Guide to Option Scheme Rules (Vesting & Exercise conditions explained)

When setting up your Option Scheme, there are different rules and conditions to consider - all of which will be covered in this guide!

Introduction and Key Terms

When you create an EMI or Unapproved Scheme on SeedLegals, you need to set up your Option Scheme rules. There are a variety of different questions and terms to select from which this guide will break down so they're all digestable and easy to understand.

The first important thing to go through is the key terminology associated with setting up your Option Scheme and granting Options to your team members. These are outlined below chronologically:

- Promising - This is what happens in the Service agreement e.g. a Consultancy, Employment, or Advisor agreement. Here you are making a promise that you will grant the options. If you didn’t mention equity in the service agreement, no problem.

- Granting - This is where the person actually acquires the options, through the Option Agreement. They are now an option holder.

- Vesting - When the options vest, they become available to the option holder for exercise (note, when the option holder can actually exercise may be further governed by the Exercise Rules).

- Exercising - The exercise condition is when options can be converted into shares. The shares are purchased from the company by the option holder at the exercise price, and they become a shareholder.

In the Option Scheme, you will be asked to set the Vesting Rules and the Exercise Rules. For the Vesting Rules, you are choosing default rules that you can deviate from within each grant you make to different individuals/entities. For the Exercise Rules, you will need to make a new scheme (at no extra cost!) in order to vary this for different individuals.

Some general guidelines…

- There’s always a clause in the Option Agreement which details Board Discretion. Under this clause, the Board retains the right to permit an option holder to exercise their options ‘whether or not those Options have become exercisable’. This clause shouldn’t be a substitute for the most appropriate term as you don’t want to have to hold a Board Meeting for every individual, however it does provide flexibility for unforseen enventualities.

- Please note: using Board Discretion can invalidate EMI tax benefits (please see HMRC's examples of acceptable discretion and unacceptable discretion) and to be certain, we'd always recommed posing your use case to shareschemes@hmrc.gov.uk.

- Try to make sure that the terms of the Service Agreement where you promised the options, and the Option Agreement where you actually grant the options, are consistent. This is important as you don’t want to promise your employee one thing, and give them something else. If you absolutely need to deviate from what was promised, it’s important to get the other party’s consent in writing.

Vesting Rules

We’ll now run through each of the terms that appear when you set the Vesting Rules, as well as data used to show you what is most commonly selected:

What you select here will act as a default setting, but you can vary each selection when you get to making each individual option grant.

1) How will the options vest?

The two choices here are:

- Over a period of years - this is normal time-based vesting, where options will vest over a set period, with a specific frequency e.g. over 3 years, with monthly vesting.

-

- Over 85% of schemes on SeedLegals choose to have time-based vesting

- According to a set of Milestones - more complicated and less frequently used, where options vest when a predetermined milestone is hit e.g. 100,000 subscribers. Within the same grant you may have multiple milestones. For example, with a grant of 100 options, if the first milestone is hit 50 options may vest, if the second milestone is hit, a further 50 will vest.

- ~Milestone vesting is more common in Unapproved Schemes with 17% of Unapproved schemes choosing milestone vesting.

If you pick over a period of years, there are some additional terms (if you select Milestone-vesting you’ll skip straight to question 6):

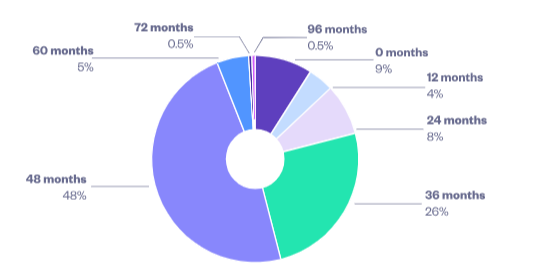

2) Over how many years will the options vest?

This sets the overall time it will take for all options to vest. The choices range from all options vesting up front to vesting over 8 years. According to our data, most startups on the platform want long term commitment in return for their options (see below).

3) Vesting frequency

This is the interval at which options will vest. The choices are every quarter, month, half year and year.

- More than 50% of companies opt for a monthly vesting frequency, which means a tranche of options are earnt alongside an employee's monthly salary

- Quarterly and yearly vesting frequency are also popular options, where around a 1/5 of companies select these.

