How to do an Instant Investment: step-by-step guide

Set up Instant Investments for one or more investors.

Use an Instant Investment to add investments totaling anything up to your approved raise amount, create documents for each investor, and then create one SH01 covering all of them. Read on for our step-by-step guide.

Get ready to start your Instant Investment

Have you already done a funding round on SeedLegals?

If so, you'll probably have enabled Instant Investments so you already have the necessary approvals.

If not, Instant Investments can still work for you - you won't be able to use the Express Lane (explained below) but follow this guide and select the options on SeedLegals to create all the documents you need.

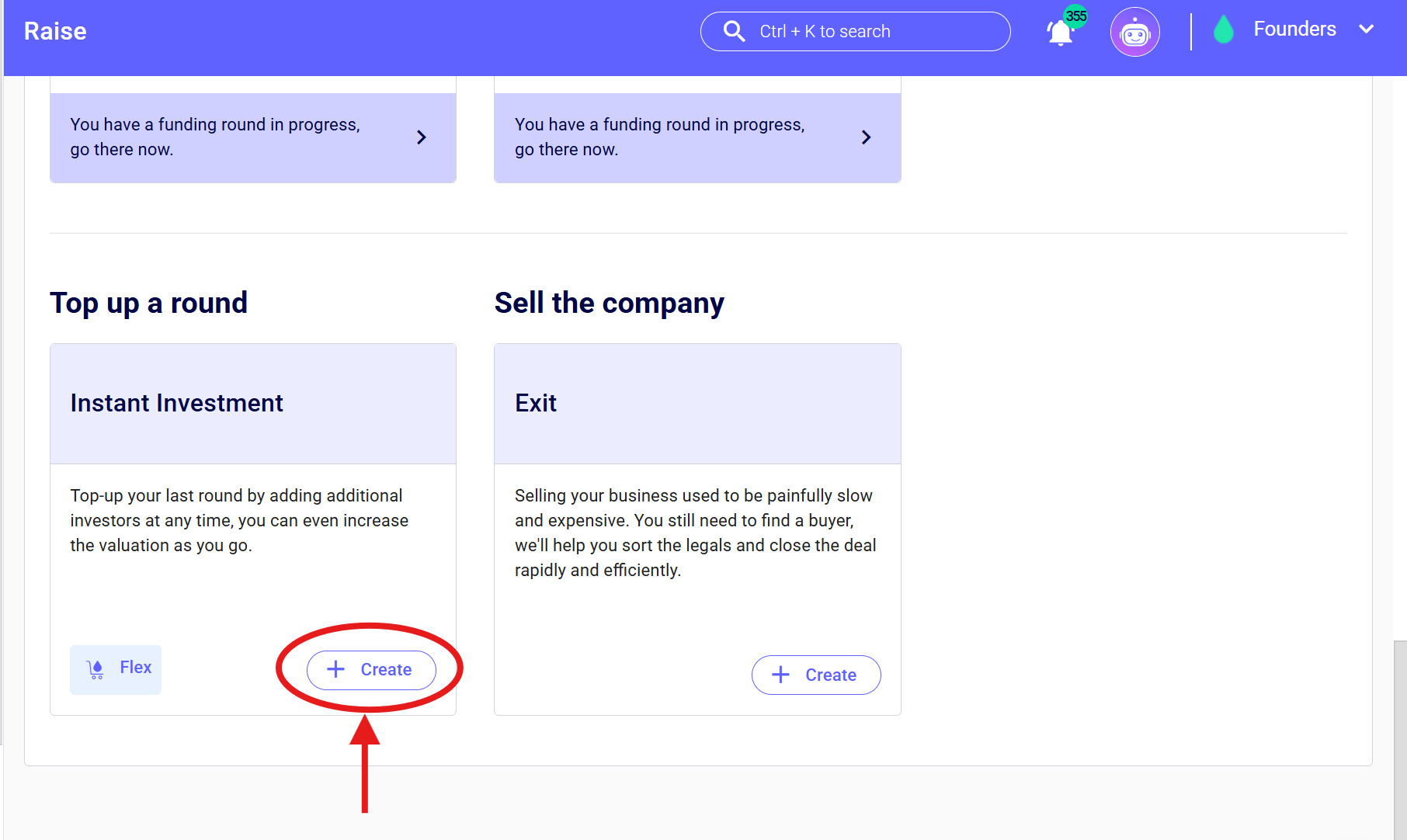

Step 1: Start your Instant Investment

Head to the Raise tab and click Create, then scroll down until you see Instant Investment.

