How to build your Advance Assurance application with SeedLegals

A step by step guide for building Advance Assurance application on SeedLegals

What’s the SEIS / EIS Advance Assurance?

If your startup is incorporated in the UK, you’ve probably already heard about SEIS / EIS Advance Assurance. But in case you haven’t, take a look at this article.

In the UK, funding rounds are fueled by the SEIS and EIS tax relief schemes. SEIS and EIS funding are more popular than ever, with no signs of slowing down. The latest stats from HMRC for the tax year 2021 to 2022 show:

- 4,480 companies raised a total of £2,305 million under the EIS scheme (the highest number of companies and total amount raised since the scheme was introduced). That’s a 39% increase in EIS funding compared to the 2020 to 2021 tax year.

- 2,270 companies raised a total of £205 million under the SEIS scheme (the highest number of companies and total amount raised since the scheme was introduced). That’s a 16% increase in SEIS funding compared to the 2020 to 2021 tax year.

What does that mean for you? More companies are using SEIS and EIS to successfully land investment. If you can show potential investors that they can benefit from the tax relief, you’ll make the prospect of investing in your company more attractive.

How will obtaining SEIS / EIS Advance Assurance increase your odds of raising funds?

Advance Assurance is a pre-approval from HMRC, indicating to your investors that investment in your company is likely to qualify for S-EIS tax relief. As such, Advance Assurance has become an important tool for founders who want to increase their investability. In fact, ~90% of UK angel investors won’t invest in companies that are not S-EIS eligible. If you’re looking to raise funds, Advance Assurance is likely the first document your investor will want to see.

HMRC can take up to 40 working days to approve your application, so make sure you start applying a month or two before meeting investors. You don’t want to be in a position where you have to push back a meeting with investors just because you don’t have your Advance Assurance yet.

Applying for SEIS / EIS Advance Assurance with SeedLegals - the easy way

Applying for Advance Assurance can be quite complex to do on your own. The good news is that applying with SeedLegals is easy, quick and efficient. It shouldn’t take you more than 15-30 minutes to complete your application on SeedLegals.

Then, you’ll send us your application for review, and our dedicated S-EIS team will get back to you in 3-5 business days with our review, which includes all our comments before it can be submitted to HMRC. Our goal is to get you approved, so we will work closely with you to flag any issues in your application and to help you correct them.

With Advance assurances, we have a 98% success rate with HMRC! Just to compare, HMRC released stats last year showing that the general success rate is only 62%.

Once you get our “green light” (i.e. after we feel comfortable that your application is in the best shape possible, and you’ve corrected all the issues we flagged), we will submit your application to HMRC directly. Within 15 to 45 working days, HMRC should get back with an approval, which your dedicated associate will promptly communicate to you!

Do I need to speak with anyone to get started?

No. You can start building your application on the SeedLegals platform whenever and wherever you like. If you have any questions along the way, you can always use the chat feature on the platform, and our support team will reply to you in minutes!

Before we jump into the process, if you haven’t yet, make sure you’ve signed up to SeedLegals (it’s free)

Applying for Advance Assurance step by step

Starting out

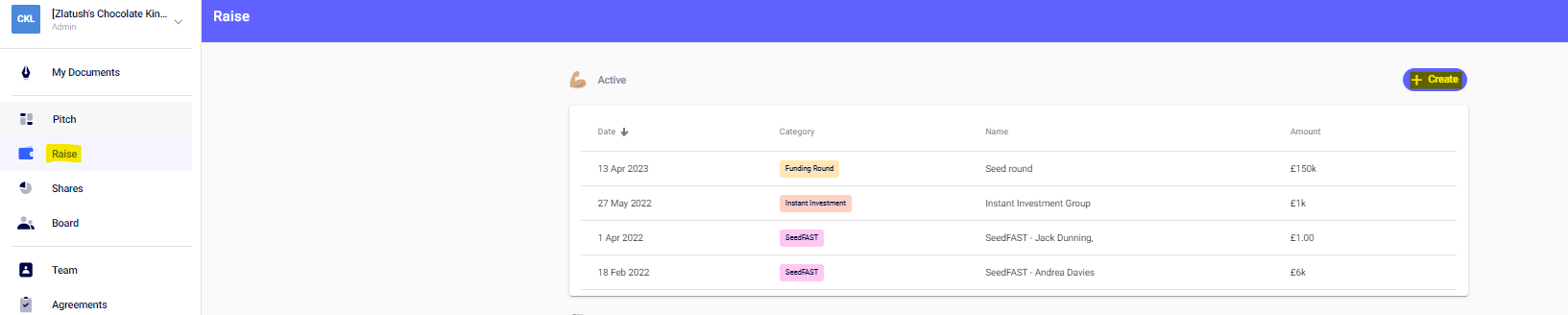

After logging into the platform, you’ll see this dashboard. Hit ‘Raise’ > and then the "Create" button:

