How many share options should I grant to my employees?

Giving equity to your employees is a fantastic way to attract top talent in the early days when cash is scarce. It’s one of the main ways startups compete with high corporate salaries, and aligns employees with company goals, a win-win!

At SeedLegals we are big advocates of issuing equity options to employees. However with few resources out there it can sometimes be hard to know how much equity to give out, and how to optimally structure equity compensation in your company.

We’ve put together this article to help you decide, summarising industry-leading reports from Balderton Capital, and drawing from our own data on SeedLegals to give you a comprehensive view.

Are you interested in setting up an option scheme for your company? See how we can help you here.

How large should your option pool be?

An option pool is the portion of company equity that is reserved for future employees, and you’ll need to decide how big your option pool should be. The decision on how many options to give each employee will vary depending on the overall size of your option pool (a bigger pool means you have more equity to give them).

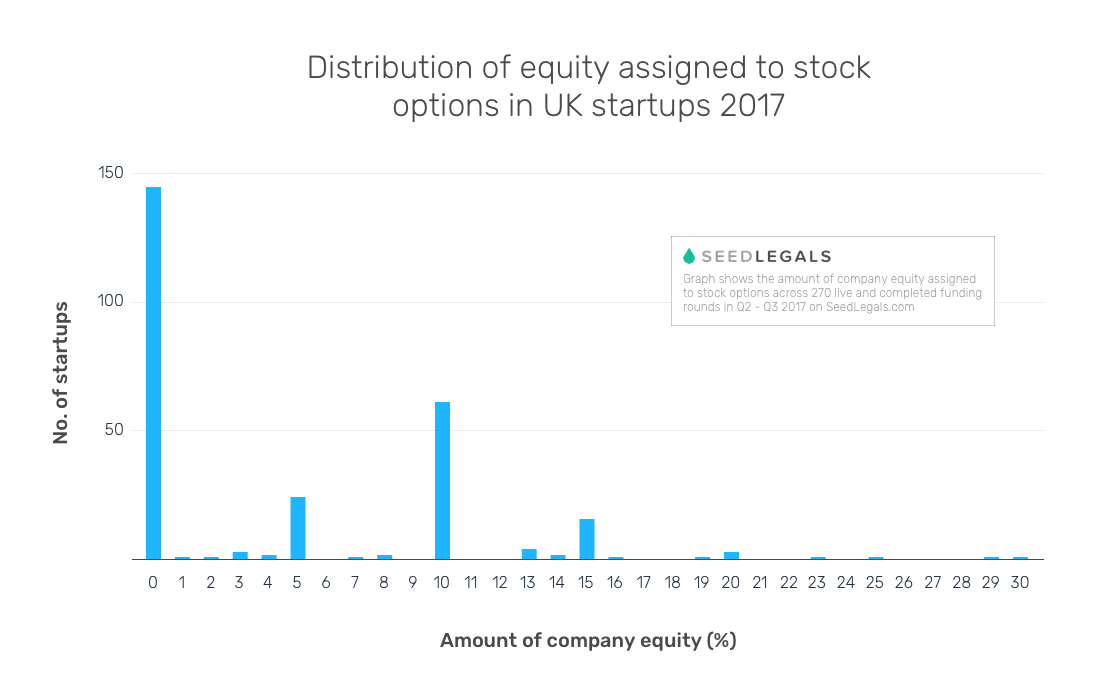

Our data shows that half of UK startups put aside 5 – 15 % of their equity at funding rounds towards their options pool, with 10% being the median.

Figure 1 – A graph to show the percentage of shares assigned to share option pools in UK funding rounds of between £200k – £3m on SeedLegals.com

