Dilution: How it works

What is dilution, and how does it affect start-up ownership?

When it comes to start-up equity, the concept of dilution can be a little tricky to wrap your head around. This article is going to break dilution down into a simple concept for you to understand so you're better equipped when giving away equity in the company.

So, what is dilution?

When a company sells or gives away equity to investors, employees or advisors, it issues new shares (or new options, see the difference here). Through this practice, the existing shareholders end up owning a reduced proportion of the company, despite not selling any of their own shares during the funding round. This outcome is known as ‘Dilution’.

There are two core points to remember with dilution:

-

New shares are created when bringing on investors or advisors. Rarely will you transfer existing shares.

-

Ownership: The ownership percentage each shareholder will have after investment is found by:

Shares owned by Shareholder / Total Number of Shares Outstanding (including new shares)

Let’s use an example:

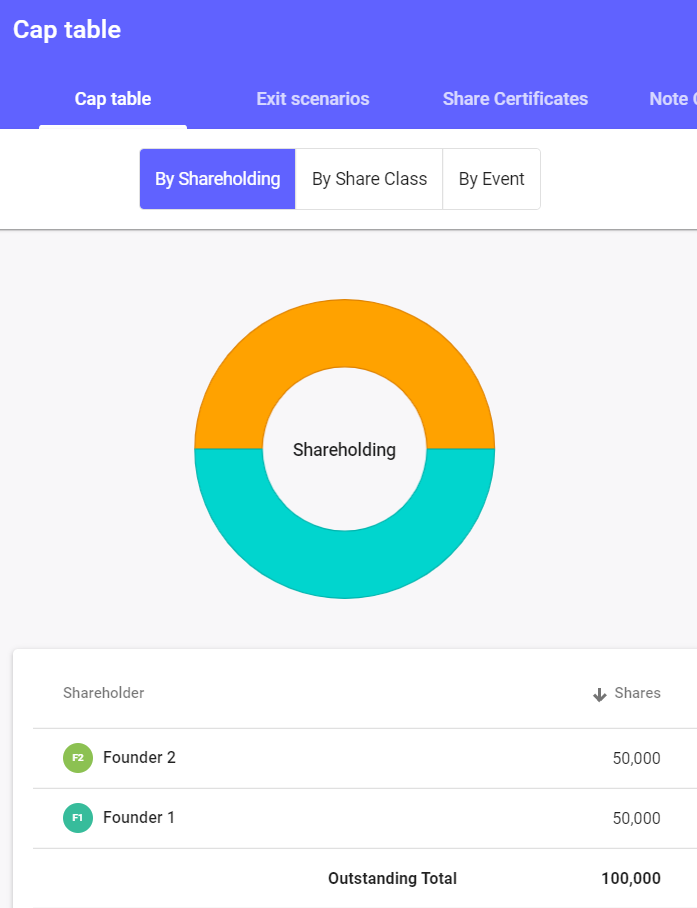

A start-up has two founders, who each own 50% of the business. The company has 100,000 shares outstanding meaning the cap table looks like this:

So, each founder owns 50,000 / 100,000 = 50% of the company - easy!

Funding Round

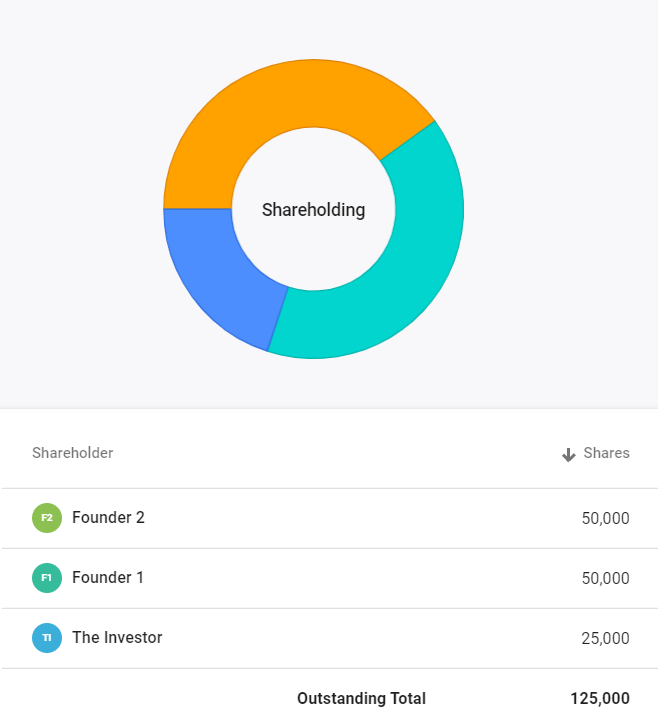

Now the start-up is raising £100,000 in exchange for 20% of their business. The investor comes on board, and the company issues new shares to them as part of the funding round (the legals are all done through our funding round products for you!)

In order to receive the shares, the start-up creates new shares for the investor. The investor receives 25,000 new shares, making their ownership 25,000 / 125,000 = 20%.

We discuss the maths behind the 25,000 shares here (in the context of preemption), but the good news is that the SeedLegals platform takes care of all the maths for you!

Here's how the cap table will look now:

You’ll notice that both founders still own 50,000 shares each, like before, but now they own a smaller slice of the overall company:

Founder Shares / Total Shares Outstanding = 50,000 / 125,000 = 40% each

In this funding round, each founder has been diluted by 10% each = 20% overall.

And that's all there is to dilution in early-stage funding rounds!

Some additional points on dilution:

While we're here, we may as well cover all the bases.

What does the 'Fully Diluted' section on my SeedLegals Cap Table Mean?

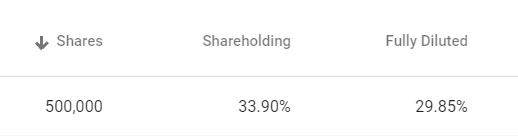

When you create an option pool on SeedLegals, your cap table will change to reflect both the current shareholding and your fully diluted shareholding of each shareholder:

In this case, the fully diluted shareholding is the percentage of shares you will own when all the options in your option pool have been issued and converted into shares. The 'shareholding' is the percentage of shares you own as of the moment.

What dilution terms do I need to look out for?

In later funding rounds, shareholdings can become more complex, and dilution can be harder to track. In particular, preferential terms like preemption and anti-dilution clauses are sometimes requested by investors. We have articles that explain those terms and other dilution-related items, which are linked below. Preemption is standard, but if anti-dilution or non-dilution terms are being requested, please get in contact with our team to discuss.

If you have any questions that aren’t covered in this article, please click the chat bubble, and one of our associates will be delighted to help explain or jump on a call!

For other related articles, please see: