Carbon13 Funding: a step-by-step guide

Your step-by-step guide to securing your Carbon13 funding using SeedLegals.

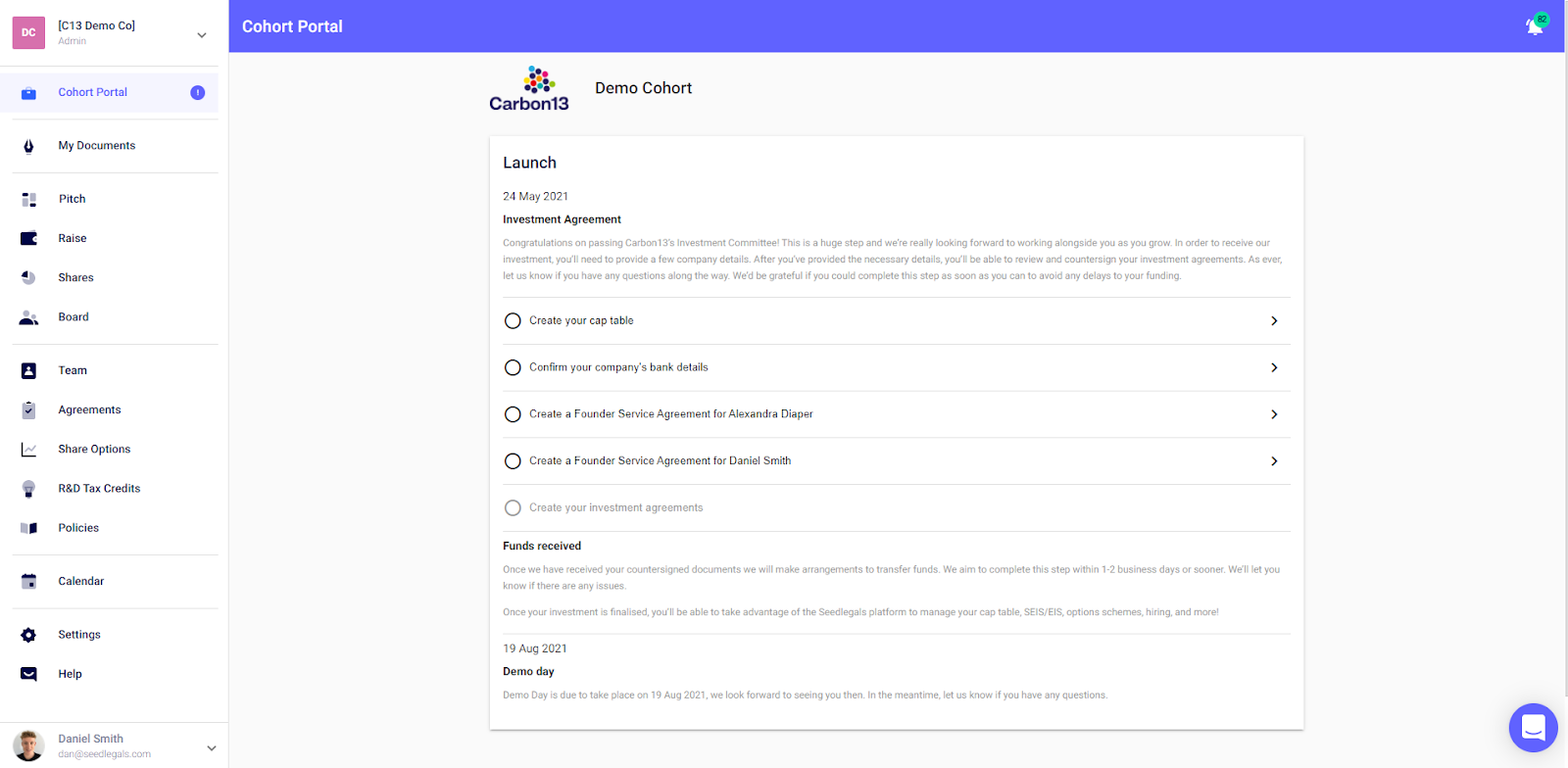

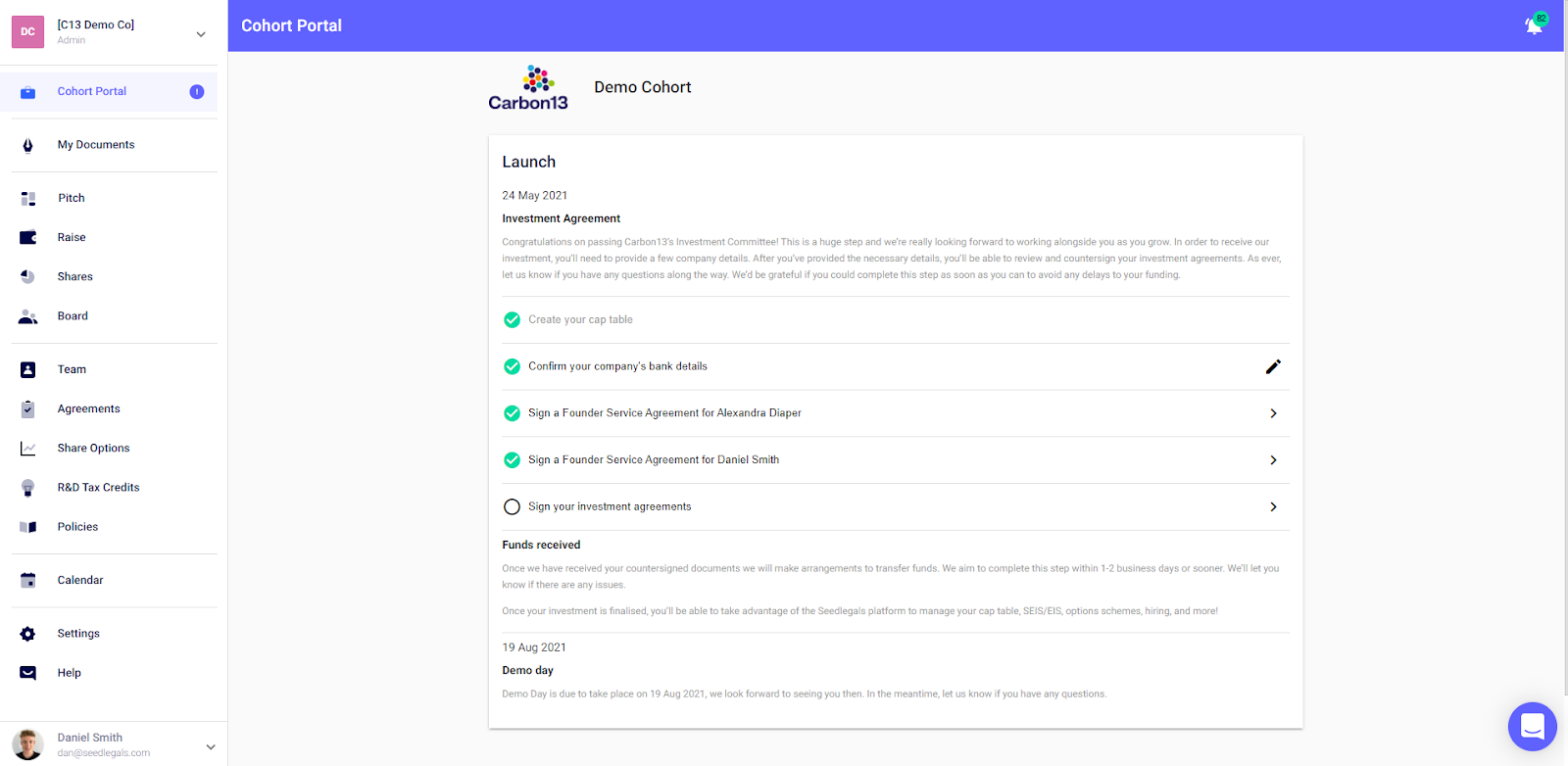

Now that you’ve formed your team, it's time to set up your company on SeedLegals and receive your funding. Carbon13 will have added you and your cofounder(s) to a team and your company will now be waiting for you on SeedLegals. Just hit the drop-down list of companies in the top left to switch from Carbon13 to your own company. Then from ‘Cohort Portal’ all the next steps will be laid out for you.

