Step-by-Step Guide to Exercising Options

There are three main parts to the exercising process.

Part 1: Preliminary checks

Step 1: Your employee notifies the CEO that they wish to exercise their options

The first step is for your employee to trigger the start of this process by notifying the CEO that they wish to exercise.

- Check their notice of exercise period in clause 9.2 of the Agreement. It will say either 7, 14 or 30 days:

You must then check whether they can exercise:

- If they are currently employed, please check clause 9.1 of their Option Agreement to see if they are eligible to exercise. The employee must have vested options at this point.

- If the employee is leaving the company, please check clause 9.2 of their Option Agreement to see if they are able to exercise.

Step 2: Cap table check

You need to ensure that your cap table is up to date on the platform.

Step 3: Check your Option holder exercise window

If the Option holder is a leaver, check that they have waited 30 days after leaving the company if the exercising window is 45 days in their scheme rules, or 75 days if the exercising window is 90 days, 6 months, 1 year or 5 years. If the exercise window is 30 days, there are no time restrictions to adhere to. If the Option holder wants to exercise before earlier, please note that the company would need to sign a board resolution allowing them to do so.

Step 4: Begin the process of exercising options on SeedLegals

Start by clicking ‘Share Options’ within the menu on the left side of the SeedLegals platform, and then click the ‘Option Holders’ view. You should find your option holder under ‘Active Grants’.

Then find the relevant option holder who is exercising their options and click on their bar.

There will be a pop-out screen from the right, at the bottom you should click ‘Stop vesting’ if the employee is leaving, or then ‘Exercise Options’ if the employee isn’t leaving.

If the employee is not leaving, skip to Part 1 - Step 5.

If the employee is leaving:

- Select on the next page whether they keep their vested options or lose all options. This will depend on what kind of Leaver they are. Check the Leaver definitions in the Agreement, as well as the Leaver clause (9.2) if you’re unsure.

- Otherwise, if you want to cancel the option grant altogether, you can select that too. Cancelling a grant is rare, and usually because there’s been a mistake made in the grant. You do not need to cancel the grant if the person is leaving, as the options will naturally lapse. If you’re unsure, please reach out to the team.

If the employee is keeping their vested options, on the next page you can input their leaving date and how many options have vested. The platform will automatically calculate the number for you based on their vesting schedule, so there’s usually no need to override this figure.

You can then select ‘exercise options’ at the bottom of the overview page and proceed to the next step.

Step 5: Creating your Notice of Exercise

The Notice of Exercise is required for the options to be exercised and the employee to be granted their shares. Simply click on the ‘Create’ button to go ahead and generate the document and then share it with them to sign.

When you share this document with your employee, it's a good time to tell them that they need to transfer money to the company's bank account in exchange for the shares. The amount to transfer is the exercise price * number of options being exercised.

