Everything you need to know about your share options

Watch the video

Read the guide

-

What is an option?

-

What is vesting, and when do my options vest?

-

What does 'exercise my option' mean?

-

Do I have to pay any money for these options?

-

How could I lose my options? What happens if I lose the company?

-

Is there a minimum period that I have to be with the company for these options?

-

What tax is payable on the exercise of options?

-

What tax is payable on exit?

-

What happens to my options if I die?

-

What is 'accelerated vesting'?

-

How do I make money from my options? Can I work out how much?

-

What is the Joint Election form?

1. What is an Option?

An option is a right to buy a share at a future point in time, at a price that is decided now. For employee share options, that agreed price (the "exercise price") is usually a small fraction of the company's current share price, so that the employee gets to make a profit when they exercise their options later.

2. What is vesting, and when do my options vest?

Vesting is how you earn options. Just like you don't get your full salary on day one of a job, you earn over a period of time and/or milestones.

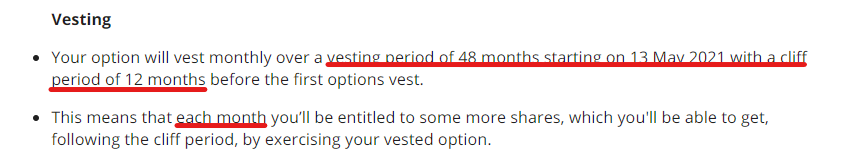

If you take a look at your option agreement, you can see a summary of the terms on the first page, e.g.:

If your option grant is time-based (which is the case for the vast majority of employees), the key terms to look out for are:

-

Vesting period - here it's 48 months

-

Vesting start date - usually this is your first date of employment

-

Vesting cliff - how long before the first set of options start vesting. Here it would be 12 months after the vesting start date.

-

Vesting frequency - how often the options accrue, often monthly

The terms above are our most standard ones.

You may also see terms in your option grant related to Vesting Acceleration, which are explained here.

3. What does 'exercise my option' mean?

When you exercise your option, you are buying the shares in the company over which the option exists. This is the point you actually become a shareholder and own equity in the company.

If you want to exercise your options, check your option agreement to see when you can exercise and how many options have vested, then let the CEO know that you want to exercise.

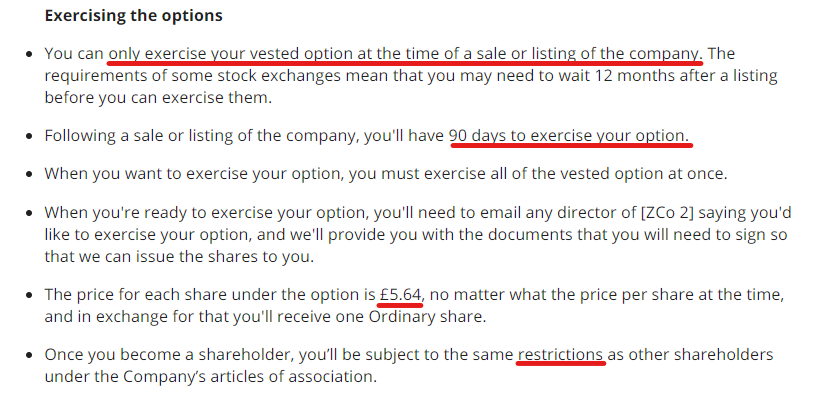

You can also find a summary of your exercise rules on the first page of your option agreement, e.g.:

The key points to look out for are:

-

When you can exercise - here it's an exit-only scheme

-

How long you have to exercise following leaving/exit - usually 90 days

-

The exercise price you need to pay to buy each share - here it's £5.64

-

Restrictions that apply to all shares in the company, which can be found at Schedule 4 of your option agreement (EMI only), and in full detail in the company's Articles of Association.

If you are exercising, the CEO will have you sign a Notice of Exercise, you'll pay the exercise price and then they will process the rest of the paperwork to give you your shares. You'll know you have the shares when you receive a share certificate showing you own shares in the company.