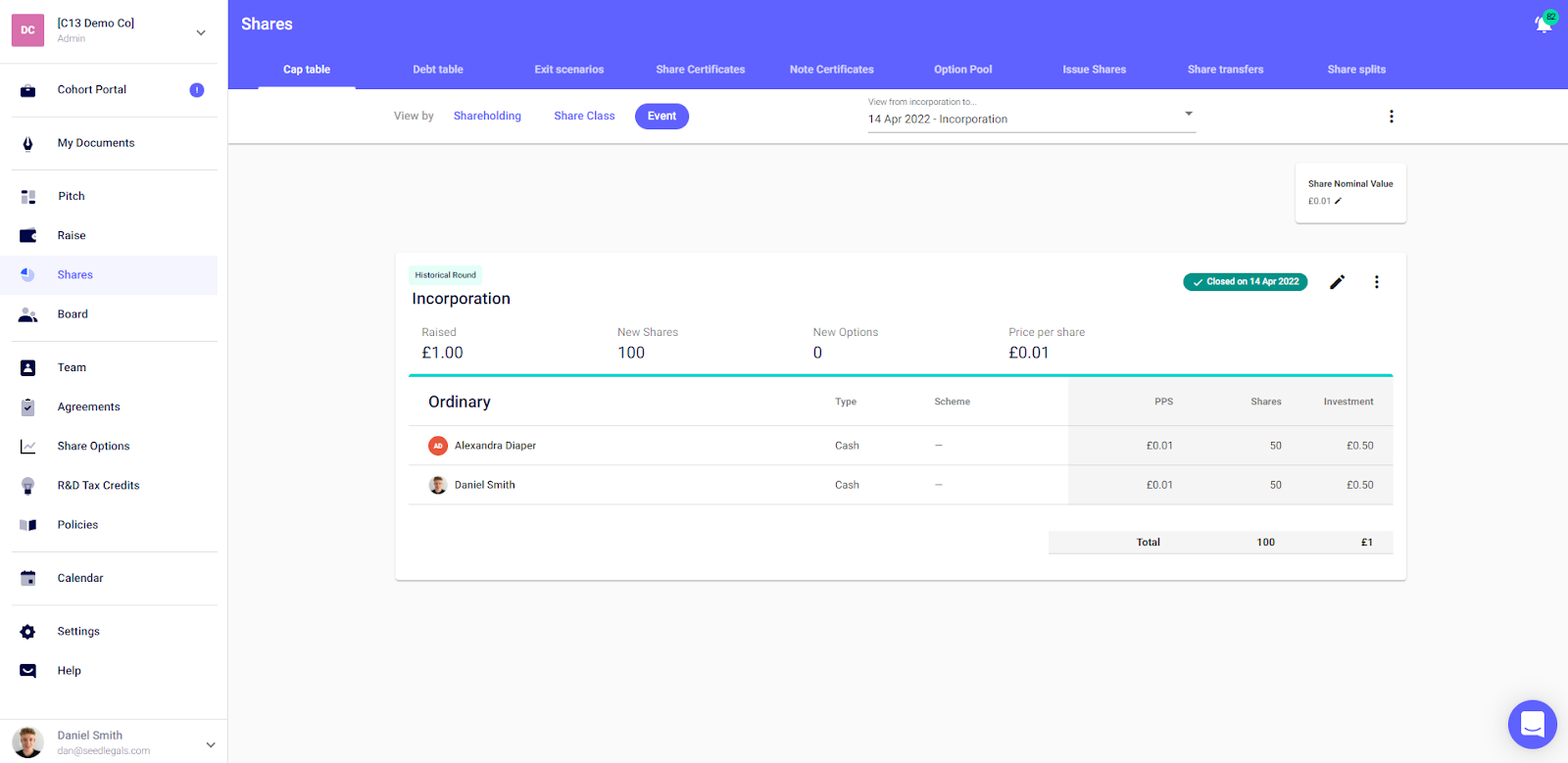

1. Set up your Cap Table. Carbon13 companies will need to have 1,000,000 shares in total, split 50/50 between the co-founders. Here’s how to set that up:

-

Choose Ordinary Shares

-

Make sure the shares have voting and dividend rights

-

Make sure you and your co-founder are the only shareholders

-

Give you and your co-founder 500,000 shares each

-

Set the nominal value to £0.0001 per share

Once you have set up your incorporation round, you’ll be taken to your cap table:

