What happens if I create a bigger/smaller Option Pool than I need?

This article explains the impact of changing the size of the option pool and how to update the pool on SeedLegals

When you create an options pool it has the effect of pricing the shares for future investors as if those option shares existed. Basically, when you create an options pool you dilute all existing shareholders.

Pool is bigger than I need

If the options pool doesn't get used and you want to cancel it later, no problem... but that has the effect of reducing the total number of shares (including the option pool), which is equivalent to increasing the % equity of every shareholder at that time. Basically, if you create more options than you need, and cancel them later, that has the effect of diluting you (the founders and existing shareholders), and transferring some of your % equity to later investors.

For example, if a sole shareholder creates an option pool, they would be diluting their own shareholding. If they then brought on two investors before decreasing the size of the option pool, the relative increase in the shareholding would benefit all three investors equally (pro rata), whereas the founder was the only one whose shareholding was diluted.

Worked Example 1

Founder A is the only shareholder on the cap table holding 100,000 shares. He creates an option pool of 10% equal to 11,111 options, meaning his fully diluted shareholding becomes 90%

Founder A brings on Investor A and gives them 2%. This results in a fully diluted cap table of:

- Founder A - 88.20%

- Investor A - 2%

- Option pool - 9.8%

If the pool was later reduced to 5%, the resulting shareholding distribution would be:

- Founder A - 92.89%

- Investor A - 2.11%

- Option pool - 5%

Worked Example 2

As a counter-example, imagine Founder A creates an option pool of 5% from the start, before taking investment from Investor A. In this scenario, Investor A’s shareholding would not ‘increase’ as a result of the shrunken option pool. Overall, the shareholding would be:

- Founder A - 93.10%

- Option pool - 4.90%

- Investor A - 2%

So, our recommendation is to create only as many options as you think you'll need between now and your next funding round, and if you need more you can create more then.

Pool is smaller than I need

Alternatively, you may run out of shares in your Option Pool, in which case you will typically need to obtain additional permissions from the company’s shareholders if you want to grant more share options.

Our advice is to create only as many options as you think you'll need between now and your next funding round, and if you need more you can create more then.

Updating the pool on SeedLegals

If you want to go ahead and reduce the pool, follow the below steps.

1. Go to the 'Cap Table' tab and select 'Options' from the top banner. You can then click on the option pool. You'd then be able to click 'create/update option pool'.

You will see a side navigation pane on the right side where you can indicate whether you will need approval documents to reduce the pool, or if you are just reflecting a reduction you made off platform. Select 'continue'.

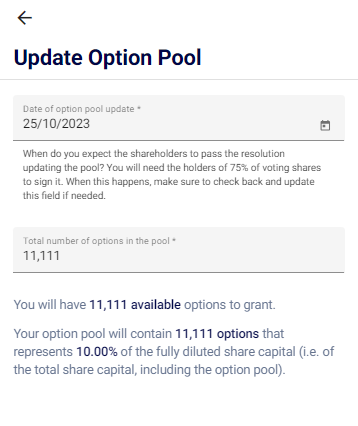

In the same side navigation panel, you will see that the pool size is set to the size you currently have. Edit the number of options to the size you want to have. In this example, there is a 10% pool. If I wanted to reduce it to 5%, I would update the number from 11,111 to 5,264. If I wanted to extend the pool from 10% to 15%, I would update the number from 11,111 to 17,647.

Select 'confirm' when you've input the size you would like.

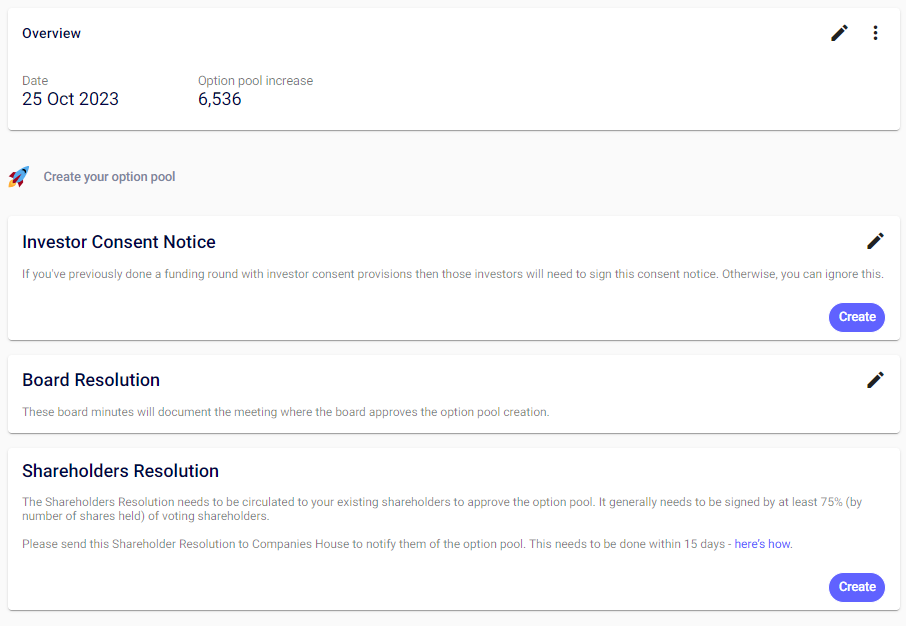

Since creating an Option Pool update affects the existing shareholders, it needs the consent of the shareholders to update that pool of reserved shares.

If you require investor consent to create options you can create the Investor Consent Notice - though this may not be necessary for your company. You should check your Shareholders Agreement to check if you need investor majority consent to increase your company share capital and create an Option Pool. If you don’t need investor majority consent, then skip this document.

You will need approval on this change to the pool on a board and shareholder level.

To document that creation of the pool on a board level, select the pencil icon next to 'Board Resolution'. Here you should set the date of the board meeting, who the chairperson was, and whether any of the directors were absent. Then you can select 'create' to generate the Board Minutes. One director needs to sign the Board Minutes.

You will then need existing shareholders to approve the Option Pool through the Shareholders Resolution. Please create and send the Shareholders Resolution to all shareholders, get it signed by 75% of voting shareholders, and then upload it to Companies House.

Once the option pool update is finalised, it will be reflected in your SeedLegals cap table.