4. Do I have to pay any money for these options?

Yes. You will have to pay the exercise price * number of options granted in your Option Agreement. You do not need to pay anything upon the granting of the options, only when you exercise.

5. How could I lose my options? What happens if I leave the company?

There are typically 2 ways you could lose your options as an employee:

-

If you are a Bad Leaver, that is someone who is fired through breaking the law, or gross misconduct. If you are a bad leaver, your options will lapse.

-

If you are on an Exit-Only scheme and have left the company. Under this scheme, you can only exercise the options if there is a liquidity event, and if you leave the company before that time, your options will lapse.

The general rule for those who leave outside of being a Bad Leaver is that you lose your unvested options, but get to keep your vested options. The exception to this is an Exit-Only scheme. It's worth noting that even if you get to keep your unvested options, you still need to check how long you have to exercise and whether you can exercise right now.

6. Is there a minimum period that I have to be with the company for these options?

There might be a "cliff" period in your option agreement. Think of it as a probationary period during which time no options vest. Then once the cliff is over, you'll get all the options that would have accrued over those months.

For example, if you were promised 96 options, vesting monthly over four years, you'd accrue 2 options each month. With a 1 year cliff, in the first year none of the options vest, but then at the end of the cliff the first 24 options vest in one go. So if you left within your cliff period, none of your options would have vested. After the cliff, the options will vest at the typical 2 per month rate.

7. What tax is payable on the exercise of options?

This would depend on the exercise price for the options (the price you pay per share) compared with how HMRC values the company. If your exercise price is the same as the HMRC value (or higher) - then there's no tax on exercise.

If the exercise price is below the price HMRC decides - there might be tax to pay on exercise (normally income tax on the difference between the price you paid for the option and HMRC's value).

8. What tax is payable on exit?

For EMI options, provided that you have held your options for at least 2 years (and still meet the requirements), then you'll only pay 14% (as a result of gaining Business Asset Disposal Relief, formerly called Entrepreneur’s Relief) on any profits that you make from your options. If it's less than 2 years, you'll pay your typical capital gains tax rate. This is as of 6 April 2025.

For Unapproved options, you'll pay your normal capital gains tax rate.

9. What happens to my options if I die?

Your estate has 12 months to exercise all of your granted options, if it chooses to.

10. What is accelerated vesting?

Accelerated vesting means that if there is an exit-event all the options in the grant will become available for exercise. Typically, you will need to stay on at the company for a set period after the acquisition to get your accelerated vesting. The reason for this is that the acquirer often isn't just buying a company's assets or customer base but is investing in the winning team. So they'll want everyone to stay on for a set period after they buy the business. You can find the details for this at Schedule 2 to your Option Agreement.

Here are some helpful definitions:

-

Vesting Acceleration - Whether your options have accelerated vesting on a sale of the company.

-

Acceleration Portion - The % of your unvested options will vest immediately on a sale of the company.

-

Acceleration Period - The minimum number of months you need to work for the company following a sale to get all of your vesting acceleration.

-

Accelerate on an IPO? - Whether the vesting acceleration will also apply on an IPO (Initial Public Offering), or only on a sale of the company.

11. How do I make money from my options? Can I work out how much?

Firstly, you can't sell the option, you'll have to wait until you have shares in the company. Most likely you will sell your shares along with everyone else in the company when there's an acquisition, but of course the exact terms of the deal will determine this.

As an exit is typically several years away, and there are many moving parts e.g. how much the company is being sold for, future rounds which will dilute everyone and the company's liquidation structure, it is quite tricky to estimate what your return will be. For this reason, employees often hold off from exercising their options until they are sure there is an exit on the horizon. At this point, you can get a better feel for the terms of the deal and an accountant may be able to help you with tax planning.

12. What is the Joint Election form?

It's a form that places the burden of any tax arising from the exercise of the options on you rather than the company. This is only relevant if your exercise price is below the value of the shares HMRC decides and it is an industry standard for the company to have this protection. If it comes to it, this is a very nice problem to have as it means the company has proven it's value and you're cashing out.

Did this answer your question?