SeedFAST Key Terms Master Guide

What terms should you select and what are their implications? Find out below

The SeedFAST is SeedLegals’ version of an Advance Subscription Agreement (ASA). We have ensured that our SeedFAST is built in the most founder-friendly way possible whilst also using market-standard terms that are S/EIS compliant. With a SeedFAST you can take in funds from investors today, in exchange for shares in the future upon conversion.

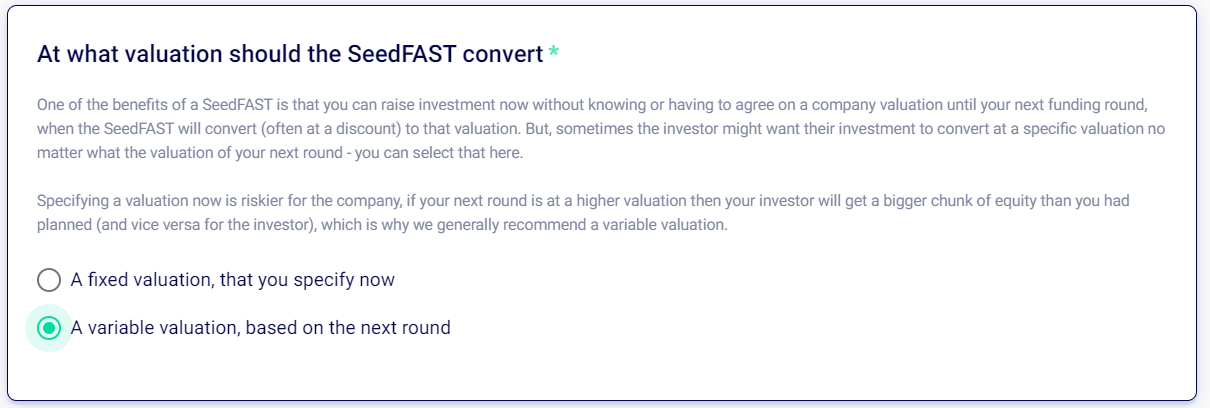

Fixed vs Variable Valuation?

The valuation is one of the most important aspects of a SeedFAST as it determines how much equity your investor will receive, and what share price they will receive. This is because we get the price per share at conversion by taking the valuation and dividing it by the fully-diluted total of shares (shares + option pool) in your company before the conversion.

Within a SeedFAST, you have the option of setting a Fixed Valuation SeedFast, or Variable Valuation SeedFAST.

- With a Fixed Valuation, no matter what Valuation is set within a future fundraise, the SeedFAST will convert at this specified Valuation. Using the below example, the SeedFAST will convert at a Pre-Money Valuation of £2,500,000, regardless of what the Valuation is set within your future fundraise.

- With a Variable Valuation, the SeedFAST will convert at the Pre-Money Valuation of a future fundraise, subject to a specified discount or Valuation Cap. This means that you do not need to specify a valuation at the point of signing.

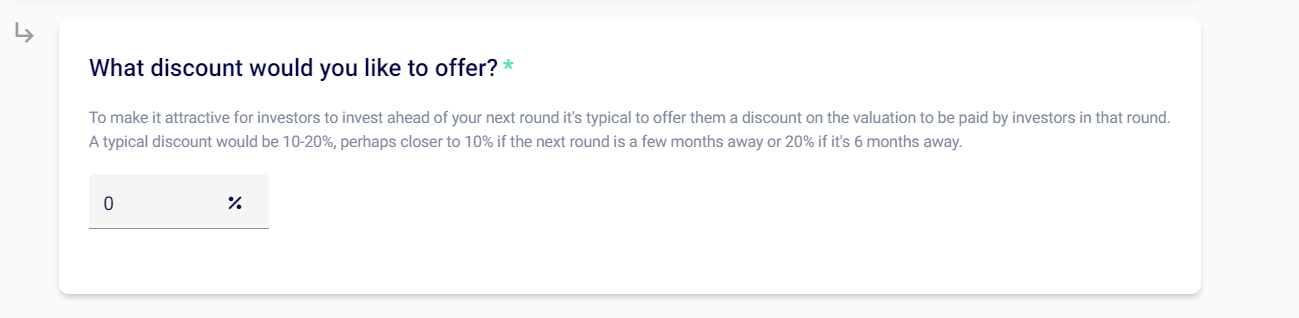

Would you like to offer a discount to your investor?

