Guidance for Submitting Detailed Information for R&D Tax Relief

If you are a company claiming Research and Development (R&D) tax relief, you must provide detailed information about your R&D activities to HMRC. Recently, HMRC made changes to the way in which companies must submit this information correctly.

New Changes

As of August 8th, 2023, companies must now submit an additional information form to HMRC to support all claims for R&D. The additional information form must be submitted before your company’s Corporation Tax Return (CT600).

Any CT600 submitted without additional information form will not be considered for R&D tax credits.

Who can submit

You are eligible to complete the additional information form if you are:

- A representative of the company.

- An agent acting on behalf of the company.

Submitting Detailed Information

To submit the detailed information, you will need to complete the R&D project summary template provided by HMRC. This template requires detailed information about the R&D project, including:

- A description of the project

- The scientific or technological advance that the project sought to achieve

- A summary of the scientific or technological uncertainties that the project faced

- The methods used to overcome the uncertainties

- Whether the project was successful in achieving a scientific or technological advance

You will also need to provide information about the costs associated with the R&D project(s), including:

- Staff costs

- Consumable items

- Subcontractor costs

- Software costs

- Clinical trial costs

- Data licence costs (for accounting periods on or after 01 April 2023)

- Cloud computing costs (for accounting periods on or after 01 April 2023)

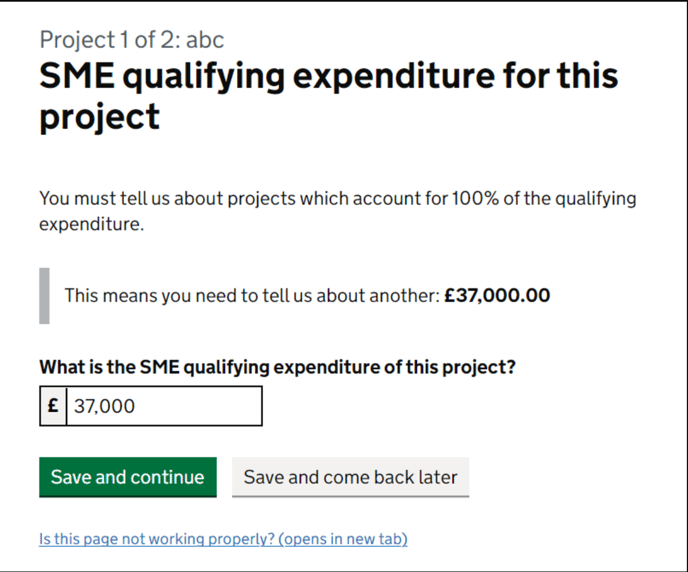

As part of the form, HMRC will ask for your total qualifying expenditure for each of your projects.

Qualifying Indirect Activity

Qualifying Indirect Activity refers to activities that support or contribute to the R&D project but do not directly relate to the scientific or technological aspects of the project itself, such as administration, laboratory support or maintenance costs.

-1.png?width=688&height=419&name=Untitled%20(1)-1.png)

To make things simple, SeedLegals have developed an additional QIA label which will help you calculate which costs are to be considered qualifying indirect activities.

.png?width=688&height=298&name=Untitled%20(2).png)

Claiming R&D Tax Relief

Once your detailed information has been completed, you can then submit your R&D tax relief claim. Your claim should include information about the costs associated with the R&D project, including the costs of staff, consumables, subcontractors, software, and clinical trials. You should also include information about any state aid that you received for the project.

SeedLegals Support

As part of your claim, our platform generates a form that covers the sections that need to be completed in the additional information form, making it easier and faster to provide the necessary information.

.png?width=688&height=545&name=Untitled%20(3).png)

As always, our team of associates are also available to provide support over a call and guide our clients through the process.