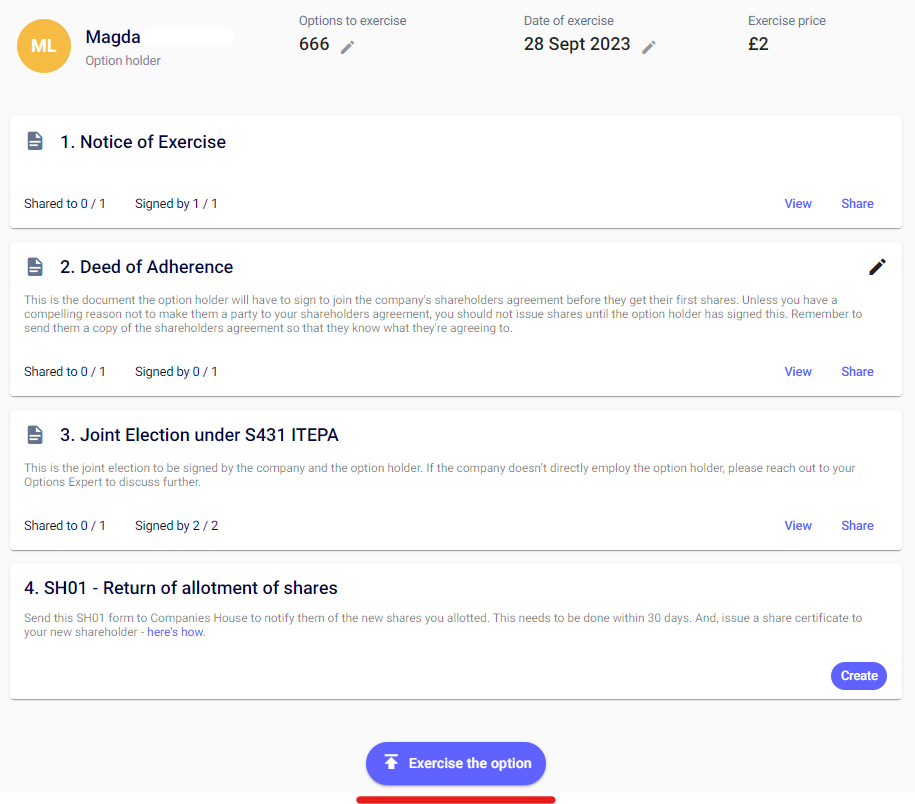

Part 2: Documents to sign, transfer of funds and share issuance

Step 1: Sign the Deed of Adherence (if applicable)

You are about to have a new shareholder in your company, which means they should agree and sign onto any existing shareholder agreements, if you have them in place.

If you do not have any shareholder agreements in place, skip this document completely (don’t ‘Create’).

If you do, create the document select ‘yes’ in the workflow. You should provide your employee with a copy of the shareholder's agreement. Then they can sign the Deed of Adherence, through which they are bound by the same terms as all other shareholders.

Step 2: Sign the s.431 Election (optional)

When you sign a s.431 election with an employee who is exercising their share options, you both confirm that the employee will only pay Income Tax once: when they exercise their options. When the employee sells their shares in the future, they will only have Capital Gains Tax to pay. For more information on the s.431 election, see this article.

Step 3: Transfer of funds

You’ll then need to ensure that the Option holder transfers the funds to the company’s account in exchange for the shares.

Step 4: Convert your employee's share options into shares

Warning: The notice of exercise, transferring of monies and Deed of Adherence (if applicable) need to be signed before shares can be issued to the employee. Make sure these steps are done before you go to the next step.

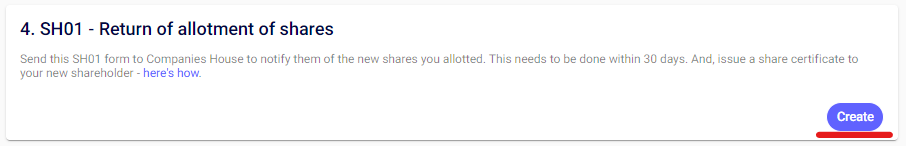

Once you have received the payment for the shares, you can issue your employee shares in the company, and complete the SH01 form. Click the create button, then sign the SH01 form by clicking the purple ‘Sign’ icon at the top of the page. You should then file it on Companies House.

Step 5: File SH01 on Companies House

We have a guide on how to file an SH01 form on Companies House here.

Or if you prefer to post the SH01 to Companies House, you can do so to the appropriate address:

Part 3: Completing the process on the platform

Step 1: Click the 'Exercise the option' button under the SH01

This finalises the options exercise on the platform and your employee will now be a shareholder on your cap table.

This finalises the options exercise on the platform and your employee will now be a shareholder on your cap table.

Step 2: Generate share certificates

You can generate their share certificate by clicking on Shares on the left hand side > Share Certificates at the top of the page.

Have the director and a witness sign the certificate, then you can select the certificate and send it to your shareholder's email.

Lastly, please ensure to add the share issuance to your off platform personal share register.

All done!