A discount allows you to discount the price per share for the investor. This incentivizes an investor to put money in without being issued shares immediately. A typical discount we see is 10-20%, depending on the proximity of the funding round. The longer the wait for conversion, the higher the discount tends to be.

The discount is applied to the Pre-Money Valuation you set within your future fundraise. Within the screenshot below, a 20% discount is specified. This means that your investor will convert his SeedFAST at a 20% to whatever Valuation you set within your future round.

Do you want to put a Cap on the valuation at which the SeedFAST will convert?

Placing a Valuation Cap will prevent your Investor converting their SeedFAST at a Valuation higher than the Cap. With the £2,000,000 Valuation Cap, if you raise at a higher Valuation than £2,000,000, the SeedFAST will convert at a valuation of £2,000,000.

If you stipulate both a Discount and a Valuation Cap, then the investor will benefit from the lower Valuation of either the Cap or Pre-Money Valuation with the discount applied. For example, if you set a Valuation Cap of £2,500,000 and a discount of 20%, shown in the above example, in the event that you raise at a £3,000,000 valuation, then the investor will benefit from the discount, as the resulting £2,400,000 is lower than the Valuation Cap.

If there is no funding round, what valuation will the SeedFAST convert at?

This is the Longstop Valuation, also sometimes referred to as the Low Valuation. This will be the valuation at which your SeedFASTs convert if you choose to convert your SeedFASTs via a Conversion Agreement (an Instant Conversion on SeedLegals) as opposed to a Funding Round.

What amount of investment constitutes a ‘new Funding Round’?

This asks you to set a minimum amount that constitutes a qualifying ‘Funding Round’. In short, this is the amount you must fundraise in order to enable your investors to benefit from any stipulated discount or Valuation Cap.

You can stipulate whether you want this amount to be inclusive or exclusive of your SeedFAST raise. We recommend excluding your SeedFAST raise from this amount, to provide more flexibility as to how you wish to raise via SeedFAST. That being said, if you have previously stipulated that your qualifying ‘Funding Round’ includes your SeedFAST raise, we recommend keeping your SeedFASTs consistent, so they all convert under the same circumstances.

What share class will the SeedFAST convert into?

This section allows you to either specify a particular share class to give your investors or just give them whatever the most favourable share class is at the time of conversion.

What should I set as my longstop date?

This is the date by which your SeedFAST must convert. HMRC rules state that the maximum longstop date is 6 months after the signing of the SeedFAST Agreement. Therefore, if you’re planning on issuing S/EIS shares, please select the first option as per the screenshot above.

Add in specific wording?

Here, if you’re dealing with an investor who wants to change the wording and format of the Agreement, we offer various options to amend the SeedFAST to accommodate the deal. For example, stipulating a YC post-money cap will enable the SeedFAST to convert at a Post-Money valuation, as opposed to a Pre-Money valuation. Unless your investor requires specific terms, please select ‘None’ here.

Will you provide warranties that the company own its IP, there is no judgment against the company, etc?

This is a set of promises to your investor that your company owns its IP, and is not in ‘legal trouble’ etc. If your investor hasn’t asked for this, it is not necessary.

You can now indicate that you’re raising via multiple SeedFASTs (and generate Board and Shareholders’ resolutions that will cover this entire raise) in the Board resolution section of the SeedFAST workflow.

Any other questions?

Please reach out to the team on our Live Chat if you have any questions on setting the terms of your SeedFAST - we're here to help!