How to complete a SeedFAST on SeedLegals: a step by step guide

If you want to take in funds ahead of a round using a SeedFAST then this guide is for you!

A SeedFAST is a type of Advance Subscription Agreement (ASA). It is a quick and inexpensive way to raise funds from investors in an S/EIS compliant way without having to do a full round, allowing the investors to convert their investment into shares in the next funding round or by the longstop date.

For more information on what a SeedFAST is, please see Introducing SeedFAST, an SEIS/EIS-friendly way to raise ahead of a funding round.

The key documents as part of a SeedFAST are your SeedFAST Agreement, Investor Consent Notice, Board Resolution & Shareholders Resolution. This guide will take you through all the steps needed to create and close an investment using a SeedFAST.

1. Start your SeedFAST

To start your SeedFAST, you will need to create your SeedFAST Group first. Head to the Raise tab and click Create.

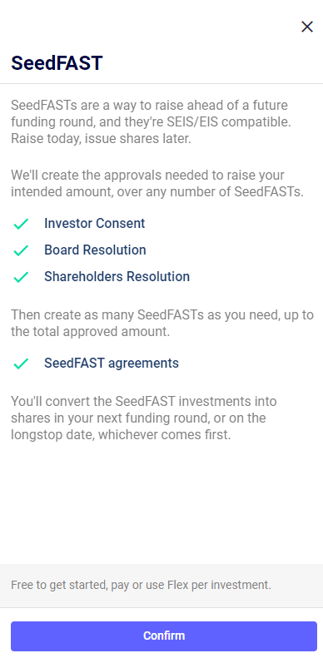

Scroll down a little bit to the Raise ahead of a round section, and click Create under “SeedFAST and then ''Confirm'' when the pop-up appears to start your SeedFAST Group

You can set the key terms for your SeedFAST Group

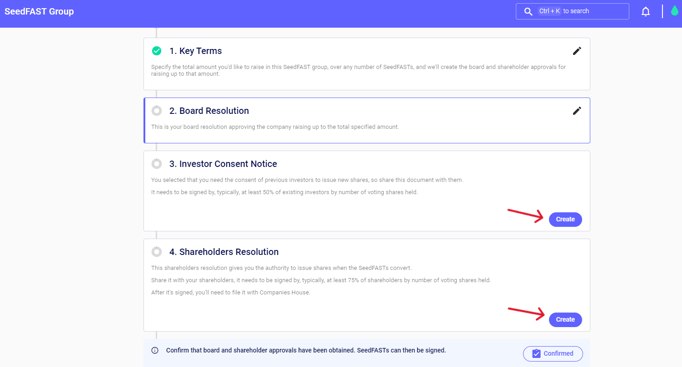

After setting your terms, you can now create your Board Resolution by clicking on the pencil icon on the right side, the Investor Consent Notice if necessary, and the Shareholder Resolution by clicking on ''Create'' on the right.

You need to click on ''Confirmed'' to ensure that your SeedFAST Agreement is ready to be signed

You can now create your SeedFAST by clicking on ![]()

After cliking Add investment, you will then be prompted to select the investor. Please note SeedFASTs are individual agreements and you’ll need to create one per investor. Please see this guide if you’re setting up a SeedFAST for a company investor.

The next window allows you to select:

- The amount being invested

- The date - this is just the proposed date of the investment and it is used to date your SeedFAST in the Timeline, this doesn’t feed through to any of the SeedFAST documents.

- The share class - Please remember to select a share class that is already described in your Articles of Association.

- SEIS/EIS requirements.

- Whether you would like to start with fresh terms or clone terms from a previous SeedFAST.

Lastly, click ![]() to purchase the SeedFAST. You can see more about our pricing on our pricing page.

to purchase the SeedFAST. You can see more about our pricing on our pricing page.

2. Key Terms

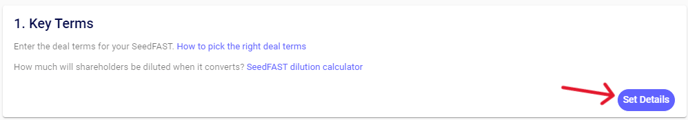

You will be taken directly to the key terms. Otherwise, click ''Set Details'' next to the Key Terms.

Are you doing more than one SeedFAST at a time?

