How to register your EMI Option Scheme with HMRC

HMRC requires companies to register their EMI Option Scheme using an online service. If you have multiple EMI schemes you only need to register one scheme. This is how you can tell HMRC about your EMI Options Scheme:

Step 1: Sign in using your Government Gateway account: Follow this link and click "Sign in”. Then either log in with your company’s details or click "Create sign in details" if you need to set up a new account. If your accountant usually manages your Government Gateway, you might need to get the details from them.

Please make sure you are PAYE registered and you are signed in with the account linked to the PAYE registration. Here's a video guide from HMRC on how to set up PAYE.

Step 2: Scroll down to the section that says Employment related Securities (ERS) and click on Submit Employment Related Securities returns. If you don't see this, it's probably because you haven't signed up for online PAYE with your account and so you'll need to do that, or perhaps your accountant has.

-1.png)

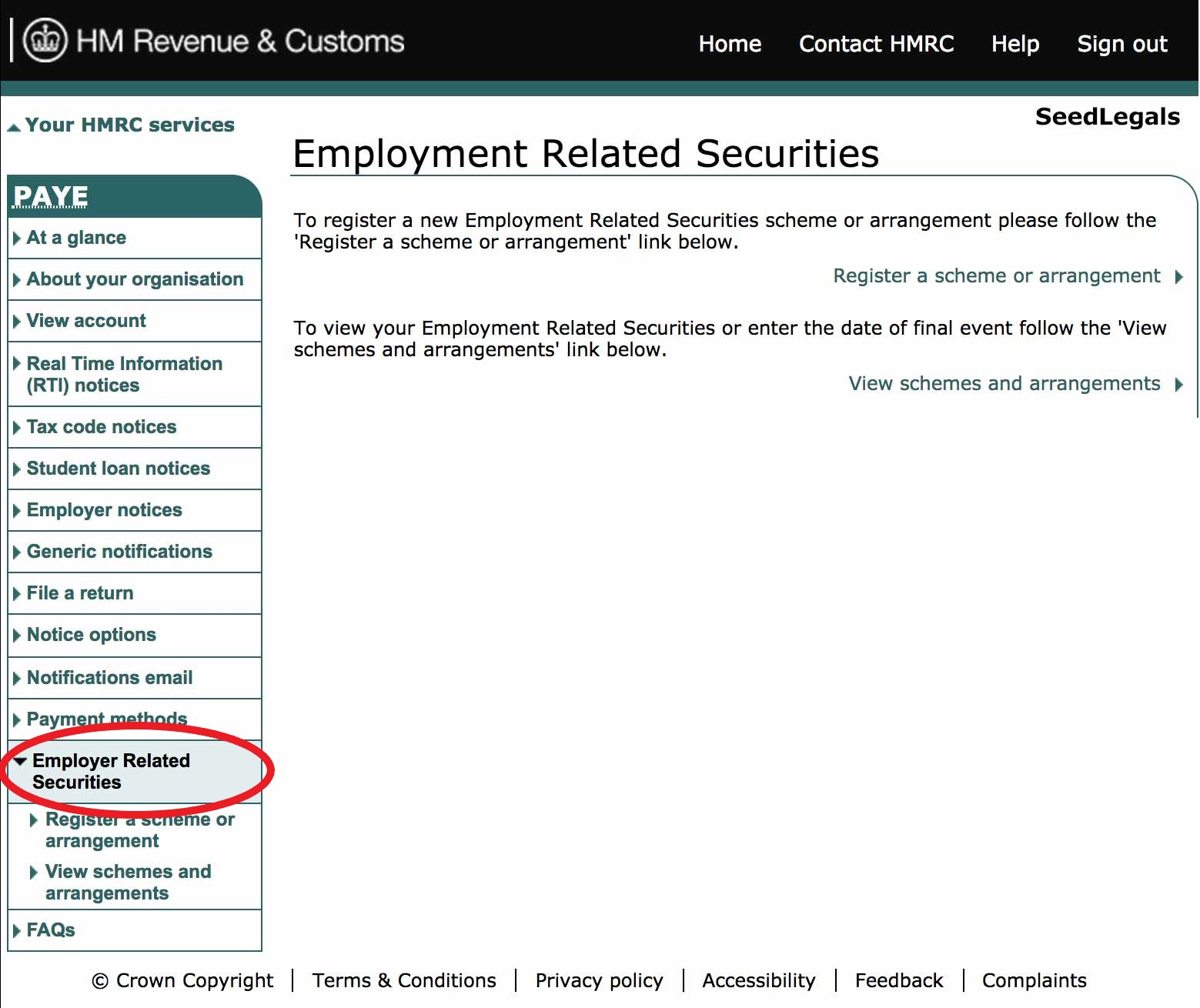

Step 3: Click on the ‘Employment Related Securities’ (may also be seen as ‘ERS Online Service’ under the ‘Other Services’ tab).

