When and How to apply for R&D Tax Credits

Learn more about R&D tax credits, when and how to apply for R&D tax relief under the SME scheme on SeedLegals

The R&D tax relief scheme is a tax incentive designed to encourage greater spending on R&D and investment in innovation. Under the Merged RDEC scheme, companies can typically claim a net benefit of between 15% and 16.2%, while loss-making R&D intensive SMEs (ERIS) can claim back up to 27% of their qualifying spend.

When to apply for R&D tax relief?

To be able to submit an R&D claim, your company must have finished at least 1 financial period in which you have undertaken R&D activity and incurred qualifying R&D expenditure. However, you can start your R&D claim at any time before or after the end of the financial period. We recommend that you write your R&D tax relief claim throughout the financial period, as this will help you record your R&D activities and expenses more accurately and easily throughout the year.

R&D relief must be claimed within 2 years of the accounting period the R&D took place. For example, if your accounting year end is 31 December 2023, you have until 31 December 2025 to submit your claim. This means you are able to submit an amended tax return for a previous period if you may have missed out on potential tax credits or tax savings.

Pre Notification Requirement

Another deadline to keep in mind is the claim notification form. If your claim period starts on or after 1 April 2023, you will need to submit a pre-notification form to HMRC. The deadline for this is 6 months after the end date of your claim.

For instance, if your claim period is from 1 April 2023 to 31 March 2024, the deadline to submit the pre-notification form would be 30 September 2024.

This is a hard deadline and HMRC will not consider the application if you miss it, so please don't leave this to the last minute. If you have an open claim with us, we can generate a template on the platform that you can use as a guide to help you submit the form on the HMRC portal

How to apply for R&D tax relief?

Your R&D claim consists of a Technical Narrative, which includes a breakdown of your R&D eligible expenditure. SeedLegals will help you generate your Technical Narrative and the figures for your tax computation. After we have reviewed your claim and you are happy with it, we will give you instructions on how to submit the R&D claim through your accountant. Follow the steps below to learn how to complete your R&D claim and submit it to HMRC:

Before you start your claim, please ensure the following -

-

You are eligible to claim R&D tax credits under the SME scheme. If you are not sure, click here to check if you are eligible to claim R&D tax relief.

-

As soon as you complete the financial period for which you plan to claim R&D tax relief, request your accountant to prepare your company accounts and tax computation for the period. Please send them to us as soon as they are ready. Don't worry if you have not completed your financial period yet.