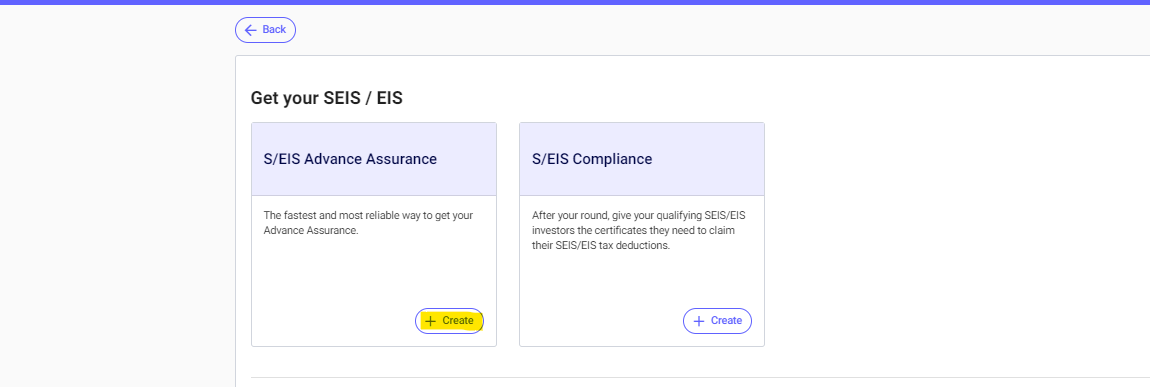

Then, select "Advance assurance" on the next page:

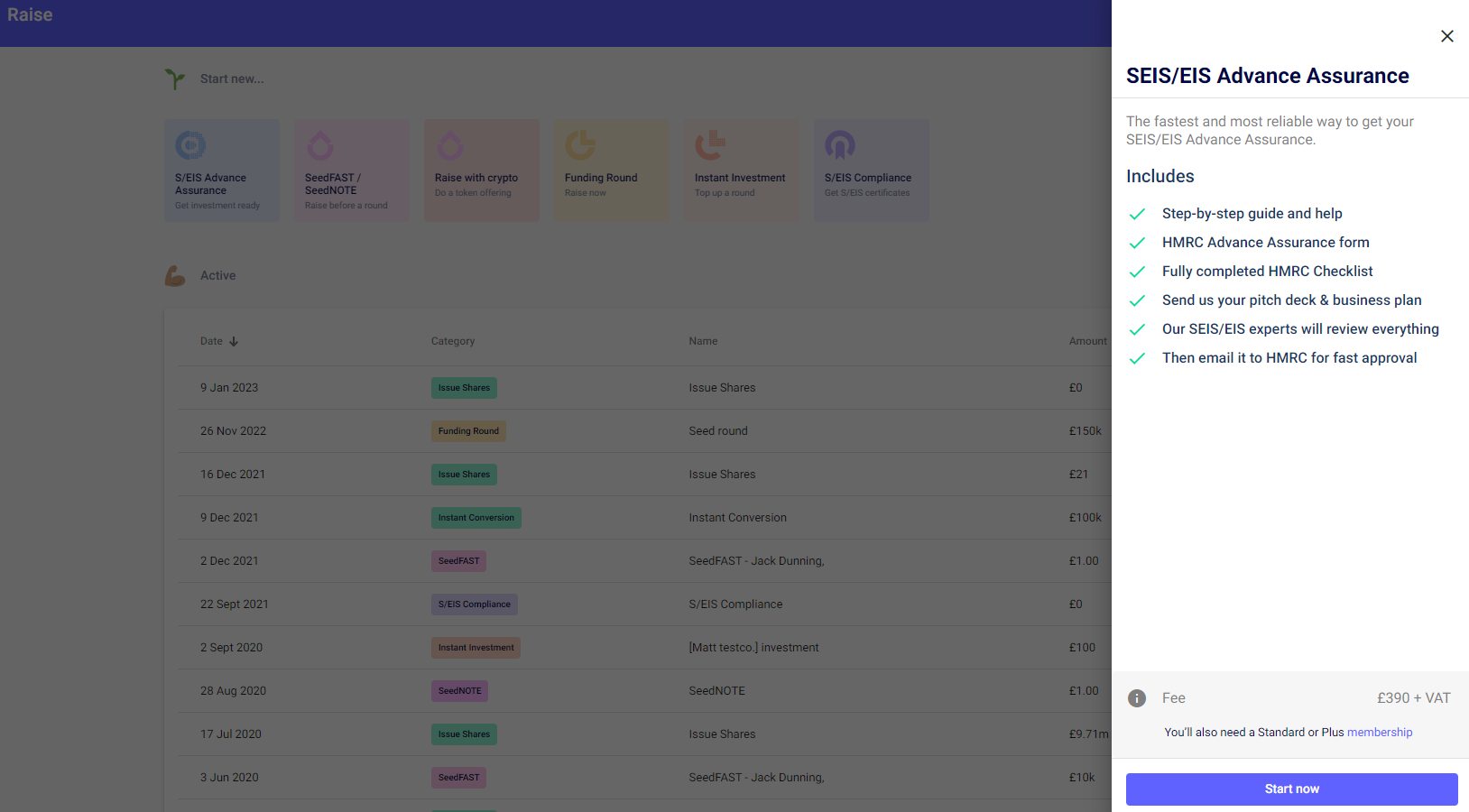

A new window will open on the right side of the screen. Just click on the ‘Start now’ button.

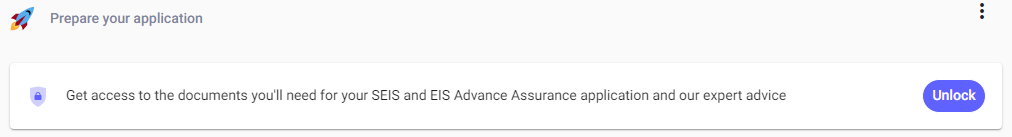

Next, you'll need to click the 'unlock' button.

Next, you'll need to click the 'unlock' button.

1. Complete the questions

The first section requires you to fill out information regarding your company details. For a quick video guide on how to complete the questions, see below:

Your company will need to be incorporated and have a Unique Taxpayer Reference Number 'UTR'. We can review your application even if you don't have your UTR yet, but note that you will need it before we can submit the application to HMRC.

