How do I fill in an SH01?

A guide to correctly filling in the SH01 Allotment of Shares form for Companies House

The SH01 is an essential document to be sent to Companies House any time you need to allot new shares in your company. In your funding round, Seedlegals makes this process a breeze, by automatically filing in the document for you.

For any allotments off the Seedlegals platform, you can find the SH01 form here.

Simply follow the steps below:

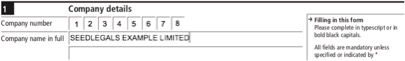

1. Details

You can find your Company Number on the incorporating document for your company, by searching the Companies House database.

Ensure that you use all CAPITALS when filling in the form, and that you do not abbreviate your company name!

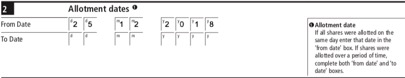

2. Allotment dates

In most cases, the shares will be allotted on the same day, so there is no need to fill in the To Date line.

Ensure that prior to filling this is, you are conscious of any EIS/SEIS timing issues, or other tax related considerations which might require that you are mindful of the date allotted - For example, ensure that the date funds were received is prior to the date on the form!

If you’re filing this SH01 for a blended SEIS/EIS round, remember that to remain compliant for both relief schemes you will need to ensure the shares were issued over a range of dates, as SEIS shares must be issued at least 24 hours before EIS shares.

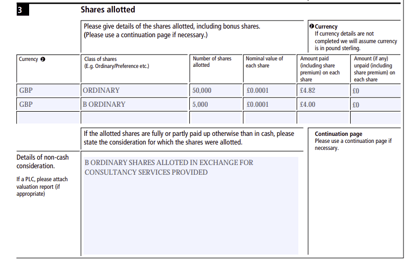

3. Shares Allotted

This section is concerned only with the new shares which you are allotting.

Ensure that you use a new line for any different currency, or different class of shares.

The Nominal value of each share can be found within your IN01 (Incorporating Document) - or SH02 if you have done a Share Split. For the avoidance of doubt, the Nominal Value is not to be confused with the price paid for the new shares.

Under Amount Paid, the Share Premium is the price that the shares were actually sold for, so make sure to enter the Price Per Share from the sale. If you are allotting shares to a new founder, then it would be typical to just enter the Nominal Value here. This is the individual Price Per Share, not the aggregate amount.

You can also allot shares in exchange for services. In this case, see line 2 of the example. Simply write the value per share of the services provided under the Amount Paid, and then provide a brief description under the box below.

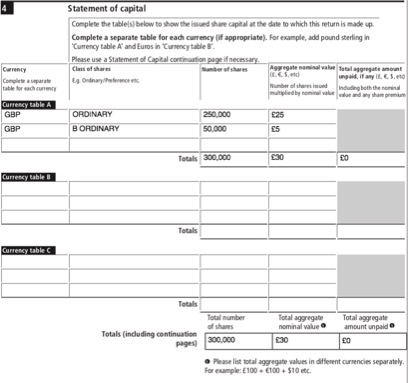

4. Statement of Capital

The Statement of Capital is used to provide a total picture of the company assets. This includes the prior existing shares, in combination with the new shares allotted in section 3.

When filling in the number of shares, include both the allotted shares, and those already in existence. In this example SEEDLEGALS EXAMPLE LTD would have held 200,000 Ordinary shares prior to the 50,000 allotted above in this SH01 and 45,000 B Ordinary shares prior to the 5,000 allotted above.

Use a separate line for each share class, if you hold more than three class of shares, use the continuation page (Page 7).

Use Currency Table B and C only if shares are issued in currencies other than that listed in Currency Table A

The Aggregate Nominal Value is calculated by multiplying the Number of Shares with the Nominal Value of the Shares.

Remember to fill in not just the total for each currency, but, even if you have only one currency, fill in the total at the bottom of the page.

5. Statement of Capital (Prescribed Particulars of Rights Attached to Shares)

The Statement of Capital (Prescribed Particulars of Rights Attached to Shares) section is used to ensure that a clear definition is set for the meaning of each class of share listed under the Statement of Capital.

Ensure that any class of share listed above is also described here.

In the example, you can find the standard legal definition of the Ordinary Share (or copy & paste the text below)

< The Ordinary Shares are Ordinary Shares that do not carry any present or future preferential right to dividends, to the company's assets on a winding up or to be redeemed in preference to shares in any other class of shares. They have attached to them full voting rights and full dividend rights. They do not confer any rights of redemption. They have capital distribution rights limited to pro rata rights in proportion to the total number of Ordinary Shares.>

For any other class of shares, ensure that you clearly describe them in relation to their difference in rights to the Ordinary shares.

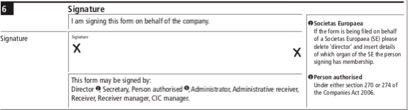

6. Signature

Don’t forget to sign!

7. Additional Details

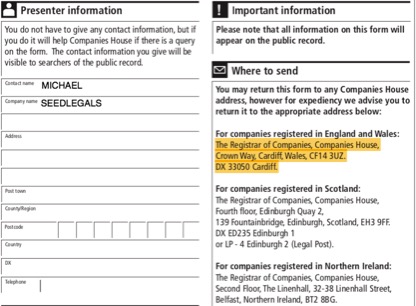

This page is optional. Please note that, as Companies House documents are public record, any information written here will be publicly available.

The address highlighted is the relevant address for any companies registered in England and Wales.

8. Finally...

Once all of that is done - mail the form to the address highlighted. Alternatively you can fill out and file your SH01 via Companies House Web Filing:

In order to file the SH01 with Companies House online, you will have to re-type the generated information into an online form on the Companies House portal. This video guide explains exactly how to upload or amend your SH01 online.

Don't forget to issue the share certificate to the lucky new shareholder!