How to Issue Shares to your co-founders and team members: a step by step guide

How to use the Issue Shares product on the platform - a 10 step guide.

In most cases, the easiest and most tax-efficient way to give equity to a team member is to grant options. If, however, you are looking to onboard a new co-founder or team member immediately, you can do this by issuing new shares.

The Issue Shares product lets you issue new shares to team members at the price per share of your choosing. The Issue Shares product includes everything you need to document a share issuance to a team member only. It should not be used for issuing shares to investors.

Note: Issuing shares at below market value may create a tax liability and issuing shares at nominal value should especially only be done within the first few months of incorporation.

If you have completed a funding round previously, you may need Investor Consent. More on this here: What is investor consent? When you need it, and when to offer it

If you have done this round with SeedLegals, you can find it in Schedule 6 of your Shareholders Agreement.

Here's the process step-by-step:

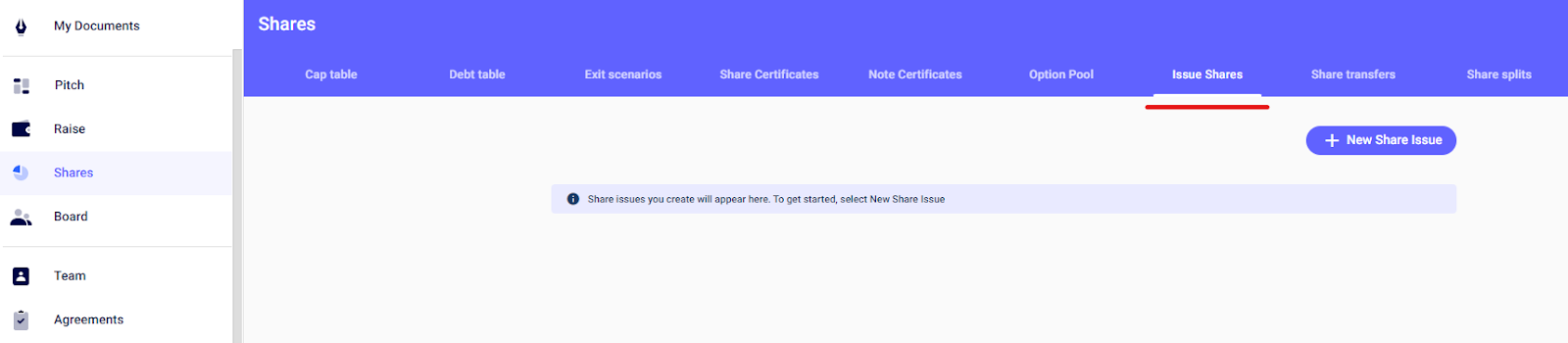

Step 1: Head over to the Shares > Issue Shares and hit the "New Share Issue" button.

Step 2: An overview of the product will appear on the right-hand side. Once you've read that, please click "Start Now".

Step 3: Next:

-

choose the date of the share issuance - when do you want those shares to be issued to your co-founder or team members? This is the date that will appear on the SH01 form.

-

choose the share class - what share class will you give to your co-founders and team members? This will often be the same as yours to your co-founders but it could also be Ordinary B (Non-Voting) for your team members.

-

enter the price the team member will pay per share.

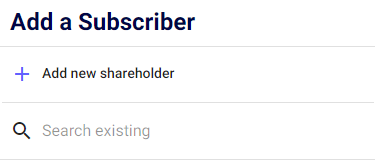

Step 4: Add the persons you would like to issue equity to (subscriber) by clicking on "Add new" in the Subscribers box. You can add either a new subscriber (and enter their details) or search for an existing shareholder.

If you add a company as a shareholder, please see how to add a company investor here.

Step 5: Choose how much equity you want to allot. This can be expressed either as a percentage or as a flat number of shares.

Great, you've done the most difficult part! Now you just have to create the documents and get them signed...

Step 6: Unlock, set the terms and create the Board Resolution - these Board Minutes will document the meeting where the board approves the issuing of new shares. Let us know who chaired the meeting and if any directors were absent.

Once you've clicked "done", create the Board Minutes by clicking on the "create" button in the Board Resolution box. You'll have to get this document signed by the director of the company.

Step 7: Create the Shareholders Resolution by clicking on the "create" button. It needs to be shared with your existing shareholders to allow the company to issue the new shares (click on the "share" button at the top of the document). It will then generally need to be signed by at least 75% (by number of shares held) of voting shareholders.

Step 8: Create the SH01 form by clicking on the "create" button and get it signed by the company's director.

Step 9: Send the signed SH01 form and the signed Shareholders Resolution to Companies House.

The easiest and fastest way to file your SH01 to Companies House is to web file by logging in here and following this guide: How to File an SH01 form.

The Shareholders Resolution can be uploaded to Companies House here.

OR

Send the signed SH01 form and the signed Shareholders Resolution to Companies House:

For companies registered in England and Wales: The Registrar of Companies, Companies House, Crown Way, Cardiff, Wales, CF14 3UZ.DX 33050 Cardiff.

Step 10: Issue share certificates to your co-founders or team members by clicking on the "issue share certificates" button.

Now you might want to have a look at this article titled "how do I issue share certificates".

You're all done, nice!

Please note that you will need to update your Shareholder Register, although the Cap Table on SeedLegals can be downloaded as a list of shareholders, you will need to maintain a Shareholder Register offline alongside several other statutory registers. Please see our handy guide here for more information on what these need to contain