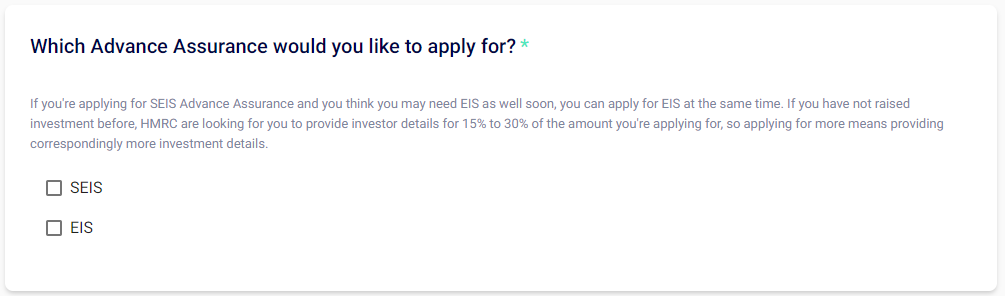

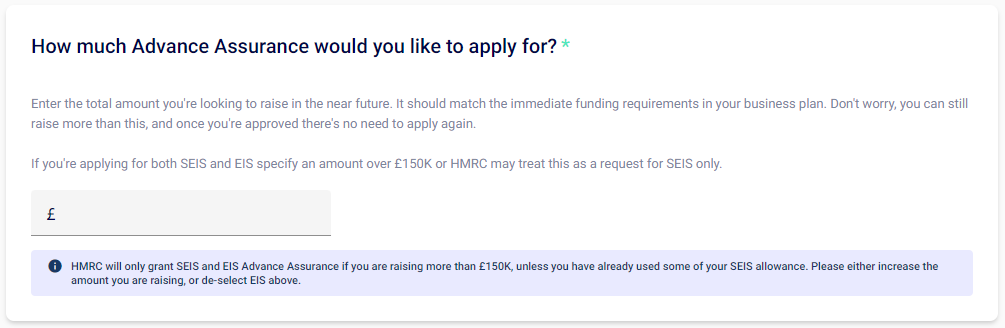

On the following page, select which scheme you're applying for. If you're applying for up to £150k (£250k under the new rules - but they are not in place yet!) then only select SEIS, but if you're applying for anything higher then you should select both SEIS and EIS [you can apply for both at the same time] - unless your company is not eligible for SEIS at this stage. If you’re not sure about your eligibility, have a read of this article.

HMRC try to avoid artificial investments that are done just for the sake of getting S-EIS tax relief without taking on any risk. Genuinely entrepreneurial start-ups should not be affected by this provision. We suggest you to use our default wording: “The risk to capital requirement has been met, see our attached Business Plan for details”.

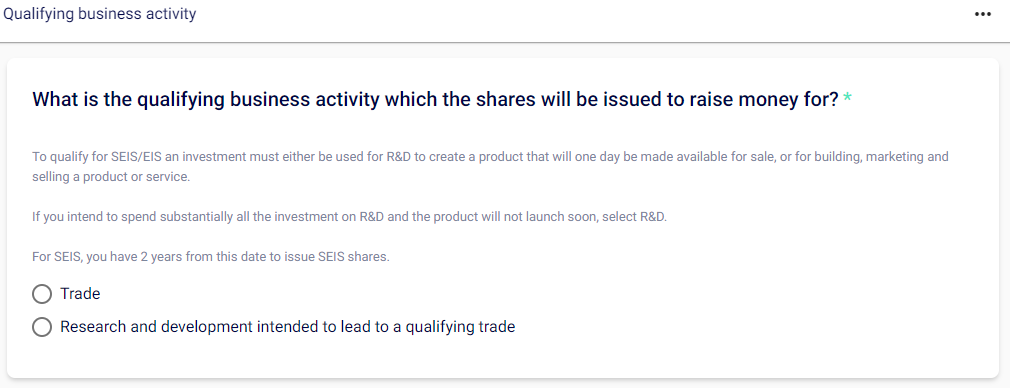

Here you need to tell HMRC whether the funds will be used for a trade or R&D. If you will begin your trade using the money for the investment, please select 'Trade'. If, however, you intend to spend the funds solely on R&D that will lead to the trade in the future, please select 'R&D'!

Regardless of whether you select 'Trade' or R&D, you'll then need to select whether the trade/R&D has started yet. If yes, then you'll also need to include the date when you started trading as well as the details. If no, you'll simply need to fill in the details of the trade. Please note that the trade must have started no more than 2 years before your application, or you will not be eligible for SEIS! See more information on that here.

HMRC also want to understand your trading activities. Here you can choose one of two tactics, either explain in detail your activity or just refer HMRC to the attached business plan. We recommend leaving the suggested text as it is for the application. The business plan is part of your application - no worries, you’ll get a list from us later of all the documents that need to accompany your application.