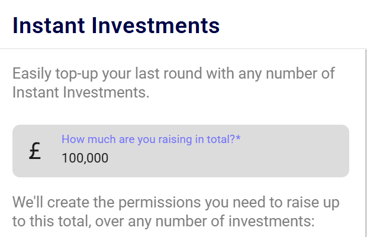

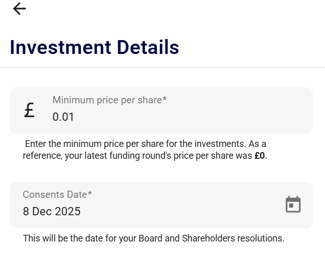

Then fill in the total raise amount, click Start now, and then fill in the minimum price per share, and then hit Confirm.

Step 2: Fill in the Key Deal Terms

Follow the prompts to fill in the answers. We use your answers to automatically generate the documents for the Instant Investment.

Confirm whether you need investor consent and preemption, or if you can use the Express Lane. If you have previously carried out a Funding Round on SeedLegals, then go to the Funding Round Key Deal Terms to check whether you can use the Express Lane. This helpful guide explains how to check your Key Deal Terms.

Confirm the date of your last Shareholders Agreement, and add your bank details and any additional items if you need to.

Confirm the date of your last Shareholders Agreement, and add your bank details and any additional items if you need to.

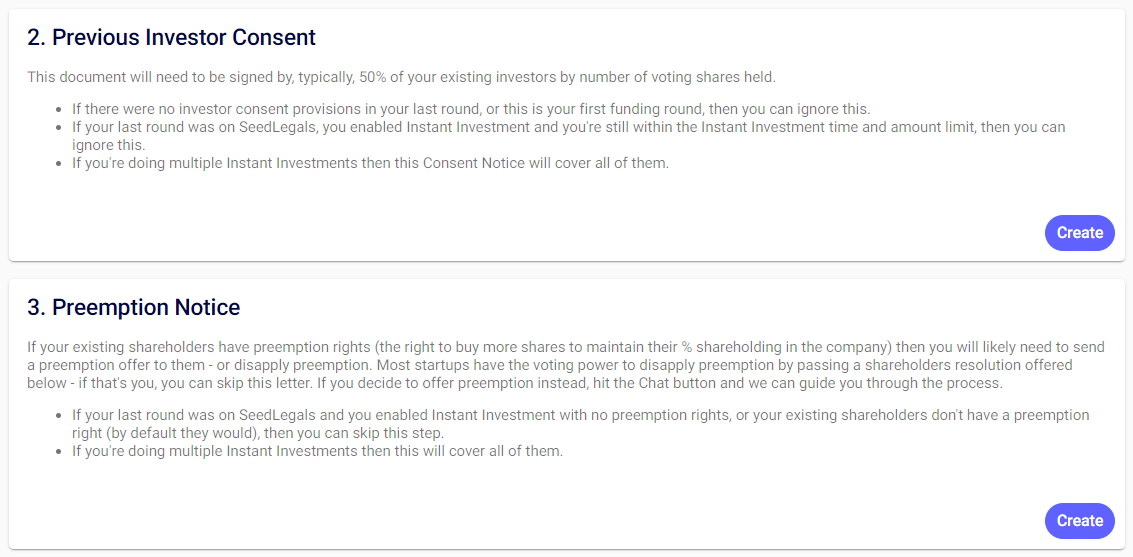

Step 3: If no Express Lane - Circulate Investor Consent and Preemption Notice

If you haven't completed a previous funding round on SeedLegals, or if you're over the amount and/or time allowances agreed in the previous round, you'll need to circulate these extra documents to authorise the Instant Investment.

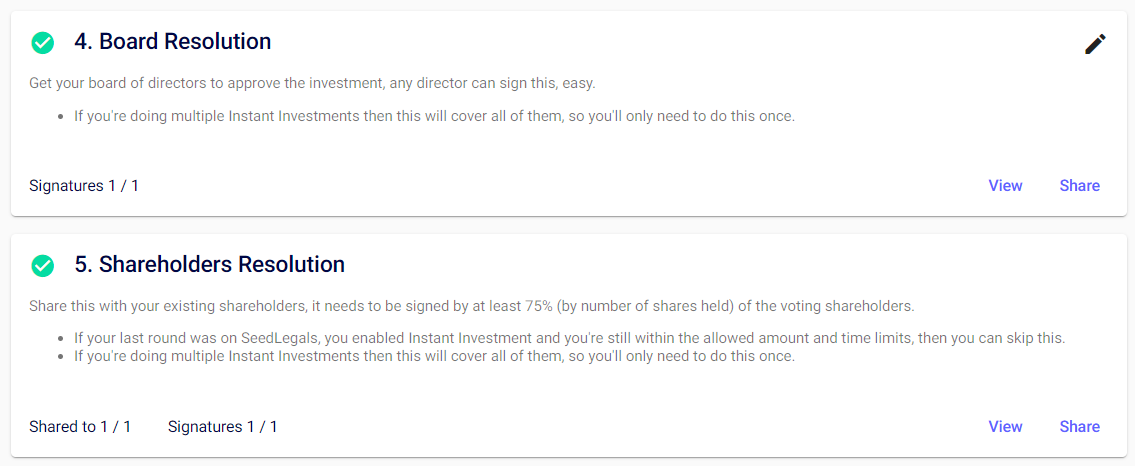

Step 4: Complete the Resolutions

Resolutions are how your company gets official approval for certain actions - here, it's for permission to issue new shares.

