Step-by-step guide to managing your employees' options when they are leaving the company

Important Considerations

1. EMI options expire 90 days after the employee leaves the company...

For EMI options, if your employee is leaving (or if a director is resigning their post) this is a disqualifying event for the purposes of EMI.

As per EMI legislation, they have 90 days to exercise their options before they will lose all their EMI benefits. The reason for this is that EMI exists to help start-ups hire and retain talent and so, if an employee (or director) is leaving the company, it’s no longer serving that purpose.

So does this mean that all option grants expire after 90 days of leaving?

Not necessarily. Within both the rules of our EMI and Unapproved schemes, there is a prompt which asks "after they leave, how long will they have to complete the exercise of their options?"

Whatever option you pick here will be how soon the options lapse after the employee leaves However, for EMI options, if your lapsing period is longer than the 90 day EMI period, this means that the EMI benefits disappear, but the employee may still exercise their now Unapproved options up until they lapse.

What do I do if I want to exercise an option at a different time than outlined in the Option Agreement?

This will depend on various factors - your Option scheme owner will be best placed to provide tailored guidance. Please contact us for more information.

2. Time Restrictions

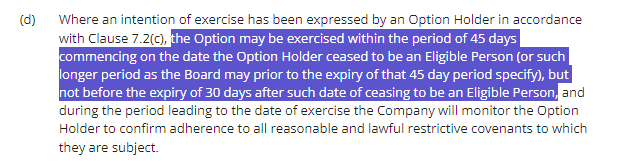

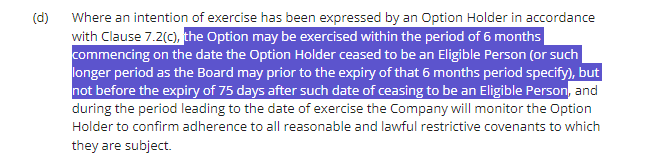

In your options agreement, under clause 7.1(d) for an Option Agreement under an Unapproved Scheme and clause 9.1(d) for an Option Agreement under an EMI Scheme, you will find that the option holder's exercise is subject to a time restriction.

If the option holder has 45 days to exercise their options after leaving the Company, this restriction is 30 days. This means that the option holder should wait 30 days after leaving before they can exercise their options.

If you choose that the option holder can exercise 90 days, 6 months, 1 year or 5 years after leaving, in your options scheme rules, then the option holder should not exercise until 75 days after they leave the company.

The reason for these restrictions are so that the Company can ensure that the leaver is not a bad leaver and that they comply with any restrictive covenants that they are subject to. For example, not joining a competitor within a certain time frame.

Therefore, option holders should wait at least 30 or 75 days (depending on your scheme rules) to exercise after leaving the company. If the exercise window is 30 days, there is no time retrictions to adhere to.

What if the option holder wants to exercise before the restriction?

If they want to exercise earlier, that's fine! However, the company would need to sign a board resolution allowing them to do so.

Having considered the above, follow these steps to manage your employee's options when they leave:

