If you're issuing shares at various prices per share, or different classes of share, use this guide to put together one SH01 for them all.

The SH01 form is an essential document that needs to be sent to Companies House when you allot new shares in your Company. If you’re allotting shares in quick succession that happen to be under different share classes (Ordinary, B Ordinary (non-voting), and so on) or different prices per share, you’re likely going to want to allot all these shares at Companies House using one SH01 form. This guide will show you how.

This guide builds on the how to fill an SH01 Form: a step-by-step guide which is a more general overview of how to complete an SH01.

The first step, download the SH01 form and then complete the steps below:

1) Company details

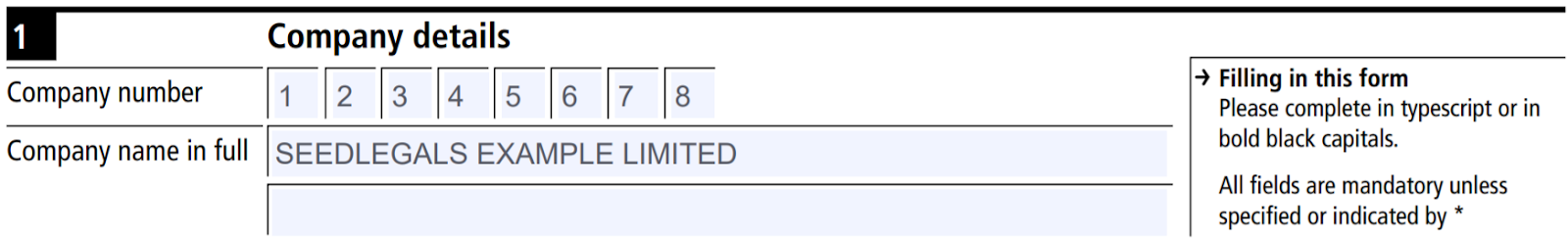

2) Allotment dates

When allotting shares you need to make sure:

- All funds are fully paid up before they are issued, this means the allotment date needs to be on the same day or after all the funds were received in the Company account.

- SEIS shares are allotted at least one day before EIS and normal (non-SEIS/EIS) shares.

- The investors share certificates are dated the same date as the allotment date on the SH01, because this is the date they were issued.

When creating an SH01 for multiple share allotments or share classes, if the shares were all issued on the same date, you should enter this date in the From Date section on the SH01 and you can leave the To Date section blank.

If the allotment of shares spans a few different dates, the From Date will be the earliest date of share issue. the last of the SEIS funds were received. The To Date will be the last.

Please note that if the dates span more than two weeks, we’d recommend filing two separate SH01s.

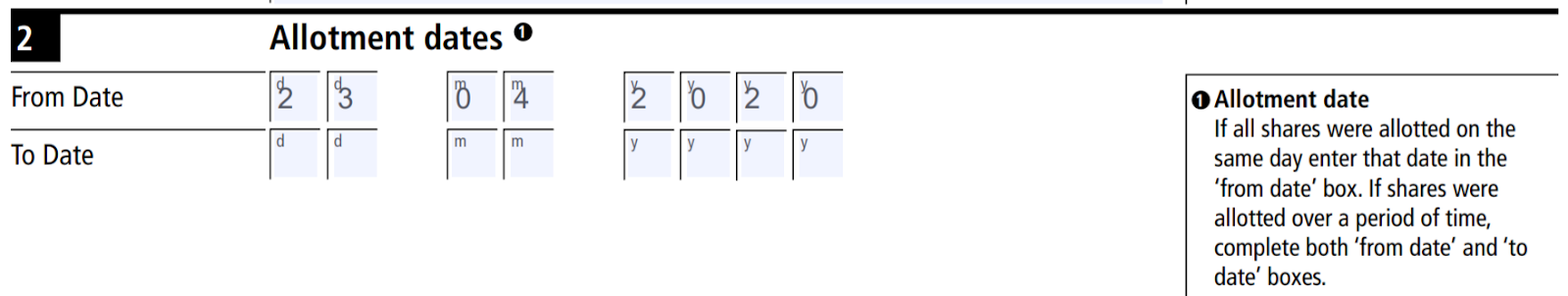

3) Shares allotted

The shares allotted section needs to show all the shares issued at this time. If the shares were all issued at the same price per share you can put these all on one line! And you should put the totals on separate lines if the allotments occurred at different prices per share, or if you issued different share classes to the investors.

For example, and as per the image above, if you had multiple shares in which you allotted 100,000 Ordinary Shares total at £5.56 these would all go on one line. If you had other shares issued at £5.50 per share, a slight discount, this would go on another line, and if you also issued B Ordinary shares then these would go on another line.

