What happens if you haven’t allowed yourself to do an Instant Investment in your last funding round? Can you still top-up your round?

You haven’t allowed yourself to do an Instant Investment in your last funding round and you'd like to top-up your round? That’s completely fine, it doesn’t mean you cannot top-up! It just means that you have more admin to do if you’d like to raise additional investment.

Topping up your round without using the Express Lane

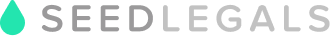

If you are not using the Express Lane you will need to select that when setting up the Key Deal Terms for the Instant Investment Group.

If you have given investor consent rights to your investors in your previous round, you’ll need to select “Yes” to this question:

If your existing shareholders have a pre-emption right, meaning you haven’t disapplied it in your previous round, you’ll need to select “Yes” to this question:

This will enable you to circulate both the Pre-Emption Notice and Previous Investor Consent, which you’ll have the option to create after you’ve filled out the rest of the Key Deal Terms:

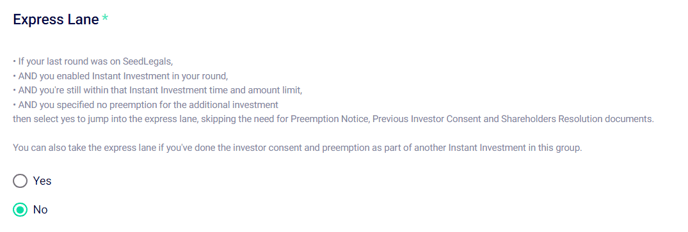

You will also need to pass the Shareholders Resolution in addition to the Board Resolution. You should share your Shareholders Resolution with your existing shareholders, it needs to be signed by at least 75% (by the number of shares held) of the voting shareholders.

Closing your Instant Investment

Make sure you have a read at this very useful guide on how to close your instant investment on the platform to make sure everything is signed and dated correctly! Finally, you will create and sign your SH01 Form and file it to Companies House! Here’s how to do it online.