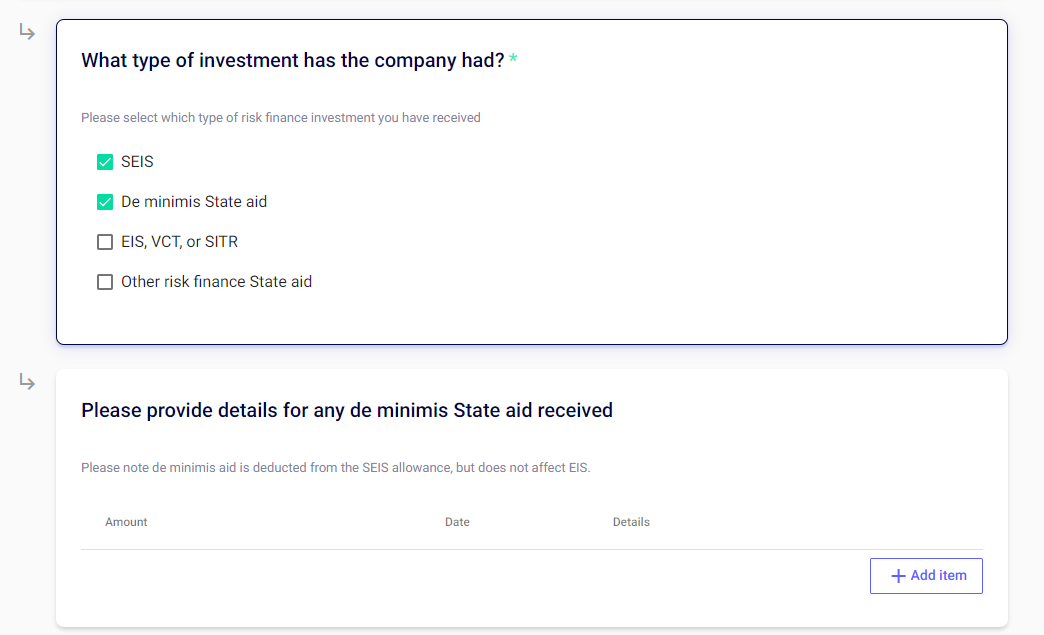

Under the 'Past investment or State aid' section, it's really important that you disclose receiving either of these. Note that any SEIS investment already received would be deducted from your overall SEIS allowance. De Minimis Aid will also count towards the maximum cap of £150,000 that can be raised through the SEIS scheme. If you did receive a grant, carefully read your grant certificate and see if it affects your S-EIS allowance - it should be mentioned on your grant certificate. If you have received external investment in the past, these details will be reflected in your external Share Register too, so it is important to ensure this document is accurate and matches Companies House.

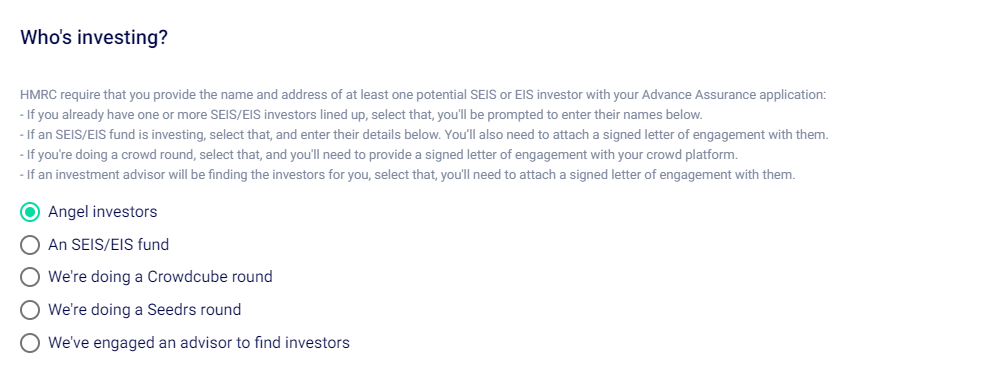

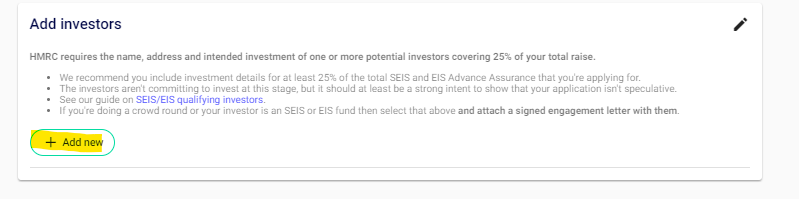

If you have received SEIS or EIS investment in the past, you will not need to provide details of your investors. However, if you have not, you will need to present a list of your potential investors to HMRC. For angel investors, you will need their name and address, and for all other options, you will need to provide a letter of engagement. You need to put down at least one potential investor that covers 25% of the overall amount you are applying for.

Here, simply set the total number of your next funding round. For example, if you do a funding round of £350,000, that’s the number you should put in this text box. Please note that this should only be the SEIS or EIS amount you are raising and not the full amount of the round though!

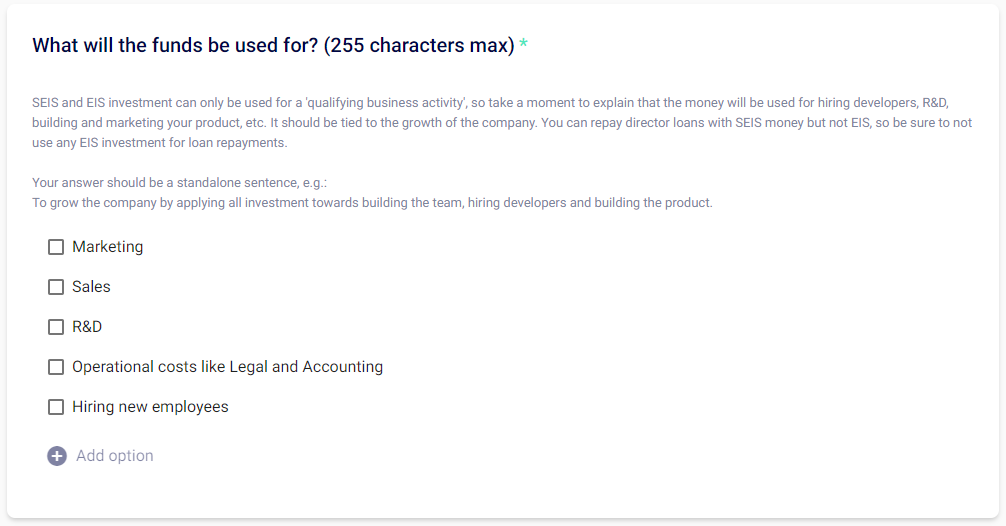

Here, you'll need to tell HMRC what the funds will be used for. We recommend just selecting some of our prepared options, but feel free to add any additional ones.

