Option Pool Guide

-

Creating the pool pre- or post-money

If you're wondering how share options differ from shares, have a look at this article: Shares versus Options: what's the difference?

What is an Option?

The Americans call them Stock Options. We call them Share Options. Either way, they let you give employees, consultants and advisors the right to buy shares in the company in the future, at a specified price.

How shares are created from the option pool

When you grant an option you use up part of the option pool, but those shares do not actually come into existence until the option is exercised. So, for example, if you grant an option to acquire 10 shares today, the size of your option pool is immediately reduced by 10 shares, but those 10 shares will only materialise (get issued and allotted) when the option holder exercises the option and you record that option holder’s name opposite that number of shares on your shareholders’ register.

Why we recommend options

We always recommend options to your employees, advisors and consultants for a few reasons:

-

Options forward vest, you can issue options when they complete the work and you won't have to complete a share buy back / share transfer if you end the contract in the vesting period.

-

You can choose when the options are exercised as a Company, allowing you to keep them off the Cap Table so you don't have to revert back to them for shareholder votes, and you can keep the voting power within the founding team.

-

Options are tax efficient if you are issuing them to employees because they can claim through the EMI scheme.

What is an Option Pool?

If you're looking to issue options you first need to have an Option Pool in place.

An Option Pool is a ring-fenced percentage of your share capital which you have authority from your shareholders, board, and investors to allot.

Contrary to popular belief, there is no actual pool, vault or any other “space” or even account where option shares are kept. It really is just a number - a number of shares which the board has a permission to offer, typically without having to secure any additional consents, to those employees and/or advisors who the company wants to incentivise through share options.

Your option pool reflects the number of shares the company has set aside to grant as share options to employees, advisors, etc. You usually create an option pool (either pre- or post-money) as part of a funding round. Your option pool will appear in your cap table in a grey colour. The option pool is not under a defined share class, as you can determine the share class of the share options when you grant them.

How big should my option pool be?

When sizing your option pool the most important consideration is when you'd next want to ask your investors to expand it. You will need to get a shareholder's resolution (to be signed by 75% of voting shareholders) and you may also require Investor Consent. So you want the pool to be large enough ideally so that you don't have to bother your investors (and ask to agree to dilution) between each round.

Many investors will expect a 10% pool to be in place at the time of their investment (see Pre- or post-money below) and this is a good rough guide for an option pool. The exception here would be if you're looking to give EMI options to a late joining co-founder. For more information on how many options to give to different people within your organisation have a read of our guide here.

Pre- or post-money?

When setting up a funding round on SeedLegals, you can choose a “pre-money” or a “post-money” option pool. A pre-money option pool of, for example, 10% will dilute your existing shareholders slightly more than a 10% post-money option pool, which dilutes existing shareholders and the new investors proportionally.

Option Pools are nearly always created pre-money in a funding round since it’s only the existing shareholders who get diluted by the Option Pool. This is generally what the new investors are going to insist on (you're promising them a particular % of the company for their investment, if you then tell them, oh, it's actually 10% less than that, you got diluted already, well, that's not something they're generally expecting, unless by prior agreement). Here is an interesting article on how to size an employee option pool.

Either way, you will not be issuing new shares to anybody just yet: you will merely be pre-authorising this further issue, if and when future share options are exercised.

When to create an Option Pool on SeedLegals

If you're a venture backed Company and you're looking to grant options and issue options we always recommend creating an option pool in a funding round. This is the easiest way to create an Options Pool, you can do it with the click of a button through the SeedLegals funding round products, and it is often expected from investors.

So if you're planning on doing a funding round soon, create your Option Pool as part of the round!

Alternatively, you may want to create an Option Pool outside of your funding round. Maybe you don't plan on raising investment for a while (or ever) and you have some advisors/consultants/employees that you want to grant options to immediately. You can do this on SeedLegals too, see below.

What happens if I create a bigger Option Pool than I need?

When you create an option pool it has the effect of pricing the shares for future investors as if those option shares existed. Basically, when you create an Option Pool you dilute all existing shareholders.

