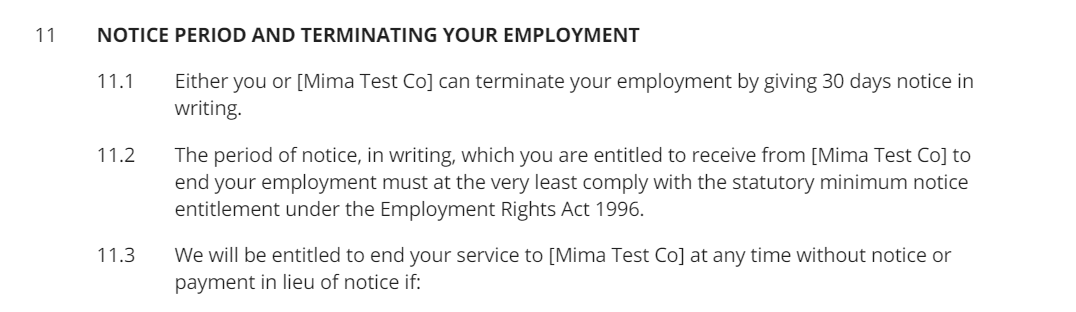

The first thing to check is their Founders Service Agreement to see what the agreement says about their termination and notice period. This is important because if there’s a vesting schedule in place it will allow you to calculate how many shares have vested.

To identify your obligations in relation to their notice period, establish the end of their employment with the company, and begin with calculating how many shares they have, look at the section under “Notice Period and Terminating Your Employment” of their employment agreement (Founder’s Service Agreement, FSA):

2. What if the Founder is a Director?

Firstly, read your Articles of Association to check who has the authority to remove a Founder Director, this would be under the section, “Appointment of Directors.” This section will also detail any rights that are terminated when the Founder ceases to be a Director. To terminate a Founder requires a board meeting held by the members with the requisite authority to approve the termination and board resolution. If the Founder is a Director, a TM01 form will need to be filed to Companies House. See our article here on How to terminate a director | SeedLegals.

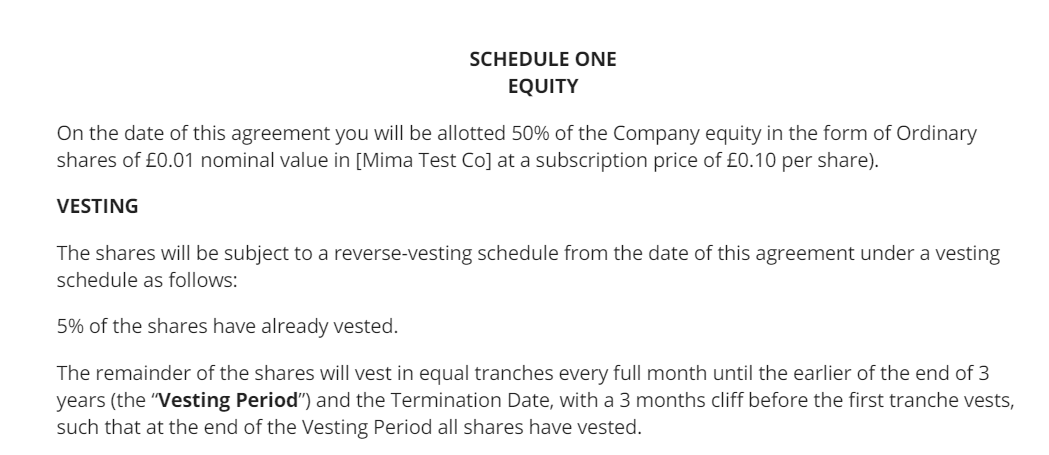

3. Is there a vesting schedule?

The next step is to consider the Leaver provisions and the equity the Founder is entitled to.

The most important part of establishing the equity allocation is whether there is a vesting schedule in place. This is found under Schedule One of the Founders Service Agreement if you haven’t done a funding round.