For the Board Resolution, fill in the terms and get the signature of one director.

If you're using the Express Lane, you don't need a Shareholders Resolution because the Shareholders Resolution from your previous funding round covers the allotment of shares in your Instant Investments.

If you aren't using the Express Lane, the Shareholders Resolution must be signed by 75% of the voting shareholders (that's 75% by shares held).

Step 5: Go through the Disclosures

The documents you sign with investors contain warranties - promises or guarantees you make to the investors that the facts about your company are true and reliable.

In this section, you'll review the warranty statements and write notes (disclosures) about anything that isn't completely accurate or needs more detail. You'll see representations - statements of fact - in bold, with fields below where you can type in disclosures.

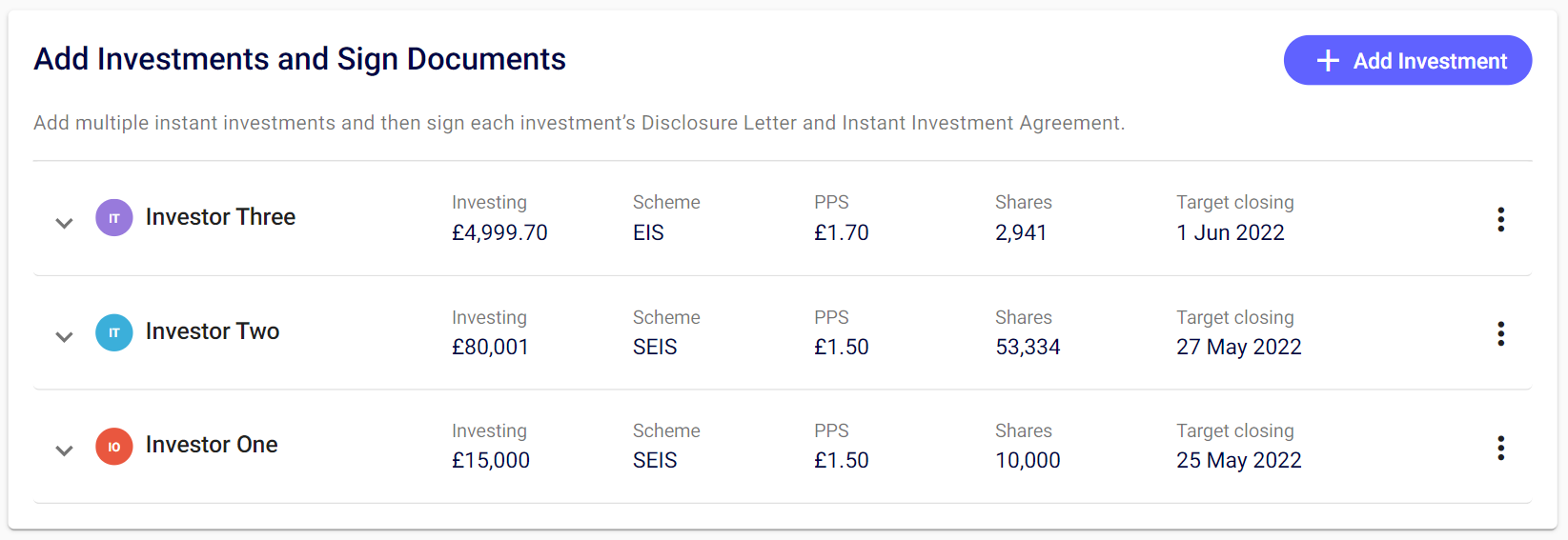

Step 6: Add your Investors

Next, add one or more investors.

You can only add investment up to your approved raise amount - the amount you approved in the previous funding round. You can add as many investors as you like, but the total amount of all their investments must not be over the approved amount. (Our system won't let you go over that amount.)

For each investor, you can set the price per share, target closing date and tax relief scheme.