If the option pool doesn't get used and you want to cancel it later, no problem... but that may have the effect of reducing the total number of shares (including the option pool), which is equivalent to increasing the % equity of every shareholder at that time. Basically, if you create more options than you need, and cancel them later, that has the effect of diluting you (the founders and existing shareholders), and transferring some of your % equity to later investors.

However, when setting up a Seed Round on SeedLegals you can specify that, if there is an exit coming up, the unallocated part of the option pool (if any) will be returned to the founders in the form of readily exercisable share options.

If you need to reduce the pool on the platform, have a look at this guide.

What happens if I create a smaller Option Pool than I need?

Alternatively, you may run out of shares in your Option Pool, in which case you will typically need to obtain additional permissions from the company’s shareholders if you want to grant more share options.

Our advice is to create only as many options as you think you'll need between now and your next funding round, and if you need more you can create more then.

If you need to extend the pool on the platform, have a look at this guide.

How to Create an Option Pool on SeedLegals

An Option Pool is simply getting the permissions of existing shareholders to reserve shares that can be created and issued in the future. No shares exist when the option pool is created. Think of them as virtual shares, waiting to be created when an employee exercises their share options.

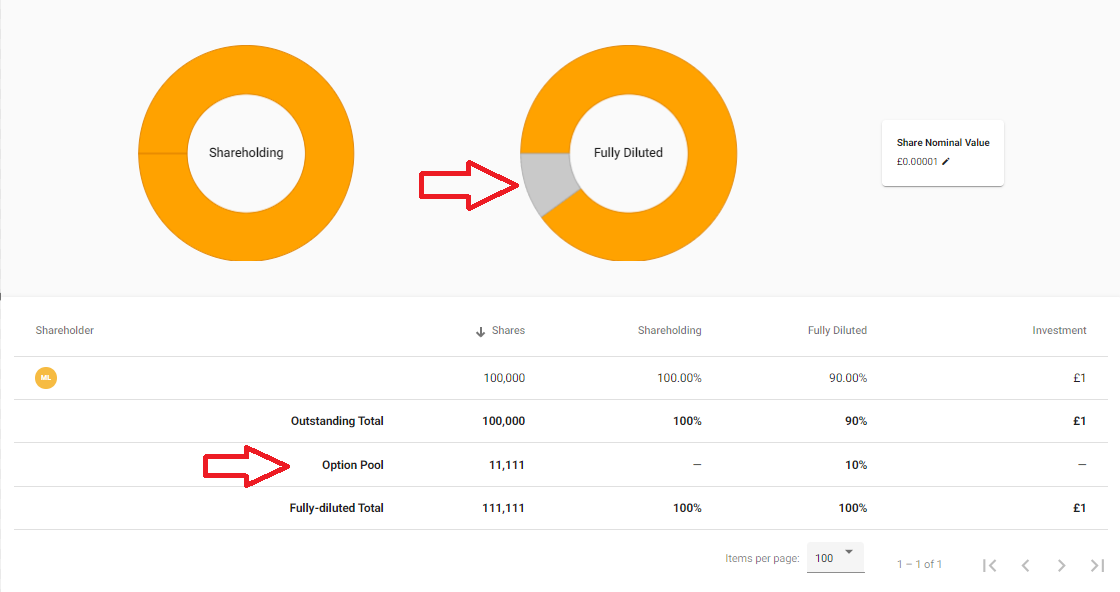

Since creating this reserved pool of shares dilutes the existing shareholders, as an example, if there were 100 shares in the company, and you create an Option Pool of 10 shares, the shareholders now own 100 out of 110 of what's known as the fully diluted capital in the company (which just means the shares plus the reserved Option Pool).

To create the Option Pool, first select the Cap Table window on the left hand side of your SeedLegals dashboard. Then, select the Option Pool tab. From there you will select the Create / Update Option Pool button.