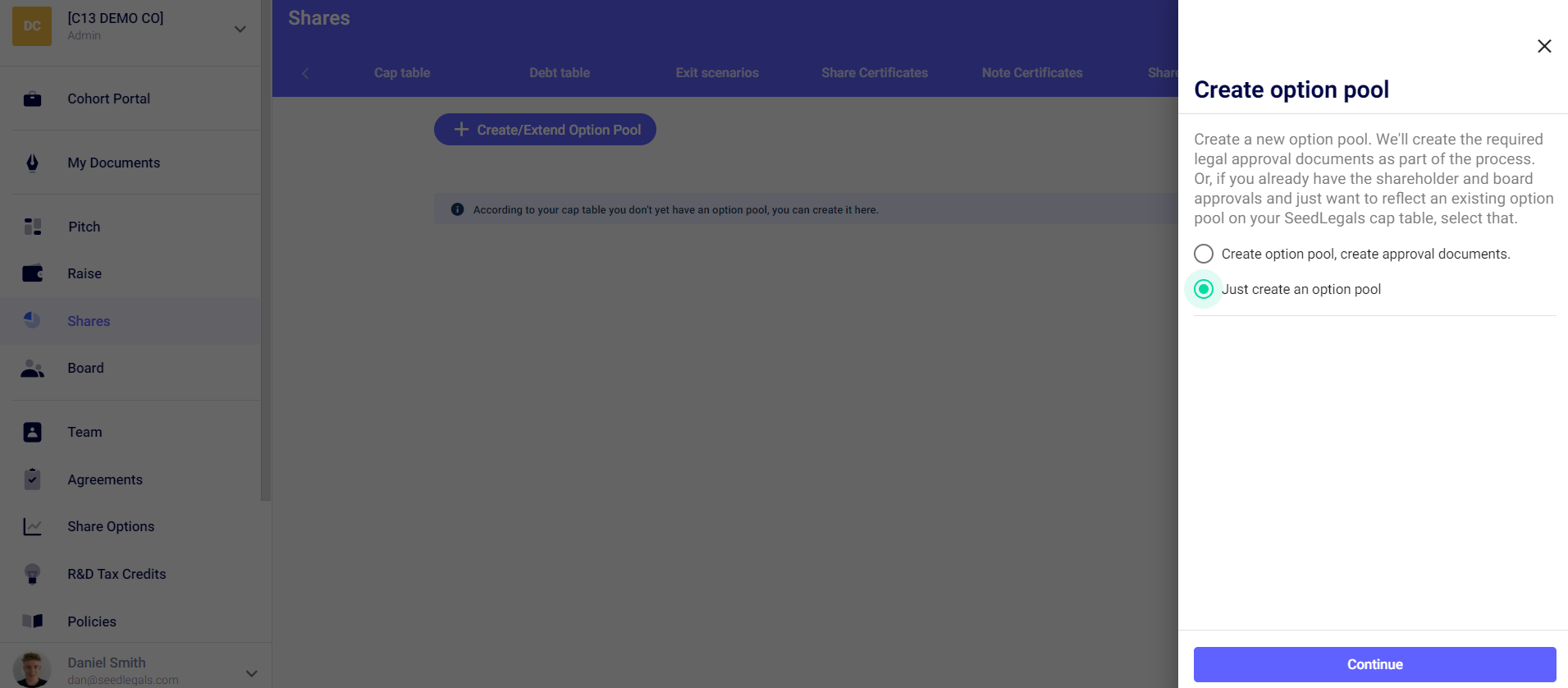

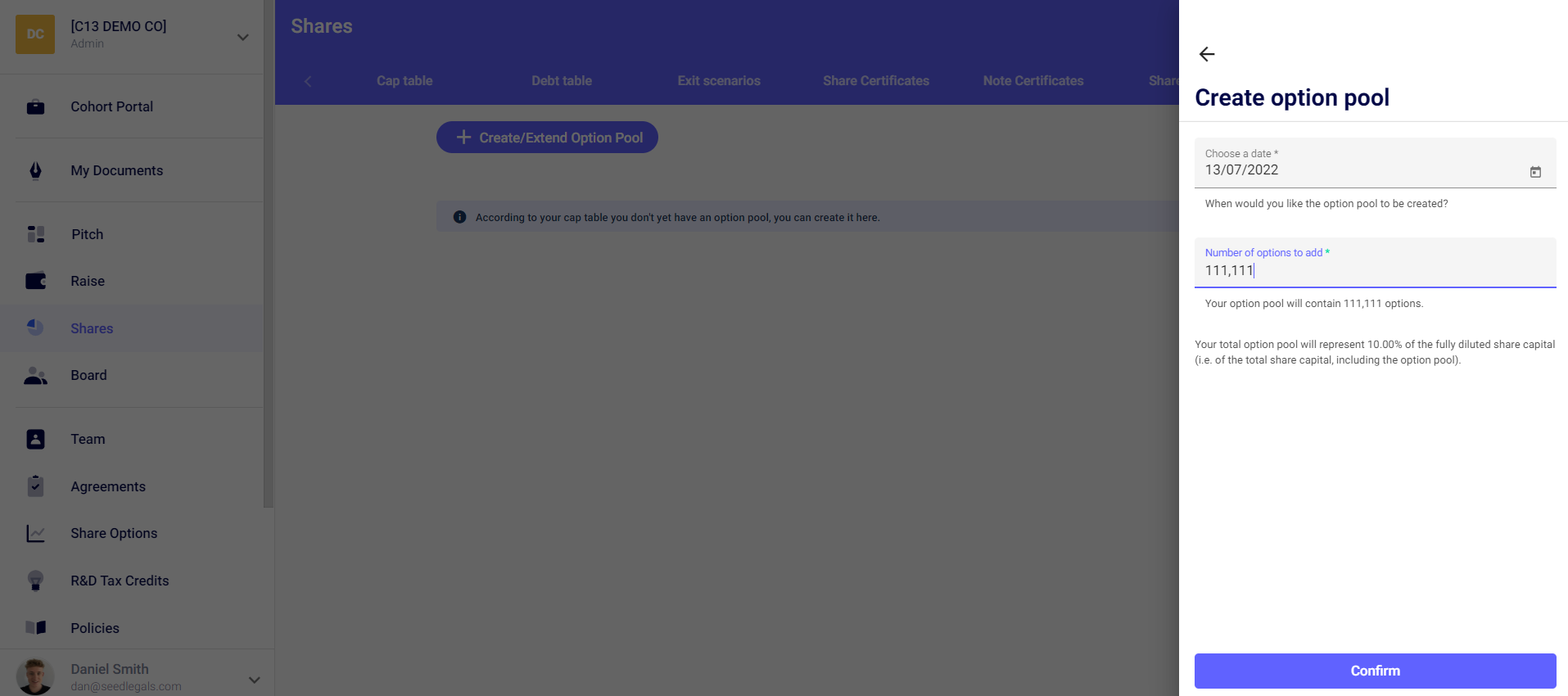

From here, you will want to reflect an option pool creation of 111,111 options - equating to a 10% option pool - which is being approved as part of your off-platform resolutions. You can do this buy heading to the option pool section at the top of the shares tab > create option pool > selecting "just create an option pool" > enter the number 111,111 in the text box.