Step 1: Marking them as a leaver on platform

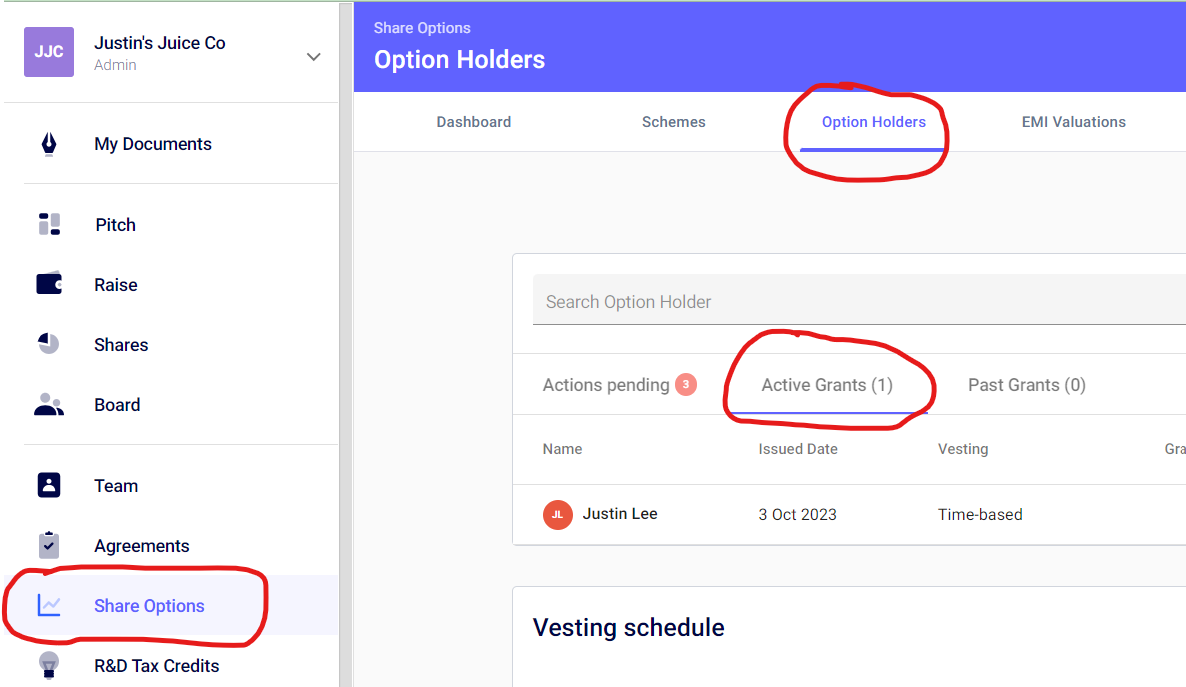

So now that your employee is no longer at the company, you need to mark them as a leaver on the platform.

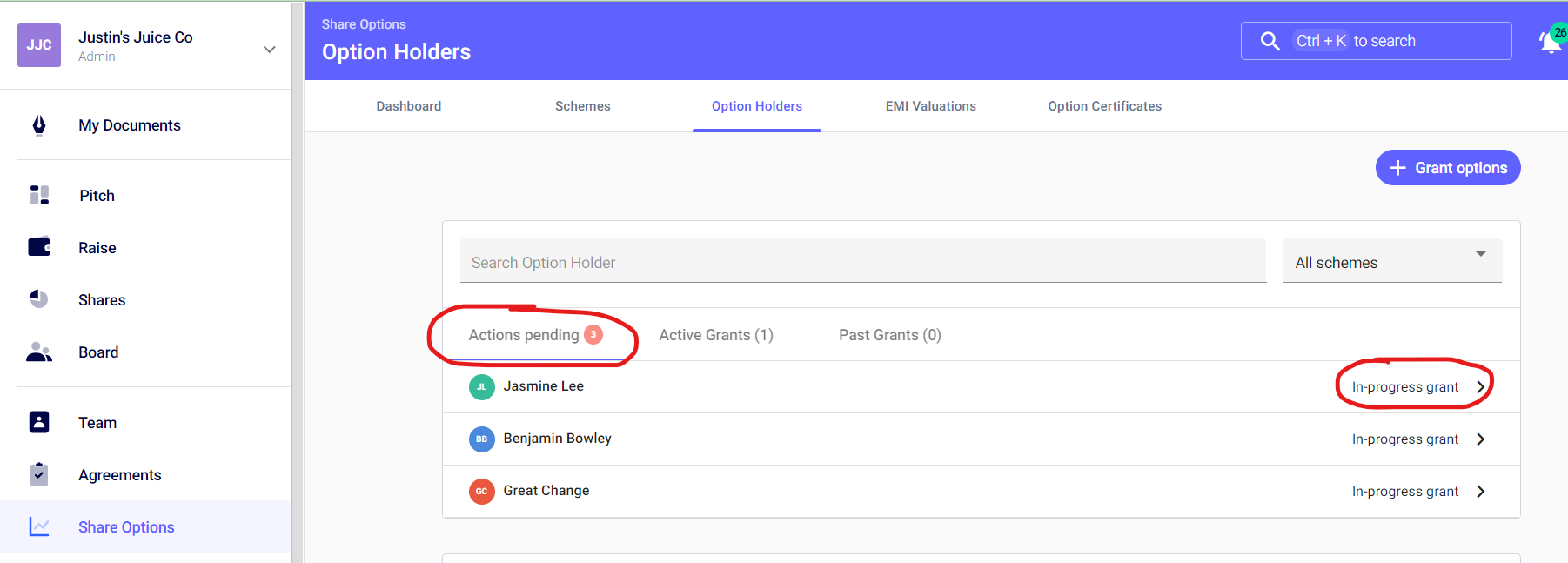

You can do this by heading to Share Options on the left tab, then Option Holders on the top section and then 'Active Grants'.