Note! If your page doesn't look like the below please make sure you are PAYE registered and you are signed in with the account linked to the PAYE registration:

Then, click on ‘Register a scheme or arrangement’.

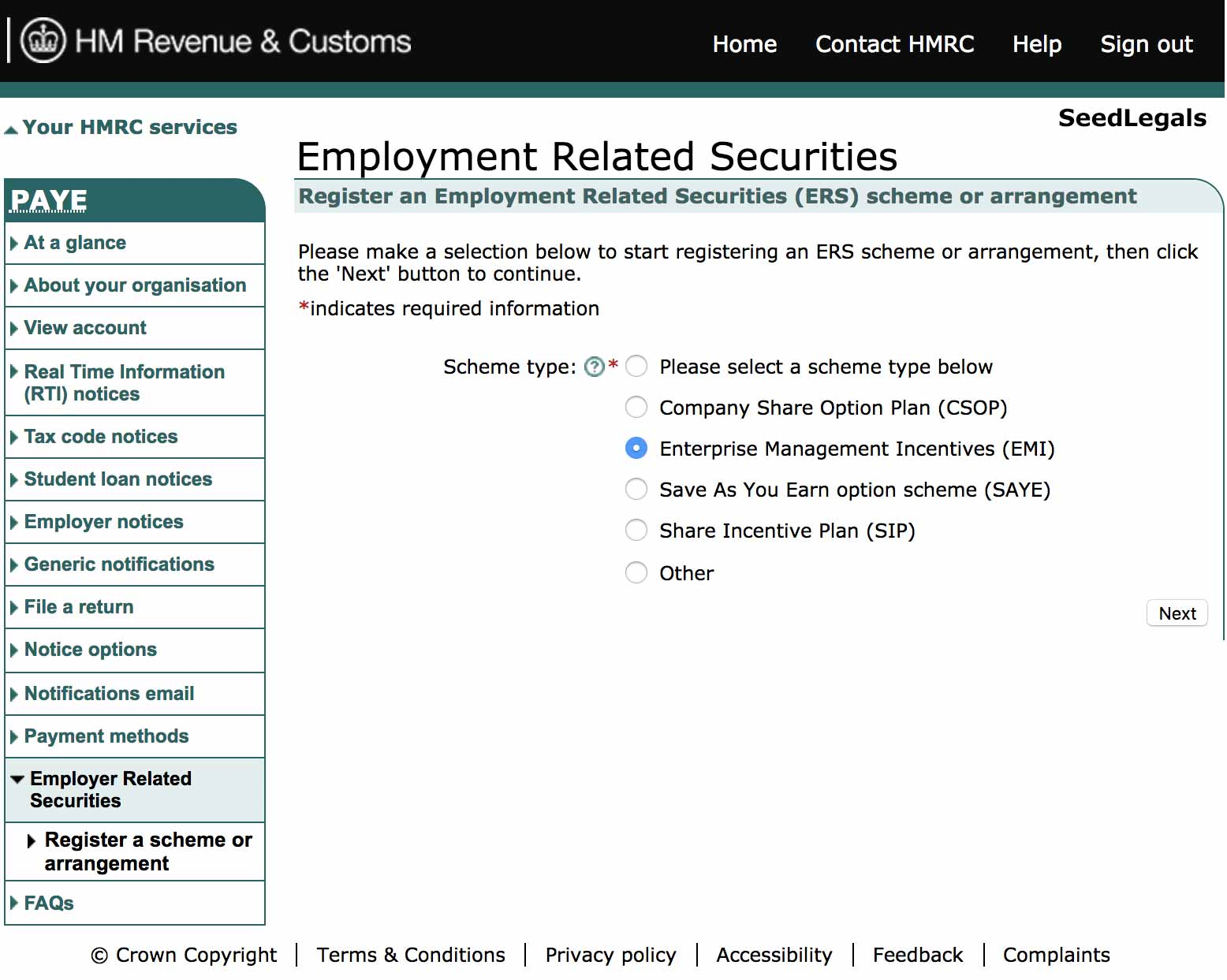

Step 4: Once you are prompted to the following page, click on ‘ Enterprise Management Incentives (EMI)’ and then click on ‘Next’.