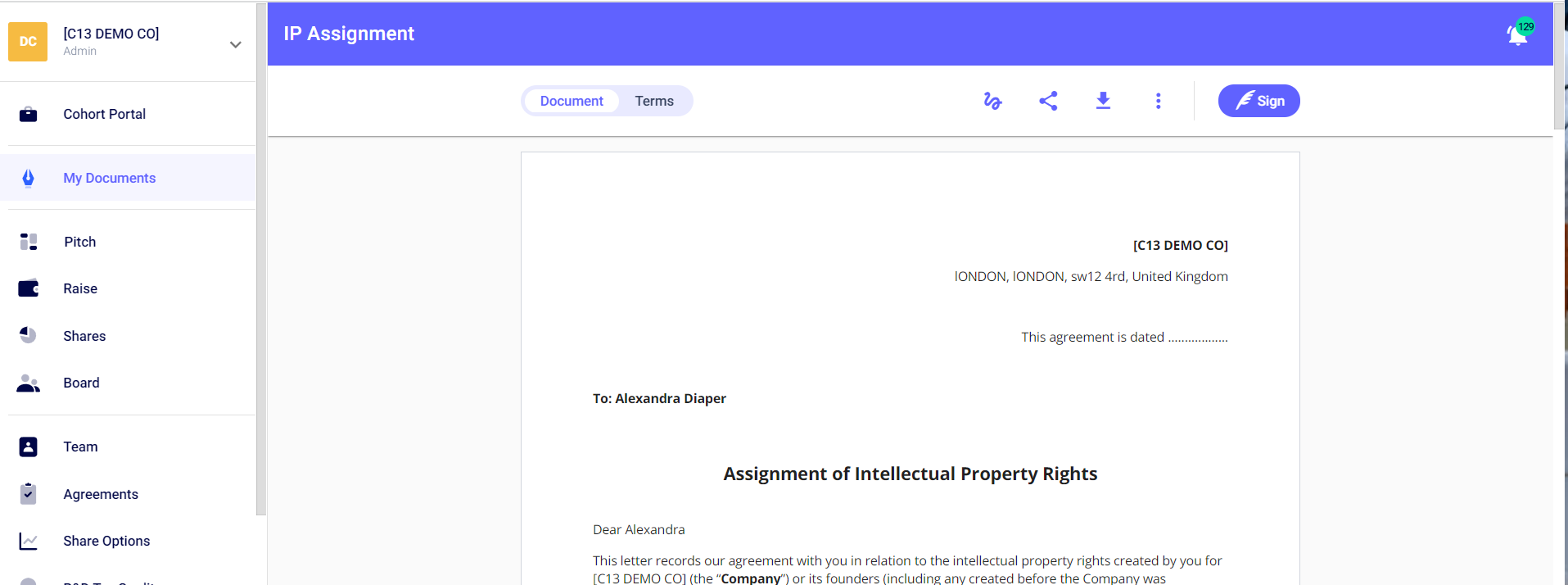

2. Sign an IP Assignment: To do this, you will need to head to the Agreements tab in the navigation bar > create IP Assignments for you and your cofounders > sign the documents in the top right-hand corner.

