Consultancy Agreement vs Employment Agreement - what’s the difference?

Consultancy Agreement vs Employment Agreement - what’s the difference?

While Employment Agreements concern hiring persons to suitable long-term positions within the company, Consultancy Agreements particularly deal with services of an independent person to fulfil periodic or temporary requirements of the company.

Employment Agreements are used to hire employees. Employment law requires that your contract should set out what has been agreed, in respect of:

-

your salary and working conditions;

-

any flexible and remote working arrangements;

-

probation and termination;

-

equity incentive plan (share and stock options);

Consultancy Agreements, on the other hand, are contracts for services given by an independent contractor (a self-employed individual) for the provision of consultancy services.

A Consultancy Agreement is limited to a specific project or time period. It is intended for use by clients when they are engaging a consultant to provide professional services and where the engagement will not be deemed employment.

Consultants provide services for a fee but are not considered to be employees as they don’t have an employer and provide services to a business on a self-employed basis.

The law treats employees and independent contractors differently - so the fact that the person is a consultant and not an employee has several implications, such as:

-

the remuneration of a consultant is made on the production of invoices and not through payroll. There is no predetermined wage or salary but a negotiated rate for services provided.

-

the consultant is responsible for paying their own tax and the business using the consultant should not have to pay national insurance contributions;

-

the business does not have as many obligations towards the consultant as it does to its employees.

Delineating the role of a consultant from that of an employee is important, for purposes of managing tax, health insurance and to avoid troublesome claims under employment law relating to unfair dismissal, sick leave etc.

However, it is not always easy to establish which category an individual falls into. And it is not enough to simply state that the agreement is a consultancy agreement and that the consultant is self-employed and not an employee. Courts will look behind contractual terms when determining employment status if they do not reflect the true agreement between the parties and will determine the appropriate category by examining a number of factors, such as:

-

who controls the work and the work product;

-

whether the hired party must provide progress reports;

-

the duration of the relationship between the parties;

To avoid consultants from becoming employees, you should:

-

allow the consultant to maintain a sufficient amount of control over their working conditions (when they work, how and at what times);

-

avoid using the same consultant for an indefinite period without breaks. Use consultants for specific projects and do not prohibit the consultant from working for others;

-

allow consultants to use their own equipment and do not integrate them into the workplace (no company email address for example);

-

regularly review the arrangements between the parties in order to ascertain whether your consultant is still a consultant or whether they are actually an employee and should be treated as such.

The good news is: if you’re looking to hire a consultant, our Consultancy Agreement makes that easy. Your consultant’s engagement will not be deemed employment as we’ve designed the perfect Consultancy Agreement, ready for you.

You can even give the consultant shares or share options which vest over a period of time or on hitting specified milestones.

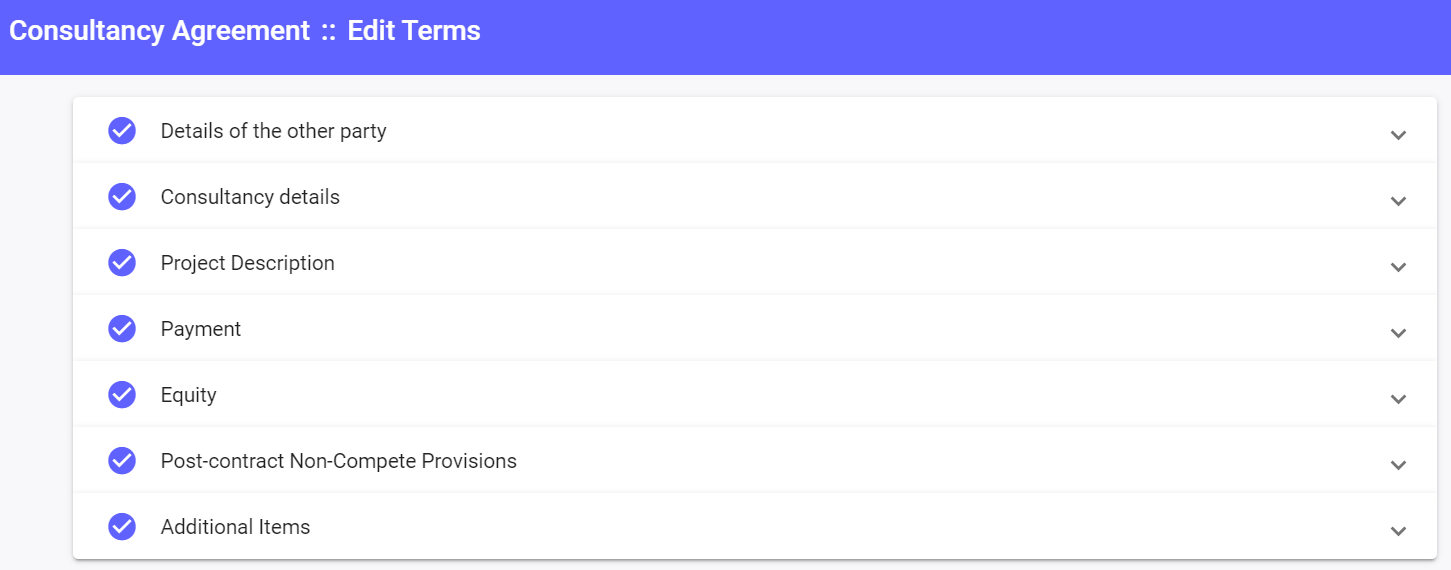

Here is what you’ll be able to set in our Consultancy Agreement:

Please do not hesitate to contact us via the online chat at the bottom right of your screen.

Please do not hesitate to contact us via the online chat at the bottom right of your screen.