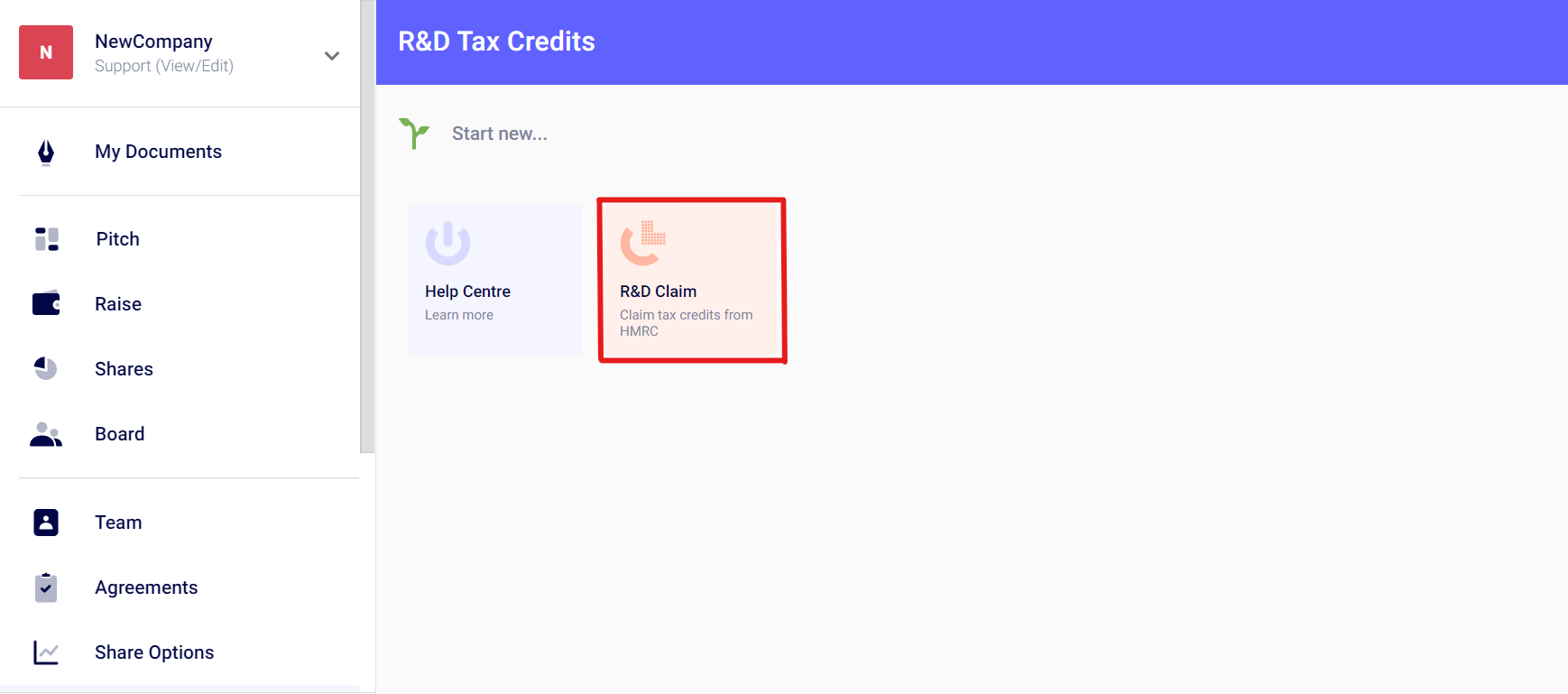

1. Start your R&D claim

After you have ensured that you are eligible to claim R&D tax credits under the SME scheme, click the R&D Cashback tab and Select R&D Claim to start a new R&D tax credits claim.

A new window will open to the right side of the page with information about the SME R&D tax credits claim product, pricing, our services and eligibility criteria. Click 'Continue' if you are happy with the services and can confirm that you are eligible to claim R&D tax relief under the SME scheme.

You will then be able to enter the financial year for which you would like to claim R&D tax relief. If you would like to claim R&D tax relief for more than 1 financial year, please make 2 separate R&D claims.