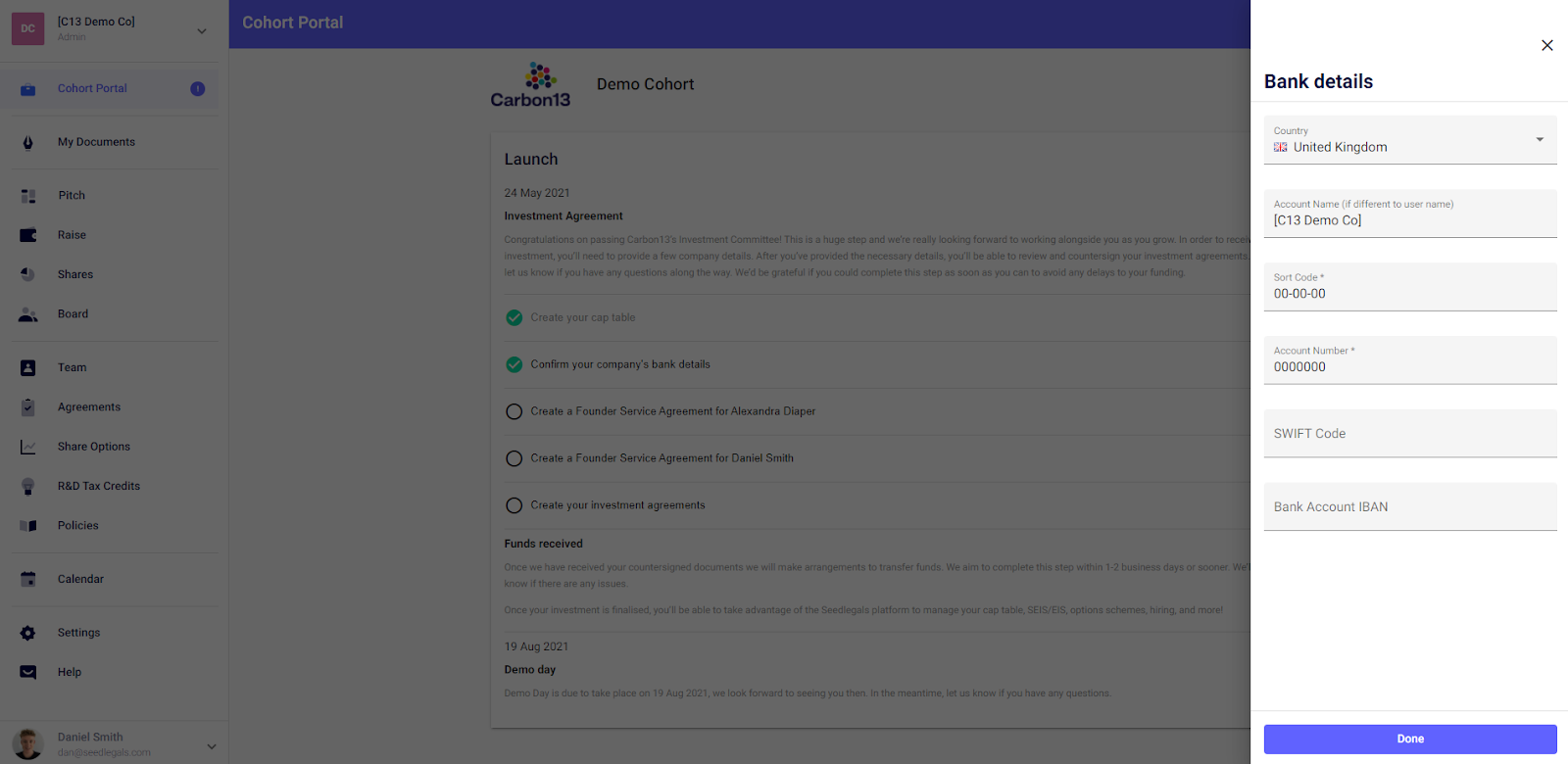

3. Enter your Bank Details: You will then want to go back to the cohort portal to fill in your company bank details ((if you don’t have an IBAN or SWIFT don’t worry).

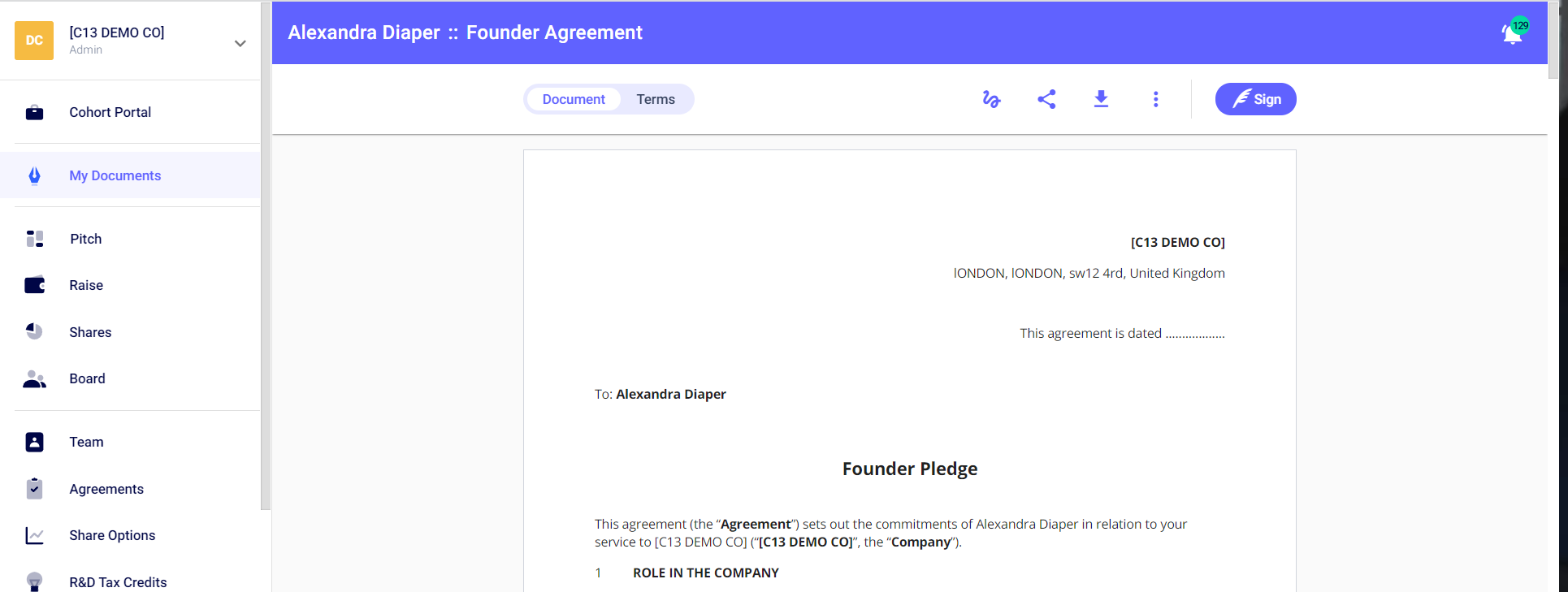

4. Create and Sign your Founder Agreements: You will need to sign your co-founder’s agreement on behalf of the company and you will need to sign your own agreement in the presence of a witness.