4) What % of options will vest immediately?

If you'd like to compensate someone from the time they've already been with the company, or for work already done, you may want to make a % of options immediately vest within your grant.

Note: you can select a different % of options that have already vested (if any at all) at an individual grant level.

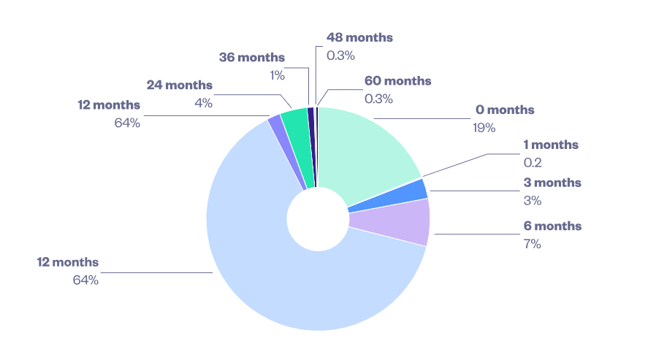

5) Vesting Cliff

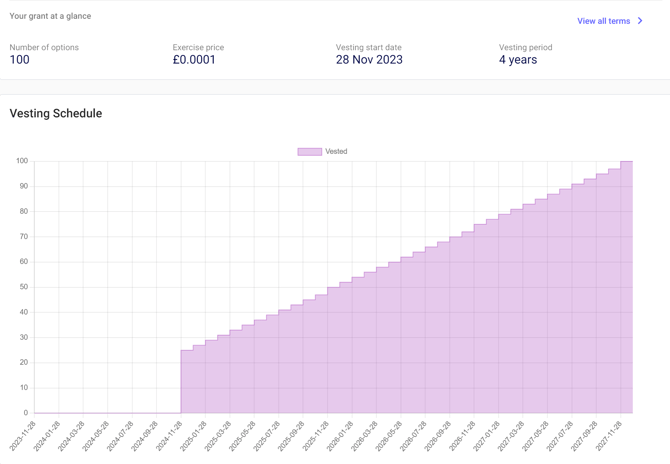

A vesting cliff acts as a period of time that an Option Holder has to stay with the company before they are able to vest any of their options.

For example if you have 100 options vesting monthly over 4 years, with a 1 year cliff, no options will vest at all during the 1 year cliff. Then after that year, the first 25 options that would have vested, all vest at once. The vesting would then continue on a monthly basis for the rest of the options that have been granted.

Around 75% of schemes on SeedLegals have a cliff period, with 12 month being the most common at 64%. You can see the data in further detail below.

6) Will any employee's options have accelerated vesting on a sale of the company?

Accelerated vesting is where all unvested options immediately vest upon an exit event, such as a sale of the company.

Some further points to consider...

- Accelerated vesting means that your employees can benefit after a change of control (such as a company sale), which incentivises your employees to create value to reach a sale.

- However, often acquirers are looking to invest in the winning team as much as the company. If there is the opportunity for many to exit as the company is sold, it could be off-putting to a potential buyer. Therefore you may want to reserve accelerated vesting for a couple of senior hires.

- An acquirer will likely want to renegotiate this anyway at the time of a sale of the company, but specifying this now will help set expectations all round.

6a) What % of the employee's unvested options will vest immediately on a sale of the company?

You should pay attention to this one if a sale is imminent, and your employee is a new joiner. In that case, partial accelerated vesting may be most appropriate. In the majority of cases, where a sale is not close, founders tend to choose either no accelerated vesting at all or 100%.

6b) What is the minimum number of months the employee needs to work for the company following a sale to get all their vesting acceleration?

Also known as an 'earnout period', this is a minimum specification of time the employee must continue to work for the company before they can benefit from accelerated options vesting.

- Over 3/4 of schemes on SeedLegals have a 12 month accelerated vesting period

7) Will vesting accelerate on an IPO?

As an IPO isn't really a change of control, it's less common to have unvested options vest on an IPO.

- Of the schemes on SeedLegals which have accelerated vesting , 25% have provisions to accelerate vesting at IPO.