When you click 'Create/Update Option Pool' you will see a side navigation panel on the right where you can can tick whether you just want to reflect a option pool you updated off platform or if you need to create the pool with our documents ('create with approval documents'). Select 'continue'.

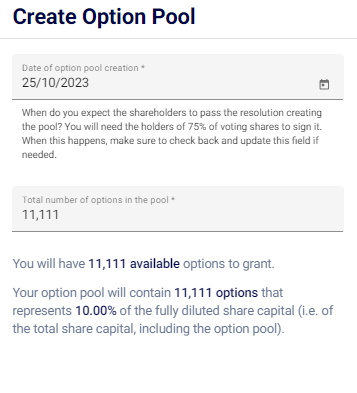

In the side navigation panel, please indicate how many options you would like in the pool and select 'confirm'.

Since creating an Option Pool dilutes the existing shareholders, it needs the consent of the shareholders to create that pool of reserved shares.

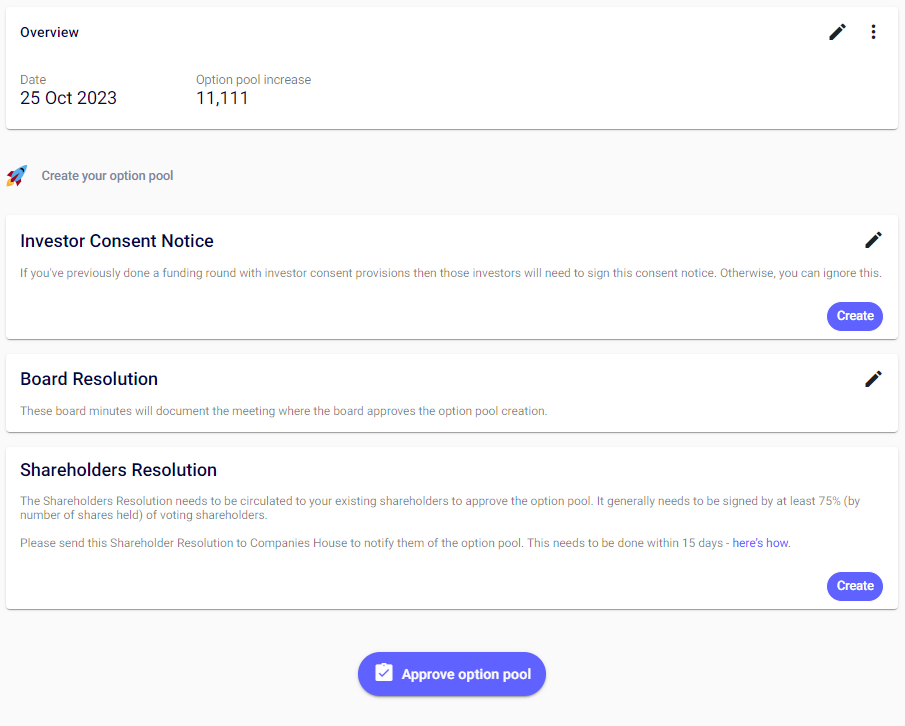

If you require investor consent to create options you can create the Investor Consent Notice - though this may not be necessary for your company. You should check your Shareholders Agreement to check if you need investor majority consent to increase your company share capital and create an Option Pool. If you don’t need investor majority consent, then skip this document.

You will need approval on a board and shareholder level.

To document that creation of the pool on a board level, select the pencil icon next to 'Board Resolution'. Here you should set the date of the board meeting, who the chairperson was, and whether any of the directors were absent. Then you can select 'create' to generate the Board Minutes. One director needs to sign the Board Minutes.

You will then need existing shareholders to approve the Option Pool through the Shareholders Resolution. Please create and send the Shareholders Resolution to all shareholders, get it signed by 75% of voting shareholders, and then upload it to Companies House.

Once you've finalised the option pool, it will appear on your Cap Table, as shown below:

Providing that you followed these steps, you will now have set up your Option Pool successfully - congratulations!

As always with SeedLegals, if you have any questions, please do get in touch.