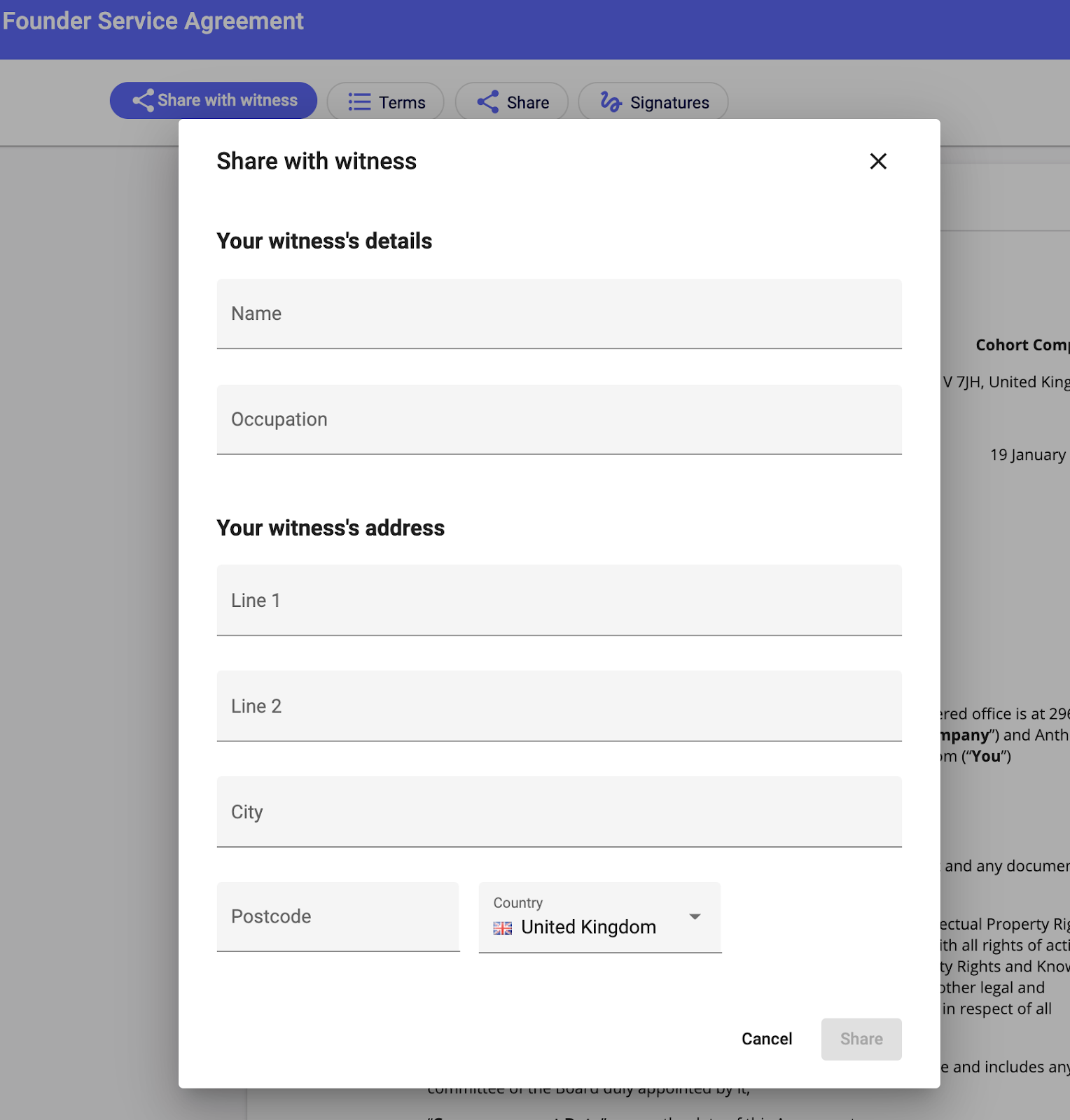

When you sign your own agreement you will be asked for your witnesses details. Don’t worry if you aren’t sure of these, your witness will be able to add / correct these later.

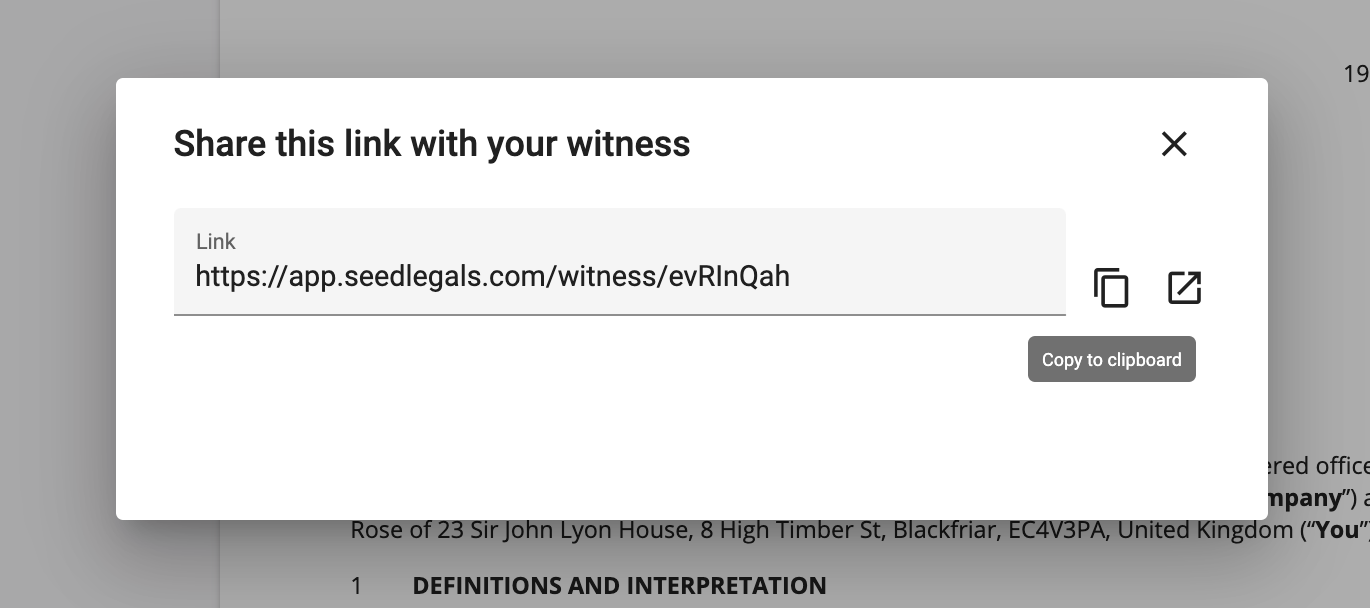

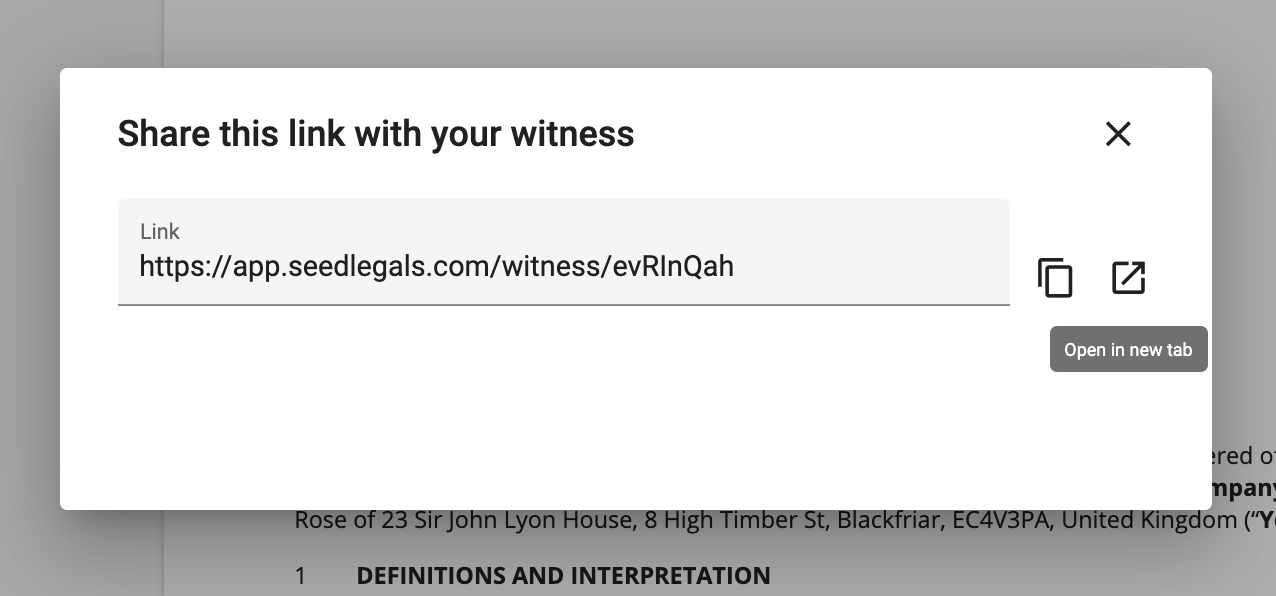

Now you can either copy the url to share with the witness, or open the witness page in a new tab.