Exercise Rules

We’ll now run through each of the questions that appear when you set the Exercise Rules:

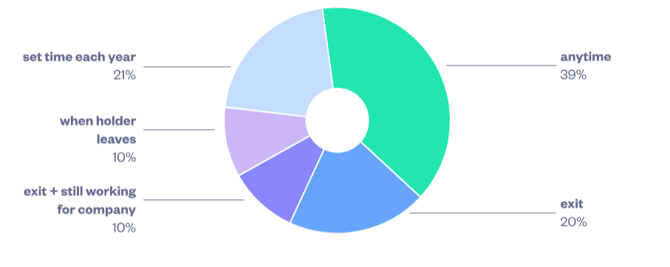

1) When can Team Members exercise their options?

The exercise rules control when your option holders are able to convert their options into shares and become shareholders of the company. The choices here are as follows:

- Anytime - as soon as options vest for an option holder, they are able to exercise them at anytime

- During a fixed period each year e.g. Jan 1-15 - sets the exercise condition to a certain time period in the year, meaning you can get all the paperwork complete at the same time, in one go.

- Only when the person leaves the company - sets the exercise condition to only when the option holder leaves the business, where you can further stipulate that the options must be exercised within 90 days of the employee leaving. This ensures that the EMI tax benefits for the employee can be retained (see further detail on this below), as opposed to setting an exercise condition on sale, where leaving employees will likely lose the tax benefit as they cannot exercise until such an exit event.

- Only on a sale of the company - option holders can exercise their vested options on sale of the company, even if they have left the company.

- Only on a sale of the company, and the person loses their options if they leave before then ('exit + still working for company') - also known as an 'Exit Only' scheme, this means option holders will lose all their options (vested and unvested) should they leave before an exit event.

- Note: EMI options must be exercised within 90 days of an employee leaving (as this counts as a disqualifying event) for that employee to get their EMI tax benefits. This means an exercise rule of 'on sale' ('Exit Only or not) requires an employee to be with the company on an exit to be eligible for EMI tax benefits.

If you select 'Only on a sale of the company' or 'Only on a sale of the company and the person loses their options if they leave before then' you should skip straight to question 5

2) What is the minimum % of their vested options that an option holder can exercise?

This question refers to the options that your team members have already vested, and not the unvested portion. We recommend setting this to 100%, as this will minimise administrative workload as well as prevent option holders exercising a couple of options, several times.

3a) How long does an employee have to let you know that they intend to exercise their options?

This is the initial notification phase, whereby option holders will have a set period of time to let you know if they intend or don't intend to exercise their options. The quicker you know, the faster you can reallocate their unused options to others if they don't plan to exercise them.

3b) How long will an employee have to exercise their options after they leave the company?

Our schemes require option holders to exercise within a certain time frame after they leave the company as exercising (or failing to do so and options lapsing) will impact the share capital. The choices are 45 days, 90 days, 6 months, 1 year and 5 years.

Points to consider…

- If an employee on an EMI scheme leaves the company, they have to exercise their vested options within 90 days to get the EMI tax benefits or they be liable for income tax and non-EMI capital gains taxes.

- For this reason, many companies chose a 90-day limit to encourage employees to exercise in the timeframe best for everyone.

- For contractors and those on an Unapproved scheme there's no 90 day limit as this is not a tax advantaged scheme (such as an EMI scheme), so you can give them a much longer grace period.

4) What types of leavers do you want to describe in the Option Scheme?

Here you have the choice of choosing between:

- Good and Bad Leavers only -

Bad Leavers are typically those fired for gross negligence/misconduct who would then lose all their options (included those which have vested). Good Leavers are anyone other than Bad Leavers who would keep their vested options but lose their unvested options.- We would recommend selecting this for simplicity, as well as how the rules for Good Leavers would also apply equally to Voluntary and Forced Leavers

- Good, Bad, Voluntary and Forced Leavers - Forced Leavers are those forced out for no fault of their own and Voluntary are those who leave out of their own choice e.g. to join another company.

5 & 6) Within how many years of grant will the options have to be exercised? Can the employee exercise their options if there's no company exit by then?

Since EMI Options must be exercisable within 10 years of grant, we would recommend allowing options to become exercisable by then, regardless of whether the employee leaves or if there is no company exit by then.

Conclusion

All in all, there are a few considerations to take into account when setting up your Option Scheme on SeedLegals. If you'd like to learn more about the data gathered in this article, you can access a free report gathered from companies on the platform here.