How to address the SEIS/EIS Risk to Capital requirement in your business plan - a slide template

Whether you’re just starting your SEIS/EIS Advance Assurance, or completing your Compliance Statement, you should be aware of HMRC’s Risk to Capital Condition.

This condition was introduced by HMRC in early 2018, however from 8th October 2019 all applications for Advanced Assurance are required to directly address the Risk to Capital Condition.

In summary, the principles are that the company must have the intention to grow and develop and that the qualifying investment poses a significant risk of a loss of capital. There is no exhaustive list of factors that HMRC consider but they include:

-

Increasing number of employees

-

Sources of income

-

Assets

-

Subcontracting

-

Ownership/ Management structure

-

Marketing of the investment to potential investors

-

Fragmentation

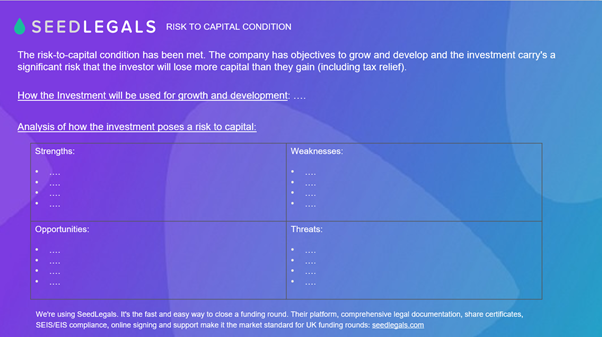

You can make a slide similar to the one below to address the Risk to Capital directly in your business plan.

In the slide only address factors that apply to your business. And it’s a good idea to explain how these factors contribute to the risk of the investment and/or show the company’s objective to develop and grow.

If you find yourself in a grey area, or if you think something might negatively affect your application don’t try and hide this. And don’t worry too much if you’re in this position, HMRC don’t consider each factor individually but will look at all relevant factors and the overall context of the investment. For example, it might be that using an SPV, or subcontractors, is a standard practice in your industry or that despite having high value assets you do not intend to sell these for profit and they are required by your company to generate income.

When addressing the condition, you should analyse the strengths and weaknesses of your company proposition and how this contributes to a significant risk to capital investment. For example, the company might have an income-stream lined up, but this isn’t enough to protect the investment, and the company intends use the income to reinvest in the growth of the company and its infrastructure.

If HMRC believe that your company is at risk of failing this condition, they will inform you first, and will ask for more information on the relevant points. And if your application is rejected due to this there is a right to appeal.

If you are uncertain about the Risk to Capital or you have more questions on this topic, hit the chat button in the bottom right of this page and send us a message!