4. Have you done a funding round?

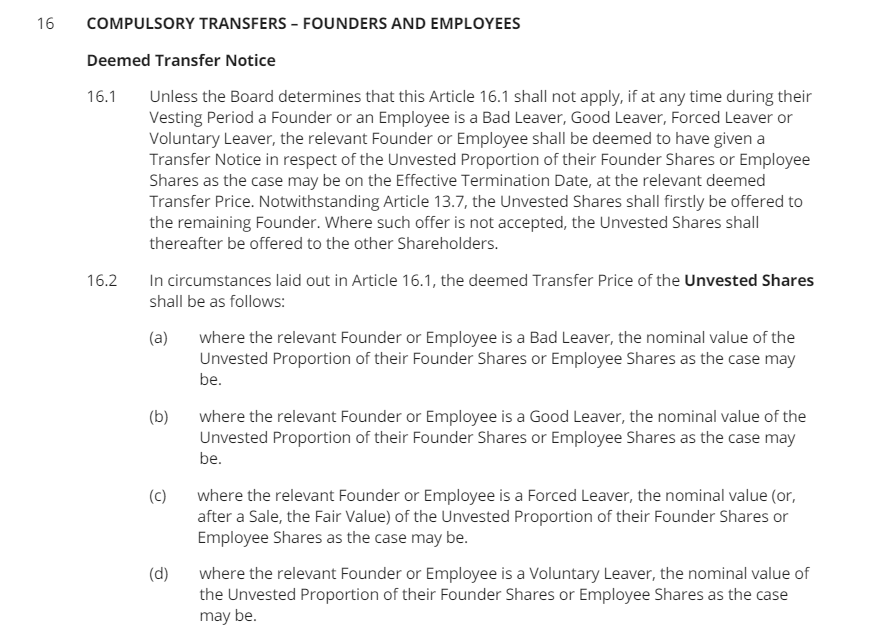

Where you have done a funding round, the share vesting schedule contained in the FSA will appear in the Articles of Association. Under the “Definitions” section of the Articles, you’ll find important definitions relating to the vesting schedule, including “Initial Vested Proportion,” “Vested Proportion,” “Vesting Period,” and “Vesting Start Date,” which will help you calculate how many shares have vested to the Founder, and how many shares are still unvested. It is important here to consider whether the departing Founder had a vesting cliff or milestones specific to their equity entitlement and to factor that into the calculation. You’ll also find definitions for “Leaver,” “Good Leaver,” “Bad Leaver,” and sometimes “Forced Leaver” and “Voluntary Leaver.” It’s important to read each definition to help you categorise what type of Leaver the Founder is, and how much equity they are entitled to. If you haven’t done a funding round, please refer back to the Founder Service Agreement to find out what each type of Leaver is classified as.

Once you’ve calculated how many shares have vested to the departing Founder, and decided what type of Leaver they are, the Compulsory Transfers section in your Articles will tell you the Transfer Price for the vested and unvested shares for each type of Leaver. The departing Founder will also be deemed to have given a Transfer Notice in respect of their unvested shares on the date they are given notice of their termination.

For example, if the Founder leaves for gross misconduct they will be classed as a ‘Bad Leaver’ and they may be forced to transfer the unvested proportion of their shares at nil value. Take a look at the FSA or Articles to see the differences between a Bad Leaver, a Good Leaver, and if defined, a Forced Leaver and a Voluntary Leaver.

5. What is the share transfer procedure?

Firstly, check your Articles of Association to see if the Leaver shares are subject to preemption, and who the shares should be offered to first.

If you're transferring the shares to another individual this is super easy to do and you can do this through a few clicks on SeedLegals. Check out our article here on How to do a Share Transfer | SeedLegals.

If you are transferring the shares back to the Company this is called a share buyback, we currently don't support this on the platform but please do reach out if you have any questions about the process!

When your co-founder leaves it can be a complicated process, this guide hopefully gives you an overview of the key points. If you do have any questions about anything in relation to the steps please do reach out, we would be happy to help.