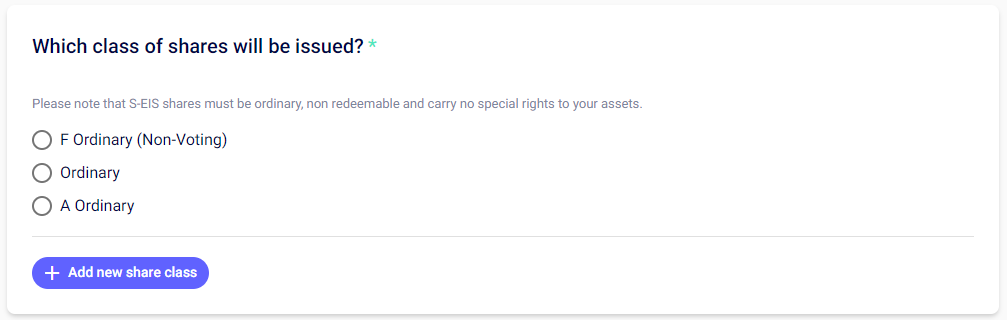

S-EIS shares must be ordinary shares, so you'll need to ensure that the share class you select below is eligible.

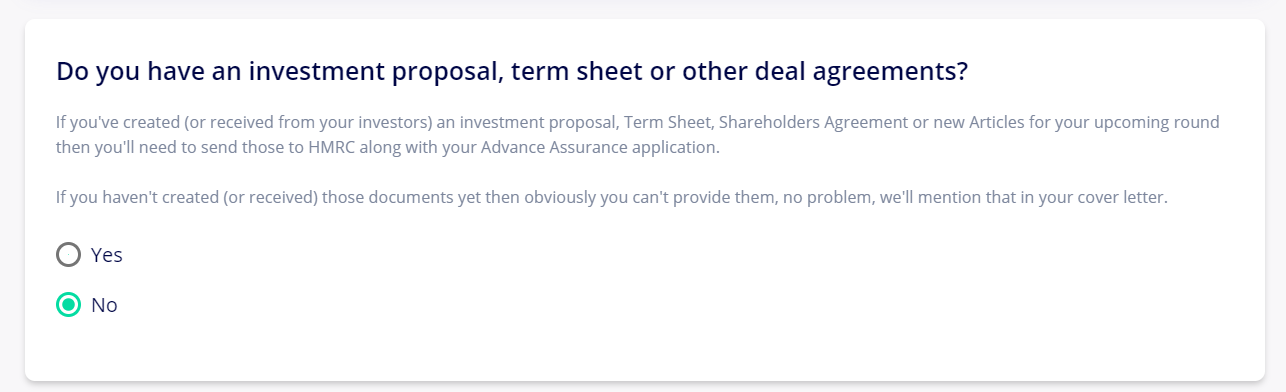

Hit ‘yes’ only if you’ve got a term sheet or shareholders agreement from your investors. But if you haven’t or if you don’t have investors yet, hit ‘no’. Not to worry, it won’t affect your chances of getting approved by HMRC (most of the companies don’t have a Term Sheet or else at this point).

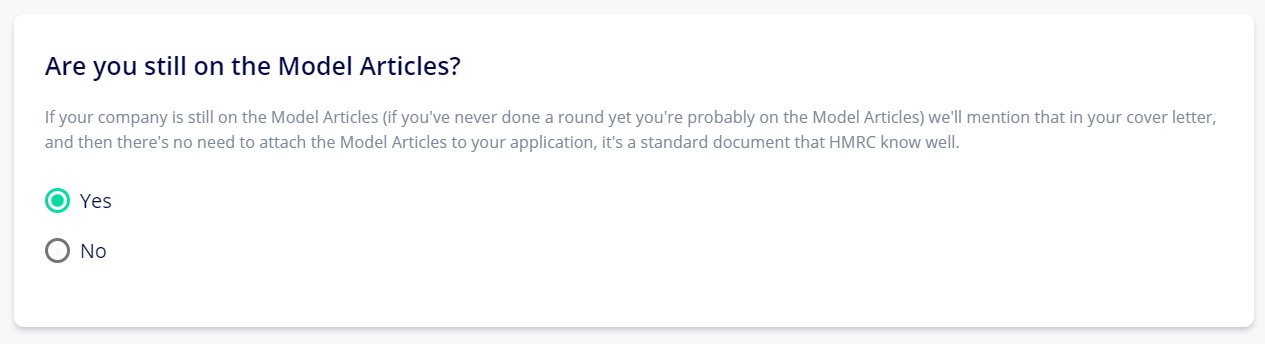

When you registered your company at Companies House, the Model Articles were applied by default. So if you have not changed them, just choose ‘no’ (most companies are still using the Model Articles at this point).