If the answer is yes, you will need to enter the total of all the investments. This amount entered will feed into the SeedFAST and also the Investor Consent Notice, Shareholders Resolution, and Board Resolution. This means when completing SeedFASTs you only need to complete and sign one Investor Consent Notice, Board Resolution, and Shareholders Resolution for all SeedFASTs.

At what valuation should the SeedFAST convert?

Here you have a choice to select that it will always convert at a set valuation or it will convert at a variable valuation (and discount) based on your next round share price.

If you select that it will convert at a variable valuation then you will be asked to select a discount, the high valuation cap, and the low (or longstop) valuation. It’s important to keep in mind when selecting this option, that the SeedFAST will convert in one of two scenarios: a) at the next qualifying funding round either at the valuation set by the new non-SeedFAST investor and the discount, or b) at the low/longstop valuation that you set here, if you hit the longstop date.

For more information about what to set as your discount, cap, and low valuation see this article, how to choose the right deal terms for your SeedFAST / Advance Subscription Agreement.

What defines a new funding round?

This question asks you to pick the automatic conversion trigger and the amount you need to raise (including or excluding other SeedFASTs) before the SeedFAST converts. It’s important to set a sensible amount here to avoid your SeedFAST converting at a low valuation. Please bear in mind that if this trigger is met, there is an obligation on the company to convert the SeedFAST within a full qualifying funding round (generating a Shareholders Agreement, new Articles of Association, and so on).

What share class will the SeedFAST convert into?

The standard here is to keep it so that the SeedFAST converts into the best available share class in the next funding round so that your SeedFAST investors get the same deal terms as the new incoming investors.

If you select that the SeedFAST will convert at the share class specified (when you set the SeedFAST up) again please remember to select a share class already described in your Articles of Association.

SEIS and EIS are important considerations here. If you end up issuing shares under a preferential share class in the funding round, the SeedFAST will automatically convert into that preferential share class. If S/EIS shares convert into a share class that has better rights than other share classes in the company, that SeedFAST will become S/EIS ineligible. If you expect to bring on investors who will request a preferential share class (more common with VCs in bigger rounds) within your next funding round, you may want to consider selecting the second option here.

When would you like the SeedFAST to convert if there’s no new funding round?

Select here the time period by which you would like to convert the SeedFAST if there is no new funding round. The SeedFAST must will convert at the Low/Longstop Valuation if a funding round has not occurred within this time period, known as the Longstop Date.

Please note if you would like your SeedFAST to be SEIS/EIS Compatible (as per the HMRC guidelines) then you must set the Longstop Date to 6 months from the date of the agreement.

Investor Rights Section

After entering your bank details you are taken through to the Investor Rights section. As a SeedFAST investor, until you convert, you haven’t been issued any equity. This means you don’t come up as a shareholder on the cap table, you don’t have any voting rights, rights to dividends, or rights of preemption.

Investors, however, can ask for specific rights as part of the SeedFAST Agreement, and if they do you can set those in this section here.

Additional Items and Cover Page

The last two sections allow you to add any Additional Items and an explanatory Cover Page and once complete you can now create and unlock your SeedFAST. If you have any Additional Items you want added, we recommend reaching out to the team so we can do a sense check for you!

3. SeedFAST Agreement:

Now you can create, unlock, sign and share the SeedFAST with your investor. Once your investor has signed the agreement, ask them to send you their investment.

Please note, to unlock this agreement you will be prompted to pay the SeedLegals fee.

4. Board Resolution:

This document is important to show that the Board of Directors approve the SeedFAST investments, you will need to have a board meeting and get one Director to sign this Board Resolution.

Multiple SeedFASTs

When you click on the pencil icon on the top right side of the Board Resolution box (see image above) the first question will appear (see below). If you are planning on doing more than one SeedFAST, you should tick ‘yes’ to this question.

You should then enter the total amount of investment you plan to raise via SeedFAST. This amount entered will feed into the SeedFAST cover page and also the Investor Consent Notice, Shareholders Resolution, and Board Resolution. This means when completing SeedFASTs you only need to complete and sign one Investor Consent Notice, Board Resolution, and Shareholders Resolution for all SeedFASTs.

Next, you’ll be asked to set a minimum valuation at which this group of SeedFASTs can convert if there is no funding round. Remember - the lower the valuation at conversion, the more equity is given away to the investor. So you can think about this figure as ‘the most investor-friendly valuation’ approved by the Board - if you want to offer an investor a lower valuation some time in the future, you’ll have to gain additional approvals for this through new resolutions.