N.B. If you are registering an Unapproved scheme through you have granted ERS, you should select 'Other'.

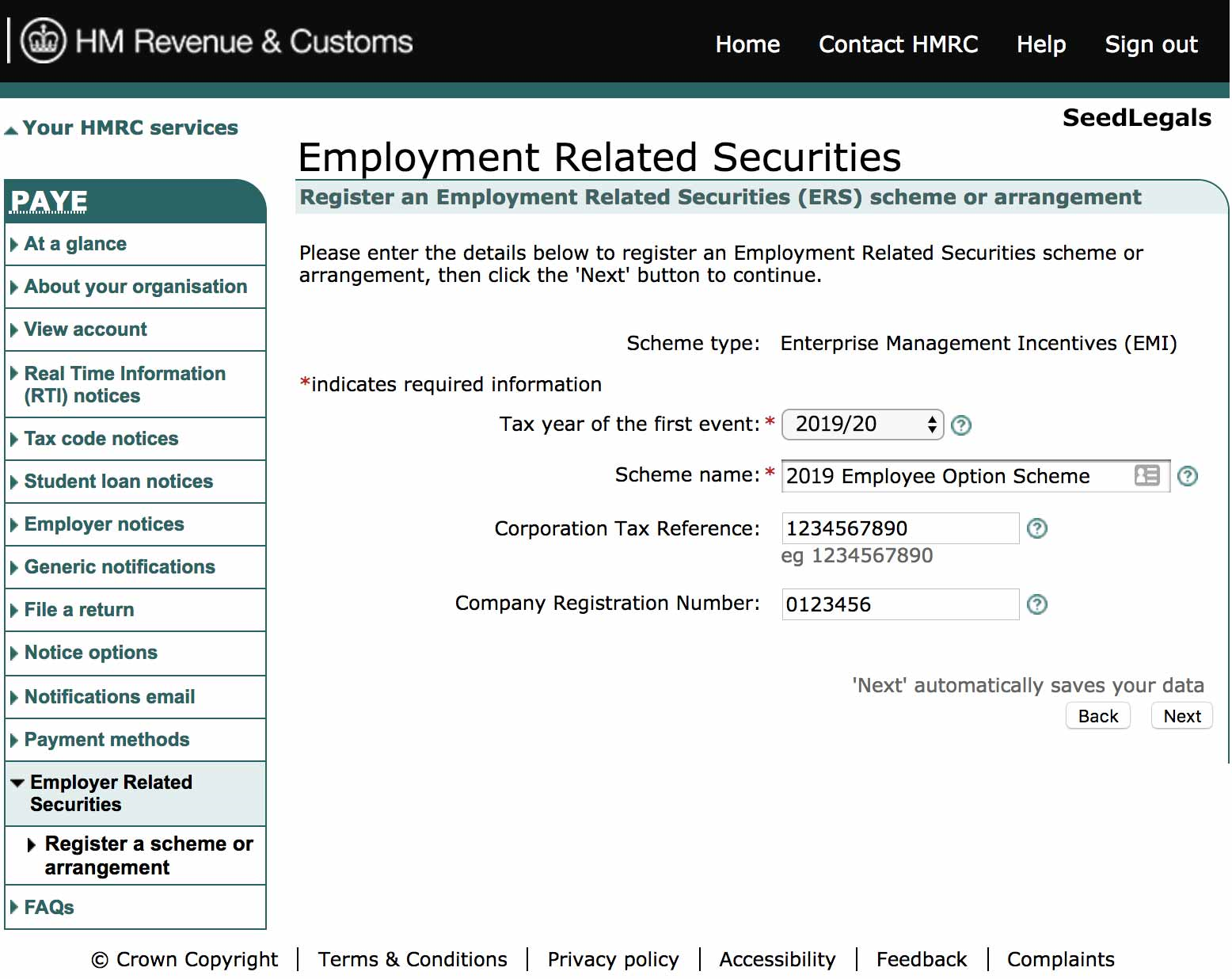

Step 5: Select the tax year of your scheme (note that the tax year runs from 6 April to 5 April the next year. You then have until midnight on 6 July to submit your EMI annual return). Choose a name for your scheme, and then you may be asked to enter your UTR and the CRN. Once done, click ‘Next’.