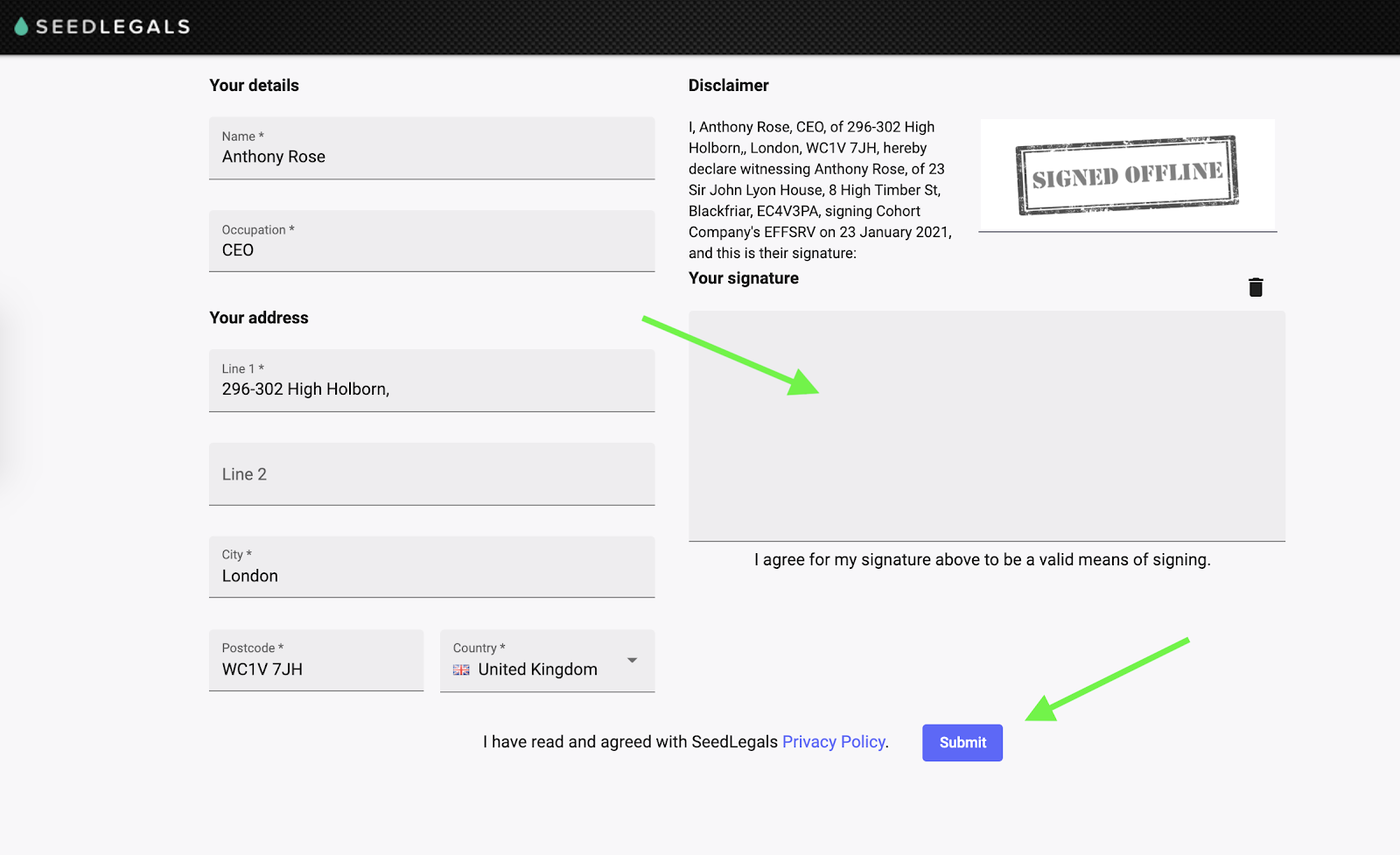

All the witness needs to do is check their details, sign in the space provided and hit ‘submit’.

5. Complete your Investment Agreement: After you have set-up your cap table, signed your IP Assignment, entered your company bank details and created your founder agreements, you can then move on to setting up your investment agreement for Carbon13’s investment.