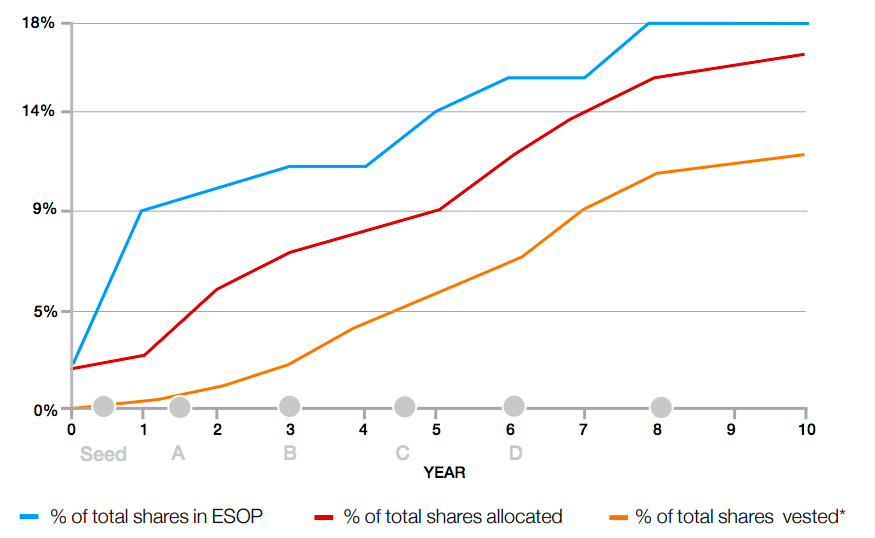

For companies raising early stage funding (between £200k and £3m) both Index Ventures and Balderton Capital agree that at the Seed Round companies should set aside around 10 % of total company equity for their employee option scheme. The amount committed to the option scheme is then likely to rise when the company progresses through later funding rounds (See Figure 2).

Figure 2 – A graph to show the percentage of shares (available, allocated and vested in option pools). Source: Balderton Essentials Guide to Employee Equity

Should you offer your whole team equity options or only some individuals?

Offering the whole team equity options means that every hire is invested in your business, it encourages collaboration and could create a cultural shift in the business really emphasising that everyone is in it together.

On the contrary, the advantages of not offering everyone options is that it allows you to be selective with option distribution, only giving options to key hires or star performers as a reward and to really incentivise them to stay with the business.

Another idea is to do a bit of both – give everyone in the company a low base value of options on joining, then allocate extra to the key performers as a reward.

The answer to this question, it really comes down to individual/company preference, there is no right or wrong way to allocate equity options.

Sign up to SeedLegals to set up an option scheme for your company or book a demo with a member of the team.

Based on their seniority, how much equity should I give to my employees?

The answer to this question should be based on both how much equity is available in the employee option pool, what is the value of this person and what is a good competitive offer that will incentivise them to stay?

But it is important to set guidelines, and both Balderton Capital and Index Ventures have released reports on this topic which we have summarised below.