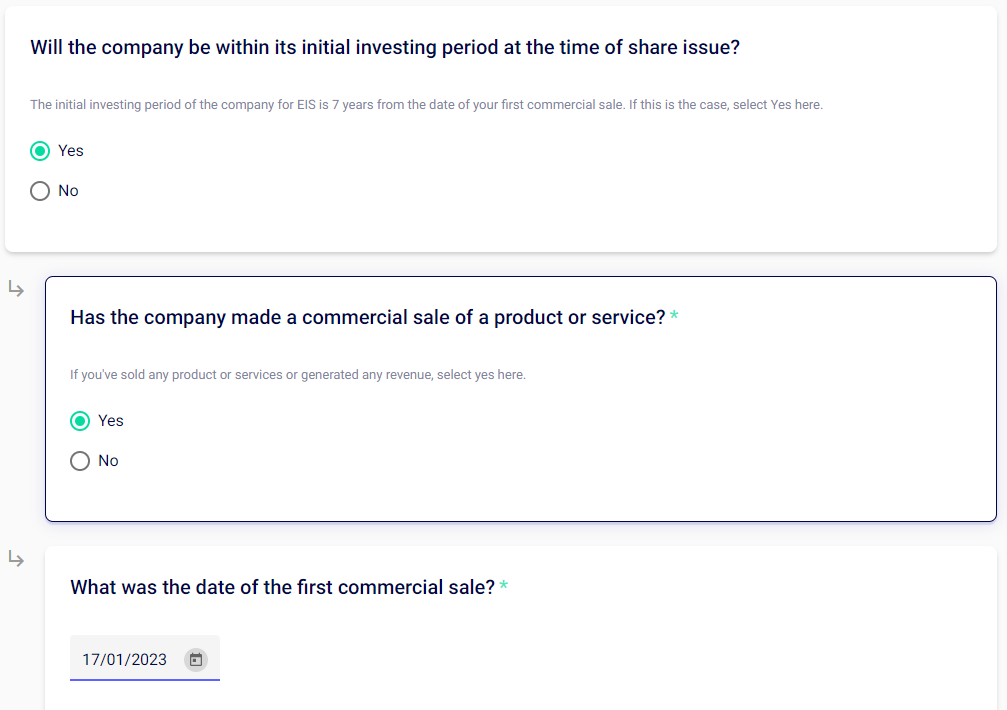

In the following section (which only appears for EIS applications), HMRC wants to understand whether the company is still within its initial investing period, which is less than 7 years from the company's first commercial sale (or, if not, how the company will satisfy one of the two exceptions to this rule). If the company is within the 7 years, then you'll need to let HMRC know if you have made a commercial sale and when this was.

If the company falls outside the 7-year window, then you'll need to select whether the company meets Condition A or Condition B. Please read our guide for more information on those, and don't worry too much about this if you are within the 7 years!

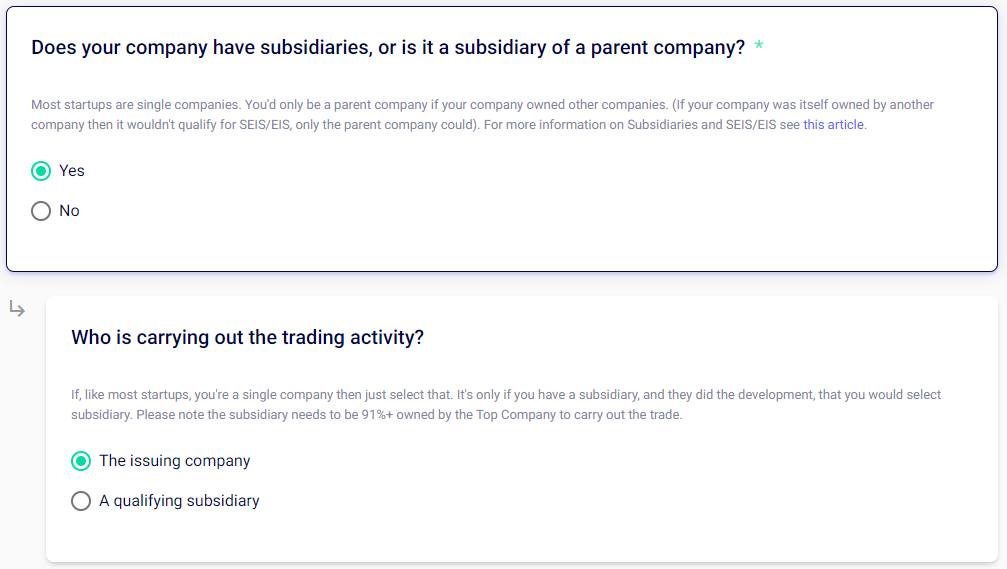

Then, for the next question, click on the ‘yes’ button only if your company is a subsidiary or if it’s the TopCo of a subsidiary. You'll then need to select which company carries out the trading activity. You will also need to upload a group structure diagram of your company structure later on.