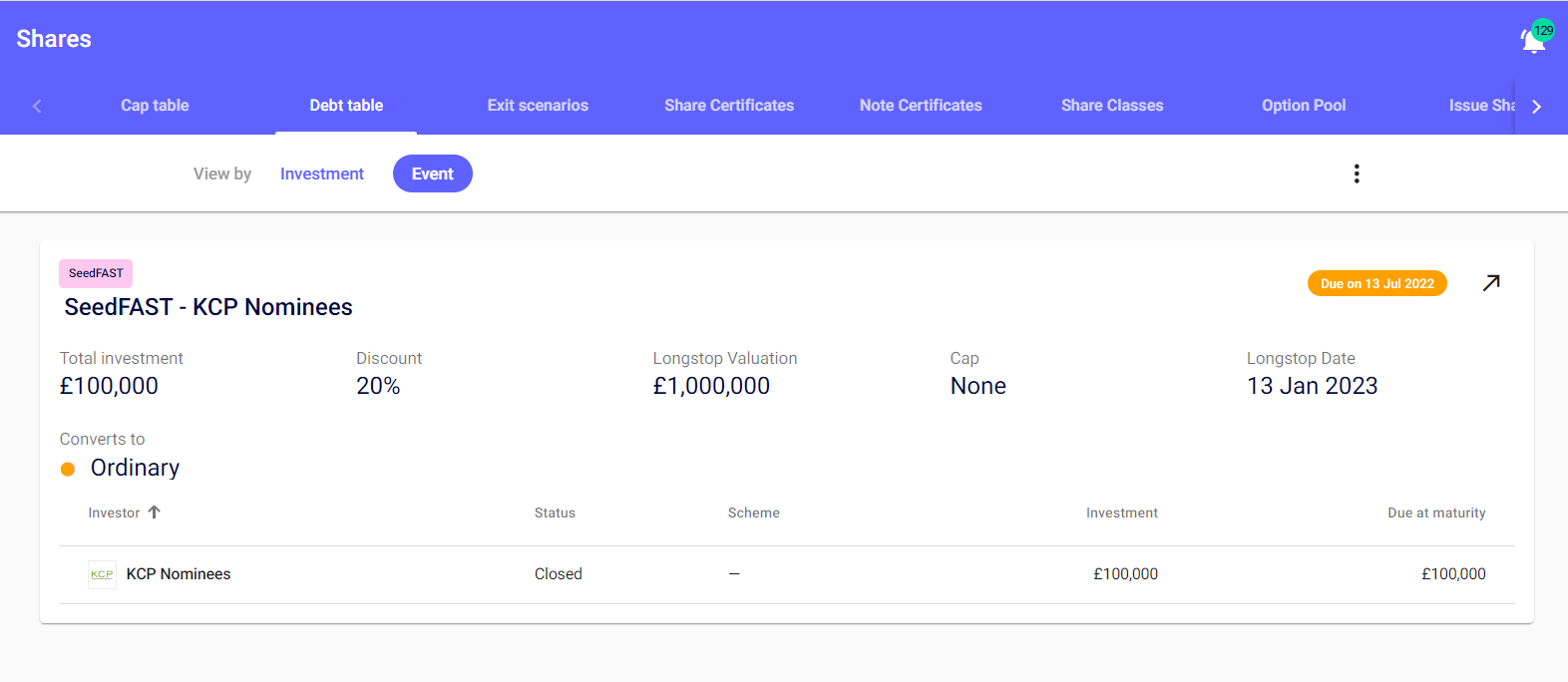

After you’ve clicked “Get Started” you’ll see the Carbon13 SeedFAST (in the name of KCP Nominees) already set up for you.

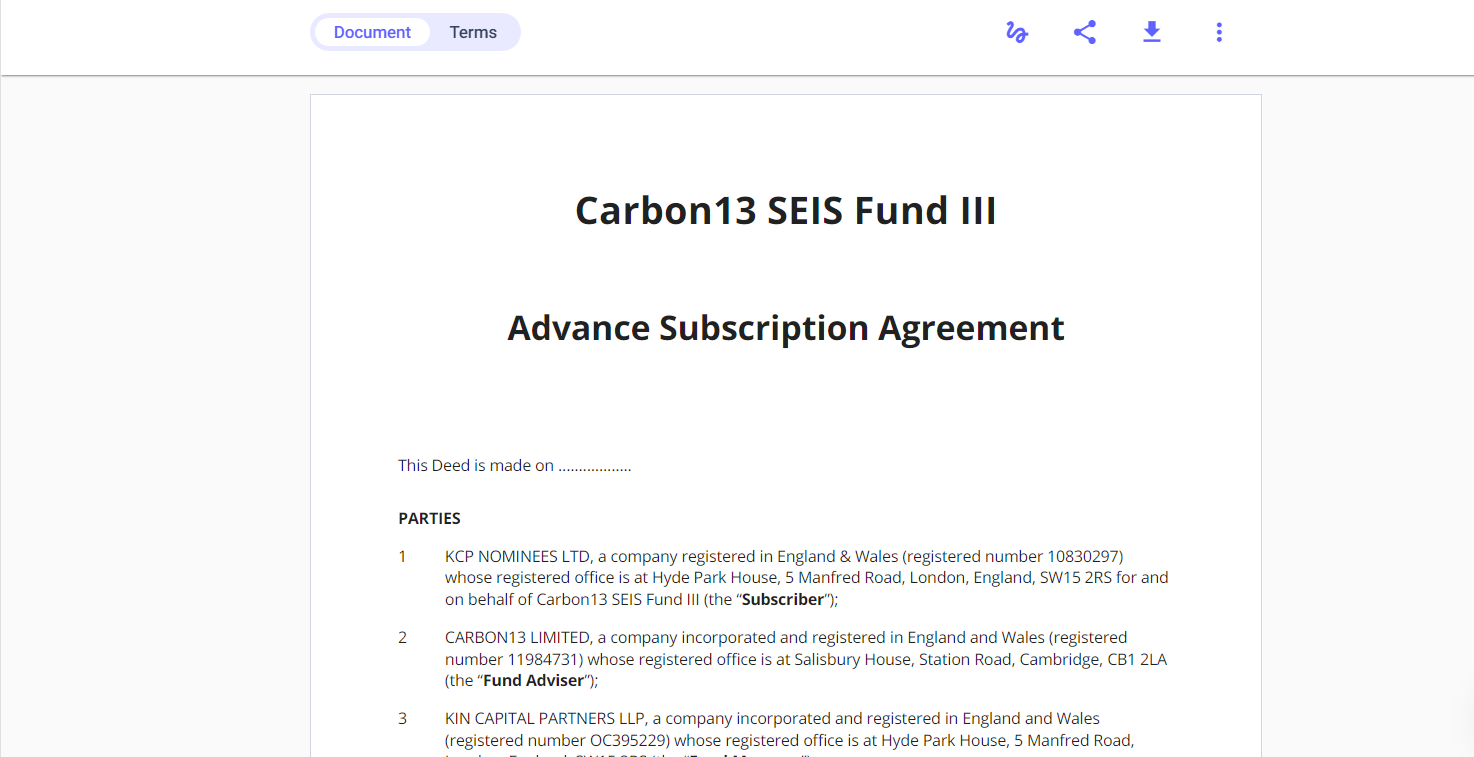

The only thing you’ll need to create is the SeedFAST Agreement, as you will be completing the Resolutions offline - please reach out to Carbon13 for these documents.

The SeedFAST will need to be signed by all the founders, KCP Nominees and Carbon13, all with witnesses (this is the same process as with the founder agreements).

You can share the SeedFAST with both KCP Nominees and Carbon13 by clicking the share button in the top right above the agreement.

Once the SeedFAST is fully-signed, you can then approve the investment at the bottom of the workflow.

You can the access the agreement from the ‘raise’ tab, or by heading to the debt table in the ‘shares’ tab.

If you have any questions regarding the terms of your SeedFAST, please get in touch with hello@carbonthirteen.com.