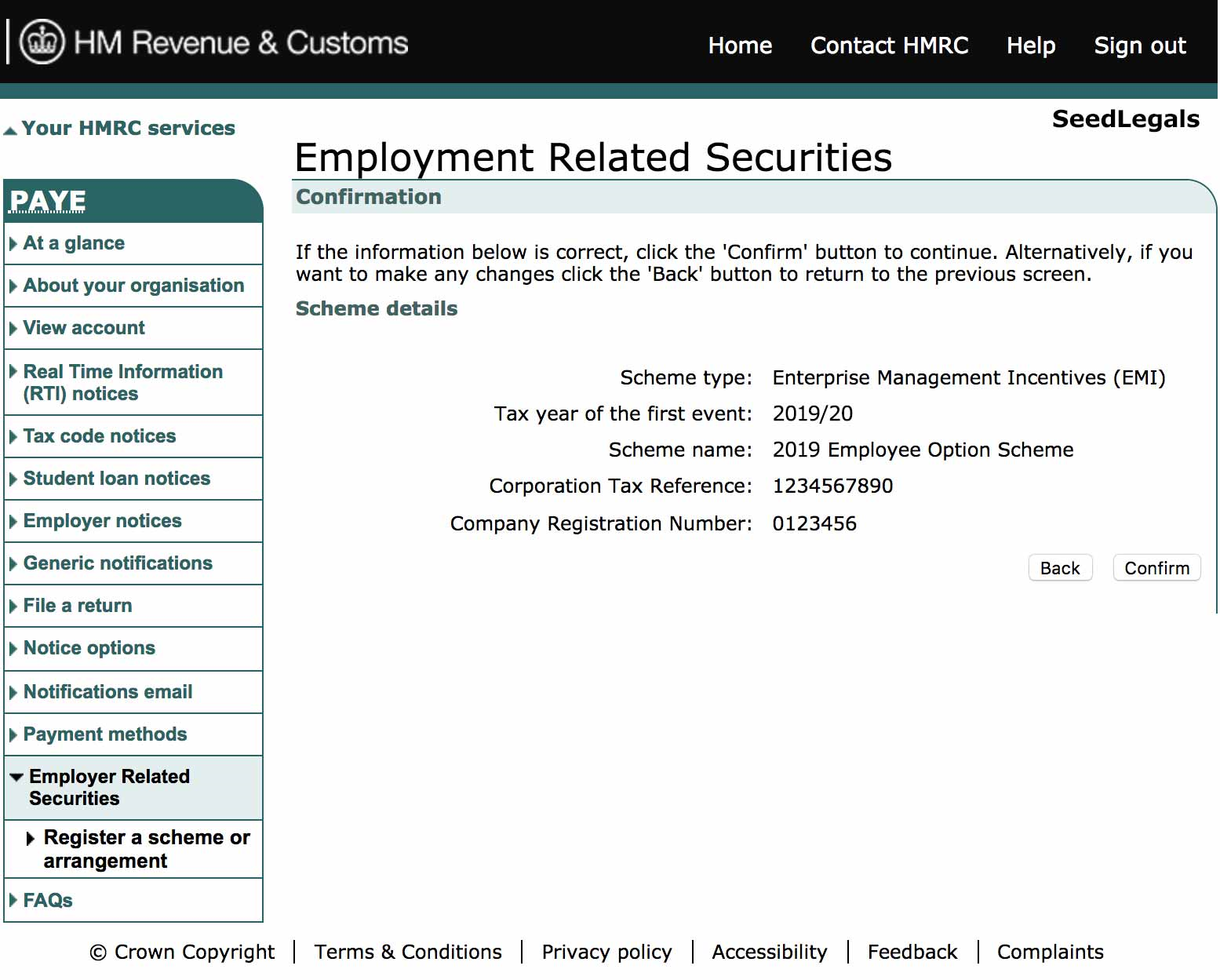

Step 6: You will now be presented with an outline of the information you have entered. Click ‘Confirm’ if these are correct.

Step 7: Complete the ‘Declaration’ page.

Step 8: You should now be able to see the ‘Acknowledgment’ page which includes a unique scheme reference number. Your EMI Scheme is now successfully registered - we recommend you screenshot this page and save it in your records! Although HMRC's acknowledgment reference states the scheme registration takes up to 2 weeks, we have typically seen customers be able to login to the portal and see the scheme registered within 24 hours. You will now be able to make the notifications of the EMI Option grants to HMRC once the option agreements are fully signed.

If you have any further questions and want to reach out to HMRC about your EMI Scheme, here’s some useful contact information:

-

HMRC’s EMI specific email: shareschemes@hmrc.gov.uk