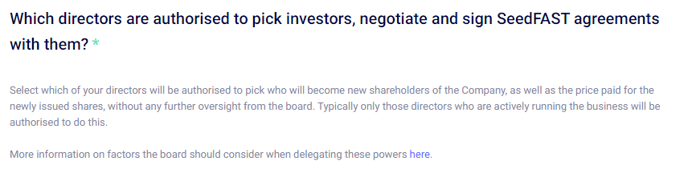

Once you’ve set your minimum valuation, you can then select which of your directors will be authorised to pick who will become new shareholders of the Company, as well as the price paid for the newly issued shares, without any further oversight from the board. Typically only those directors who are actively running the business will be authorised to do this.

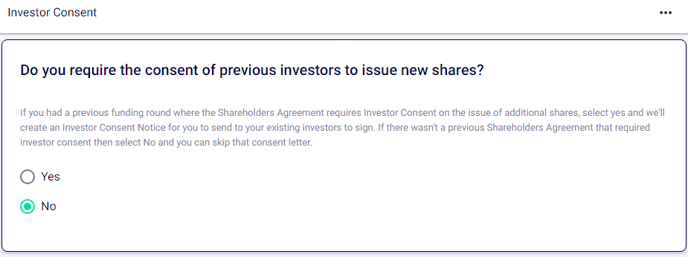

Investor Consent

Next move on to the investor consent question, this is where you stipulate if you need an Investor Consent Notice. If you had a previous funding round where the Shareholders Agreement requires Investor Consent on the issue of additional shares, select yes and we'll create an Investor Consent Notice for you to send to your existing investors to sign. If there wasn't a previous Shareholders Agreement that required investor consent then select No and you can skip that consent letter.

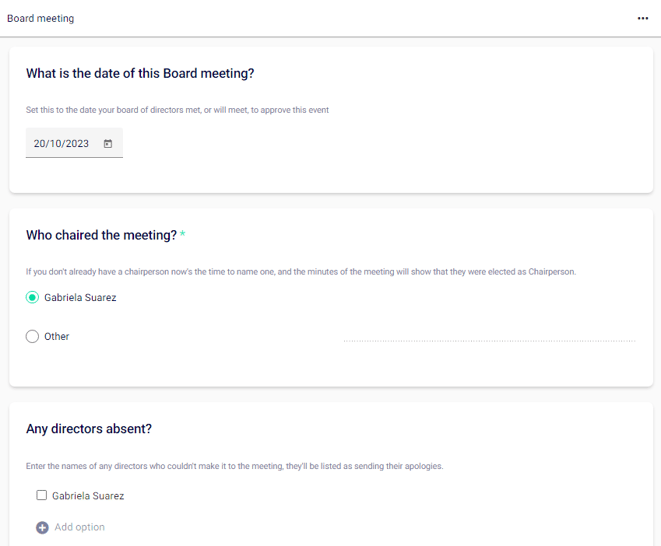

Board Meeting

Next move on to the board meeting terms. Here you will stipulate:

- The date of the board meeting

- Who chaired the meeting

- Any absent directors

Once complete, click Done in the bottom right-hand of the screen. Based on the terms you have set, you can create and sign the necessary documents, including the Board Resolution.

5. Investor Consent Notice:

As mentioned, if you have done a previous funding round and you need the consent of existing investors to issue new shares (check your existing Shareholders Agreement). If you have selected in the terms previously that you have investor consent provisions in a previous round, then an Investor Consent Notice will appear in the workflow.

Please note that if you are doing multiple SeedFAST Agreements, you will only need to send one Investor Consent Notice for the total amount you are raising through SeedFASTs.

If there were no investor consent provisions in your last round, or if this is your first round then you can ignore this document.

6. Shareholders Resolution:

The Shareholders Resolution must be signed by at least 75% of the voting shareholders before the date on the SeedFAST. You will only need one Shareholders Resolution if you are doing multiple SeedFASTs.

The Shareholders Resolution will give you authority to convert the SeedFAST(s) into shares in the Company so that the total number of new shares will not exceed the maximum number of shares that will be created if all SeedFASTs convert at the low valuation. Don’t worry: the platform will automatically do the maths to calculate this number of shares for you!

7. Archive your SeedFAST

Once all the above has been completed and the funds are transferred you can hit this button to close the SeedFAST.

And then the following button to add to your Convertibles Table.

For other articles and help with your SeedFAST please see:

For a SeedFAST when can my investors get their SEIS-EIS certificates?