C-Level Executives

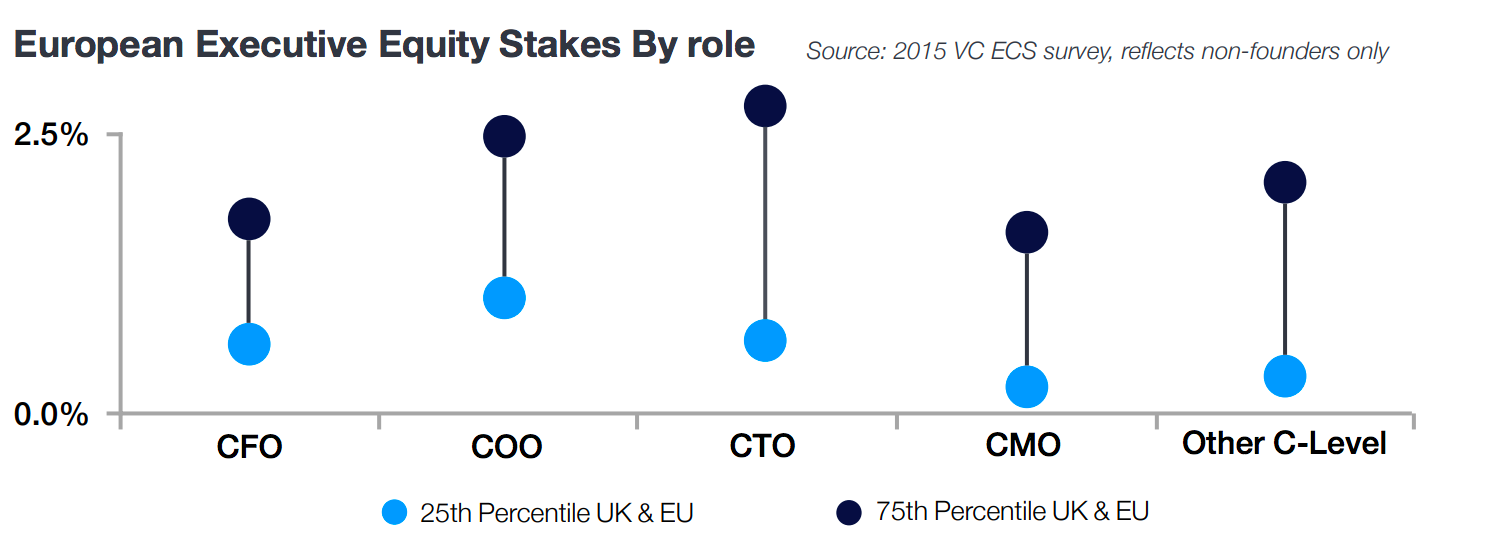

For C-Level Executives (think COO, CTO, CFO, CMO), of which most Series A and B startups will have no more than 3 true non-founding C-level Execs, options are generally granted at 0.8 to 2.5 % of the total diluted equity amount (see Figure 2). For Vice-Presidents, of which you are likely to have 5 to 8 in the organisation at Series A and B, then you might grant a lower amount of 0.3 to 2 %.

Figure 3 – A graph to show the distribution of equity given to non-founder member c-level executives.

Interestingly, European companies tend to allocate 2/3rds of their option pool to executives in later stage startups, and in the US this ratio is reversed. It highlights our reluctance in Europe to issue options to non-executive employees, something which is slowly starting to change.

Non-Exec Employees

When assigning equity options to members outside of the executive team, the reports suggest Directors may get assigned 0.5 to 1 % of total company equity, managers and other key functions 0.2 to 0.7 %, and all others employees 0.0 to 0.2 %.

At these small percentages it is often best to talk in terms of value instead of percentage – 0.1 % of total equity pool sounds a lot less appealing than £20,000 of options at a £20 M valuation. Also the larger the company valuation, the more employees you have, so the less of an option pool you have to give away. In terms of what value of options to give away to non-executive staff members, the general recommendation is that senior level members get granted 50 % – 90 % of their salary in options, medium level staff member 25 % – 50 %, and junior staff members get granted 10 – 25 %.

As an example, at a £20 M company valuation, a senior staff member on £100,000 a year salary would get granted £50,000 to £90,000 worth of options which is equal to 0.25 % to 0.45 % of total company equity.

Of course all these percentages are guidelines. It depends on both what the company is willing to offer and what the employee wants!

How much equity should I give an employee based on the stage at which they joined the company?

Generally, the relative amount of equity you give away as the company grows will be dependent on company cash flow. Earlier stage companies can’t normally afford to pay the market salary value for employees and therefore equity option compensation for first employees is higher.

Equity for first employees and founding team:

At an early stage (up to 10 employees) the reports suggest you might expect to give up to 1 % of the total company equity per employee.

Beyond the founding team:

As a mid-sized company (15 – 50 people), as salaries start to increase compared to the market value, you might start to give out options based on seniority or performance of the employee.

For growth stage companies:

For later stage and larger companies (50 employees +) it is generally advised to stick to a scheme that assigns options based on the type of role and seniority of the employee – you would now typically start assigning options as a multiple of employee salary.

What type of option scheme should I set up?

There are many different types of options schemes to choose from in the UK – you can use any of the 4 HMRC approved option schemes or design your own “unapproved” scheme. The EMI Option Scheme is by far the most popular, it has the advantage that the employer pays only capital gains tax on the rise in value of the shares above the agreed option strike price. The alternative is paying a combination of the much higher income tax and capital gains tax, with the employer also having to pay national insurance. This can account for significant savings to both the employee and the company.

Even if you don’t go with the EMI option scheme there are many advantages to creating or choosing a different option scheme, and of course, deciding on which scheme to choose depends on both the company (what size, what stage, how many employees, what are cash flows like, what kind of culture would you like to create?) and the employee (what incentive package would they prefer?).

When compared to America, options schemes in Europe are less generous (later stage European companies tend to have smaller options pools) and less inclusive (European options are far less likely to be offered to all staff members). This can be summarised by a quote from the Index Ventures Option Handbook – “On average, European employees end up with only half as much ownership in later stage companies compared to their US counterparts.” But is this an issue? That is up for discussion, and probably needs to be decided on a case by case basis. What we do know is, however you want to utilise it, having an option pool is important! It can give you leverage as a startup that will allow you to compete with the later stage companies.

What’s next?

If you’re looking to create an option pool or issue options with the EMI option scheme, open up the chat bubble and send us a message or you can sign up to the SeedLegals platform to get going.

Alternatively, we’re happy to get on call and discuss any queries you have in relation to option issuance.