Step 7: Create and sign the documents

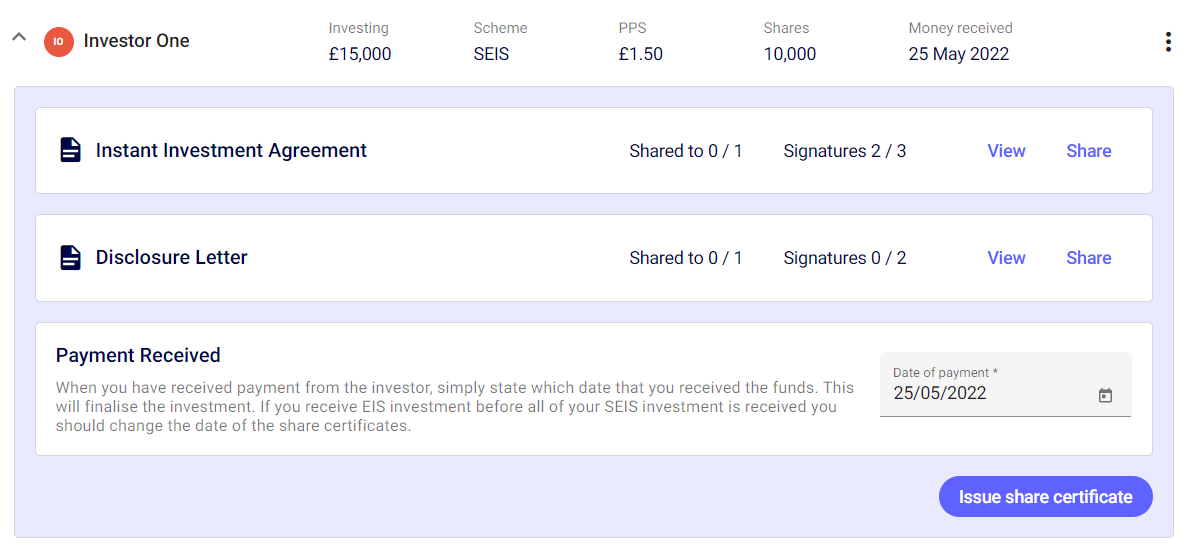

For each investor, click the arrow next to their name to go to their documents. You'll see an Instant Investment Agreement and Disclosure Letter ready to create and share.

When the documents are fully signed, use the tracker to record the date you received the money. Then you'll be able to approve the investment by clicking the Issue share certificate button.

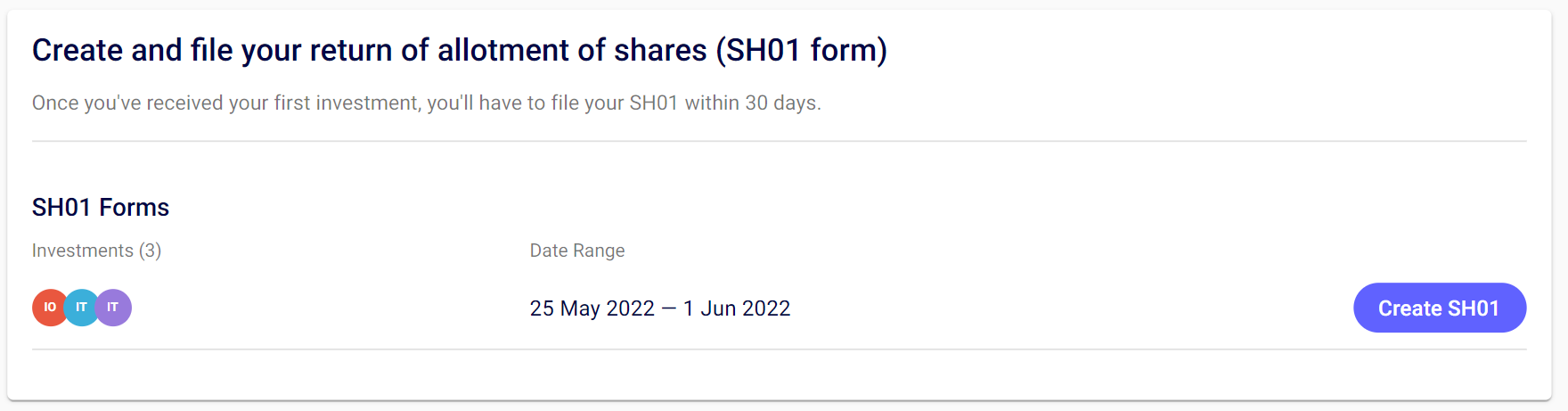

Step 8: Create and file the SH01 form

When you've received all the money and all documents are fully signed, you can generate the SH01 form.

If you have more than one investor, the SH01 will cover all the Instant Investments.

Print out and post the SH01 to Companies House, or file online - here's how.

Finished all the steps above? Now you can close the Instant Investments.

Congratulations! 🚀