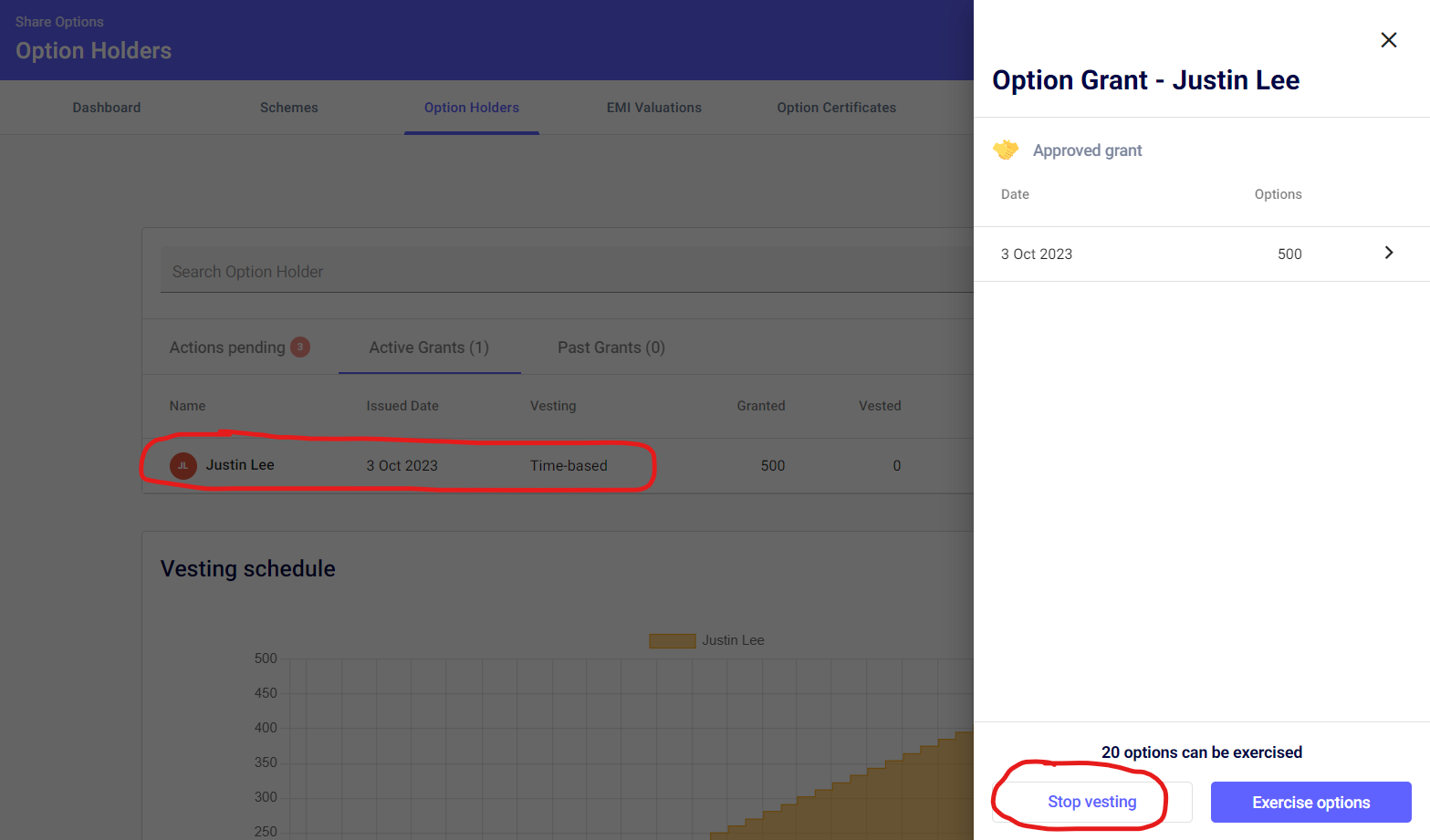

You can then select the employee who you need to mark as a leaver on the platform by clicking on their name. This brings out a bar from the right, on which you you will click ‘Stop vesting’:

You should mark them as a Good leaver and to 'keep vested options' if the employee is any type of leaver other than a Bad leaver. You should then add the date they left the company as the ‘Stop vesting date’. This freezes their vesting to the date they left the company, and they will only be able to exercise the options which vested up to this date.