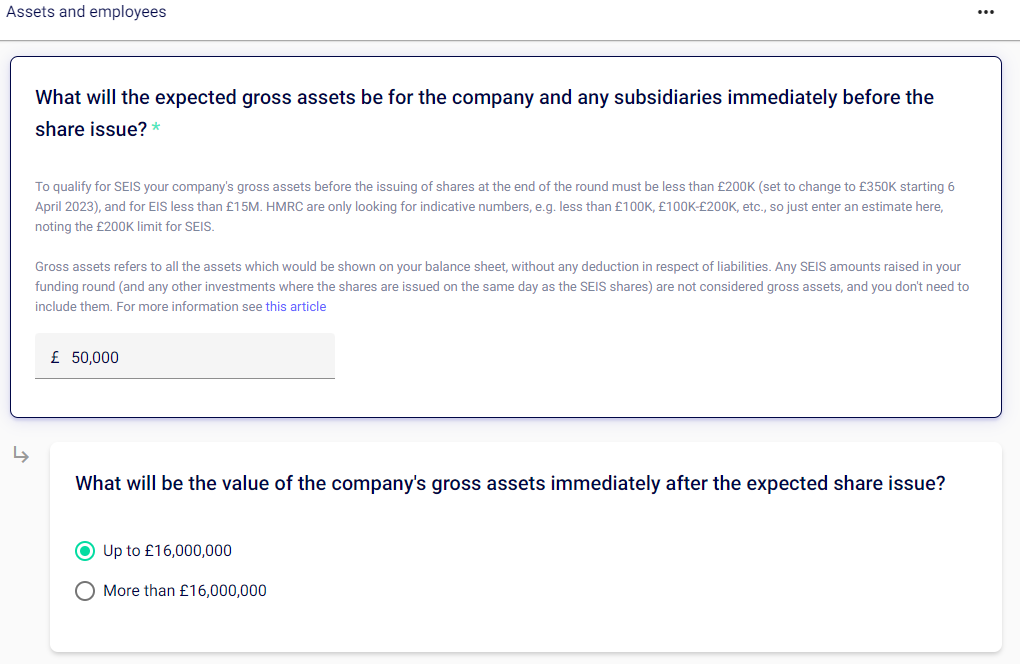

Under 'Assets and employees', you'll need to put the value of your company’s assets. Keep in mind that HMRC will only approve SEIS applications with gross assets of less than £200K (and less than £15 Million for EIS).

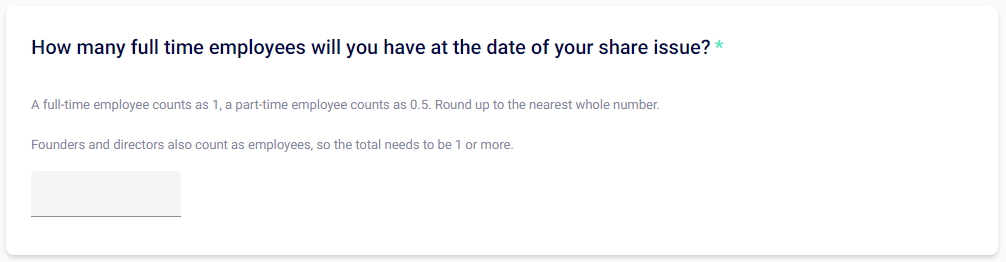

For the employee question, put a number here only if the employees are on the company’s payroll. In cases where you have part-time employees, combine their part-time roles into indicative round numbers. For example, two half-time employees would be equal to one full-time employee (most of the companies applying for the Advance Assurance are early-stage companies, so that’s very common not to have employees at this point). However, company directors also count as employees for the purpose of this test - you can see more about this here. Therefore, the number of employees should never be "0" as all companies have at least one director!

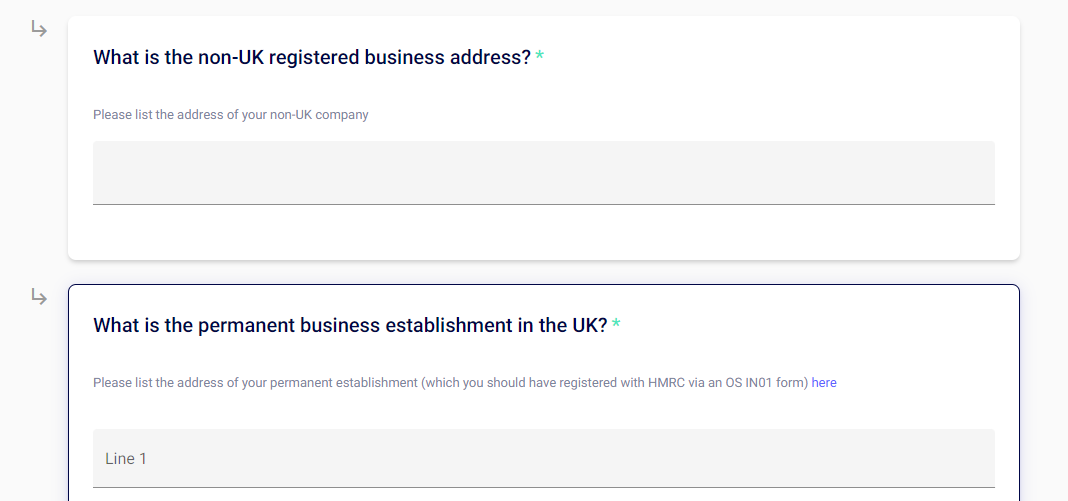

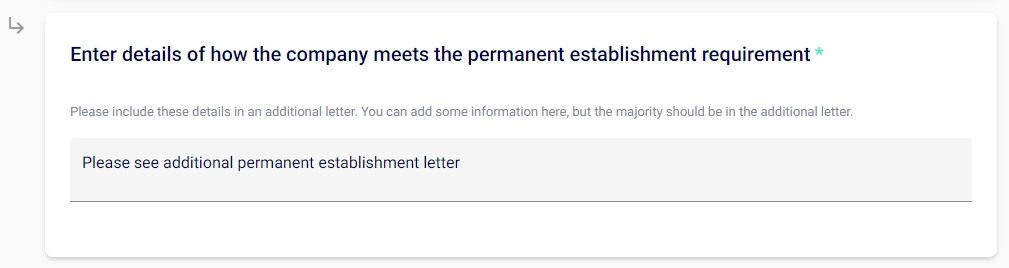

For the next question, if your company was not incorporated in the UK you'll need to let HMRC know your non-UK registered business address. You'll also have to list the address of your permanent establishment in the UK.