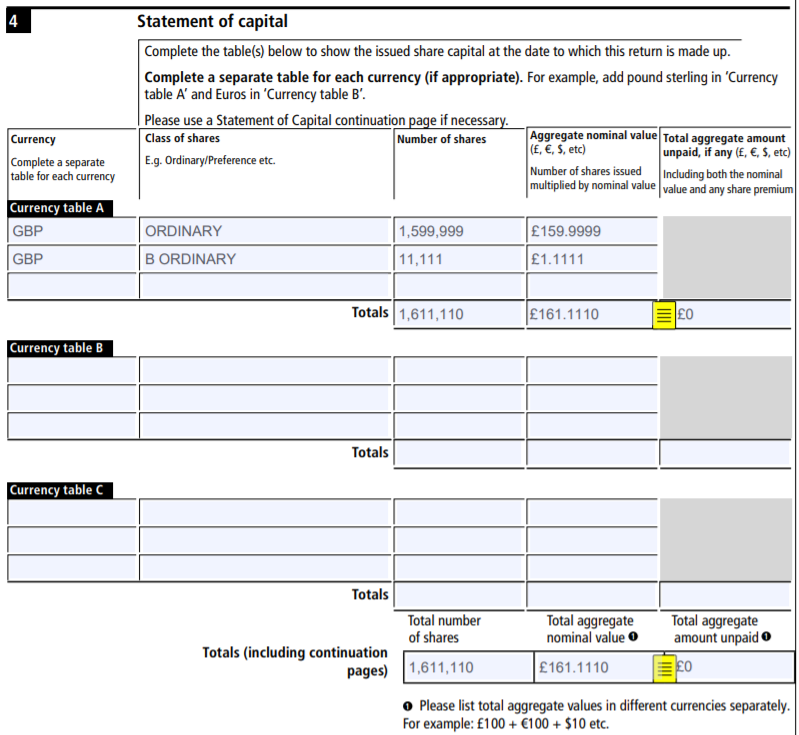

4) Statement of Capital

The Statement of Capital is used to provide a complete overview of the company shares. This will include the prior existing shares, as well as new shares allotted in section 3.

In the example above 150,000 Ordinary shares and 11,111 B Ordinary shares were allotted in the Instant Investments. The Company must have had 1,449,999 Ordinary shares and 0 B Ordinary shares before this investment, meaning the total number of shares after the investment equals 1,611,110.

Please note:

- You can work out the total aggregate nominal value by multiplying the nominal value of the shares with the number of shares, make sure you don’t miss out any decimals! You should be able to work back from the aggregate nominal value to calculate the exact number of shares in your Company.

- If you have more than one share class, you will need to use a separate line for each and you can use the continuation page on page 7 if you hold three or more classes of shares.

- If shares are issued in a currency other than that listed in Currency Table A, please use Currency Tables B and C.

- Don’t forget to fill out the totals at the bottom of this section!

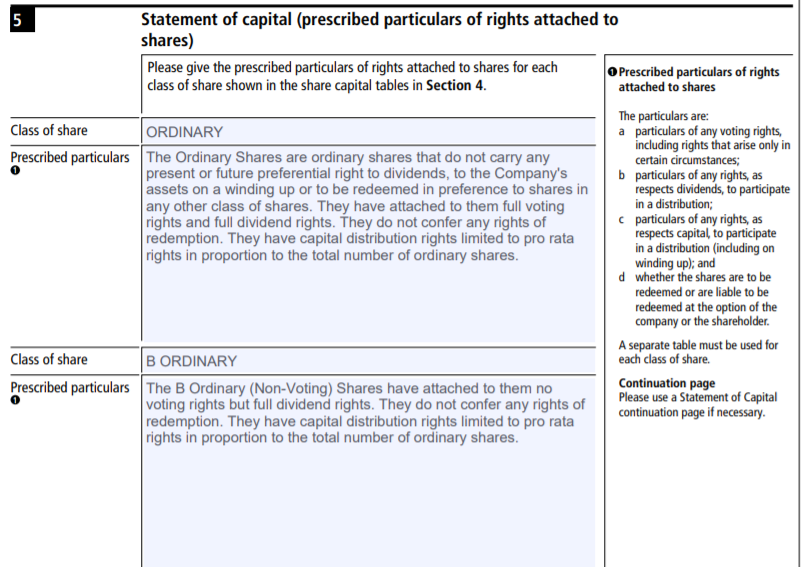

5) Statement of capital (prescribed particulars of rights attached to shares)

This section is used to make sure that a clear definition is put in place for the meaning of each class of share listed in Section 4 (Statement of Capital). Please make sure that any class of share listed above is also described here.

Below, you can find the legal definition of the Ordinary Share:

< The Ordinary Shares are ordinary shares that do not carry any present or future preferential right to dividends, to the Company’s assets on a winding up or to be redeemed in preference to shares in any other class of shares. They have attached to them full voting rights and full dividend rights. They do not confer any rights of redemption. They have capital distribution rights limited to pro rata rights in proportion to the total number of ordinary shares. >

For all other classes of shares, make sure that you clearly describe them in relation to their difference in rights to the Ordinary shares.

6) Signature

Last step, make sure you sign the SH01, this needs to be signed by a company Director.

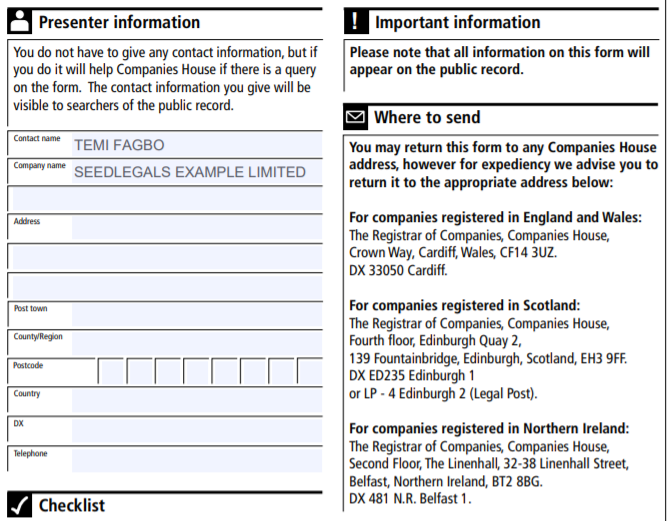

7) Additional details

The additional details page is optional, and please note that any information you disclose here will be available on the public record so don't worry about leaving this blank!

8) Final steps

Once the above is completed, you will need to post your completed SH01 to Companies House, you can find the address in the additional details image above. Please note, if you didn't have Instant Investment provisions in your funding round you will also need to post a Shareholders Resolution to Companies House, if you're unsure if you need to do this please ask!