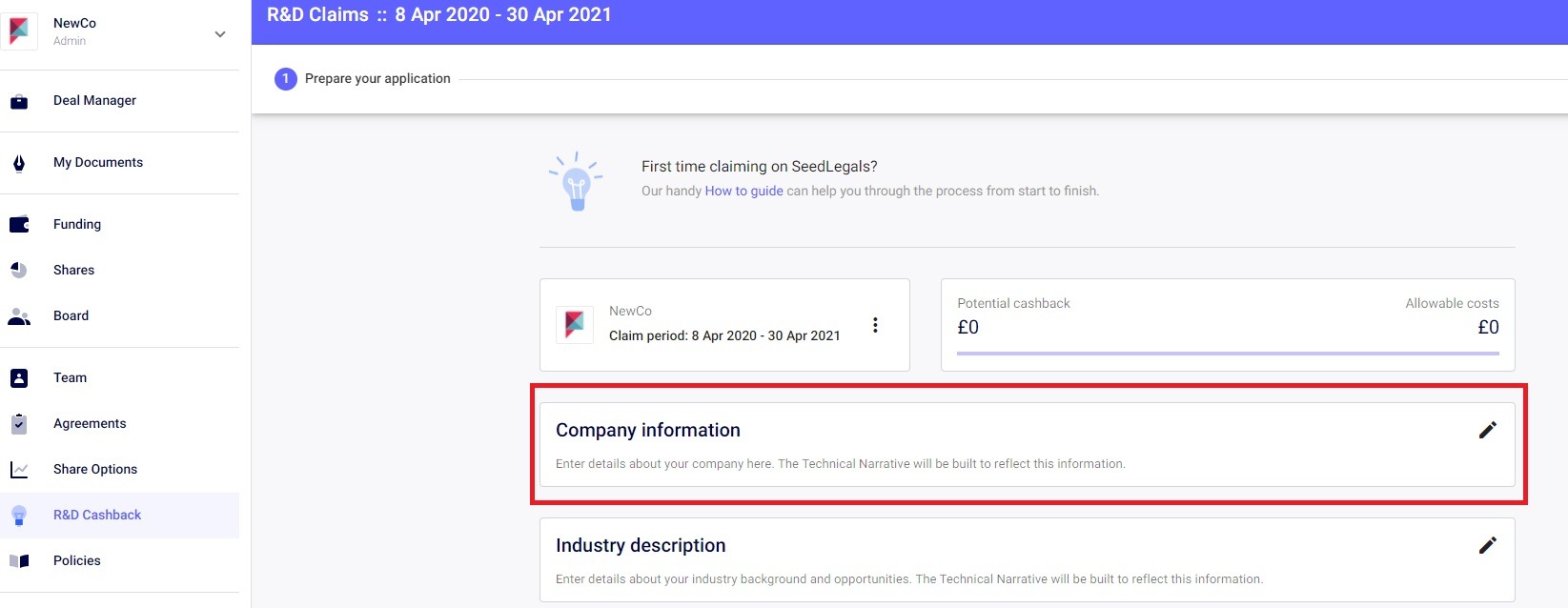

2. Complete the Company and Industry information

Start writing your technical narrative by filling in your company information. Click the pencil icon on the Company Information tab to provide information about your company, founders, awards and achievements and this information will be reflected in your technical narrative.

Similarly, click the pencil icon on the Industry Description tab and follow the instructions in the workflow to give us information about the industry you operate in and how your company is unique.

3. Add R&D Projects and view your Technical Narrative

Unlock your R&D projects section by clicking Pay Now to pay £1490. If you have multiple separate R&D activities, you can separate this into projects for the R&D claim. Each R&D claim usually consists of 1-2 R&D Projects that cover your qualifying R&D activity during the financial year of the claim. Click the Add Project + button to add a new R&D project. Follow the instructions in the workflow to fill in information about your R&D projects - the aims of the project, review of the current state of technology, timeline, technical uncertainties faced and their resolution.

Projects can span over multiple R&D periods. Don't worry if yours does. We will give you the option to copy over all the information from one claim to the others. So all you need to do is update this information in your next claim(s), without having to enter all the information again!

4. Complete your R&D expenditure

Enter the R&D eligible expenditure that relates to your R&D projects for the financial period of your claim. Choose the category (Employee costs, Subcontractor costs, Computer costs or Miscellaneous) that your expenditure relates to. If you are unsure whether an expense is R&D eligible or which category it belongs to, contact us.

Ensure that you have proof of each expense that you enter in this section and that each expense is accurate. In the unlikely event of an enquiry by HMRC, you will need to show proof of these payments.

Follow the instructions in the workflow to complete this section as accurately as possible. This information will be used to give you an estimate on your R&D claim.

5. Enter the Taxable Profit and Loss Figure

After you have entered your expenditure, fill in the Taxable Profit and Loss figure for each accounting period. If the financial period for which you are claiming R&D tax credits is more than 1 year, you will need to provide the Taxable Profit and Loss figure for each accounting period. Please refer to your tax computation to find the Taxable Profit and Loss figure or ask your accountant for it.

6. Upload Supporting Documents

While you can start your R&D claim before the end of your financial period, you must have completed a financial period in which you have undertaken R&D activity in order to submit your R&D tax credits claim. The following documents will be needed from your accountant after your financial year end -

-

The company accounts (including the detailed Profit and Loss statement) that cover the entire financial period of the claim, prepared by your accountant.

-

The tax return (including the tax computation and CT600) for each accounting period covered by your R&D claim

7. Send your claim to us for Review

As soon as you have completed the steps mentioned above, send your claim to us for review. SeedLegals' R&D associates will review your claim in 3-4 working days. We will get back to you with any changes and recommendations.

Once all the changes have been made and the claim has been approved by us, your claim will be ready for submission!

8. Send your documents to your Accountant for Submission

Once our R&D experts have approved your claim, it will be ready for submission. Please download the Technical Narrative and Letter for Accountant and send them to your accountant. Your accountant should follow the instructions in the Letter for Accountant and submit the R&D claim along with your company's tax return. If the claim is over 2 accounting periods, you will have to submit 2 tax returns. Follow the instructions in the Letter for Accountant to fill in the details of your R&D claim in both tax returns, and attach your Technical Narrative.

If your tax return has already been filed for the period, you can submit the R&D claim by making an amendment to the tax return.

9. Wait for the Results of the Claim

Once your claim has been submitted, on average, HMRC will take 6-8 weeks to process it. Then it will take another 1 week for the money to appear in your nominated bank account (in the case of payable tax credits). Please note: this process could take longer if there are some delays with HMRC or in the unlikely event of an enquiry.

Once your claim has been approved, please message us to let us know and start getting ready for the next claim!