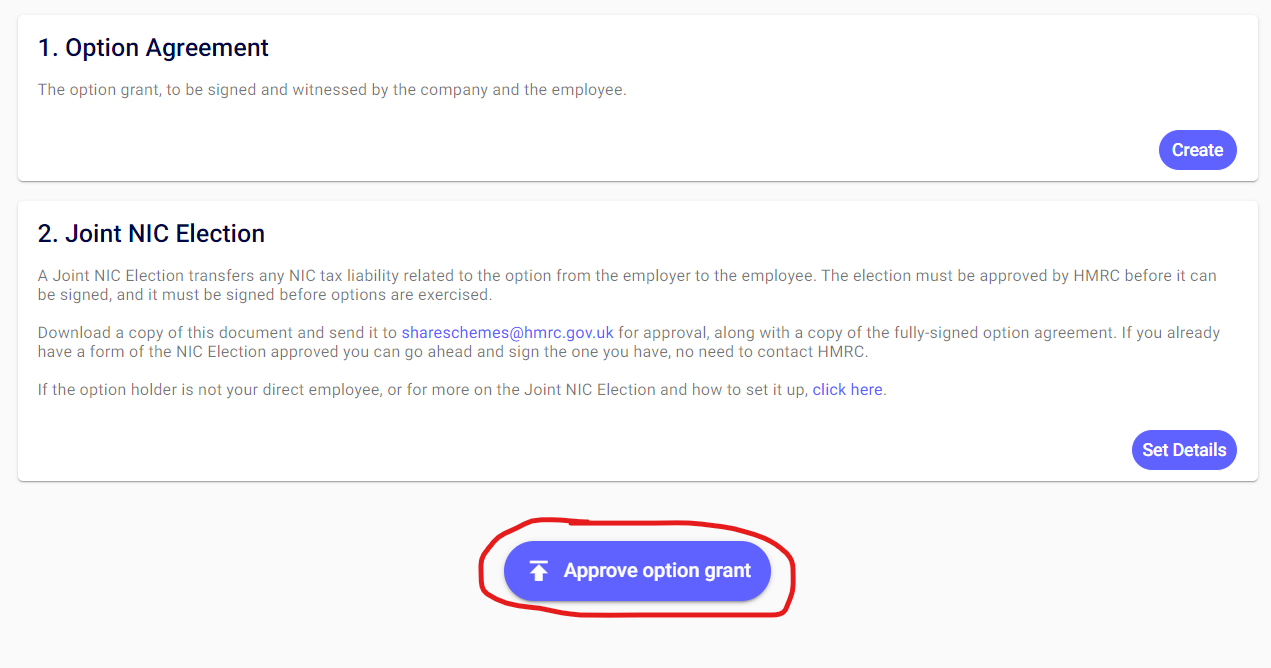

If you don't find the employee under 'Active Grants', this is likely because you have not yet closed the Option Grant. You can head to the 'Actions pending' tab, click on the employee in question's name. You can then close the grant if the Option Agreement is signed. This can be done by clicking the 'approve option grant' button at the bottom of the page.

You can then close the grant if the Option Agreement is signed by clicking the 'approve option grant' button at the bottom of the page. You will now be able to stop vesting the options following the instructions above.

Step 2: Exercise

When your employee leaves the company, they can exercise their options, so long as they haven’t yet lapsed, and it is permitted by the exercise rules of the scheme. If your employee wishes to exercise here’s our step-by-step guide to exercising options for your reference.

Lapsed grants will appear on the 'Actions Required' in the Option Holders tab.

Step 3: Updating HMRC of exercised or lapsed options for UK directors or employees

Now that the options have been converted to shares, you need to let HMRC know. Fortunately, you don’t need to let HMRC know each and every time, you just need to let them know by the 6th July in the Annual Return.

You’ll get an email nearer the time to do the Annual Return and here’s our step-by-step guide if you’re curious.