As part of the application for a company that wasn't incorporated in the UK, you'll need to submit an additional letter to address the permanent establishment requirement. This is something that the team will be able to assist you with.

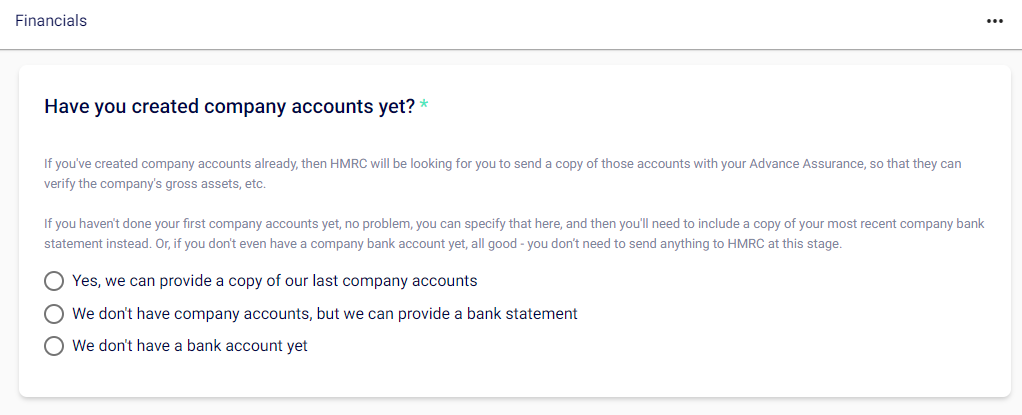

In terms of the next question, choose one of the three options here. It’s important to let HMRC know your company’s account details - and if you have filed accounts with Companies House, for instance, you do not need to supply a bank statement. If you don't have accounts but have a bank statement, then answer accordingly and provide that. Don't worry - some early-stage companies don’t have an account at the beginning, so in this case, just hit ‘we don’t have a bank account yet’. It is not a requirement to have either of the above for the purposes of Advance assurance.

2. Add your proposed investors (if you have not raised SEIS or EIS funds before)

Next, just click on "Add new" to add your proposed investors.

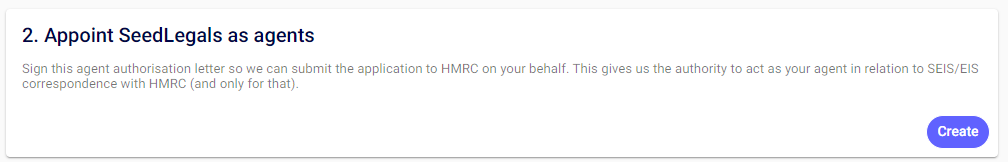

3. Appoint SeedLegals as agents

The third part of the process requires you to create and sign a letter to appoint us as your agents, which gives us the authority to submit the application and correspond with HMRC on your behalf in relation to the application.

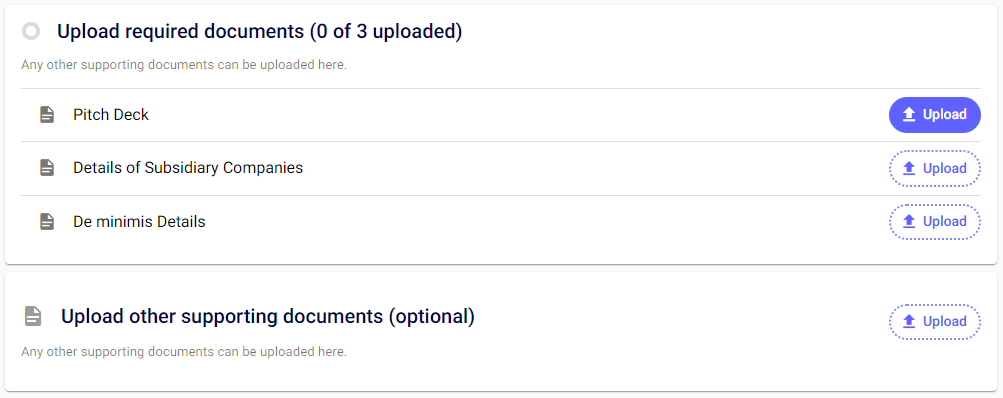

4. Upload your supporting documents

Once you've completed the questions and appointed SeedLegals as agents, you'll need to upload your required documents. The document upload slots will be generated directly based on answers to the previous questions (Step 1). In all cases, you will need to upload your Pitch Deck, as well as any other supporting documents suggested by the platform.

5. Complete & send your application to us

Once everything is completed and uploaded, you will notice that you can use our AI Health Check tool for a quick check of your application. We encourage you to do run this as it will flag any items that are missing or need amendments still which in turn will help speed up the application process. You can rerun the check as many times as you wish.

Once you've made the recommended amendments please click the 'submit for review' button to send the application to our team for a final review. We typically take 3-5 business days to review everything. After this, your dedicated S-EIS associate will send you an email regarding any changes that need to be made. Once finalised, we'll then submit this to HMRC on your behalf.